Intro

Get ready for a financial boost in the Centennial State! Learn about the Colorado Tabor Stimulus Check, a refund from the states Taxpayers Bill of Rights (TABOR). Discover the 5 key things to know, including eligibility, refund amounts, and how it affects Colorado residents. Understand the implications of this economic stimulus and what it means for you.

As the world continues to navigate the challenges of the COVID-19 pandemic, many governments are introducing stimulus packages to help their citizens cope with the economic fallout. One such initiative is the Colorado Tabor Stimulus Check, a one-time payment designed to provide relief to eligible residents of Colorado. If you're a Coloradan wondering what this stimulus check is all about, here are five essential things to know.

What is the Colorado Tabor Stimulus Check?

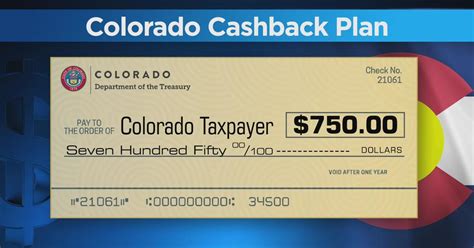

The Colorado Tabor Stimulus Check is a one-time payment of $750 for individual tax filers and $1,500 for joint filers. This payment is made possible by the Taxpayer's Bill of Rights (TABOR) Amendment, which requires the state to refund excess tax revenue to taxpayers.

Who is eligible for the Colorado Tabor Stimulus Check?

To be eligible for the Colorado Tabor Stimulus Check, you must have filed a state income tax return for the 2021 tax year. This includes both full-year and part-year residents. However, not all individuals who filed a tax return will qualify for the payment. For instance, those who owe back taxes, have outstanding debts to the state, or are incarcerated may not be eligible.

How will the Colorado Tabor Stimulus Check be distributed?

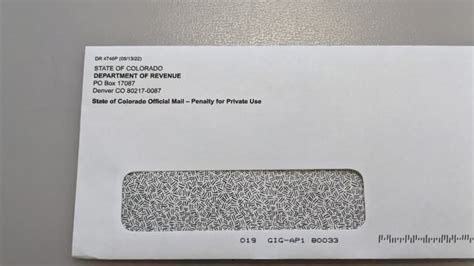

The Colorado Tabor Stimulus Check will be distributed by the Colorado Department of Revenue in the form of a direct deposit or a check. Eligible taxpayers who opted for direct deposit when filing their 2021 tax return can expect the payment to be deposited into their bank account. Those who did not opt for direct deposit will receive a check in the mail.

What can I use the Colorado Tabor Stimulus Check for?

The Colorado Tabor Stimulus Check is intended to provide relief to taxpayers who have been impacted by the COVID-19 pandemic. There are no restrictions on how you can use the payment, so you can apply it towards essential expenses, debt repayment, or savings.

When can I expect to receive the Colorado Tabor Stimulus Check?

The Colorado Department of Revenue began distributing the Tabor Stimulus Checks in August 2022. Eligible taxpayers can expect to receive their payment by the end of September 2022. If you have not received your payment by then, you can contact the Colorado Department of Revenue to inquire about the status of your payment.

What if I have questions or concerns about the Colorado Tabor Stimulus Check?

If you have questions or concerns about the Colorado Tabor Stimulus Check, you can contact the Colorado Department of Revenue or visit their website for more information. Additionally, you can reach out to a tax professional or a financial advisor for guidance on how to use your payment wisely.

Gallery of Colorado Tabor Stimulus Check Images

Colorado Tabor Stimulus Check Image Gallery

Frequently Asked Questions

What is the Colorado Tabor Stimulus Check?

+The Colorado Tabor Stimulus Check is a one-time payment of $750 for individual tax filers and $1,500 for joint filers.

Who is eligible for the Colorado Tabor Stimulus Check?

+To be eligible for the Colorado Tabor Stimulus Check, you must have filed a state income tax return for the 2021 tax year.

How will the Colorado Tabor Stimulus Check be distributed?

+The Colorado Tabor Stimulus Check will be distributed by the Colorado Department of Revenue in the form of a direct deposit or a check.

As the Colorado Tabor Stimulus Check distribution comes to a close, it's essential to remember that this payment is intended to provide relief to taxpayers who have been impacted by the COVID-19 pandemic. If you have any questions or concerns about the payment, don't hesitate to reach out to the Colorado Department of Revenue or a tax professional for guidance.