Intro

Master personal finance with My Financial Center Guide, covering budgeting, savings, investments, and money management strategies for secure financial futures and wealth creation.

Managing personal finances effectively is crucial for achieving financial stability and security. With the numerous financial tools and services available, it can be overwhelming to navigate and make informed decisions. A financial center guide can provide valuable insights and resources to help individuals take control of their financial lives. In this article, we will delve into the importance of financial management, the benefits of using a financial center guide, and provide practical tips and strategies for achieving financial success.

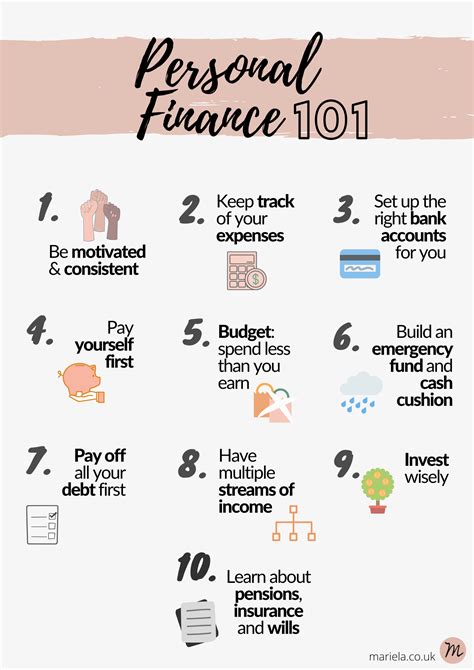

Effective financial management is essential for individuals, families, and businesses alike. It involves creating a budget, saving for the future, investing wisely, and managing debt. A well-planned financial strategy can help reduce stress, increase financial security, and achieve long-term goals. However, with the complexity of modern finance, it can be challenging to know where to start. This is where a financial center guide comes in – a comprehensive resource that provides guidance, tools, and support to help individuals make informed financial decisions.

A financial center guide can offer a wide range of benefits, from budgeting and saving to investing and retirement planning. It can help individuals identify areas for improvement, create a personalized financial plan, and provide access to expert advice and resources. With a financial center guide, individuals can gain a deeper understanding of their financial situation, make informed decisions, and achieve their financial goals. Whether you're just starting out or nearing retirement, a financial center guide can be an invaluable resource for achieving financial success.

Understanding Financial Management

Key Components of Financial Management

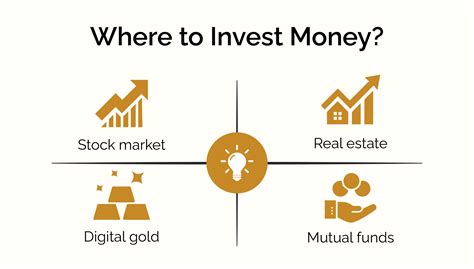

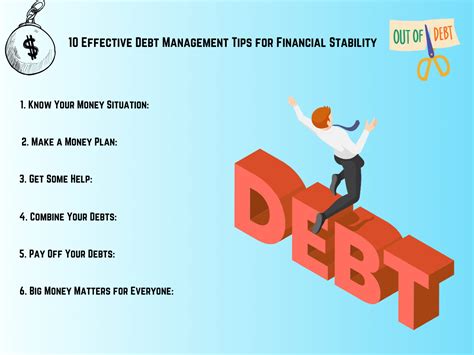

Financial management consists of several key components, including: * Budgeting: creating a plan for managing income and expenses * Saving: setting aside funds for short-term and long-term goals * Investing: growing wealth through investments, such as stocks, bonds, and real estate * Debt management: managing debt, including credit cards, loans, and mortgages * Retirement planning: saving for retirement and creating a sustainable income stream * Estate planning: planning for the distribution of assets after death By understanding these components, individuals can create a comprehensive financial plan that addresses their unique needs and goals.Benefits of Using a Financial Center Guide

How to Choose a Financial Center Guide

With the numerous financial center guides available, it can be challenging to choose the right one. When selecting a financial center guide, consider the following factors: * Expertise: look for guides that offer expert advice and resources from experienced financial professionals * Comprehensive coverage: choose guides that cover a wide range of financial topics, from budgeting and saving to investing and retirement planning * Personalization: opt for guides that offer personalized advice and planning, tailored to unique needs and goals * Accessibility: select guides that are easy to use, with clear and concise language and navigation * Cost: consider guides that offer affordable pricing, with flexible payment options and no hidden feesPractical Tips and Strategies for Financial Success

Common Financial Mistakes to Avoid

When it comes to personal finance, there are several common mistakes to avoid. These include: * Not creating a budget: failing to track income and expenses can lead to financial instability and stress * Not saving for the future: failing to set aside funds for short-term and long-term goals can lead to financial insecurity * Investing without a plan: investing without a clear strategy can lead to losses and financial instability * Not managing debt: failing to pay off high-interest debt and manage low-interest debt can lead to financial stress and instability * Not planning for retirement: failing to save for retirement and create a sustainable income stream can lead to financial insecurity and stressFinancial Planning for Different Life Stages

Financial Planning for Special Situations

There are several special situations that require unique financial planning strategies. These include: * Divorce: create a new budget, manage debt, and invest in retirement * Job loss: create a budget, manage debt, and invest in retirement * Illness or disability: create a budget, manage debt, and invest in retirement * Death of a spouse: create a new budget, manage debt, and invest in retirement By following these tips and strategies, individuals can achieve financial stability, reduce stress, and increase financial security, even in special situations.Financial Planning Image Gallery

What is financial management?

+Financial management involves creating a budget, saving for the future, investing wisely, and managing debt.

Why is financial planning important?

+Financial planning is essential for achieving financial stability, reducing stress, and increasing financial security.

How can I create a budget?

+To create a budget, track your income and expenses, identify areas for improvement, and make informed decisions.

What are some common financial mistakes to avoid?

+Common financial mistakes to avoid include not creating a budget, not saving for the future, investing without a plan, and not managing debt.

How can I achieve financial success?

+To achieve financial success, create a budget, save for the future, invest wisely, and manage debt.

In conclusion, managing personal finances effectively is crucial for achieving financial stability and security. A financial center guide can provide valuable insights and resources to help individuals take control of their financial lives. By understanding the importance of financial management, the benefits of using a financial center guide, and following practical tips and strategies, individuals can achieve financial success and secure their financial future. We invite you to share your thoughts and experiences with financial management and planning in the comments below. Additionally, we encourage you to share this article with others who may benefit from the information and resources provided. By working together, we can achieve financial stability and security, and create a brighter financial future for ourselves and our loved ones.