Intro

Discover 5 ways calendar call option strategies boost trading profits with spread, volatility, and risk management techniques, maximizing investment returns.

The world of finance is filled with intricate instruments and strategies, each designed to help investors navigate the complex landscape of the market. Among these, options stand out as a versatile tool, allowing for a variety of approaches to managing risk and speculating on potential gains. A specific type of option that has garnered attention for its unique characteristics is the calendar call option, also known as a time spread. This financial derivative allows investors to bet on the passage of time, leveraging the differing rates at which options lose value over time, a phenomenon known as time decay.

The importance of understanding calendar call options cannot be overstated, especially in today's volatile markets. Investors are constantly seeking ways to hedge their positions, speculate on price movements, and generate income from their portfolios. The calendar call option, with its ability to profit from time decay, offers a compelling strategy for achieving these goals. However, like all financial instruments, it comes with its own set of risks and complexities, making it essential for potential investors to delve deeper into its mechanics and applications.

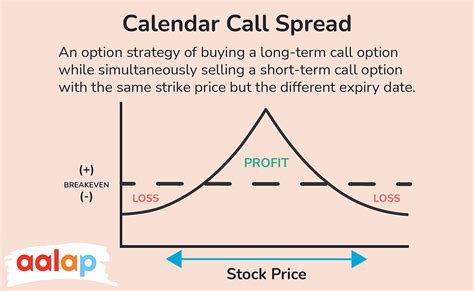

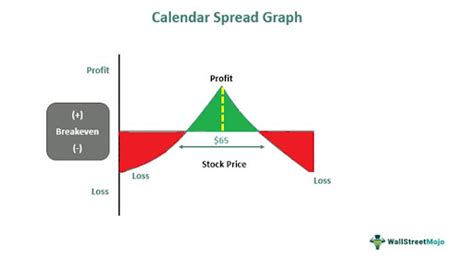

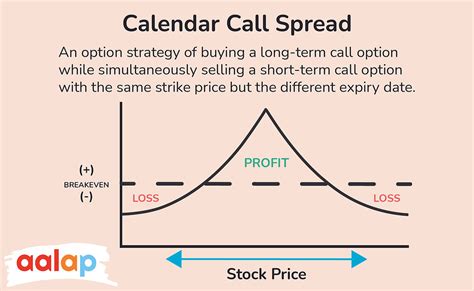

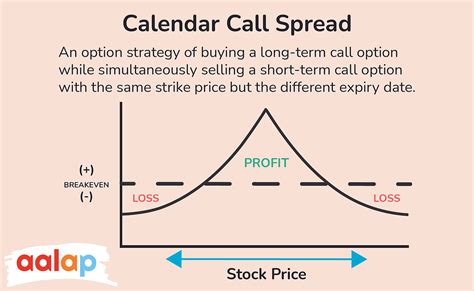

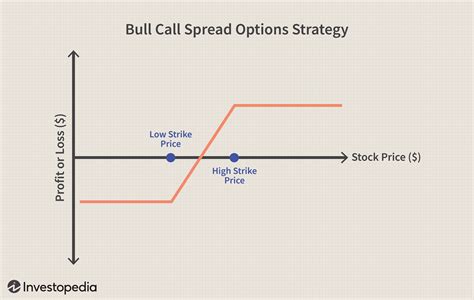

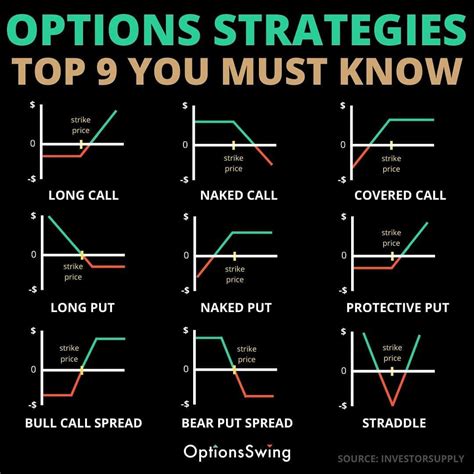

For those looking to explore the world of options trading, the calendar call option presents a fascinating opportunity. It involves buying and selling call options with the same strike price but different expiration dates. The strategy typically involves selling a call option with a near-term expiration date and buying a call option with a longer-term expiration date. The premise is to profit from the difference in time decay between the two options, as the near-term option loses value more rapidly than the longer-term option. This approach can be particularly appealing in a stable or slightly bullish market, where the investor expects the underlying asset to remain relatively unchanged or increase in value over time.

Understanding Calendar Call Options

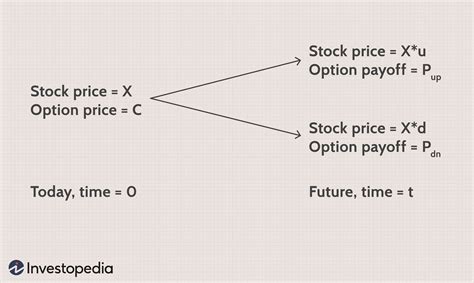

To fully grasp the concept of calendar call options, it's crucial to understand the factors that influence their value. The price of an option is determined by several components, including the underlying asset's price, the strike price, the time to expiration, volatility, and interest rates. Among these, time to expiration plays a significant role in the strategy, as options lose value over time due to time decay. The rate of this decay is not linear; it accelerates as the option's expiration date approaches. This characteristic is what calendar call options exploit, by positioning the investor to benefit from the differing rates of time decay between options with near and distant expiration dates.

Key Components of Calendar Call Options

The success of a calendar call option strategy hinges on several key components: - **Strike Price**: The price at which the underlying asset can be bought or sold. For a calendar call option, the strike prices of the bought and sold options must be the same. - **Expiration Dates**: The dates on which the options expire. The strategy involves options with different expiration dates, typically selling the near-term option and buying the longer-term option. - **Time Decay**: The loss of value of an option over time. This is more pronounced in near-term options. - **Volatility**: The degree of uncertainty or fluctuation in the price of the underlying asset. High volatility can increase the value of options but also increases risk. - **Interest Rates**: Can affect the pricing of options, though their impact is generally more significant for longer-term options.Benefits of Calendar Call Options

Calendar call options offer several benefits to investors:

- Potential for Income Generation: By selling options with near-term expirations and buying options with longer-term expirations, investors can generate income from the premium received for the sold option.

- Hedging Capabilities: These options can be used as a hedging strategy against potential losses in a portfolio, especially for investors who are bullish on an asset but want to protect against short-term volatility.

- Flexibility: Calendar call options can be adjusted based on market conditions, allowing investors to roll their positions forward or adjust strike prices as needed.

Steps to Implement a Calendar Call Option Strategy

Implementing a calendar call option strategy involves several steps: 1. **Identify the Underlying Asset**: Choose an asset that you believe will remain stable or increase in value over time. 2. **Select the Strike Price**: The strike price should be close to the current market price of the underlying asset to maximize the potential for profit. 3. **Choose the Expiration Dates**: Select a near-term option to sell and a longer-term option to buy, ensuring both have the same strike price. 4. **Monitor and Adjust**: Continuously monitor the position and be prepared to adjust as market conditions change, which may involve rolling the position forward or closing it out.Risks and Considerations

While calendar call options offer attractive potential benefits, they also come with significant risks and considerations:

- Unlimited Potential Loss: If the underlying asset moves significantly against the position, the potential loss can be substantial, especially if the investor is required to buy or sell the underlying asset at the strike price.

- Time Commitment: Managing a calendar call option strategy requires a significant time commitment, as positions need to be continuously monitored and adjusted.

- Market Volatility: High volatility can rapidly change the value of options, potentially leading to unexpected losses if not managed properly.

Managing Risks

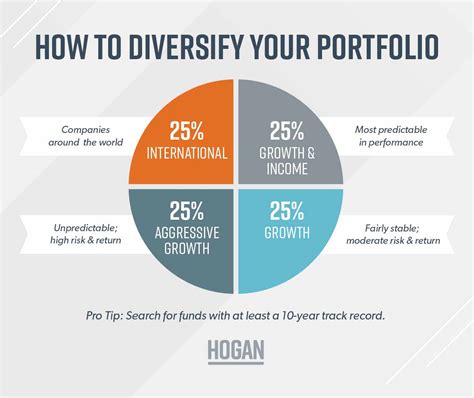

To manage the risks associated with calendar call options: - **Education**: Ensure a deep understanding of options trading and the specific strategy. - **Diversification**: Spread risk by diversifying investments across different assets and strategies. - **Position Sizing**: Manage the size of the position to limit potential losses. - **Stop-Loss Orders**: Consider using stop-loss orders to automatically close out positions if they reach a certain level of loss.Real-World Applications

Calendar call options have various real-world applications:

- Income Generation for Retirees: Can provide a regular income stream for retirees by selling options against a portfolio of stocks.

- Hedging for Corporations: Companies can use calendar call options to hedge against potential losses in their inventory or investments.

- Speculation for Traders: Traders can speculate on the price movements of underlying assets, using calendar call options as part of their strategy.

Case Studies

Several case studies illustrate the successful use of calendar call options: - **Generating Income**: An investor sells near-term call options on a stable stock, generating income from the premiums received. - **Hedging**: A company uses calendar call options to protect against potential losses in its inventory due to price fluctuations.Conclusion and Next Steps

In conclusion, calendar call options offer a sophisticated strategy for investors looking to generate income, hedge against potential losses, or speculate on price movements. However, they require a deep understanding of options trading, market volatility, and risk management. For those willing to learn and adapt, calendar call options can be a powerful tool in their investment arsenal.

Before diving into calendar call options, it's essential to:

- Educate Yourself: Learn about options trading, volatility, and risk management.

- Consult a Financial Advisor: Seek professional advice to ensure this strategy aligns with your investment goals and risk tolerance.

- Start Small: Begin with a small position to gain experience and adjust your strategy as needed.

Calendar Call Options Image Gallery

What is a calendar call option?

+A calendar call option is a strategy involving the purchase of a call option with a longer expiration date and the sale of a call option with a shorter expiration date, both with the same strike price.

How do calendar call options generate income?

+Income is generated from the premium received for selling the near-term call option. The goal is for the near-term option to expire worthless, allowing the investor to retain the premium as income.

What are the risks associated with calendar call options?

+The main risks include unlimited potential loss if the underlying asset moves significantly against the position, the need for continuous monitoring and adjustment, and the impact of market volatility on option prices.

How can I manage the risks of calendar call options?

+Risks can be managed through education, diversification, appropriate position sizing, and the use of stop-loss orders. It's also crucial to have a deep understanding of options trading and market dynamics.

Are calendar call options suitable for all investors?

+No, calendar call options are not suitable for all investors. They require a significant understanding of options trading, risk management, and market volatility. It's recommended for investors with experience in options trading and a tolerance for risk.

We hope this comprehensive guide to calendar call options has provided you with a deeper understanding of this complex and intriguing financial instrument. Whether you're a seasoned investor or just starting to explore the world of options trading, the potential benefits and risks of calendar call options make them a strategy worth considering. Remember, the key to success lies in education, experience, and a keen eye on market movements. Share your thoughts and experiences with calendar call options in the comments below, and don't hesitate to reach out if you have any further questions or need additional guidance on navigating the fascinating world of finance.