Intro

Discover 5 ways to save money, featuring budgeting tips, frugal living, and smart financial planning strategies to reduce expenses and increase savings, promoting financial freedom and stability.

Saving money is an essential aspect of personal finance that can help individuals achieve their long-term goals, such as buying a house, funding their children's education, or retiring comfortably. However, with the rising cost of living and the temptation to spend, it can be challenging to save money. In this article, we will explore five ways to save money, providing you with practical tips and strategies to help you develop a savings habit.

The importance of saving money cannot be overstated. Having a savings cushion can provide peace of mind, reduce financial stress, and give you the freedom to pursue your goals and dreams. Moreover, saving money can help you avoid debt, build wealth, and achieve financial stability. Whether you're a student, a working professional, or a retiree, saving money is crucial for securing your financial future.

In today's economy, it's easy to get caught up in consumerism and overspending. With the constant bombardment of advertisements, social media influencers, and peer pressure, it can be difficult to resist the temptation to spend. However, by developing a savings mindset and implementing effective savings strategies, you can overcome these challenges and achieve your financial goals. In the following sections, we will delve into five ways to save money, providing you with actionable advice and expert insights to help you get started.

Understanding Your Finances

Tracking Your Expenses

Tracking your expenses is a critical step in understanding your finances. For one month, write down every single transaction you make, including small purchases like coffee or snacks. This will help you identify areas where you can cut back and optimize your spending. You can use a budgeting app, spreadsheet, or even a notebook to track your expenses. Be honest and accurate, and don't forget to include irregular expenses like car maintenance or property taxes.Setting Financial Goals

Prioritizing Your Goals

Prioritizing your financial goals is essential to ensure you're allocating your resources effectively. Start by categorizing your goals into short-term (less than 1 year), medium-term (1-5 years), and long-term (more than 5 years). Then, prioritize your goals based on their urgency and importance. For example, if you have high-interest debt, it's essential to prioritize debt repayment over saving for a vacation.Automating Your Savings

Using Savings Apps

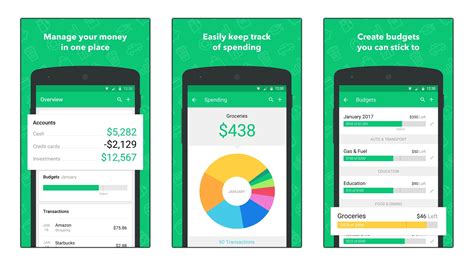

Savings apps can be a great way to automate your savings and make saving easier and more convenient. There are many savings apps available, each with its unique features and benefits. Some popular savings apps include Qapital, Digit, and Acorns. These apps can help you save money by rounding up your purchases, setting aside a fixed amount regularly, or investing your spare change in a diversified portfolio.Reducing Expenses

Using the 50/30/20 Rule

The 50/30/20 rule is a simple and effective way to allocate your income towards savings and expenses. The rule suggests that you allocate 50% of your income towards necessary expenses like rent, utilities, and groceries, 30% towards discretionary spending like entertainment and hobbies, and 20% towards savings and debt repayment. By following this rule, you can ensure that you're prioritizing your savings and expenses effectively.Investing Your Savings

Using Tax-Advantaged Accounts

Tax-advantaged accounts like 401(k), IRA, or Roth IRA can be a great way to save for retirement or other long-term goals. These accounts offer tax benefits that can help you save more money and reduce your tax liability. Consider contributing to a tax-advantaged account, especially if your employer offers a matching contribution. Always consult with a financial advisor to determine the best tax-advantaged account for your individual circumstances.Saving Money Image Gallery

What is the best way to start saving money?

+The best way to start saving money is to create a budget, track your expenses, and set financial goals. Start by allocating a small amount each month and gradually increase it over time.

How can I automate my savings?

+You can automate your savings by setting up automatic transfers from your checking account to your savings or investment accounts. You can use a savings app or consult with your bank to set up automatic transfers.

What is the 50/30/20 rule?

+The 50/30/20 rule is a simple and effective way to allocate your income towards savings and expenses. It suggests that you allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

How can I invest my savings?

+You can invest your savings by consulting with a financial advisor or using a robo-advisor. Consider investing in a diversified portfolio of stocks, bonds, and other assets to grow your wealth over time.

What is a tax-advantaged account?

+A tax-advantaged account is a type of savings account that offers tax benefits to help you save more money and reduce your tax liability. Examples of tax-advantaged accounts include 401(k), IRA, and Roth IRA.

In conclusion, saving money is a crucial aspect of personal finance that requires discipline, patience, and persistence. By following the five ways to save money outlined in this article, you can develop a savings habit, achieve your financial goals, and secure your financial future. Remember to always track your expenses, set financial goals, automate your savings, reduce expenses, and invest your savings wisely. With the right mindset and strategies, you can overcome the challenges of saving money and achieve financial freedom. We encourage you to share your thoughts, experiences, and tips on saving money in the comments below. Let's work together to build a community that prioritizes financial literacy and savings.