Intro

Learn about Kamala Harris golf tax proposal, aiming to reduce tax deductions for golf courses, affecting the golf industry and potentially generating revenue for social programs. Understand the implications, benefits, and criticisms of this proposal, and how it relates to tax reform, economic growth, and income inequality.

As the United States continues to navigate its complex tax system, a recent proposal by Senator Kamala Harris has sparked interest among golf enthusiasts and tax experts alike. The proposal, which aims to eliminate the tax deduction for golf course maintenance, has raised questions about the fairness of the current tax system and the potential impact on the golf industry.

Understanding the Current Tax System

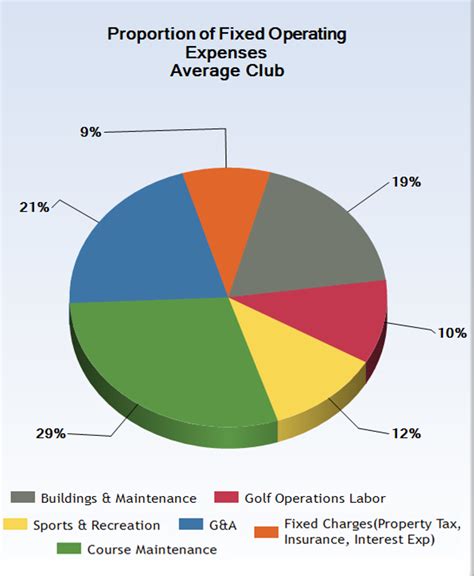

To grasp the significance of Senator Harris's proposal, it's essential to understand how the current tax system treats golf courses. Under the current system, golf courses are considered a type of business, and as such, they are eligible for certain tax deductions. One of these deductions is for the maintenance and upkeep of the golf course, including the cost of water, fertilizers, and labor. This deduction can significantly reduce the taxable income of golf courses, resulting in lower tax liabilities.

The Proposal: Eliminating the Golf Course Maintenance Deduction

Senator Harris's proposal aims to eliminate the tax deduction for golf course maintenance. The proposal argues that this deduction is unfair, as it primarily benefits wealthy golf course owners and players, rather than the broader community. By eliminating this deduction, the proposal seeks to increase tax revenues and promote a more equitable tax system.

Impact on the Golf Industry

The proposed elimination of the golf course maintenance deduction has sparked concerns within the golf industry. Many golf course owners and operators argue that this deduction is essential to their business, as it helps them maintain the high standards of their courses. Without this deduction, golf courses may need to increase their fees or reduce their maintenance costs, potentially impacting the quality of the golfing experience.

Benefits and Drawbacks of the Proposal

The proposal to eliminate the golf course maintenance deduction has both benefits and drawbacks. On the one hand, the proposal could increase tax revenues and promote a more equitable tax system. On the other hand, it could negatively impact the golf industry, potentially leading to higher fees or reduced maintenance costs.

Benefits:

- Increased tax revenues: By eliminating the golf course maintenance deduction, the proposal could increase tax revenues, which could be used to fund public services or reduce the national debt.

- Promoting equity: The proposal argues that the current tax system is unfair, as it primarily benefits wealthy golf course owners and players. By eliminating this deduction, the proposal seeks to promote a more equitable tax system.

Drawbacks:

- Negative impact on the golf industry: The proposed elimination of the golf course maintenance deduction could negatively impact the golf industry, potentially leading to higher fees or reduced maintenance costs.

- Reduced quality of golf courses: Without the deduction, golf courses may need to reduce their maintenance costs, potentially impacting the quality of the golfing experience.

Gallery of Golf Tax Images

Golf Tax Images

Frequently Asked Questions

What is the proposed elimination of the golf course maintenance deduction?

+The proposed elimination of the golf course maintenance deduction is a tax proposal that aims to eliminate the tax deduction for golf course maintenance. This deduction is currently available to golf course owners and operators, and it allows them to reduce their taxable income.

Why is the proposal to eliminate the golf course maintenance deduction?

+The proposal to eliminate the golf course maintenance deduction argues that the current tax system is unfair, as it primarily benefits wealthy golf course owners and players. By eliminating this deduction, the proposal seeks to increase tax revenues and promote a more equitable tax system.

How will the proposed elimination of the golf course maintenance deduction impact the golf industry?

+The proposed elimination of the golf course maintenance deduction could negatively impact the golf industry, potentially leading to higher fees or reduced maintenance costs. Golf course owners and operators may need to increase their fees or reduce their maintenance costs to compensate for the loss of the deduction.

As the debate surrounding the proposed elimination of the golf course maintenance deduction continues, it's essential to consider the potential impact on the golf industry and the broader community. While the proposal may increase tax revenues and promote a more equitable tax system, it could also negatively impact the golf industry, potentially leading to higher fees or reduced maintenance costs. Ultimately, the decision to eliminate the golf course maintenance deduction will depend on a careful consideration of the benefits and drawbacks of the proposal.