Intro

Discover 5 ways to access 1099 form printable, including IRS templates, online generators, and tax software, for effortless independent contractor income reporting and compliance with tax filing requirements.

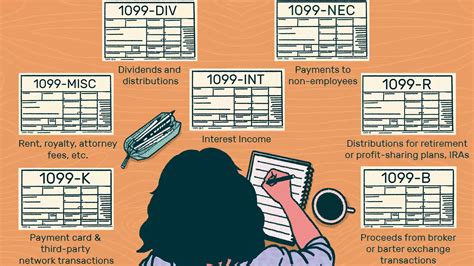

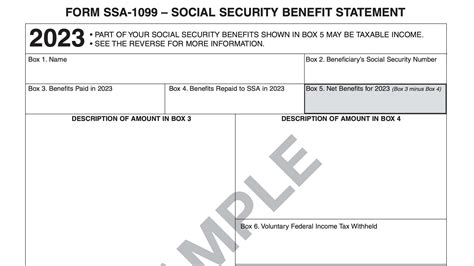

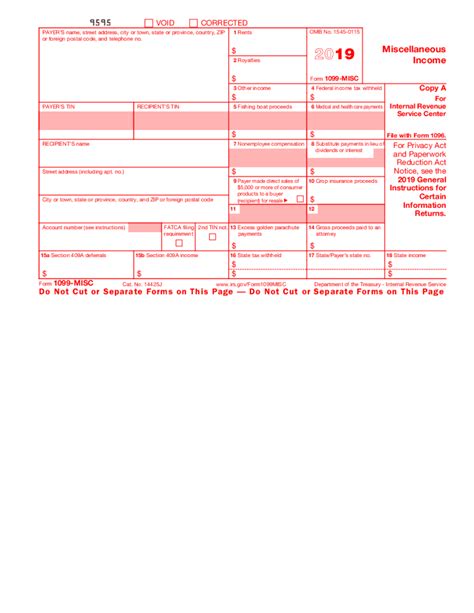

The 1099 form is a crucial document for individuals and businesses in the United States, as it reports various types of income to the Internal Revenue Service (IRS). With the rise of the gig economy and freelance work, the demand for 1099 forms has increased significantly. In this article, we will explore five ways to obtain a 1099 form printable, making it easier for you to manage your taxes and comply with IRS regulations.

The importance of 1099 forms cannot be overstated. They are used to report income from freelance work, self-employment, and other sources, such as rent, dividends, and interest. The IRS requires that businesses and individuals issue 1099 forms to recipients who have earned income above a certain threshold. Failure to comply with these regulations can result in penalties and fines, making it essential to have access to printable 1099 forms.

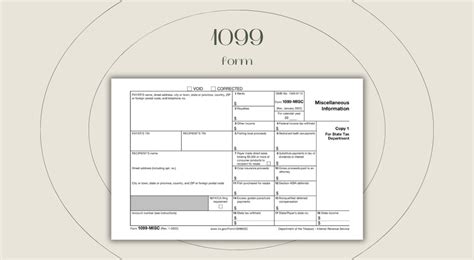

For individuals and businesses looking to obtain 1099 forms, there are several options available. You can purchase printed forms from office supply stores or online retailers, or you can download and print them from the IRS website. Additionally, many accounting software programs and tax preparation services offer printable 1099 forms as part of their packages. In this article, we will delve into the details of each option, providing you with the information you need to make an informed decision.

Understanding 1099 Forms

5 Ways to Obtain 1099 Form Printable

- Purchasing printed forms from office supply stores or online retailers

- Downloading and printing forms from the IRS website

- Using accounting software programs that offer printable 1099 forms

- Utilizing tax preparation services that provide printable 1099 forms

- Creating your own 1099 forms using a template or spreadsheet

Each of these options has its advantages and disadvantages, which we will discuss in detail. By understanding the pros and cons of each option, you can make an informed decision about which method is best for your needs.

Option 1: Purchasing Printed Forms

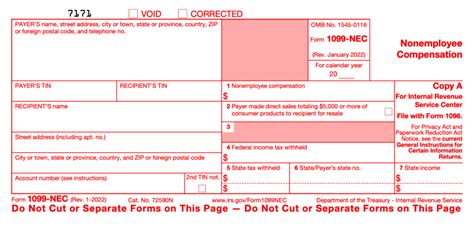

Option 2: Downloading and Printing Forms from the IRS Website

Option 3: Using Accounting Software Programs

Option 4: Utilizing Tax Preparation Services

Option 5: Creating Your Own 1099 Forms

Benefits of Using 1099 Form Printable

- Convenience: 1099 form printables are easily accessible and can be printed as needed.

- Cost-effective: Printing 1099 forms can save money compared to purchasing pre-printed forms.

- Customization: Homemade 1099 forms can be customized to meet specific needs.

- Accuracy: Using a template or spreadsheet can reduce errors and ensure compliance with IRS regulations.

By understanding the benefits of using 1099 form printables, you can make an informed decision about which option is best for your needs.

Common Mistakes to Avoid When Using 1099 Form Printable

- Failure to comply with IRS regulations

- Inaccurate or incomplete information

- Insufficient copies

- Late filing

By avoiding these common mistakes, you can ensure that your 1099 forms are accurate and compliant with IRS regulations.

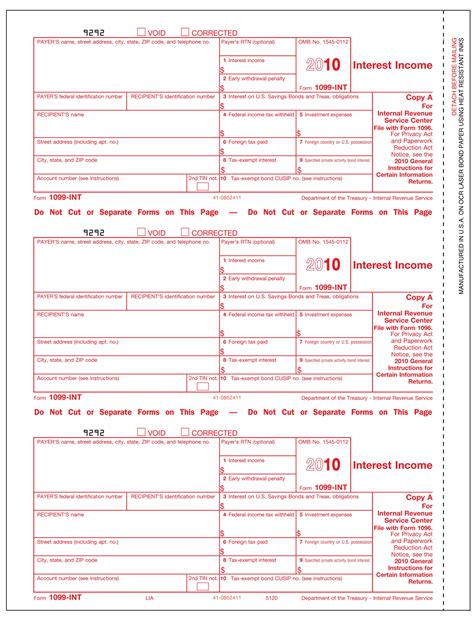

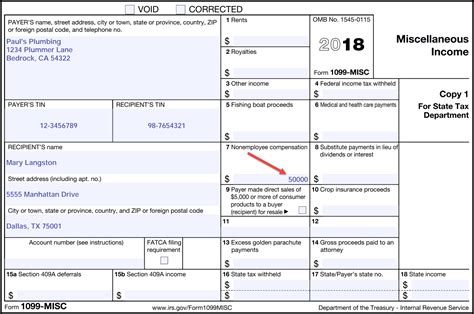

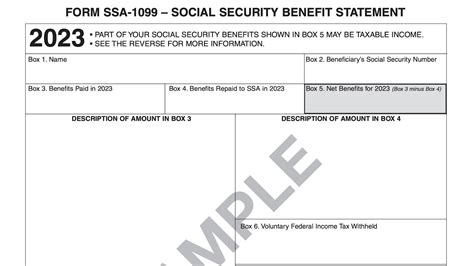

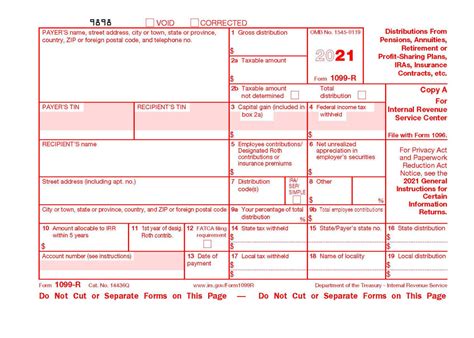

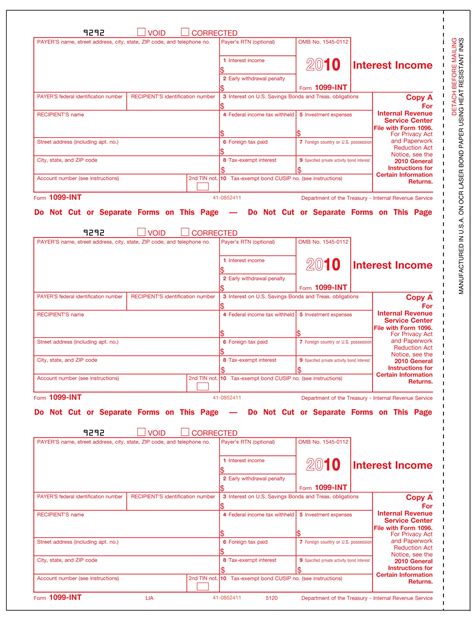

1099 Form Printable Image Gallery

What is a 1099 form?

+A 1099 form is a tax document that reports income earned from sources other than employment, such as freelance work, self-employment, and investments.

How do I obtain a 1099 form printable?

+You can obtain a 1099 form printable by purchasing printed forms from office supply stores or online retailers, downloading and printing forms from the IRS website, using accounting software programs, utilizing tax preparation services, or creating your own 1099 forms using a template or spreadsheet.

What are the benefits of using 1099 form printables?

+The benefits of using 1099 form printables include convenience, cost-effectiveness, customization, and accuracy.

What are common mistakes to avoid when using 1099 form printables?

+Common mistakes to avoid when using 1099 form printables include failure to comply with IRS regulations, inaccurate or incomplete information, insufficient copies, and late filing.

How can I ensure that my 1099 forms are accurate and compliant with IRS regulations?

+You can ensure that your 1099 forms are accurate and compliant with IRS regulations by using a template or spreadsheet, double-checking information, and filing on time.

In conclusion, obtaining a 1099 form printable is a straightforward process that can be accomplished through various methods. By understanding the benefits and common mistakes to avoid, you can ensure that your 1099 forms are accurate and compliant with IRS regulations. Whether you choose to purchase printed forms, download and print forms from the IRS website, use accounting software programs, utilize tax preparation services, or create your own 1099 forms, the key is to find a method that works best for your needs. By doing so, you can simplify the tax preparation process and reduce the risk of errors and penalties. We invite you to share your experiences and tips for obtaining and using 1099 form printables in the comments section below.