Intro

Boost financial control with 5 finance tracking tips, including budgeting, expense monitoring, and investment tracking, to achieve fiscal stability and security.

Effective finance tracking is crucial for achieving financial stability and success. It allows individuals to monitor their expenses, create budgets, and make informed decisions about their financial resources. In today's fast-paced world, managing finances efficiently is more important than ever. With the rise of digital banking and financial tools, tracking finances has become easier and more accessible. However, many people still struggle to keep their finances in order, often leading to debt, financial stress, and missed opportunities.

Financial tracking is not just about monitoring expenses; it's also about understanding where your money is going and making conscious decisions about how you want to allocate your resources. By implementing a few simple strategies, individuals can significantly improve their financial management skills and work towards achieving their long-term financial goals. Whether you're trying to save for a big purchase, pay off debt, or simply build wealth over time, effective finance tracking is the foundation upon which all other financial strategies are built.

The importance of finance tracking cannot be overstated. It provides a clear picture of your financial situation, helping you identify areas where you can cut back on unnecessary expenses and allocate more funds towards savings and investments. Moreover, tracking your finances helps you stay on top of your bills and payments, avoiding late fees and negative impacts on your credit score. In essence, finance tracking is the first step towards taking control of your financial life and ensuring that your money is working for you, not against you.

Understanding Your Financial Landscape

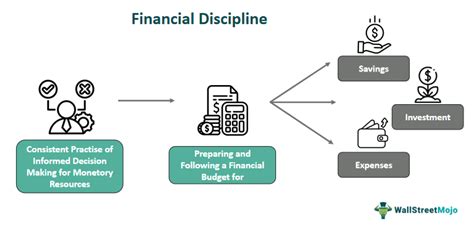

To start tracking your finances effectively, you first need to understand your current financial landscape. This involves gathering all relevant financial information, including income statements, bank accounts, credit card statements, loans, and any investments. Having a comprehensive view of your financial situation will help you identify patterns, such as where you tend to overspend and areas where you can improve your financial discipline.

Assessing Income and Expenses

Assessing your income and expenses is a critical step in finance tracking. It involves calculating your total monthly income from all sources and then categorizing your expenses into needs (essential expenses like rent, utilities, and groceries) and wants (discretionary spending like dining out, entertainment, and hobbies). This distinction helps in prioritizing essential expenses and making adjustments to discretionary spending to align with your financial goals.Setting Financial Goals

Setting clear financial goals is essential for effective finance tracking. Your goals could range from short-term objectives like saving for a vacation or paying off a credit card debt to long-term goals such as buying a house, retirement planning, or funding your children's education. Having specific, measurable, achievable, relevant, and time-bound (SMART) goals helps in creating a focused financial plan and motivates you to stick to your tracking and budgeting efforts.

Prioritizing Needs Over Wants

Prioritizing needs over wants is a fundamental principle of finance tracking. By ensuring that essential expenses are covered first, you can then allocate any remaining funds towards discretionary spending. This approach helps in maintaining a healthy financial balance and prevents overspending on non-essential items.Using Finance Tracking Tools

There are numerous finance tracking tools available, ranging from traditional methods like spreadsheets and budgeting notebooks to digital apps and software. Tools like Mint, You Need a Budget (YNAB), and Personal Capital offer comprehensive financial tracking features, including budgeting, investment tracking, and bill reminders. These tools can simplify the finance tracking process, provide real-time updates, and offer insights into your spending habits.

Automating Financial Tasks

Automating financial tasks is another strategy for effective finance tracking. Setting up automatic transfers for savings, investments, and bill payments can help ensure that you never miss a payment or forget to save. Automation also reduces the temptation to spend impulsively, as your essential financial obligations are taken care of automatically.Reviewing and Adjusting Your Financial Plan

Regularly reviewing and adjusting your financial plan is crucial for maintaining momentum and achieving your financial goals. This involves periodically assessing your income, expenses, savings, and investments to identify any changes or areas for improvement. Adjustments might include reallocating funds, changing investment strategies, or finding ways to reduce expenses.

Seeking Professional Advice

Seeking professional advice can be beneficial for individuals who are struggling to manage their finances or need guidance on specific financial matters. Financial advisors can provide personalized advice, help create a tailored financial plan, and offer strategies for overcoming financial challenges.Staying Motivated and Disciplined

Staying motivated and disciplined is key to successful finance tracking. Celebrating small victories, such as reaching savings milestones or paying off debt, can help maintain motivation. Additionally, sharing your financial goals with a trusted friend or family member and asking them to hold you accountable can provide an added incentive to stay on track.

Avoiding Financial Pitfalls

Avoiding financial pitfalls, such as accumulating high-interest debt or making impulsive purchases, is essential for long-term financial health. Being aware of common financial mistakes and taking steps to avoid them can help protect your financial stability and ensure that you're moving closer to your financial goals.Finance Tracking Image Gallery

What is the first step in effective finance tracking?

+The first step in effective finance tracking is to gather all relevant financial information and understand your current financial landscape.

How often should I review my financial plan?

+

What are some common financial pitfalls to avoid?

+Common financial pitfalls include accumulating high-interest debt, making impulsive purchases, and failing to save for the future. Avoiding these pitfalls is crucial for long-term financial health.

In conclusion, finance tracking is a vital skill for achieving financial stability and success. By understanding your financial landscape, setting clear goals, utilizing tracking tools, and maintaining discipline, you can effectively manage your finances and work towards a secure financial future. Remember, finance tracking is a continuous process that requires regular review and adjustment. With the right strategies and mindset, you can overcome financial challenges and achieve your long-term financial objectives. We invite you to share your thoughts on finance tracking, ask questions, or seek advice from financial experts to further enhance your financial management skills.