Intro

Discover 5 BYU expense tips to manage student finances effectively, including budgeting, saving, and investing strategies for financial freedom and success.

Managing expenses is a crucial aspect of personal finance, and for students at Brigham Young University (BYU), it's essential to navigate the costs associated with higher education. BYU, being a private university, comes with its own set of financial considerations. From tuition fees to living expenses, understanding how to manage your money effectively can make a significant difference in your academic and personal life. In this article, we will delve into five BYU expense tips that can help you save money, budget wisely, and make the most out of your time at BYU.

The importance of financial literacy cannot be overstated, especially for students who are often managing their finances for the first time. It's not just about saving money; it's about creating a lifestyle that is sustainable and responsible. BYU offers a unique environment that combines academic rigor with a strong sense of community, making it an excellent place to learn not just from textbooks, but from experiences and the people around you. However, to fully immerse yourself in this experience, you need to be on top of your finances.

One of the most significant challenges students face is balancing the desire to enjoy their college experience with the need to be frugal. It's a delicate balance, but one that can be achieved with the right strategies. Whether you're a freshman looking to make the most out of your first year or a senior aiming to graduate with minimal debt, understanding how to manage your expenses is key. This involves being aware of the costs associated with attending BYU, from tuition and fees to housing and food, and finding ways to minimize these expenses without compromising your educational experience.

Understanding BYU Expenses

Breaking Down Expenses

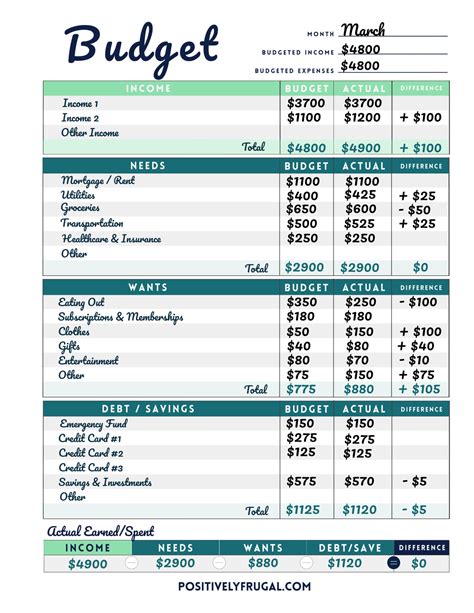

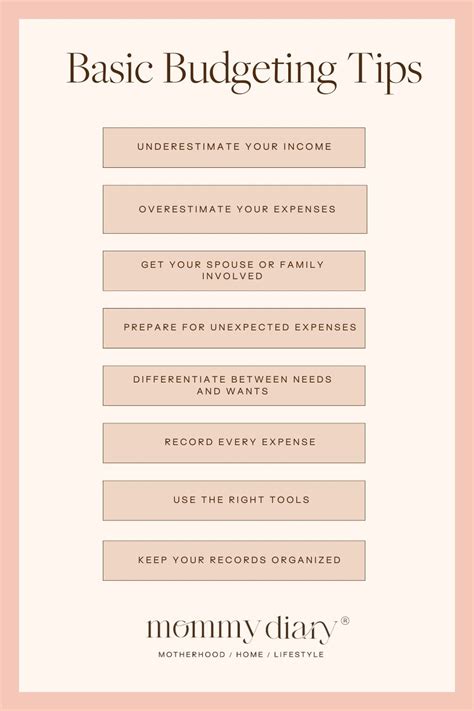

Breaking down your expenses into categories can help you identify areas where you can cut back. For instance, if you find that a significant portion of your budget is going towards dining out, you might consider cooking more meals or looking for cheaper dining options on or off campus. Similarly, understanding the costs associated with different housing options can help you make an informed decision that fits within your budget.Creating a Budget

The 50/30/20 rule is a good starting point for many students. This rule suggests that 50% of your income should go towards necessary expenses like rent, utilities, and food, 30% towards discretionary spending, and 20% towards saving and debt repayment. However, this is just a guideline, and you may need to adjust the proportions based on your individual circumstances.

Budgeting Tools and Resources

Utilizing budgeting tools and resources can make managing your finances much easier. There are numerous apps and software programs available that can help you track your spending, create a budget, and set financial goals. Some popular options include Mint, You Need a Budget (YNAB), and Personal Capital. BYU may also offer financial counseling services or workshops that can provide you with personalized advice and strategies for managing your expenses.Minimizing Debt

Avoiding Credit Card Debt

Credit card debt can be particularly problematic due to high interest rates and the potential for overspending. If you do choose to use a credit card, make sure it's for strategic purposes, such as building credit, and that you're able to pay off your balance in full each month. Avoid using credit cards for discretionary spending, and never use them for essential expenses like tuition or rent if you can avoid it.Maximizing Financial Aid

Scholarships and Grants

Scholarships and grants are particularly valuable forms of financial aid because they do not need to be repaid. BYU, as well as external organizations, offers a variety of scholarships based on merit, need, and other criteria. Applying for these early and often can help you secure more funding for your education.Lifestyle Adjustments

By being mindful of your spending habits and making conscious choices about how you allocate your resources, you can enjoy your time at BYU without breaking the bank. Remember, it's about finding a balance between enjoying your college experience and being financially responsible.

Community Resources

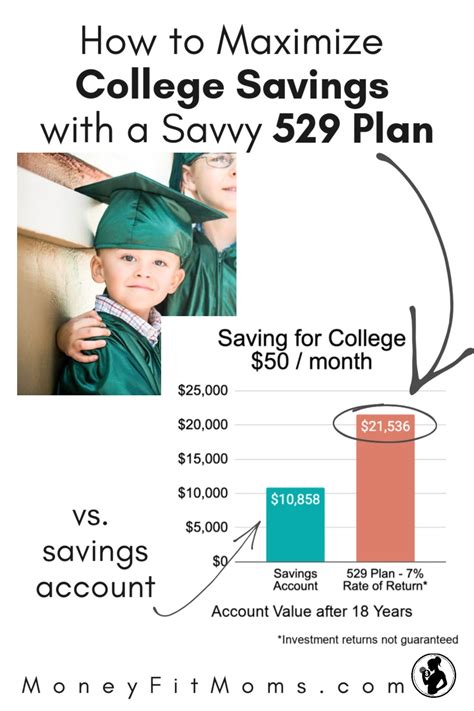

BYU and the surrounding community offer a variety of resources that can help you save money and live more affordably. From free events and activities to discount programs for students, there are many ways to enjoy your time at BYU without overspending.BYU Expense Gallery

What are the most common expenses for BYU students?

+The most common expenses for BYU students include tuition, housing, food, books, and transportation. Additionally, personal expenses such as entertainment and travel can also add up.

How can I apply for financial aid at BYU?

+To apply for financial aid at BYU, you will need to fill out the Free Application for Federal Student Aid (FAFSA). This application will determine your eligibility for federal, state, and institutional aid.

What are some tips for budgeting as a BYU student?

+Some tips for budgeting as a BYU student include tracking your expenses, creating a budget plan, and prioritizing your spending. It's also important to take advantage of resources such as financial counseling and budgeting apps.

In conclusion, managing your expenses at BYU requires a combination of financial literacy, planning, and discipline. By understanding your expenses, creating a budget, minimizing debt, maximizing financial aid, and making lifestyle adjustments, you can navigate the financial aspects of your education with confidence. Remember, your time at BYU is not just about academics; it's about personal growth, community, and preparing yourself for a successful future. We invite you to share your own tips and strategies for managing expenses at BYU, and to explore the resources available to you as you embark on this journey. Whether you're just starting out or nearing graduation, taking control of your finances can make all the difference in your college experience and beyond.