Intro

Explore BYU short term loan options, including emergency loans, financial aid, and alternative funding solutions, to help students manage unexpected expenses and achieve financial stability.

In today's fast-paced world, financial emergencies can arise at any moment, leaving individuals in a difficult spot. For students and faculty at Brigham Young University (BYU), having access to short-term loan options can be a lifesaver. BYU offers various short-term loan programs designed to help students and faculty overcome temporary financial difficulties. These loan options can provide a sense of relief and help individuals get back on their feet.

Financial struggles can be overwhelming, and it's essential to have a support system in place. BYU's short-term loan options are designed to provide a safety net for students and faculty who are facing unexpected expenses or financial setbacks. These loans can be used to cover essential expenses such as tuition, living expenses, or unexpected medical bills. By providing access to short-term loans, BYU aims to help students and faculty achieve their academic and professional goals without being hindered by financial constraints.

The importance of having access to short-term loan options cannot be overstated. These loans can help students and faculty avoid financial pitfalls, such as late fees, penalties, or even bankruptcy. By providing a temporary financial solution, BYU's short-term loan options can help individuals regain control of their finances and get back on track. Whether it's a student facing an unexpected expense or a faculty member dealing with a financial emergency, BYU's short-term loan options can provide a sense of security and peace of mind.

Introduction to BYU Short Term Loan Options

Types of Short Term Loan Options

The types of short-term loan options available at BYU include: * Emergency loans: These loans are designed to provide temporary financial assistance to students and faculty who are facing unexpected expenses or financial emergencies. * Short-term loans: These loans are designed to provide financial assistance to students and faculty who need to cover essential expenses such as tuition, living expenses, or unexpected medical bills. * Payroll deduction loans: These loans are designed to provide financial assistance to faculty and staff who need to cover essential expenses or unexpected financial emergencies.Benefits of BYU Short Term Loan Options

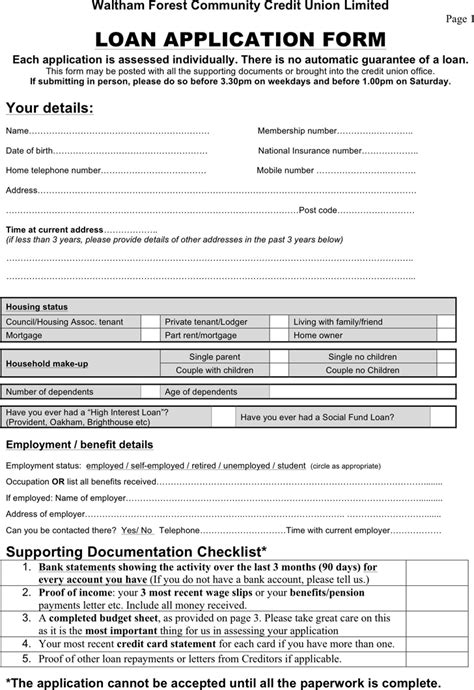

Eligibility Criteria for Short Term Loan Options

To be eligible for BYU's short-term loan options, individuals must meet certain criteria. These criteria include: * Being a current student or faculty member at BYU * Having a valid BYU ID * Meeting the specific eligibility criteria for each loan option * Having a good credit historyHow to Apply for BYU Short Term Loan Options

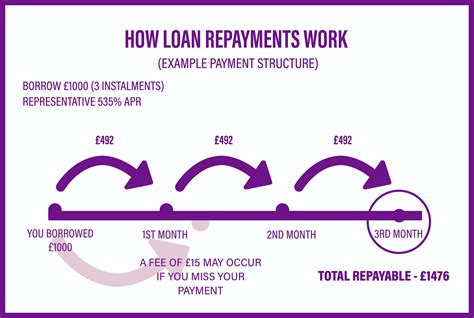

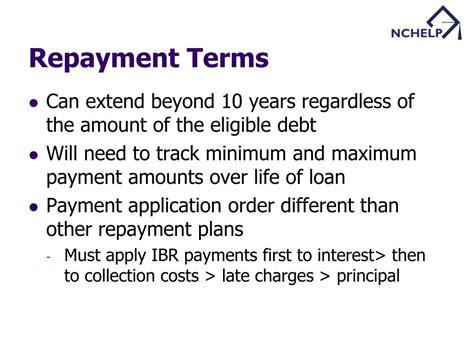

Repayment Terms for Short Term Loan Options

The repayment terms for BYU's short-term loan options vary depending on the loan type and individual circumstances. Generally, the repayment terms include: * Repaying the loan within a specified timeframe, such as 30 or 60 days * Making regular payments, such as monthly or bi-weekly payments * Paying a fixed interest rate or a variable interest rateConclusion and Next Steps

Final Thoughts on BYU Short Term Loan Options

It's essential to remember that BYU's short-term loan options are designed to provide temporary financial assistance. Individuals should carefully consider their financial situation and repayment ability before applying for a loan. By doing so, individuals can avoid accumulating too much debt and ensure that they're using the loan options responsibly.BYU Short Term Loan Options Image Gallery

What are the eligibility criteria for BYU's short-term loan options?

+The eligibility criteria for BYU's short-term loan options include being a current student or faculty member at BYU, having a valid BYU ID, and meeting the specific eligibility criteria for each loan option.

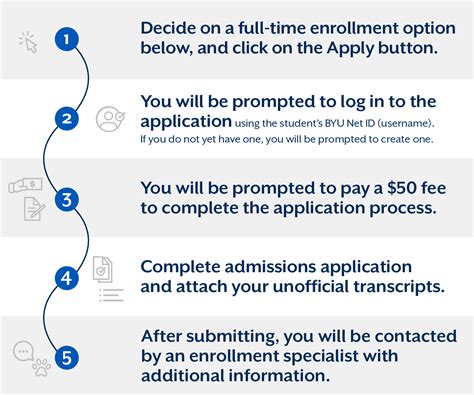

How do I apply for BYU's short-term loan options?

+To apply for BYU's short-term loan options, individuals can apply online or in person at the BYU financial aid office. The application process typically involves submitting an application form, providing required documentation, and meeting with a financial aid counselor.

What are the repayment terms for BYU's short-term loan options?

+The repayment terms for BYU's short-term loan options vary depending on the loan type and individual circumstances. Generally, the repayment terms include repaying the loan within a specified timeframe, making regular payments, and paying a fixed or variable interest rate.

We hope this article has provided you with a comprehensive understanding of BYU's short-term loan options. If you have any further questions or concerns, please don't hesitate to reach out to the BYU financial aid office. Remember to share this article with your friends and family who may be facing financial difficulties, and consider commenting below to share your thoughts and experiences with BYU's short-term loan options.