Intro

Mitigate risks with 5 BYU risk tips, including threat assessment, vulnerability management, and risk mitigation strategies to ensure business continuity and minimize potential losses.

Understanding and managing risk is crucial for individuals and businesses alike. In today's fast-paced, ever-changing world, being aware of potential risks and knowing how to mitigate them can make all the difference between success and failure. Brigham Young University (BYU) has been at the forefront of providing valuable insights and tips on risk management through its various programs and research initiatives. Here, we will delve into five key risk tips that can help individuals and organizations navigate through uncertain times.

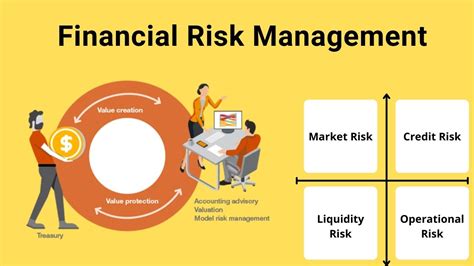

The importance of risk management cannot be overstated. It involves identifying, assessing, and prioritizing potential risks, followed by taking steps to minimize, monitor, and control their impact. Effective risk management enables entities to reduce the likelihood of negative outcomes and capitalize on opportunities, leading to enhanced resilience and competitiveness. Whether it's financial risk, operational risk, strategic risk, or compliance risk, having a comprehensive risk management strategy in place is essential for achieving long-term goals.

In the context of business and personal finance, risk management is particularly critical. It helps in making informed decisions, allocating resources efficiently, and ensuring that the organization or individual is well-prepared to face any challenges that may arise. BYU, through its academic and research endeavors, has emphasized the significance of adopting a proactive approach to risk management. By understanding the types of risks, their potential consequences, and the strategies to mitigate them, individuals and businesses can safeguard their assets, reputation, and future prospects.

Understanding Risk

Identifying Risks

Identifying risks involves a thorough analysis of the internal and external environment. This includes reviewing historical data, industry trends, market conditions, and regulatory requirements. For businesses, identifying risks might involve assessing the supply chain, customer base, financial health, and competitive landscape. Individuals might focus on personal financial risks, health risks, and career risks. The goal is to create a comprehensive list of potential risks that could impact goals and objectives.Assessing Risk

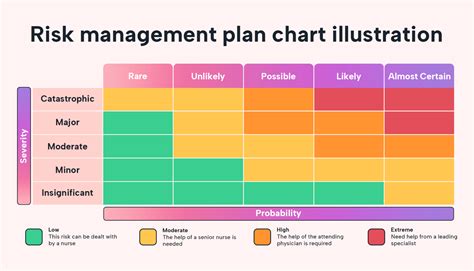

Prioritizing Risks

Prioritizing risks is crucial for effective risk management. Not all risks can be mitigated simultaneously due to resource constraints. By prioritizing risks, organizations and individuals can allocate their resources more efficiently, addressing the most critical risks first. This prioritization should be based on the risk assessment, considering both the likelihood of the risk occurring and its potential impact.Implementing Risk Mitigation Strategies

Monitoring and Review

Monitoring and review are essential components of the risk management process. Risks are dynamic; they can change over time due to internal or external factors. Therefore, it's crucial to continuously monitor the risk environment, updating the risk management plan as necessary. Regular reviews help in identifying new risks, assessing the effectiveness of current mitigation strategies, and making adjustments to ensure that the risk management plan remains relevant and effective.BYU Risk Tips

- Stay Informed: Staying informed about potential risks and their implications is the first line of defense. This involves continuous learning, staying updated with industry trends, and being aware of regulatory changes.

- Diversify: Diversification is a key strategy in managing risk. For investors, this means spreading investments across different asset classes. For businesses, it could mean diversifying products, services, or markets to reduce dependence on any one area.

- Plan Ahead: Planning ahead involves anticipating potential risks and developing strategies to mitigate them. This could include creating contingency plans, having emergency funds in place, or developing business continuity plans.

- Assess Regularly: Regular risk assessment is crucial for identifying new risks and evaluating the effectiveness of current risk management strategies. This involves periodic reviews of the risk management plan and making adjustments as necessary.

- Seek Professional Advice: Finally, seeking professional advice can be beneficial, especially for complex risks. This could involve consulting with risk management experts, financial advisors, or legal professionals to get tailored advice that suits specific needs and circumstances.

Conclusion and Next Steps

Risk Management Image Gallery

What is the importance of risk management in business?

+Risk management is crucial for businesses as it helps in identifying, assessing, and mitigating risks that could impact their operations and objectives. Effective risk management enables businesses to reduce the likelihood of negative outcomes, capitalize on opportunities, and enhance their resilience and competitiveness.

How can individuals apply risk management principles in their personal lives?

+Individuals can apply risk management principles by identifying potential personal risks such as financial risks, health risks, and career risks. They can then assess these risks, prioritize them, and implement strategies to mitigate them. This could involve creating emergency funds, having health insurance, and developing a career development plan.

What role does diversification play in risk management?

+Diversification is a key strategy in risk management. It involves spreading investments or activities across different areas to reduce dependence on any one area. This can help in managing risk by minimizing the impact of negative outcomes in any one area.

We hope this comprehensive guide to risk management, inspired by the insights from BYU, has provided you with valuable information and practical tips to navigate the complex world of risks. Whether you're an individual or an organization, adopting a proactive and informed approach to risk management is essential for achieving your goals and ensuring long-term success. We invite you to share your thoughts, experiences, and questions on risk management, and we look forward to continuing this important conversation.