Intro

Discover 5 Leaps Calendar Spreads, a trading strategy using calendar spreads, leap options, and volatility to maximize profits, with related concepts like options trading, volatility trading, and spread betting.

The world of trading and investing is filled with various strategies and techniques, each designed to help individuals navigate the complex markets and make informed decisions. One such strategy that has gained popularity in recent years is the 5 Leaps Calendar Spread. This approach involves using options to create a spread that can potentially generate profits from the passage of time, rather than relying solely on the direction of the underlying asset's price movement.

For those who are new to options trading, a leap refers to a long-term option that expires in more than 9 months. These options are less common than standard options but offer unique opportunities for traders who are willing to hold positions for extended periods. The 5 Leaps Calendar Spread is a specific type of options spread that involves buying and selling leaps with different expiration dates, creating a strategy that can be both versatile and profitable.

The importance of understanding and mastering the 5 Leaps Calendar Spread cannot be overstated. In a market filled with uncertainty and volatility, having a reliable strategy can make all the difference between success and failure. This spread offers traders a way to potentially profit from time decay, which is the gradual decrease in the value of an option as it approaches its expiration date. By correctly implementing the 5 Leaps Calendar Spread, traders can hedge against potential losses and create opportunities for gains, even in stagnant or declining markets.

As we delve into the world of the 5 Leaps Calendar Spread, it's essential to understand the underlying mechanics and how this strategy can be applied in real-world trading scenarios. Whether you're a seasoned trader or just starting to explore the possibilities of options trading, this strategy offers a unique approach to managing risk and maximizing returns. With its potential for generating consistent profits and its ability to adapt to various market conditions, the 5 Leaps Calendar Spread is an invaluable tool for any serious trader.

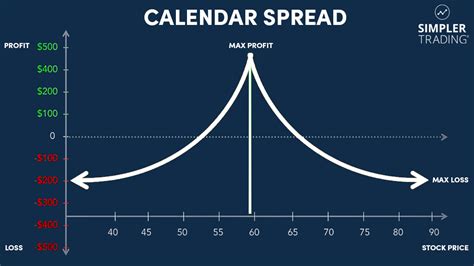

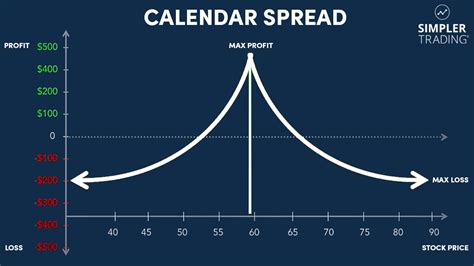

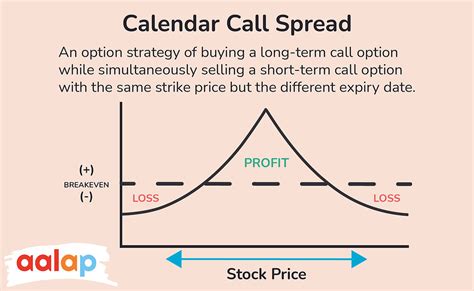

Introduction to Calendar Spreads

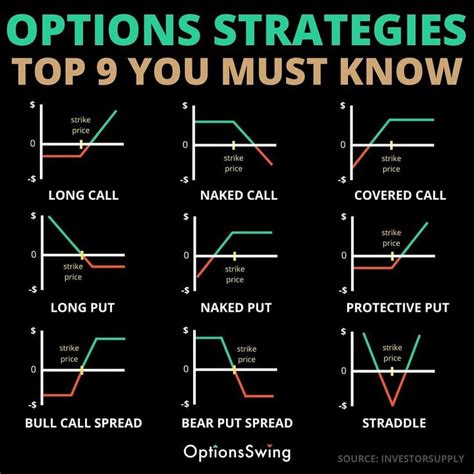

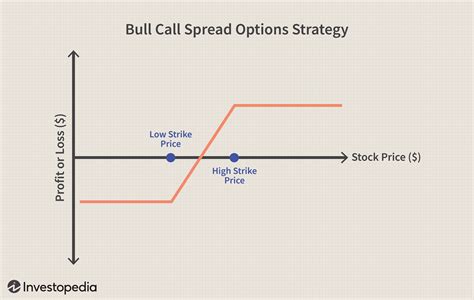

Calendar spreads are a type of options spread that involves buying and selling options with the same strike price but different expiration dates. This strategy is based on the principle that the value of an option decreases over time, a phenomenon known as time decay. By buying an option with a longer expiration date and selling an option with a shorter expiration date, traders can potentially profit from the difference in time decay between the two options.

One of the key benefits of calendar spreads is their ability to generate profits in a neutral market. Unlike directional trading strategies that require the market to move in a specific direction, calendar spreads can profit from the passage of time, regardless of the market's direction. This makes them an attractive option for traders who are looking to generate consistent returns without exposing themselves to excessive risk.

Understanding Leaps

Leaps, or Long-term Equity Anticipation Securities, are options that expire in more than 9 months. These options are designed for long-term investors who want to speculate on the price movement of an underlying asset over an extended period. Leaps offer several advantages over standard options, including greater flexibility and the potential for higher returns.

One of the primary benefits of leaps is their ability to provide long-term exposure to an underlying asset without the need for frequent rolling of positions. This can be particularly useful for traders who are looking to hedge against potential losses or speculate on long-term trends. Additionally, leaps can offer higher returns than standard options, especially in volatile markets where the potential for large price movements is greater.

Implementing the 5 Leaps Calendar Spread

The 5 Leaps Calendar Spread involves buying and selling leaps with different expiration dates, creating a spread that can potentially generate profits from time decay. To implement this strategy, traders need to follow a series of steps, including:

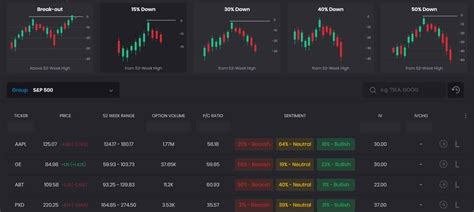

- Selecting the Underlying Asset: The first step in implementing the 5 Leaps Calendar Spread is to select the underlying asset. This can be a stock, ETF, or index, and it's essential to choose an asset that is liquid and has a high level of trading activity.

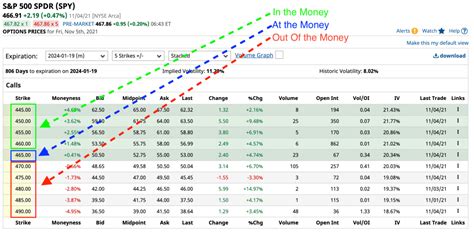

- Choosing the Strike Price: The next step is to choose the strike price for the spread. This should be a price that is close to the current market price of the underlying asset, and it's essential to select a strike price that is likely to be traded frequently.

- Buying the Long-Term Leap: The long-term leap is the option with the longer expiration date. This option should be bought at the selected strike price, and it's essential to choose an option with a high level of liquidity.

- Selling the Short-Term Leap: The short-term leap is the option with the shorter expiration date. This option should be sold at the same strike price as the long-term leap, and it's essential to choose an option with a high level of liquidity.

- Monitoring and Adjusting the Spread: Once the spread has been established, it's essential to monitor it regularly and make adjustments as necessary. This can involve rolling the position, adjusting the strike price, or closing the spread entirely.

Benefits and Risks of the 5 Leaps Calendar Spread

The 5 Leaps Calendar Spread offers several benefits, including the potential for generating consistent profits, hedging against potential losses, and providing long-term exposure to an underlying asset. However, like all trading strategies, it also involves risks, including the potential for losses, time decay, and liquidity risks.

To mitigate these risks, traders need to carefully monitor the spread and make adjustments as necessary. This can involve rolling the position, adjusting the strike price, or closing the spread entirely. Additionally, traders should always use risk management techniques, such as stop-loss orders and position sizing, to limit their exposure to potential losses.

Real-World Examples of the 5 Leaps Calendar Spread

The 5 Leaps Calendar Spread can be used in a variety of real-world trading scenarios, including:

- Hedging against potential losses: By buying a long-term leap and selling a short-term leap, traders can hedge against potential losses in a declining market.

- Speculating on long-term trends: The 5 Leaps Calendar Spread can be used to speculate on long-term trends in the market, providing traders with a way to profit from the passage of time.

- Generating consistent profits: By regularly rolling the position and adjusting the strike price, traders can generate consistent profits from the 5 Leaps Calendar Spread.

Conclusion and Next Steps

In conclusion, the 5 Leaps Calendar Spread is a powerful trading strategy that can be used to generate consistent profits, hedge against potential losses, and provide long-term exposure to an underlying asset. By understanding the mechanics of this strategy and implementing it correctly, traders can potentially achieve their investment goals and succeed in the complex world of options trading.

To learn more about the 5 Leaps Calendar Spread and how to implement it in your trading strategy, we recommend further research and education. This can involve reading books and articles, attending seminars and workshops, and practicing with a demo account. By taking the time to learn and understand this strategy, traders can potentially achieve their investment goals and succeed in the world of options trading.

5 Leaps Calendar Spread Image Gallery

What is a 5 Leaps Calendar Spread?

+A 5 Leaps Calendar Spread is a trading strategy that involves buying and selling leaps with different expiration dates to generate profits from time decay.

How does the 5 Leaps Calendar Spread work?

+The 5 Leaps Calendar Spread works by buying a long-term leap and selling a short-term leap, creating a spread that can potentially generate profits from time decay.

What are the benefits of the 5 Leaps Calendar Spread?

+The benefits of the 5 Leaps Calendar Spread include generating consistent profits, hedging against potential losses, and providing long-term exposure to an underlying asset.

What are the risks of the 5 Leaps Calendar Spread?

+The risks of the 5 Leaps Calendar Spread include the potential for losses, time decay, and liquidity risks.

How can I learn more about the 5 Leaps Calendar Spread?

+You can learn more about the 5 Leaps Calendar Spread by reading books and articles, attending seminars and workshops, and practicing with a demo account.

We hope this article has provided you with a comprehensive understanding of the 5 Leaps Calendar Spread and its potential applications in options trading. Whether you're a seasoned trader or just starting to explore the world of options, this strategy offers a unique approach to generating consistent profits and managing risk. By taking the time to learn and understand the 5 Leaps Calendar Spread, you can potentially achieve your investment goals and succeed in the complex world of options trading. We invite you to share your thoughts and experiences with the 5 Leaps Calendar Spread in the comments below, and to explore our other resources and articles for more information on options trading and investment strategies.