Intro

Discover 5 ways an amortization schedule helps with loan management, including mortgage planning, debt repayment, and interest savings, using amortization tables and calculators for financial clarity.

Amortization schedules are essential tools for managing loans and understanding the breakdown of payments over time. Whether you're dealing with a mortgage, car loan, or any other type of amortized loan, having a clear picture of how your payments are applied can help you make informed financial decisions. In this article, we'll delve into the world of amortization schedules, exploring what they are, how they work, and providing five key ways they can benefit you in managing your debt.

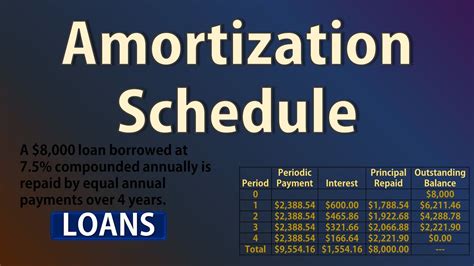

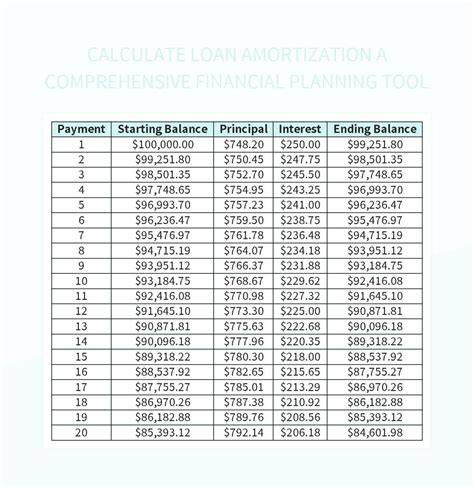

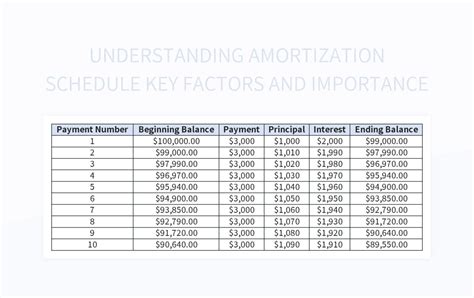

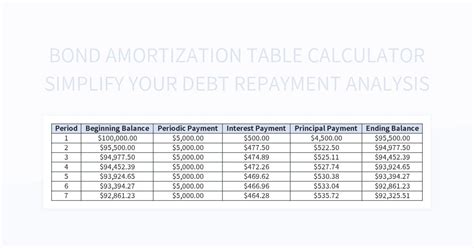

Understanding how amortization works is crucial. Essentially, amortization is the process of gradually paying off debt through regular payments. A portion of each payment goes towards the interest, and the remaining amount is applied to the principal. Over time, as the principal decreases, the amount of interest paid also decreases, allowing more of the payment to go towards reducing the loan balance. This process is typically outlined in an amortization schedule, which is a table or spreadsheet that shows how each payment is divided between interest and principal.

The importance of amortization schedules cannot be overstated. They provide transparency into the loan repayment process, helping borrowers understand how their payments are being utilized. This transparency is crucial for planning and budgeting, as it allows individuals to see exactly how much of their payment is going towards interest versus the principal. Moreover, understanding the amortization process can help borrowers make strategic decisions about their loans, such as deciding whether to make extra payments towards the principal to pay off the loan more quickly.

Introduction to Amortization Schedules

For borrowers, having access to an amortization schedule can be incredibly empowering. It allows them to see the impact of their payments over time and understand how changes in interest rates or payment amounts can affect the loan term and total interest paid. This information can be used to make informed decisions about refinancing, making extra payments, or adjusting the loan term to better suit their financial situation.

How Amortization Schedules Work

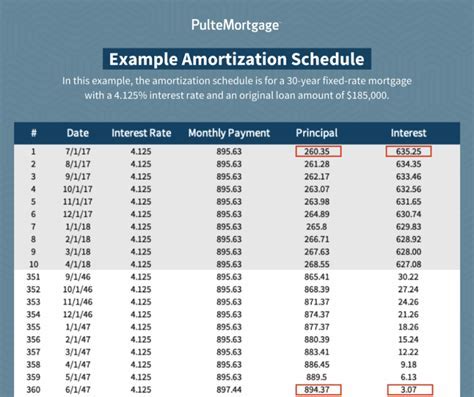

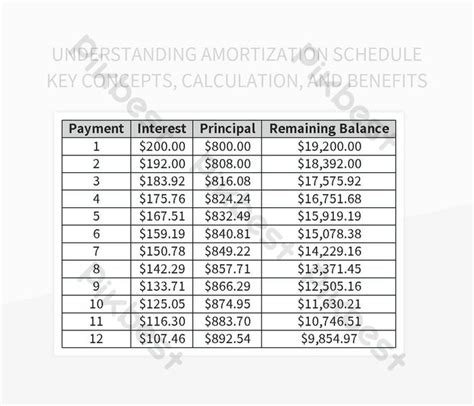

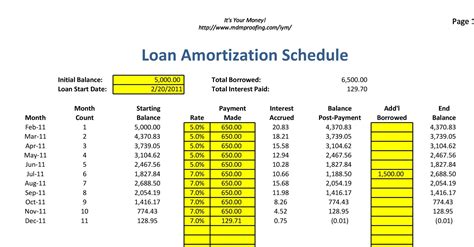

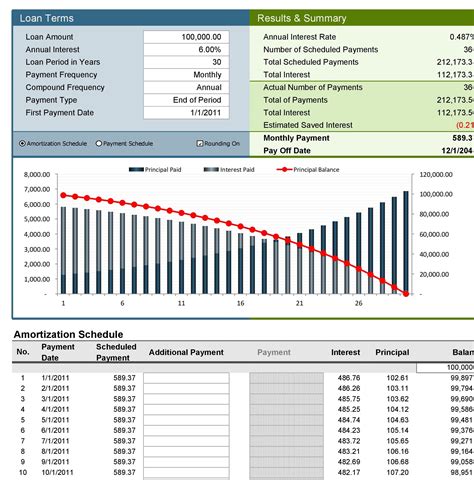

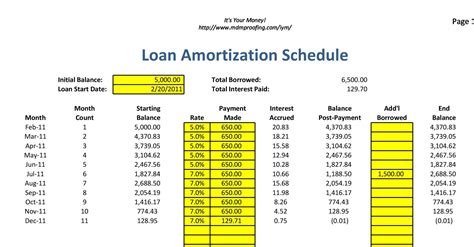

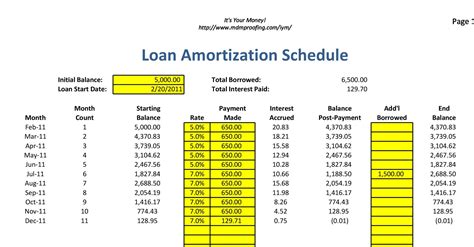

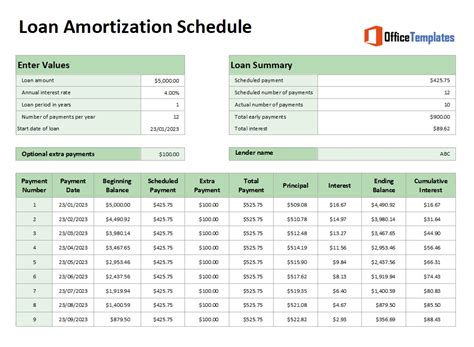

Understanding how to read and interpret an amortization schedule is key to leveraging its benefits. The schedule typically includes columns for the payment number, payment amount, interest paid, principal paid, and the outstanding balance. By reviewing these columns, borrowers can track their progress and see how their payments are impacting the loan balance over time.

Benefits of Amortization Schedules

Moreover, amortization schedules can help borrowers avoid costly mistakes. For example, by seeing the amount of interest paid over the life of the loan, borrowers may decide to refinance to a lower interest rate or make extra payments to reduce the principal more quickly. These decisions can save thousands of dollars in interest over the life of the loan.

Key Components of Amortization Schedules

The key components of an amortization schedule include the loan amount, interest rate, loan term, and monthly payment amount. These components are used to calculate the interest and principal paid with each payment. Understanding how these components interact is crucial for managing the loan effectively.For instance, a higher interest rate will result in more of the payment being applied to interest, especially in the early years of the loan. Conversely, a lower interest rate means more of the payment can be applied to the principal from the outset. Similarly, extending the loan term will generally result in lower monthly payments but more interest paid over the life of the loan.

5 Ways Amortization Schedules Can Benefit You

-

Strategic Debt Repayment: These schedules enable borrowers to make informed decisions about their debt. For example, by seeing the impact of extra payments on the loan term and total interest paid, individuals can strategically decide when and how much extra to pay towards their loans.

-

Interest Savings: By understanding the amortization process, borrowers can identify opportunities to save on interest. Making extra payments or refinancing to a lower interest rate can significantly reduce the total interest paid over the life of the loan.

-

Enhanced Transparency: Amortization schedules offer transparency into the loan repayment process. This transparency is essential for trust and understanding between lenders and borrowers, ensuring that both parties are on the same page regarding the loan terms and repayment expectations.

-

Flexibility and Adjustments: Finally, amortization schedules allow for flexibility and adjustments. By analyzing the schedule, borrowers can see how changes in payment amounts, interest rates, or loan terms affect the loan repayment. This information can be used to adjust the loan strategy, ensuring it remains aligned with the borrower's financial goals and circumstances.

Practical Applications of Amortization Schedules

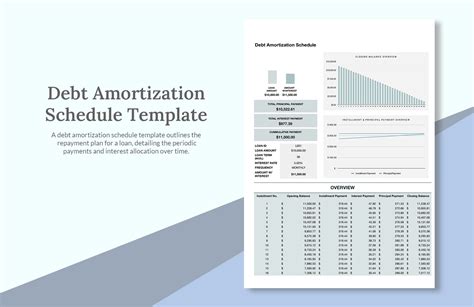

In practical terms, amortization schedules can be applied in various scenarios. For instance, when considering a mortgage, an amortization schedule can help potential homeowners understand the monthly payments and total interest paid over the life of the loan. Similarly, for car loans or personal loans, these schedules can provide insight into the repayment process and help borrowers make informed decisions about their debt.Creating Your Own Amortization Schedule

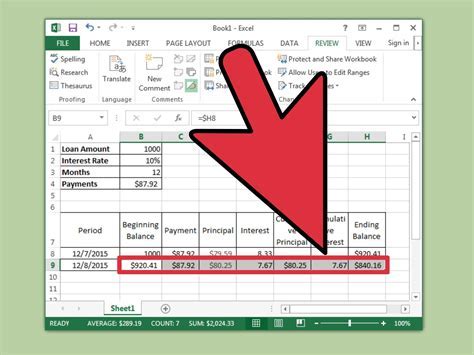

For those who prefer a more hands-on approach, templates are available that can be customized with the loan details. These templates automatically calculate the interest and principal paid with each payment, providing a comprehensive view of the loan repayment process.

Conclusion and Next Steps

As you move forward, consider how you can apply the insights from amortization schedules to your own financial situation. Whether it's making extra payments, refinancing to a lower interest rate, or simply having a better understanding of your debt, the information provided by these schedules can be invaluable. Take the first step today by creating your own amortization schedule or consulting with a financial advisor to explore how you can optimize your loan repayment strategy.

Amortization Schedule Image Gallery

What is an amortization schedule?

+An amortization schedule is a table or spreadsheet that shows how each payment on a loan is divided between interest and principal.

How do I create an amortization schedule?

+You can create an amortization schedule using a spreadsheet program like Excel or through online calculators by inputting the loan amount, interest rate, and loan term.

What are the benefits of using an amortization schedule?

+The benefits include improved financial planning, strategic debt repayment, interest savings, enhanced transparency, and flexibility in adjusting loan strategies.

We hope this comprehensive guide to amortization schedules has provided you with the insights and tools needed to navigate the world of loan repayment with confidence. Whether you're a seasoned borrower or just starting out, understanding how amortization works and leveraging the benefits of amortization schedules can make a significant difference in your financial journey. Share your thoughts and experiences with amortization schedules in the comments below, and don't forget to share this article with anyone who might benefit from a deeper understanding of loan repayment strategies.