Intro

Discover 5 ways to utilize 1099 printable forms for tax season, including independent contractor reporting, freelance income tracking, and self-employment tax filing with ease and accuracy.

The 1099 printable form is a crucial document for individuals and businesses that need to report various types of income to the Internal Revenue Service (IRS). The form is used to report income such as freelance work, rent, dividends, and other types of non-employee compensation. In this article, we will explore five ways to obtain and use the 1099 printable form, as well as provide guidance on how to fill it out and submit it to the IRS.

The importance of the 1099 printable form cannot be overstated. It is a critical document that helps the IRS track and verify income, ensuring that individuals and businesses are paying their fair share of taxes. Without the 1099 form, it would be difficult for the IRS to accurately assess taxes owed, leading to potential penalties and fines. Furthermore, the 1099 form is also used to report income to state and local tax authorities, making it a vital component of the tax reporting process.

In addition to its importance in tax reporting, the 1099 printable form is also a useful tool for individuals and businesses to keep track of their income and expenses. By using the 1099 form, individuals can accurately report their income and claim deductions and credits they are eligible for. Businesses can also use the 1099 form to report income paid to independent contractors and other non-employees, helping to ensure compliance with tax laws and regulations.

Understanding the 1099 Printable Form

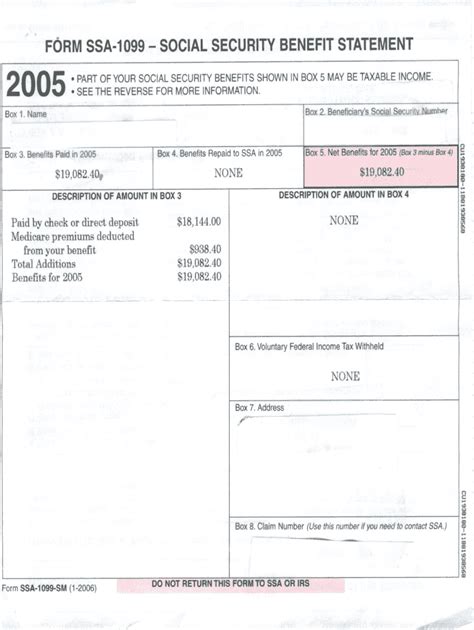

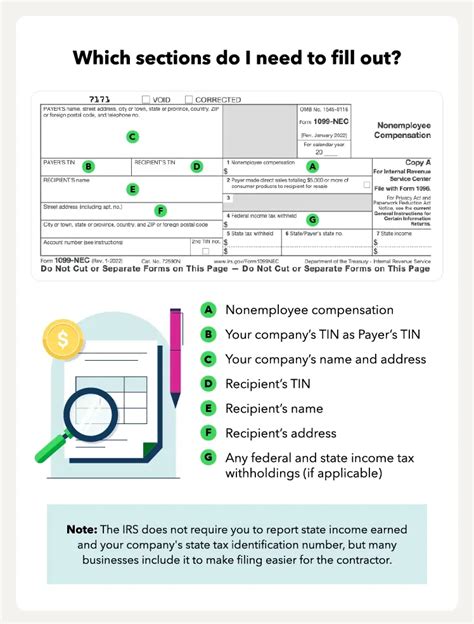

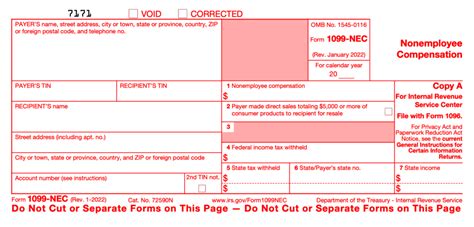

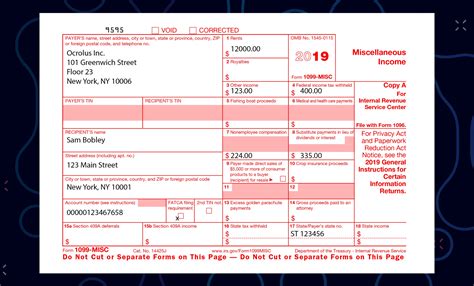

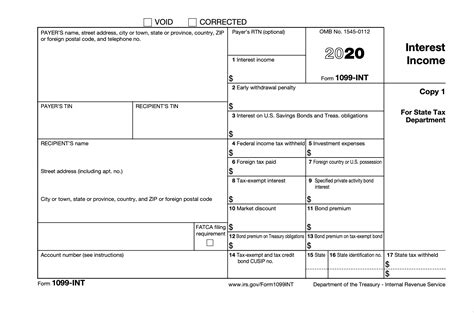

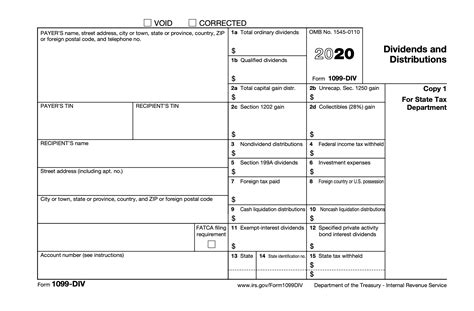

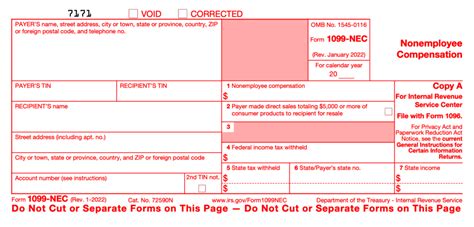

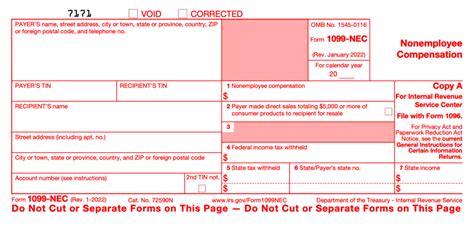

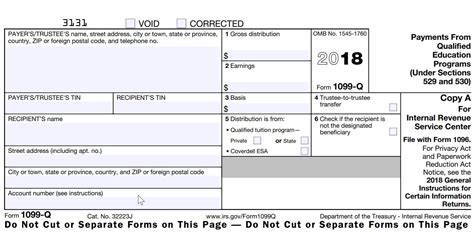

The 1099 printable form is a multi-part form that consists of several copies, including a copy for the payer, a copy for the recipient, and a copy for the IRS. The form is used to report various types of income, including freelance work, rent, dividends, and other types of non-employee compensation. The form requires the payer to provide their name, address, and taxpayer identification number, as well as the recipient's name, address, and taxpayer identification number.

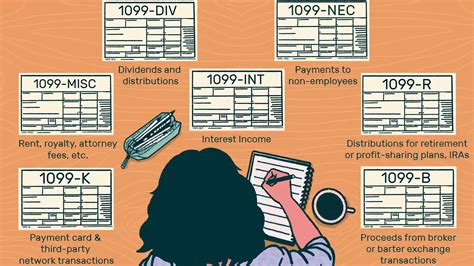

Types of 1099 Forms

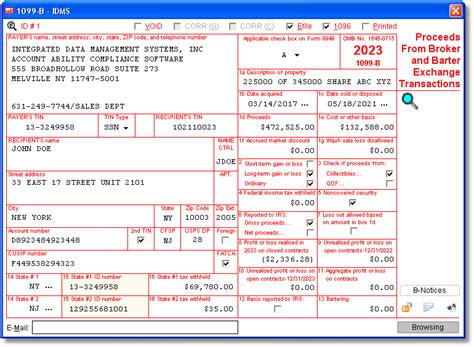

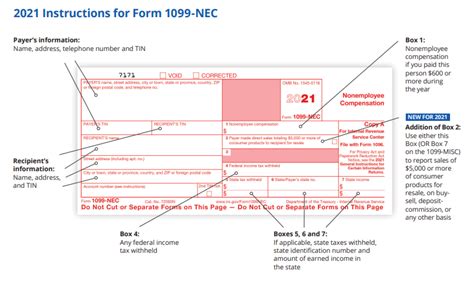

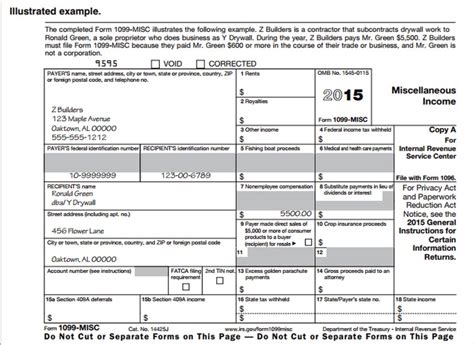

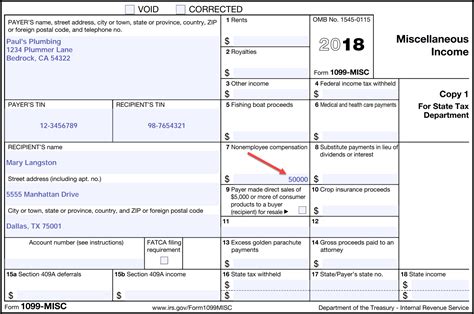

There are several types of 1099 forms, each used to report different types of income. The most common types of 1099 forms include: * 1099-MISC: Used to report miscellaneous income, such as freelance work and rent. * 1099-INT: Used to report interest income, such as interest earned on savings accounts and investments. * 1099-DIV: Used to report dividend income, such as dividends earned on stock investments. * 1099-B: Used to report proceeds from broker and barter exchange transactions.Obtaining the 1099 Printable Form

There are several ways to obtain the 1099 printable form, including:

- Downloading the form from the IRS website

- Ordering the form from the IRS by phone or mail

- Purchasing the form from an office supply store

- Using tax preparation software to generate the form

Benefits of Using Tax Preparation Software

Using tax preparation software to generate the 1099 form can be a convenient and efficient way to prepare and file the form. Tax preparation software can help ensure accuracy and completeness, reducing the risk of errors and penalties. Additionally, tax preparation software can help individuals and businesses keep track of their income and expenses, making it easier to prepare and file their tax returns.Filling Out the 1099 Printable Form

Filling out the 1099 printable form requires careful attention to detail to ensure accuracy and completeness. The form requires the payer to provide their name, address, and taxpayer identification number, as well as the recipient's name, address, and taxpayer identification number. The form also requires the payer to report the type and amount of income paid to the recipient.

Tips for Filling Out the 1099 Form

* Make sure to use the correct type of 1099 form for the type of income being reported. * Ensure that all required information is complete and accurate. * Use a separate 1099 form for each recipient. * Keep a copy of the 1099 form for your records.Submitting the 1099 Printable Form

Submitting the 1099 printable form requires careful attention to deadlines and filing requirements. The form must be filed with the IRS by January 31st of each year, and a copy must be provided to the recipient by January 31st. The form can be filed electronically or by mail, and individuals and businesses can use tax preparation software to help prepare and file the form.

Penalties for Late Filing

Failure to file the 1099 form on time can result in penalties and fines. The IRS imposes penalties for late filing, and individuals and businesses can face fines of up to $260 per form for failure to file on time.Common Mistakes to Avoid

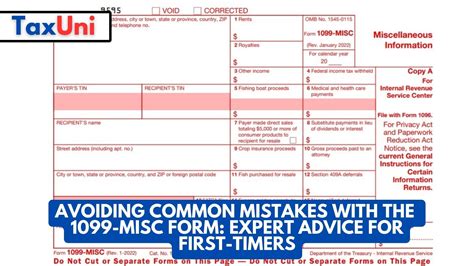

When filling out and submitting the 1099 printable form, there are several common mistakes to avoid, including:

- Using the wrong type of 1099 form

- Failing to report all required information

- Filing the form late

- Failing to keep a copy of the form for your records

Tips for Avoiding Mistakes

* Use tax preparation software to help prepare and file the form. * Double-check all required information for accuracy and completeness. * Keep a copy of the form for your records. * File the form on time to avoid penalties and fines.Gallery of 1099 Forms

1099 Form Image Gallery

What is the purpose of the 1099 form?

+The 1099 form is used to report various types of income, such as freelance work, rent, dividends, and other types of non-employee compensation.

Who is required to file the 1099 form?

+Individuals and businesses that pay non-employee compensation, such as freelance work and rent, are required to file the 1099 form.

What is the deadline for filing the 1099 form?

+The deadline for filing the 1099 form is January 31st of each year.

Can I file the 1099 form electronically?

+Yes, you can file the 1099 form electronically using tax preparation software or the IRS website.

What are the penalties for late filing the 1099 form?

+The penalties for late filing the 1099 form can range from $30 to $100 per form, depending on the timing of the filing.

In conclusion, the 1099 printable form is a critical document for individuals and businesses that need to report various types of income to the IRS. By understanding the purpose and requirements of the 1099 form, individuals and businesses can ensure compliance with tax laws and regulations. We encourage readers to share their experiences and tips for filling out and submitting the 1099 form, and to ask any questions they may have about the process. Additionally, we invite readers to explore our other resources and articles on tax-related topics, and to follow us for the latest updates and information on tax laws and regulations.