Intro

Master the NASD calendar with 5 expert tips, optimizing trading strategies and maximizing profits through savvy scheduling, market analysis, and trend forecasting techniques.

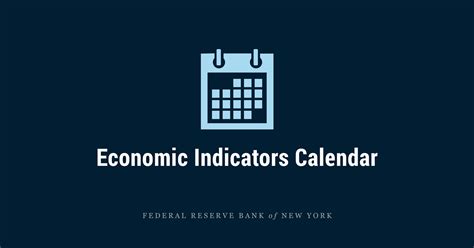

The NASD calendar is an essential tool for investors, providing valuable insights into the market's trends and patterns. Understanding how to navigate and utilize the NASD calendar can significantly enhance investment strategies and decision-making processes. In this article, we will delve into the importance of the NASD calendar and provide five tips on how to make the most of it.

Investors rely heavily on the NASD calendar to stay informed about upcoming events, earnings reports, and economic indicators that can impact market performance. By staying up-to-date with the NASD calendar, investors can anticipate potential market fluctuations and make informed decisions about their investments. The NASD calendar is a comprehensive resource that provides information on various market-related events, including initial public offerings (IPOs), mergers and acquisitions, and dividend announcements.

The NASD calendar is particularly useful for investors who want to stay ahead of the curve and capitalize on emerging trends. By analyzing the calendar, investors can identify potential opportunities and risks, allowing them to adjust their investment portfolios accordingly. Furthermore, the NASD calendar provides a platform for investors to connect with other market participants, facilitating the exchange of ideas and insights. Whether you are a seasoned investor or just starting out, the NASD calendar is an indispensable resource that can help you navigate the complex world of investing.

NASD Calendar Overview

The NASD calendar is a dynamic tool that provides real-time information on market events and trends. It is essential to understand the different components of the NASD calendar, including the various types of events, their frequencies, and their potential impact on the market. By gaining a deeper understanding of the NASD calendar, investors can develop more effective investment strategies and improve their overall performance.

Tip 1: Stay Up-to-Date with Earnings Reports

Earnings reports are a critical component of the NASD calendar, providing valuable insights into a company's financial performance. By staying up-to-date with earnings reports, investors can gain a better understanding of a company's strengths and weaknesses, allowing them to make more informed investment decisions. It is essential to analyze earnings reports carefully, considering factors such as revenue growth, profit margins, and guidance for future performance.

Key Considerations for Earnings Reports

When analyzing earnings reports, there are several key considerations to keep in mind: * Revenue growth: Is the company's revenue increasing or decreasing? * Profit margins: Are the company's profit margins expanding or contracting? * Guidance: What is the company's guidance for future performance? * Industry trends: How is the company performing relative to its peers and the broader industry?Tip 2: Monitor Economic Indicators

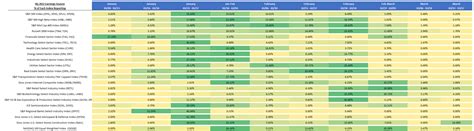

Economic indicators are another crucial component of the NASD calendar, providing insights into the overall health of the economy. By monitoring economic indicators, investors can gain a better understanding of the market's trends and patterns, allowing them to make more informed investment decisions. Some key economic indicators to monitor include GDP growth, inflation rates, and employment numbers.

Key Economic Indicators to Monitor

Some key economic indicators to monitor include: * GDP growth: Is the economy growing or contracting? * Inflation rates: Is inflation rising or falling? * Employment numbers: Are jobs being created or lost? * Interest rates: Are interest rates rising or falling?Tip 3: Analyze Market Trends

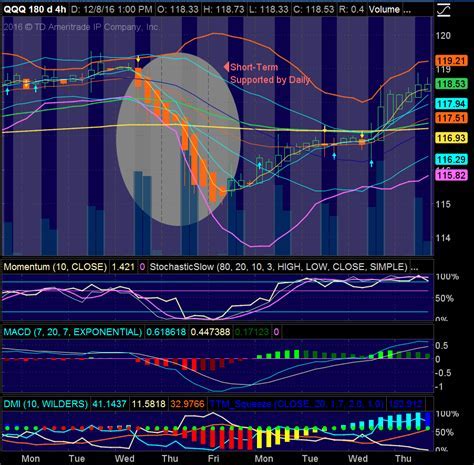

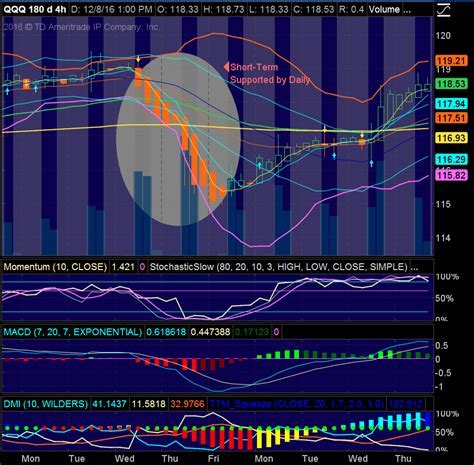

Market trends are a critical component of the NASD calendar, providing insights into the market's overall direction. By analyzing market trends, investors can gain a better understanding of the market's strengths and weaknesses, allowing them to make more informed investment decisions. Some key market trends to analyze include bull and bear markets, sector rotation, and technical analysis.

Key Market Trends to Analyze

Some key market trends to analyze include: * Bull and bear markets: Is the market trending upward or downward? * Sector rotation: Are certain sectors outperforming or underperforming? * Technical analysis: What are the charts telling us about the market's trends and patterns?Tip 4: Identify Potential Opportunities and Risks

The NASD calendar provides a wealth of information on potential opportunities and risks, allowing investors to make more informed investment decisions. By identifying potential opportunities and risks, investors can adjust their investment portfolios accordingly, minimizing losses and maximizing gains. Some key opportunities and risks to consider include IPOs, mergers and acquisitions, and dividend announcements.

Key Opportunities and Risks to Consider

Some key opportunities and risks to consider include: * IPOs: Are there any upcoming IPOs that could provide investment opportunities? * Mergers and acquisitions: Are there any upcoming mergers or acquisitions that could impact the market? * Dividend announcements: Are there any companies announcing dividend payments or changes to their dividend policies?Tip 5: Stay Connected with Other Market Participants

The NASD calendar provides a platform for investors to connect with other market participants, facilitating the exchange of ideas and insights. By staying connected with other market participants, investors can gain a better understanding of the market's trends and patterns, allowing them to make more informed investment decisions. Some key ways to stay connected include attending investor conferences, joining online forums, and following market experts on social media.

Key Ways to Stay Connected

Some key ways to stay connected include: * Attending investor conferences: Are there any upcoming conferences or events that could provide investment insights? * Joining online forums: Are there any online forums or communities that could provide investment ideas and insights? * Following market experts: Are there any market experts or thought leaders that could provide valuable insights and guidance?NASD Calendar Image Gallery

What is the NASD calendar?

+The NASD calendar is a comprehensive resource that provides information on various market-related events, including earnings reports, economic indicators, and market trends.

Why is the NASD calendar important for investors?

+The NASD calendar is essential for investors as it provides valuable insights into the market's trends and patterns, allowing them to make more informed investment decisions.

How can I use the NASD calendar to improve my investment strategy?

+By analyzing the NASD calendar, you can identify potential opportunities and risks, stay up-to-date with earnings reports and economic indicators, and adjust your investment portfolio accordingly.

What are some key events to look out for on the NASD calendar?

+Some key events to look out for on the NASD calendar include earnings reports, economic indicators, IPOs, mergers and acquisitions, and dividend announcements.

How can I stay connected with other market participants using the NASD calendar?

+By attending investor conferences, joining online forums, and following market experts on social media, you can stay connected with other market participants and gain valuable insights and guidance.

In conclusion, the NASD calendar is a powerful tool that can help investors make more informed investment decisions. By following the five tips outlined in this article, investors can stay up-to-date with earnings reports, monitor economic indicators, analyze market trends, identify potential opportunities and risks, and stay connected with other market participants. Whether you are a seasoned investor or just starting out, the NASD calendar is an indispensable resource that can help you navigate the complex world of investing. We encourage you to share your thoughts and experiences with the NASD calendar in the comments below, and to explore the various resources and tools available to help you make the most of this valuable resource.