Intro

Discover the current Federal Judgment Rate in the US and its implications on debt recovery. Learn how the Federal Judgment Rate affects creditors, debtors, and financial institutions. Stay updated on the latest rates and understand its relationship with interest rates, judgments, and credit markets to make informed financial decisions.

The federal judgment rate in the United States is a critical piece of information for individuals and businesses dealing with debt, loans, and investments. In this article, we will explore the current federal judgment rate in the US, its history, and its implications for various stakeholders.

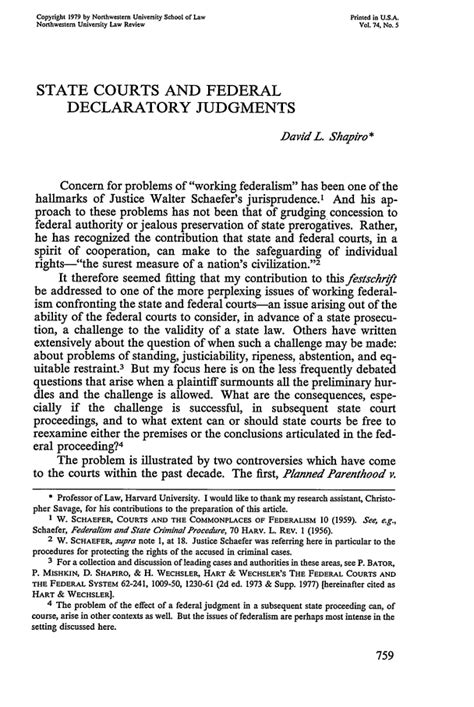

What is the Federal Judgment Rate?

The federal judgment rate, also known as the federal judgment interest rate, is the interest rate applied to judgments entered in federal court cases. This rate is set by the federal government and is used to calculate the interest accrued on outstanding judgments.

Current Federal Judgment Rate

As of the latest available data, the current federal judgment rate in the US is 3.25% per annum. This rate is subject to change, and it is essential to check the official website of the US Department of the Treasury or the Administrative Office of the US Courts for the most up-to-date information.

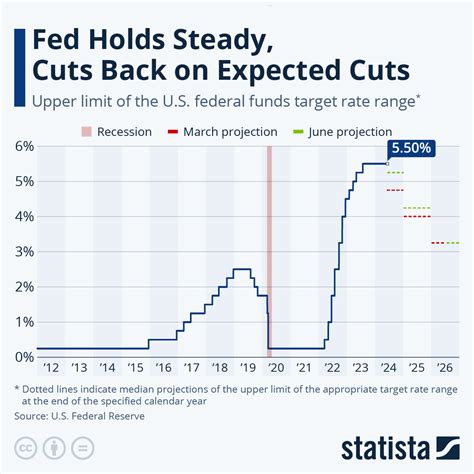

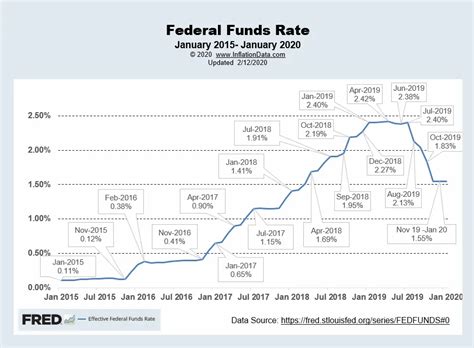

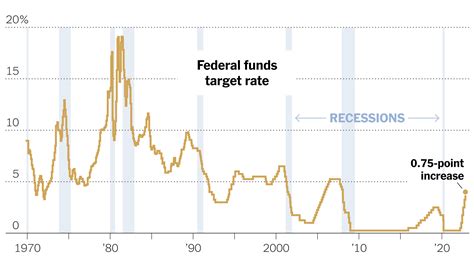

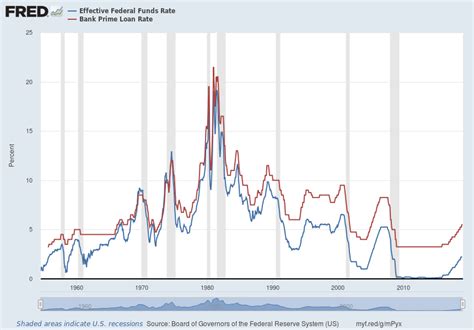

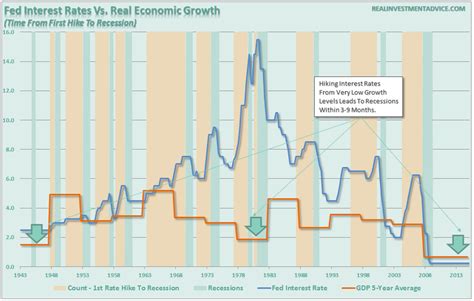

History of the Federal Judgment Rate

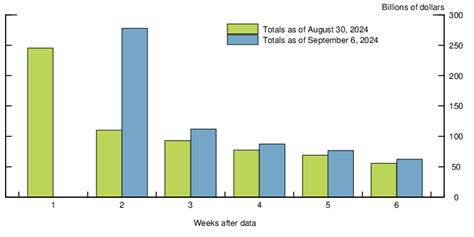

The federal judgment rate has fluctuated over the years, reflecting changes in the overall economic conditions and monetary policy. The rate is typically adjusted quarterly, and the changes are usually minor. However, during times of economic downturn or rapid growth, the rate may undergo more significant changes.

How is the Federal Judgment Rate Calculated?

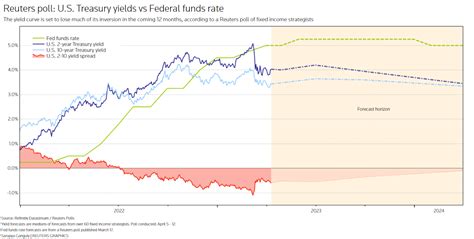

The federal judgment rate is calculated based on the average yields on outstanding marketable U.S. Treasury securities. The rate is determined by the Secretary of the Treasury, in consultation with the Attorney General and the Director of the Administrative Office of the US Courts.

Implications of the Federal Judgment Rate

The federal judgment rate has significant implications for various stakeholders, including:

- Debtors: The federal judgment rate affects the amount of interest accrued on outstanding judgments. A higher rate can increase the burden on debtors, making it more challenging to pay off debts.

- Creditors: The federal judgment rate influences the returns on investment for creditors. A higher rate can result in higher earnings for creditors, but it may also lead to increased borrowing costs for debtors.

- Businesses: The federal judgment rate can impact business decisions, such as investments, loans, and credit policies. A stable and predictable rate can help businesses plan and make informed decisions.

Comparison with Other Interest Rates

The federal judgment rate is often compared to other interest rates, such as the prime rate, federal funds rate, and Treasury yields. These rates can provide insights into the overall interest rate environment and help stakeholders make informed decisions.

Key Differences

The federal judgment rate differs from other interest rates in several ways:

- Purpose: The federal judgment rate is specifically designed for calculating interest on federal judgments, whereas other rates serve different purposes, such as influencing monetary policy or determining borrowing costs.

- Calculation: The federal judgment rate is calculated based on Treasury yields, whereas other rates may be influenced by a broader range of factors, including economic indicators and market conditions.

Gallery of Federal Judgment Rate

Federal Judgment Rate Gallery

FAQs

What is the current federal judgment rate in the US?

+As of the latest available data, the current federal judgment rate in the US is 3.25% per annum.

How is the federal judgment rate calculated?

+The federal judgment rate is calculated based on the average yields on outstanding marketable U.S. Treasury securities.

What are the implications of the federal judgment rate for debtors and creditors?

+The federal judgment rate affects the amount of interest accrued on outstanding judgments. A higher rate can increase the burden on debtors, making it more challenging to pay off debts, while a lower rate can result in lower earnings for creditors.

In conclusion, the federal judgment rate is a critical component of the US financial system, influencing the interest accrued on outstanding judgments. Understanding the current rate, its history, and implications is essential for stakeholders, including debtors, creditors, and businesses.