Intro

Discover BYU Provo AP credit information, including advanced placement policies, course equivalencies, and transfer credits, to enhance your academic journey with flexible learning options and accelerated degree paths.

The importance of understanding credit information cannot be overstated, especially for individuals looking to manage their finances effectively. Brigham Young University (BYU) in Provo, Utah, offers various resources to help students and community members navigate the complex world of credit. In today's economy, having a good grasp of credit principles is crucial for making informed decisions about personal finances, investments, and long-term financial planning.

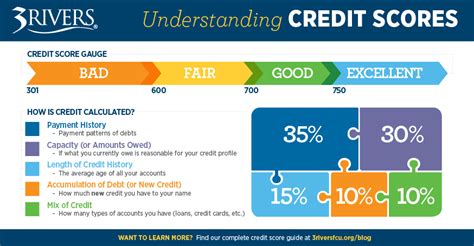

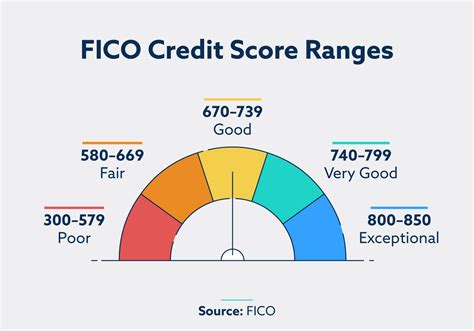

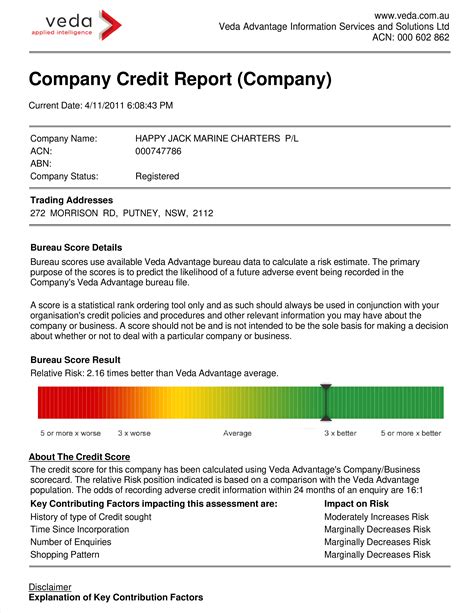

Credit information encompasses a broad range of topics, including credit scores, credit reports, and the responsible use of credit cards. It's essential for individuals to comprehend how their credit behavior affects their financial health and future opportunities, such as securing loans or mortgages. Moreover, the digital age has made it easier for people to access credit, but it also increases the risk of mismanaging credit, leading to debt and financial instability.

The BYU community, including students, faculty, and staff, can benefit from the resources available on campus that focus on financial literacy and credit management. These resources often include workshops, counseling services, and online materials designed to educate individuals about the best practices in managing credit. By understanding how credit works and how to maintain a healthy credit profile, individuals can avoid common pitfalls such as accumulating high-interest debt or damaging their credit score due to late payments or other negative marks.

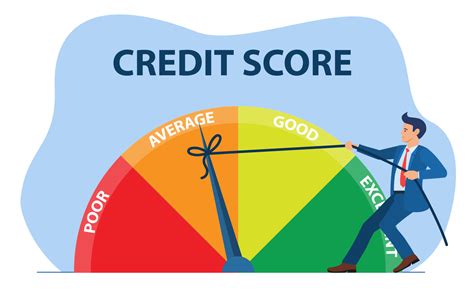

Understanding Credit Scores

Managing Credit Reports

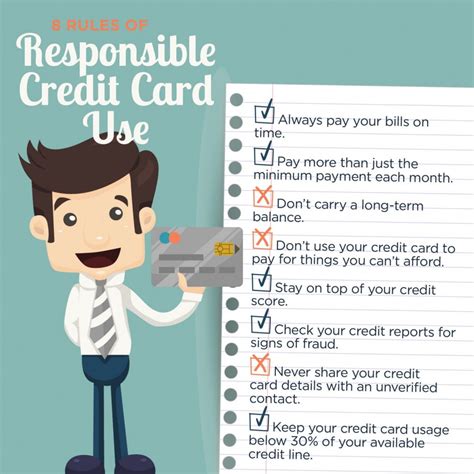

Responsible Use of Credit Cards

Benefits of Good Credit Management

Effective credit management offers numerous benefits, including lower interest rates on loans and credit cards, better loan terms, and even advantages when applying for apartments or cell phone plans. Good credit management demonstrates responsibility and can open up more financial opportunities, making it easier to achieve long-term goals such as purchasing a home or starting a business. Moreover, maintaining a good credit score can provide peace of mind, reducing financial stress and anxiety about the future.Steps to Improve Credit Scores

Common Mistakes in Credit Management

Common mistakes in credit management include missing payments, accumulating too much debt, applying for too many credit cards, and not regularly checking credit reports. These mistakes can lead to negative marks on credit reports, lower credit scores, and increased financial difficulties. Awareness of these potential pitfalls is crucial for maintaining good credit health and avoiding costly errors.Financial Literacy and Credit Education

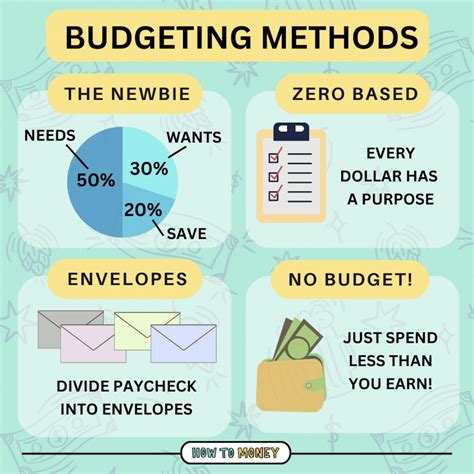

Importance of Budgeting

Budgeting is a cornerstone of financial management, allowing individuals to track their income and expenses, set financial goals, and make informed decisions about how to allocate their resources. A well-crafted budget helps in prioritizing needs over wants, reducing unnecessary expenses, and ensuring that financial obligations, such as credit card payments and loan repayments, are met on time.Tools and Resources for Credit Management

Role of Technology in Credit Management

Technology plays a significant role in modern credit management, offering a variety of digital tools and platforms that simplify the process of tracking finances, paying bills, and monitoring credit reports. Mobile apps, online banking services, and automated payment systems reduce the likelihood of late payments and make it easier to stay organized. Additionally, technology enhances security, with features such as two-factor authentication and encryption protecting sensitive financial information.Credit Management Image Gallery

What is a good credit score?

+A good credit score typically ranges from 700 to 850, indicating a low risk for lenders and potentially leading to better loan terms and lower interest rates.

How often should I check my credit report?

+It's recommended to check your credit report at least once a year to ensure accuracy and detect any signs of identity theft or fraud.

What are the benefits of responsible credit card use?

+Responsible credit card use can help build credit, earn rewards, and provide convenience and security for purchases, as long as payments are made on time and credit utilization is kept low.

In conclusion, managing credit effectively is a vital skill for achieving financial stability and security. By understanding credit scores, managing credit reports, using credit cards responsibly, and leveraging educational resources and tools, individuals can navigate the complex world of credit with confidence. The BYU Provo community, with its emphasis on financial literacy and credit education, provides a supportive environment for learning and growth in these areas. As individuals continue on their financial journeys, remembering the importance of credit management and taking proactive steps to maintain good credit health will be essential for realizing their long-term financial goals. We invite readers to share their experiences and insights on credit management, and we encourage everyone to take advantage of the resources available to improve their financial literacy and credit knowledge.