Intro

Download printable 1099 forms for tax filing, including 1099-MISC and 1099-INT, with easy instructions for independent contractors, freelancers, and small businesses, ensuring accurate IRS reporting and compliance.

The importance of printable 1099 forms cannot be overstated, especially for businesses and individuals who need to report various types of income to the Internal Revenue Service (IRS). The 1099 form is a crucial document used to report income earned from self-employment, freelance work, dividends, interest, and other sources. With the rise of digital technology, it's now easier than ever to download and print 1099 forms online. In this article, we'll delve into the world of printable 1099 forms, exploring their benefits, types, and how to download and fill them out correctly.

For many businesses and individuals, tax season can be a daunting time, filled with paperwork and deadlines. However, with the advent of printable 1099 forms, the process of reporting income has become much simpler. These forms can be easily downloaded from the internet, filled out, and printed, saving time and reducing the risk of errors. Moreover, printable 1099 forms are environmentally friendly, as they eliminate the need for paper waste and mailing.

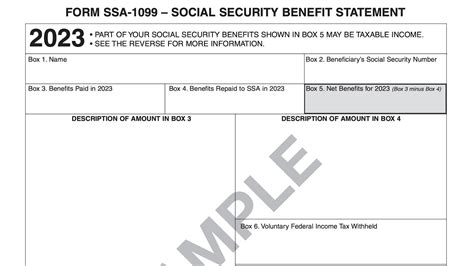

The IRS requires businesses and individuals to report certain types of income using 1099 forms. For example, self-employed individuals must report their income using Form 1099-MISC, while banks and financial institutions must report interest and dividend payments using Form 1099-INT and Form 1099-DIV, respectively. Failure to report income accurately and on time can result in penalties and fines, making it essential to understand the different types of 1099 forms and how to use them correctly.

Benefits of Printable 1099 Forms

The benefits of printable 1099 forms are numerous. Firstly, they save time and effort, as they can be easily downloaded and filled out online. This eliminates the need to visit a physical store or wait for forms to be mailed. Secondly, printable 1099 forms reduce errors, as they can be filled out using a computer or mobile device, minimizing the risk of mistakes. Finally, they are cost-effective, as they eliminate the need for paper and mailing costs.

In addition to these benefits, printable 1099 forms are also environmentally friendly. By reducing the need for paper waste and mailing, they help to minimize the carbon footprint associated with tax reporting. This is especially important for businesses and individuals who value sustainability and want to reduce their environmental impact.

Types of 1099 Forms

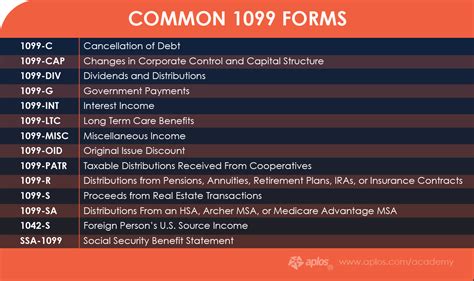

There are several types of 1099 forms, each used to report different types of income. The most common types of 1099 forms include:

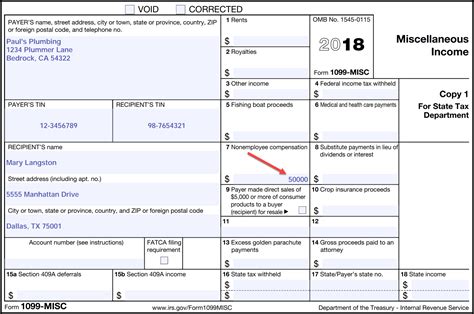

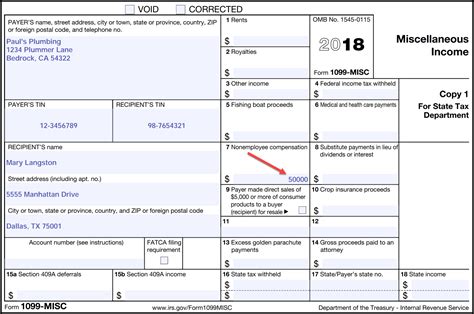

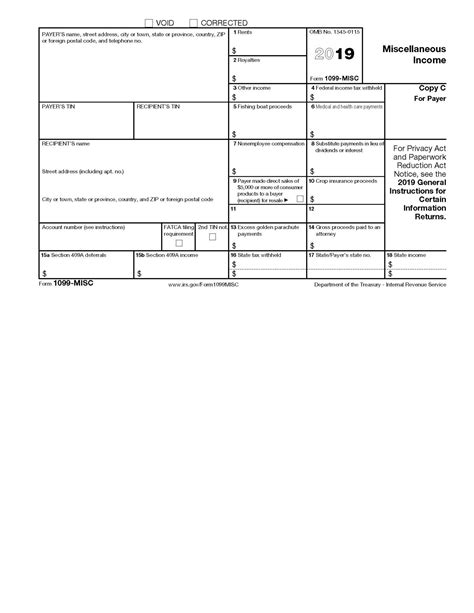

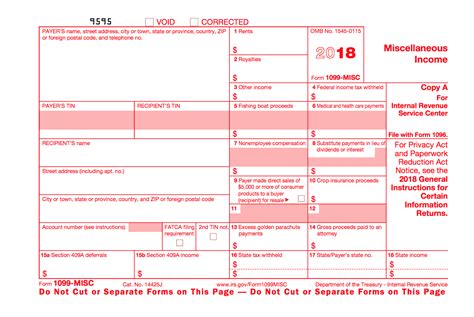

- Form 1099-MISC: Used to report self-employment income, freelance work, and other types of miscellaneous income.

- Form 1099-INT: Used to report interest payments, such as interest earned on savings accounts and investments.

- Form 1099-DIV: Used to report dividend payments, such as dividends earned on stocks and mutual funds.

- Form 1099-B: Used to report proceeds from the sale of securities, such as stocks and bonds.

- Form 1099-K: Used to report payment card and third-party network transactions, such as credit card payments and online transactions.

Each type of 1099 form has its own specific requirements and deadlines, making it essential to understand which form to use and when to file it.

How to Download and Fill Out 1099 Forms

Downloading and filling out 1099 forms is a straightforward process. Here are the steps to follow:

- Visit the IRS website or a reputable online tax preparation service, such as TurboTax or H&R Block.

- Select the type of 1099 form you need to download.

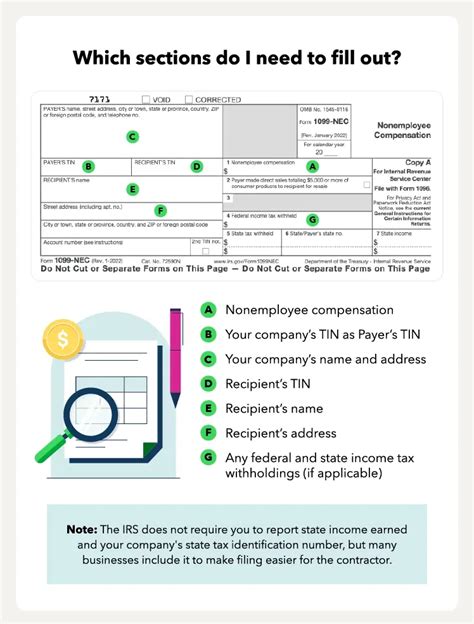

- Fill out the form using a computer or mobile device, making sure to include all required information, such as the recipient's name, address, and tax identification number.

- Review the form for errors and accuracy.

- Print the form and sign it, if required.

- Mail the form to the recipient and the IRS, if required.

It's essential to note that 1099 forms must be filed with the IRS by January 31st of each year, and recipients must receive their forms by January 31st as well.

Common Mistakes to Avoid

When filling out 1099 forms, there are several common mistakes to avoid. These include:

- Inaccurate or missing information, such as the recipient's name or tax identification number.

- Incorrect form type or version.

- Failure to sign the form, if required.

- Failure to mail the form to the recipient and the IRS, if required.

- Missing deadlines, such as the January 31st deadline for filing 1099 forms with the IRS.

By avoiding these common mistakes, businesses and individuals can ensure that their 1099 forms are accurate and filed on time, reducing the risk of penalties and fines.

Tips for Filing 1099 Forms

Here are some tips for filing 1099 forms:

- Use a reputable online tax preparation service, such as TurboTax or H&R Block, to download and fill out 1099 forms.

- Make sure to include all required information, such as the recipient's name, address, and tax identification number.

- Review the form for errors and accuracy before printing and signing it.

- Mail the form to the recipient and the IRS, if required, by the January 31st deadline.

- Keep a copy of the form for your records, in case of an audit or other issue.

By following these tips, businesses and individuals can ensure that their 1099 forms are filed accurately and on time, reducing the risk of penalties and fines.

Conclusion and Next Steps

In conclusion, printable 1099 forms are an essential tool for businesses and individuals who need to report income to the IRS. By understanding the benefits, types, and requirements of 1099 forms, individuals can ensure that they are filed accurately and on time, reducing the risk of penalties and fines. Whether you're a self-employed individual, a business owner, or a financial institution, printable 1099 forms can help you navigate the complex world of tax reporting with ease.

As you move forward with filing your 1099 forms, remember to stay organized, accurate, and timely. Use a reputable online tax preparation service, such as TurboTax or H&R Block, to download and fill out 1099 forms. Make sure to include all required information, review the form for errors and accuracy, and mail it to the recipient and the IRS, if required, by the January 31st deadline. By following these steps, you can ensure that your 1099 forms are filed correctly and reduce the risk of penalties and fines.

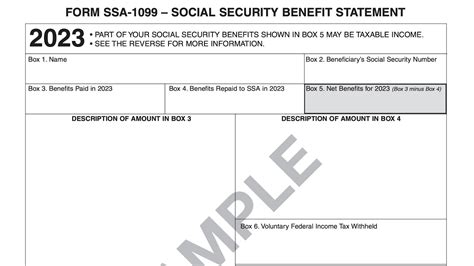

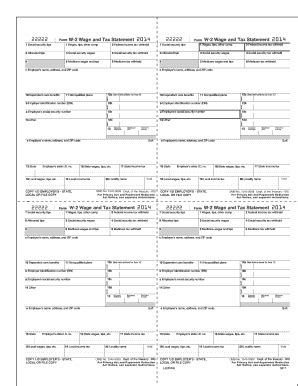

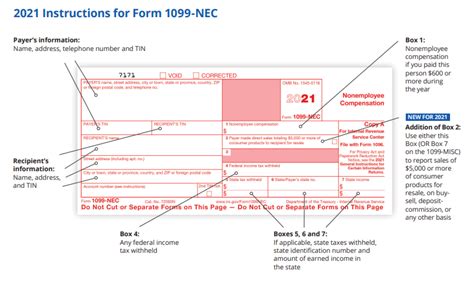

Printable 1099 Form Image Gallery

What is a 1099 form?

+A 1099 form is a document used to report income earned from self-employment, freelance work, dividends, interest, and other sources.

What types of 1099 forms are there?

+There are several types of 1099 forms, including Form 1099-MISC, Form 1099-INT, Form 1099-DIV, Form 1099-B, and Form 1099-K.

How do I download and fill out a 1099 form?

+You can download and fill out a 1099 form by visiting the IRS website or a reputable online tax preparation service, such as TurboTax or H&R Block.

What is the deadline for filing 1099 forms?

+The deadline for filing 1099 forms with the IRS is January 31st of each year.

What are the penalties for not filing 1099 forms on time?

+The penalties for not filing 1099 forms on time can include fines, interest, and other penalties, depending on the severity of the error and the type of form.

We hope this article has provided you with a comprehensive guide to printable 1099 forms. Whether you're a business owner, self-employed individual, or financial institution, understanding the benefits, types, and requirements of 1099 forms is essential for accurate and timely tax reporting. By following the tips and guidelines outlined in this article, you can ensure that your 1099 forms are filed correctly and reduce the risk of penalties and fines. If you have any further questions or concerns, please don't hesitate to reach out to us. We're always here to help. Share this article with your friends and colleagues, and don't forget to comment below with your thoughts and experiences with printable 1099 forms.