Intro

Unlock the full potential of your Lockheed Martin employee benefits with our expert guide. Discover how to maximize your savings through 401(k) matching, ESPP, and other investment opportunities. Boost your financial security and retirement readiness with insider tips and strategies tailored to Lockheed Martins benefits package.

As a Lockheed Martin employee, you have access to a comprehensive benefits package that can help you achieve your financial goals and secure your future. One of the most valuable benefits offered by the company is the Employee Savings Plan (ESP), a 401(k) plan that allows you to save for retirement and other long-term goals. In this article, we will explore the features and benefits of the Lockheed Martin ESP, and provide tips on how to maximize your employee savings benefits.

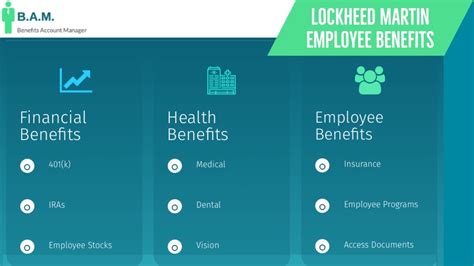

Understanding the Lockheed Martin Employee Savings Plan

The Lockheed Martin ESP is a tax-deferred retirement savings plan that allows eligible employees to contribute a portion of their salary to a retirement account on a pre-tax basis. The plan is designed to help employees save for retirement and other long-term goals, such as buying a home or funding a child's education.

Key Features of the Lockheed Martin ESP

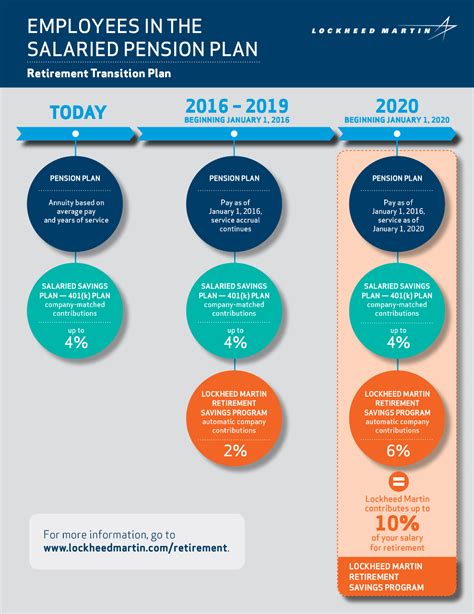

- Company Match: Lockheed Martin matches 100% of the first 4% of employee contributions to the ESP, up to a maximum of 4% of the employee's annual salary.

- Investment Options: The ESP offers a range of investment options, including a variety of mutual funds, index funds, and a Lockheed Martin stock fund.

- Vesting Schedule: Employee contributions to the ESP are vested immediately, while company matching contributions are vested over a three-year period.

- Loan Provision: Employees can borrow up to 50% of their vested account balance, up to a maximum of $50,000.

Maximizing Your Employee Savings Benefits

To maximize your employee savings benefits, follow these tips:

- Contribute Enough to Maximize the Company Match: Contribute at least 4% of your salary to the ESP to maximize the company match. This is essentially free money that can help your retirement savings grow faster.

- Take Advantage of the Catch-Up Contribution: If you are 50 or older, take advantage of the catch-up contribution provision, which allows you to contribute an additional $6,500 to the ESP in 2022.

- Invest Wisely: Choose a diversified portfolio of investments that align with your risk tolerance and financial goals.

- Monitor and Adjust Your Investments: Periodically review your investment portfolio and adjust as needed to ensure that it remains aligned with your financial goals.

- Consider Contributing to a Roth 401(k): If available, consider contributing to a Roth 401(k), which allows you to contribute after-tax dollars to the ESP and potentially reduce your tax liability in retirement.

Benefits of Maximizing Your Employee Savings Benefits

Maximizing your employee savings benefits can have a significant impact on your financial well-being. Some of the benefits of maximizing your employee savings benefits include:

- Increased Retirement Savings: By contributing to the ESP and taking advantage of the company match, you can increase your retirement savings and potentially achieve your long-term financial goals.

- Reduced Tax Liability: Contributions to the ESP are made on a pre-tax basis, which can reduce your taxable income and lower your tax liability.

- Improved Financial Security: By saving for retirement and other long-term goals, you can improve your financial security and reduce your reliance on debt or other sources of funding.

Common Mistakes to Avoid

When maximizing your employee savings benefits, there are several common mistakes to avoid:

- Not Contributing Enough: Failing to contribute enough to the ESP to maximize the company match can result in missed opportunities for retirement savings growth.

- Not Monitoring and Adjusting Investments: Failing to monitor and adjust your investments can result in a portfolio that is not aligned with your financial goals.

- Taking Loans from the ESP: Taking loans from the ESP can result in reduced retirement savings and potential tax penalties.

Conclusion

Maximizing your employee savings benefits is an important step in achieving your long-term financial goals. By understanding the features and benefits of the Lockheed Martin ESP, and following the tips outlined in this article, you can maximize your employee savings benefits and potentially achieve financial security.

Gallery of Lockheed Martin Employee Savings Benefits

Lockheed Martin Employee Savings Benefits Image Gallery

Frequently Asked Questions

What is the Lockheed Martin Employee Savings Plan?

+The Lockheed Martin Employee Savings Plan (ESP) is a 401(k) plan that allows eligible employees to contribute a portion of their salary to a retirement account on a pre-tax basis.

How much can I contribute to the ESP?

+Employees can contribute up to 50% of their eligible compensation to the ESP, up to a maximum of $19,500 in 2022.

What is the company match?

+Lockheed Martin matches 100% of the first 4% of employee contributions to the ESP, up to a maximum of 4% of the employee's annual salary.