Intro

Explore IRS jobs in Philadelphia and discover exciting career paths in taxation, finance, and government. Learn about opportunities in enforcement, compliance, and administration, and find out how to land a job with the Internal Revenue Service in Philly. Advance your career with IRS Philadelphia jobs and gain experience in tax law, auditing, and more.

The city of Philadelphia, known for its rich history and vibrant cultural scene, is also a hub for career opportunities in various fields, including tax administration. The Internal Revenue Service (IRS), a bureau of the U.S. Department of the Treasury, employs thousands of individuals across the country, including in Philadelphia. In this article, we will delve into the world of IRS jobs in Philadelphia, exploring the opportunities and career paths available to those interested in pursuing a career with the IRS.

The Importance of IRS Careers

The IRS plays a critical role in the country's tax system, responsible for collecting taxes, enforcing tax laws, and providing taxpayer assistance. As a result, the IRS employs a diverse range of professionals, from tax examiners and revenue agents to IT specialists and administrative assistants. Careers with the IRS offer a sense of purpose, stability, and opportunities for growth and development.

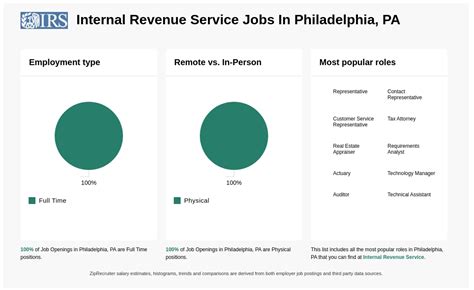

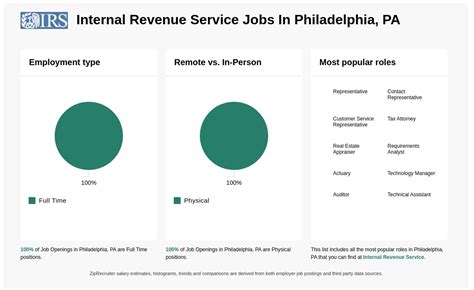

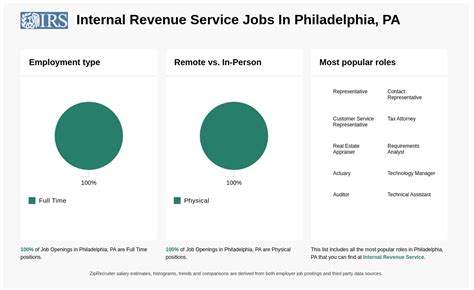

IRS Jobs in Philadelphia: Overview

Philadelphia is home to one of the IRS's largest regional offices, employing hundreds of individuals in various roles. Some of the most common IRS jobs in Philadelphia include:

- Tax Examiners: Responsible for reviewing tax returns, identifying errors or discrepancies, and conducting audits.

- Revenue Agents: Conduct complex audits and examinations to ensure compliance with tax laws.

- Tax Compliance Officers: Enforce tax laws and regulations, conducting investigations and audits.

- IT Specialists: Support the IRS's technology infrastructure, developing and implementing software applications and systems.

Career Paths with the IRS

The IRS offers a range of career paths, from entry-level positions to senior leadership roles. Some of the most common career paths include:

- Taxpayer Service Representative: Provide assistance to taxpayers, answering questions and resolving issues.

- Tax Compliance Officer: Enforce tax laws and regulations, conducting investigations and audits.

- Revenue Agent: Conduct complex audits and examinations to ensure compliance with tax laws.

- Manager: Oversee teams of employees, managing workload and providing guidance and support.

Requirements and Qualifications

To be eligible for IRS jobs in Philadelphia, candidates must meet certain requirements and qualifications, including:

- Citizenship: Must be a U.S. citizen or national.

- Age: Must be at least 18 years old.

- Education: Must have a high school diploma or equivalent; some positions require a bachelor's degree or higher.

- Experience: Must have relevant work experience, depending on the position.

- Background Check: Must pass a background check and fingerprinting.

How to Apply

To apply for IRS jobs in Philadelphia, candidates can visit the USAJOBS website, which is the official website for federal government job listings. Candidates can search for IRS jobs by location, job title, and keyword, and apply online.

Benefits of Working for the IRS

Working for the IRS offers a range of benefits, including:

- Competitive Pay: IRS employees receive competitive pay and benefits.

- Job Security: IRS employees enjoy job security and stability.

- Opportunities for Growth: The IRS offers opportunities for career advancement and professional development.

- Sense of Purpose: IRS employees play a critical role in the country's tax system, contributing to the nation's revenue and economic growth.

Challenges and Opportunities

Working for the IRS can be challenging, with high levels of stress and pressure to meet deadlines. However, the IRS also offers opportunities for growth and development, as well as a sense of purpose and fulfillment.

Conclusion

IRS jobs in Philadelphia offer a range of opportunities for those interested in pursuing a career in tax administration. From tax examiners and revenue agents to IT specialists and administrative assistants, the IRS employs a diverse range of professionals. With competitive pay, job security, and opportunities for growth and development, careers with the IRS are an attractive option for those looking for a challenging and rewarding career.

Gallery of IRS Jobs in Philadelphia

IRS Jobs in Philadelphia Image Gallery

FAQs

What are the most common IRS jobs in Philadelphia?

+The most common IRS jobs in Philadelphia include tax examiners, revenue agents, tax compliance officers, and IT specialists.

What are the requirements for working for the IRS?

+To be eligible for IRS jobs in Philadelphia, candidates must be U.S. citizens, at least 18 years old, and have a high school diploma or equivalent. Some positions require a bachelor's degree or higher.

How do I apply for IRS jobs in Philadelphia?

+Candidates can apply for IRS jobs in Philadelphia through the USAJOBS website, which is the official website for federal government job listings.