Intro

Track the latest trends and insights on Chinas Producer Price Index (PPI), a key indicator of the countrys inflation and economic growth. Explore how PPI affects industries, including manufacturing, commodities, and trade. Stay ahead of market shifts with in-depth analysis and forecasts, and discover how PPI influences Chinas economic outlook.

China's Producer Price Index (PPI) is a crucial economic indicator that reflects the changes in prices of goods and services at the production level. It is a leading indicator of inflation and provides insights into the overall health of the Chinese economy. In recent years, the PPI has gained significant attention from policymakers, investors, and economists due to its implications for monetary policy, inflation, and economic growth.

The PPI is calculated by the National Bureau of Statistics of China (NBS) and measures the average change in prices of a basket of goods and services produced by Chinese manufacturers. The index includes prices of raw materials, intermediate goods, and final products, providing a comprehensive picture of the production costs and pricing pressures in the Chinese economy.

Recent Trends in China's Producer Price Index

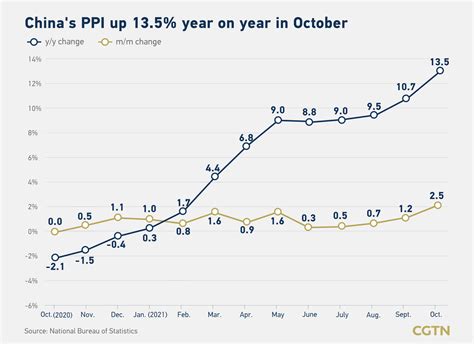

In recent years, China's PPI has experienced significant fluctuations, influenced by various factors such as changes in global commodity prices, domestic economic policies, and supply and demand imbalances. According to the NBS, the PPI has been on a rising trend since 2020, driven by the recovery in global demand and the subsequent increase in commodity prices.

However, the PPI growth rate has slowed down in recent months, reflecting the moderation in global commodity prices and the impact of the COVID-19 pandemic on the Chinese economy. The PPI growth rate declined from 9.1% in May 2021 to 6.1% in December 2021, indicating a gradual easing of inflationary pressures in the Chinese economy.

Factors Influencing China's Producer Price Index

Several factors influence China's PPI, including:

- Global commodity prices: Changes in global commodity prices, such as oil, metals, and agricultural products, have a significant impact on China's PPI. An increase in global commodity prices can lead to higher production costs and, subsequently, higher PPI.

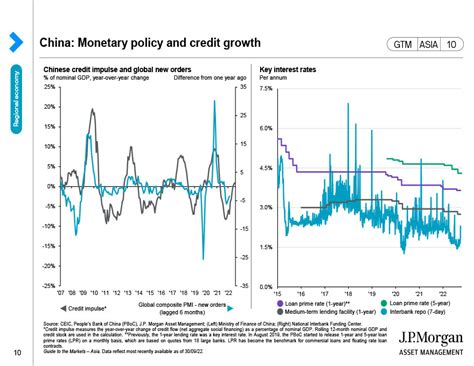

- Domestic economic policies: The Chinese government's economic policies, such as monetary policy and fiscal policy, can influence the PPI. For example, an expansionary monetary policy can lead to higher demand and, subsequently, higher PPI.

- Supply and demand imbalances: Imbalances in supply and demand can also influence the PPI. For example, a shortage of raw materials can lead to higher prices and, subsequently, higher PPI.

Implications of China's Producer Price Index

China's PPI has significant implications for the Chinese economy, including:

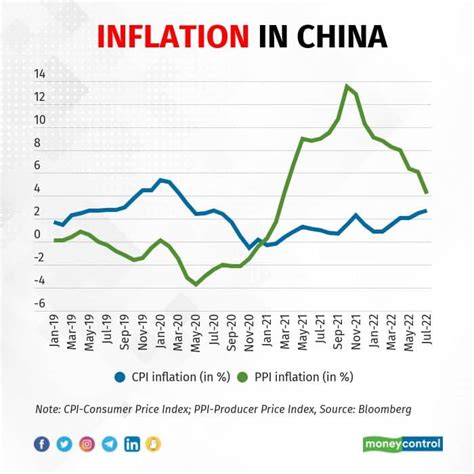

- Inflation: The PPI is a leading indicator of inflation. An increase in the PPI can lead to higher inflation, which can erode the purchasing power of consumers and reduce the competitiveness of Chinese exports.

- Monetary policy: The PPI is an important indicator for monetary policy decisions. The People's Bank of China (PBOC) closely monitors the PPI to determine the appropriate monetary policy stance. A high PPI growth rate may lead to tighter monetary policy to control inflation.

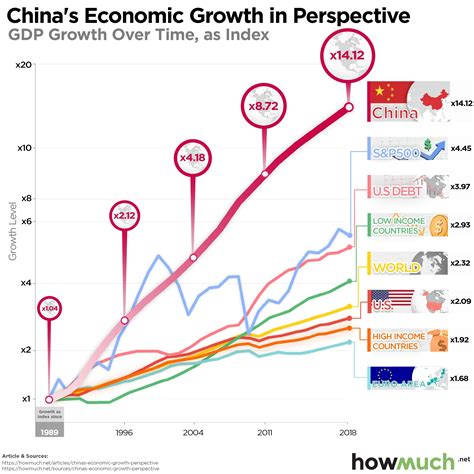

- Economic growth: The PPI is also an indicator of economic growth. A high PPI growth rate can indicate a strong economy, while a low PPI growth rate can indicate a sluggish economy.

PPI and Its Relationship with Other Economic Indicators

The PPI is closely related to other economic indicators, including:

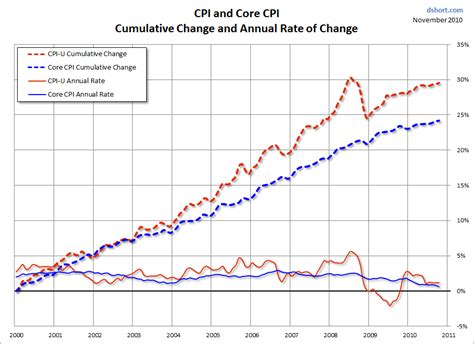

- Consumer Price Index (CPI): The CPI measures the change in prices of goods and services consumed by households. The PPI and CPI are closely related, as an increase in PPI can lead to higher CPI.

- Gross Domestic Product (GDP): The GDP measures the total output of the economy. The PPI is an important indicator of GDP growth, as an increase in PPI can indicate a strong economy.

Conclusion

In conclusion, China's Producer Price Index is a crucial economic indicator that reflects the changes in prices of goods and services at the production level. The PPI has significant implications for the Chinese economy, including inflation, monetary policy, and economic growth. Understanding the trends and insights of the PPI can provide valuable information for policymakers, investors, and economists.

We hope this article has provided you with a comprehensive understanding of China's Producer Price Index. If you have any questions or would like to share your thoughts, please leave a comment below.

China Producer Price Index Image Gallery

What is the Producer Price Index (PPI)?

+The Producer Price Index (PPI) is a measure of the average change in prices of goods and services produced by manufacturers.

How is the PPI calculated?

+The PPI is calculated by the National Bureau of Statistics of China (NBS) using a basket of goods and services produced by Chinese manufacturers.

What are the implications of the PPI for the Chinese economy?

+The PPI has significant implications for the Chinese economy, including inflation, monetary policy, and economic growth.