Intro

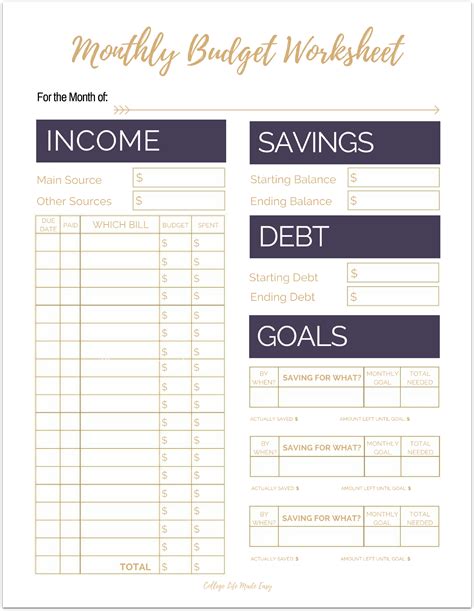

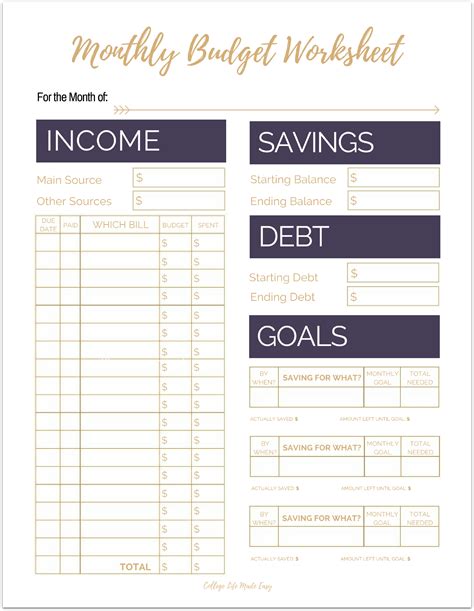

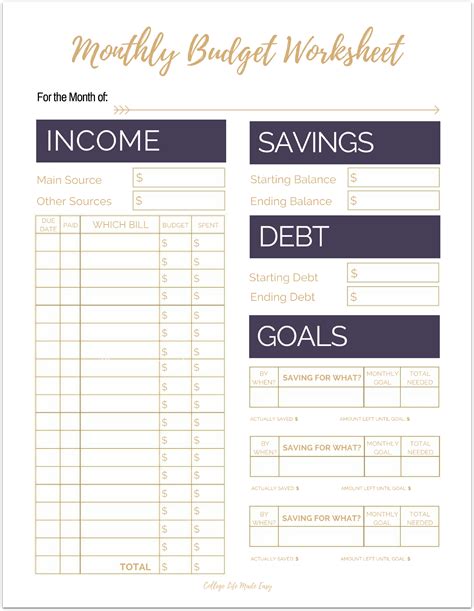

Master budgeting with 5 essential budget worksheets, featuring expense trackers, income calculators, and financial planners to optimize savings, reduce debt, and improve money management skills.

Creating a budget is an essential step in managing your finances effectively. It helps you understand where your money is going, identify areas for improvement, and make informed decisions about your financial resources. A budget worksheet is a tool that simplifies the process of creating and tracking your budget. In this article, we will delve into the world of budget worksheets, exploring their importance, types, and how to use them effectively to achieve your financial goals.

Budgeting is not just about restricting your spending; it's about making conscious decisions about how you allocate your resources to achieve your financial objectives. Whether you're looking to save for a big purchase, pay off debt, or simply manage your day-to-day expenses, a budget worksheet can be your guide. It provides a clear picture of your income and expenses, helping you identify patterns, cut back on unnecessary spending, and prioritize your financial goals.

Effective budgeting requires discipline, patience, and the right tools. With the plethora of budgeting apps, spreadsheets, and worksheets available, it can be overwhelming to choose the right one for your needs. However, traditional budget worksheets remain a popular choice due to their simplicity and flexibility. They can be customized to fit your specific financial situation and goals, making them an invaluable resource for anyone looking to take control of their finances.

Understanding Budget Worksheets

Budget worksheets are designed to help you track your income and expenses over a specific period, usually a month. They typically include columns for income, fixed expenses (such as rent, utilities, and car payments), variable expenses (like groceries and entertainment), savings, and debt repayment. By filling out a budget worksheet regularly, you can monitor your spending habits, stay on top of your bills, and make adjustments as needed to stay within your means.

Types of Budget Worksheets

There are several types of budget worksheets available, each catering to different financial needs and preferences. Some of the most common types include:

- Zero-Based Budget Worksheet: This type of budget starts from a "zero balance," where every dollar of income is assigned to a specific expense or savings goal. It's ideal for those who want to ensure every dollar is accounted for.

- 50/30/20 Budget Worksheet: This worksheet allocates 50% of your income towards necessary expenses (like rent and utilities), 30% towards discretionary spending, and 20% towards saving and debt repayment. It's a good starting point for those new to budgeting.

- Envelope Budget Worksheet: This system involves dividing expenses into categories (like groceries, entertainment, etc.) and allocating a specific amount of cash for each category. It's helpful for those who prefer a more tactile approach to budgeting.

Benefits of Using Budget Worksheets

The benefits of using budget worksheets are numerous. They help you:

- Track Your Spending: By monitoring where your money is going, you can identify areas of unnecessary spending and make cuts.

- Set Financial Goals: Whether it's saving for a down payment on a house, paying off credit card debt, or building an emergency fund, budget worksheets help you prioritize your goals.

- Reduce Stress: Knowing exactly how much you have to spend and save can significantly reduce financial stress and anxiety.

- Improve Financial Discipline: Budgeting helps you develop healthy financial habits, such as saving regularly and avoiding impulse purchases.

How to Use Budget Worksheets Effectively

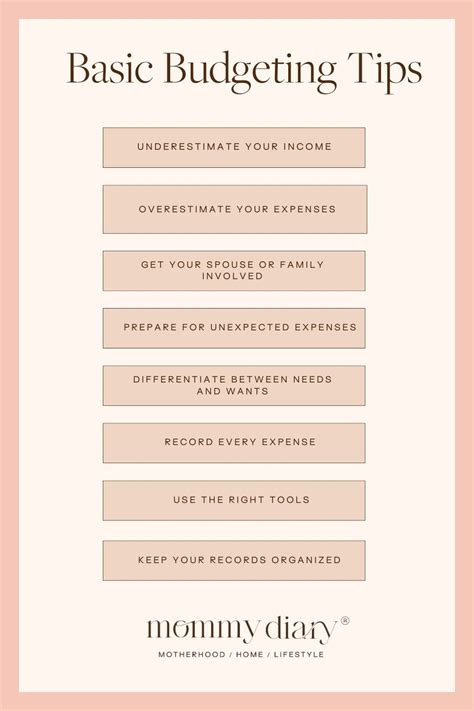

To get the most out of budget worksheets, follow these steps:

- Choose the Right Worksheet: Select a worksheet that aligns with your financial goals and preferences.

- Gather Financial Information: Collect all relevant financial documents, including pay stubs, bills, and bank statements.

- Fill Out the Worksheet: Accurately fill out the worksheet, making sure to include all sources of income and expenses.

- Review and Adjust: Regularly review your budget to identify areas for improvement and make adjustments as needed.

- Stay Consistent: Budgeting is an ongoing process. Commit to regularly updating and reviewing your budget worksheet.

Common Budgeting Mistakes to Avoid

While budgeting can be highly beneficial, there are common mistakes to watch out for:

- Not Accounting for Irregular Expenses: Failing to budget for occasional expenses, like car maintenance or property taxes, can throw off your financial plans.

- Underestimating Expenses: Being too optimistic about how much things cost can lead to budget shortfalls.

- Not Prioritizing Needs Over Wants: Failing to distinguish between essential expenses and discretionary spending can lead to financial strain.

Conclusion and Next Steps

In conclusion, budget worksheets are a powerful tool for taking control of your finances. By understanding the different types of worksheets, their benefits, and how to use them effectively, you can set yourself on the path to financial stability and success. Remember, budgeting is a journey, and it's okay to make adjustments along the way. The key is to stay committed, be patient, and continuously work towards your financial goals.

Budgeting Image Gallery

What is the purpose of a budget worksheet?

+A budget worksheet is used to track income and expenses, helping individuals manage their finances more effectively and make informed decisions about their financial resources.

How often should I review my budget worksheet?

+It's recommended to review your budget worksheet regularly, ideally once a month, to ensure you're on track with your financial goals and to make any necessary adjustments.

What are some common budgeting mistakes to avoid?

+Common budgeting mistakes include not accounting for irregular expenses, underestimating expenses, and failing to prioritize needs over wants. Avoiding these mistakes can help ensure your budget is realistic and effective.

We hope this comprehensive guide to budget worksheets has been informative and helpful. Whether you're a seasoned budgeter or just starting out, remember that budgeting is a tool to help you achieve your financial goals. By staying committed, being patient, and continuously working towards your objectives, you can achieve financial stability and success. Share your thoughts on budgeting and how you use budget worksheets in the comments below. Don't forget to share this article with anyone who might benefit from learning more about managing their finances effectively.