Intro

Discover how advanced claims technologies are revolutionizing the insurance industry. Learn how automation, AI, and data analytics are streamlining insurance claims processing, improving customer experience, and reducing costs. Explore the benefits of implementing cutting-edge claims management systems and transform your insurance operations.

The insurance industry is on the cusp of a revolution, driven by the increasing adoption of advanced claims technologies. These cutting-edge solutions are transforming the way insurance companies operate, making the claims process faster, more efficient, and more customer-centric. In this article, we will delve into the world of advanced claims technologies and explore how they are streamlining the insurance industry.

Insurance companies have long struggled with manual, paper-based claims processes that are time-consuming, prone to errors, and often frustrating for customers. However, with the advent of advanced claims technologies, insurers can now automate many of these processes, freeing up resources to focus on more strategic and customer-facing activities. From artificial intelligence (AI) and machine learning (ML) to blockchain and the Internet of Things (IoT), these technologies are redefining the insurance landscape and setting new standards for claims handling.

Key Benefits of Advanced Claims Technologies

So, what are the key benefits of advanced claims technologies for insurance companies? Here are some of the most significant advantages:

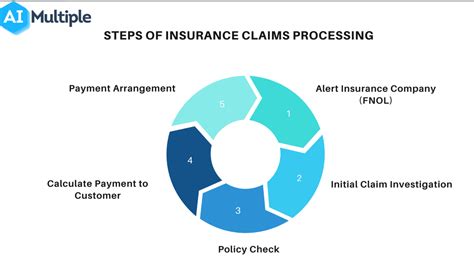

- Faster claims processing: Advanced claims technologies can automate many of the manual tasks involved in claims processing, such as data entry and document review. This enables insurers to process claims faster and more efficiently, reducing the time it takes to settle claims and improving customer satisfaction.

- Improved accuracy: Advanced claims technologies can also improve the accuracy of claims processing by reducing the likelihood of human error. This can help to minimize the risk of claims being denied or delayed due to errors or omissions.

- Enhanced customer experience: Advanced claims technologies can provide customers with a more seamless and transparent claims experience. For example, insurers can use mobile apps and online portals to allow customers to submit claims and track their progress in real-time.

- Reduced costs: By automating many of the manual tasks involved in claims processing, insurers can reduce their operational costs and improve their bottom line.

Artificial Intelligence (AI) and Machine Learning (ML)

Two of the most exciting advanced claims technologies are AI and ML. These technologies have the potential to revolutionize the insurance industry by enabling insurers to analyze large datasets, identify patterns, and make predictions about future claims.

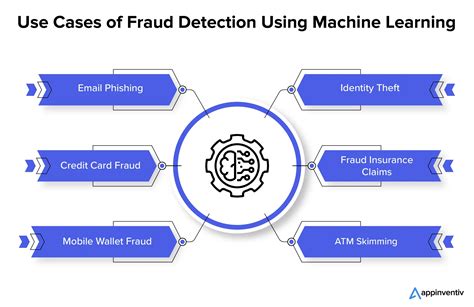

- Claims fraud detection: AI and ML can be used to detect claims fraud by analyzing patterns of behavior and identifying anomalies. This can help insurers to reduce the risk of fraudulent claims and improve their overall claims handling process.

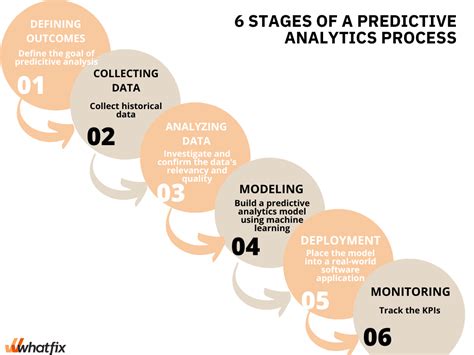

- Predictive analytics: AI and ML can also be used to predict the likelihood of future claims. This can help insurers to identify high-risk customers and tailor their policies and pricing accordingly.

- Automated claims processing: AI and ML can be used to automate many of the manual tasks involved in claims processing, such as data entry and document review. This can help insurers to process claims faster and more efficiently.

Blockchain and the Internet of Things (IoT)

In addition to AI and ML, blockchain and IoT are two other advanced claims technologies that are transforming the insurance industry.

- Blockchain: Blockchain is a decentralized, digital ledger that can be used to record and verify transactions. In the insurance industry, blockchain can be used to create a secure and transparent record of claims, reducing the risk of errors and disputes.

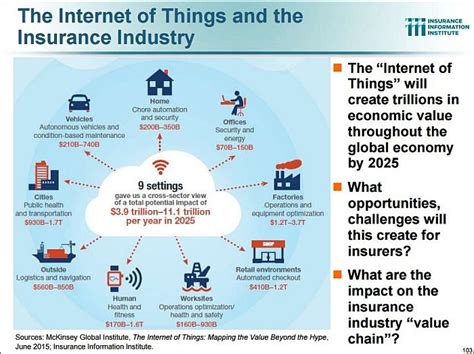

- IoT: IoT refers to the network of physical devices, vehicles, and other items that are embedded with sensors and software, allowing them to collect and exchange data. In the insurance industry, IoT can be used to collect data about customer behavior and preferences, enabling insurers to tailor their policies and pricing accordingly.

Implementing Advanced Claims Technologies

Implementing advanced claims technologies can be a complex and challenging process, requiring significant investment in new technologies and training for employees. However, the benefits of these technologies are clear, and insurers that fail to adopt them risk being left behind.

- Start small: Insurers should start by implementing advanced claims technologies in a small, controlled environment, such as a single claims processing center. This will enable them to test and refine their systems before rolling them out more widely.

- Invest in training: Insurers should invest in training for their employees, ensuring that they have the skills and knowledge needed to use advanced claims technologies effectively.

- Monitor and evaluate: Insurers should continuously monitor and evaluate their advanced claims technologies, identifying areas for improvement and making adjustments as needed.

Conclusion

In conclusion, advanced claims technologies are transforming the insurance industry, enabling insurers to process claims faster and more efficiently, improve customer satisfaction, and reduce costs. From AI and ML to blockchain and IoT, these technologies have the potential to revolutionize the way insurers operate, and those that fail to adopt them risk being left behind.

Gallery of Advanced Claims Technologies

What are advanced claims technologies?

+Advanced claims technologies refer to the use of cutting-edge technologies such as artificial intelligence, machine learning, blockchain, and the Internet of Things to improve the insurance claims process.

How can advanced claims technologies benefit insurance companies?

+Advanced claims technologies can benefit insurance companies by enabling them to process claims faster and more efficiently, improve customer satisfaction, and reduce costs.

What are some examples of advanced claims technologies?

+Examples of advanced claims technologies include artificial intelligence, machine learning, blockchain, and the Internet of Things.