Intro

Discover 5 ways bill sales can boost revenue, improve cash flow, and enhance financial stability through invoice factoring, accounts receivable financing, and more, optimizing business operations and reducing debt.

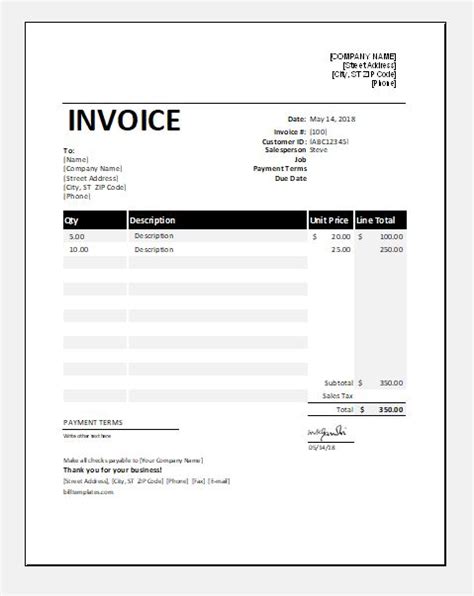

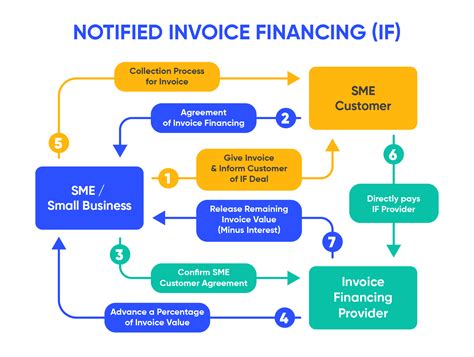

The concept of bill sales, also known as invoice financing or factoring, has become increasingly popular among businesses looking to improve their cash flow and manage their finances more effectively. Bill sales allow companies to sell their outstanding invoices to a third-party financier, who then collects the payment from the customer. This approach can provide businesses with immediate access to funds, reducing the need to wait for customers to settle their accounts. In this article, we will explore the importance of bill sales, their benefits, and the mechanisms behind this financial tool.

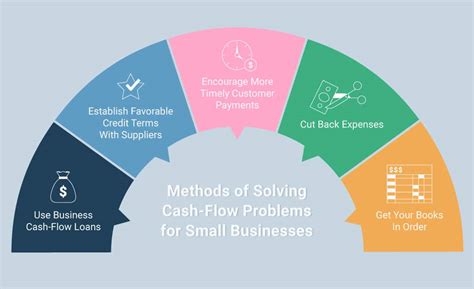

Bill sales are particularly useful for small and medium-sized enterprises (SMEs) that often face cash flow challenges due to delayed payments from clients. By selling their invoices, these businesses can receive the necessary funds to cover operational expenses, invest in growth opportunities, and improve their overall financial stability. Moreover, bill sales can help companies avoid the risks associated with late payments, such as damaged credit scores and increased debt.

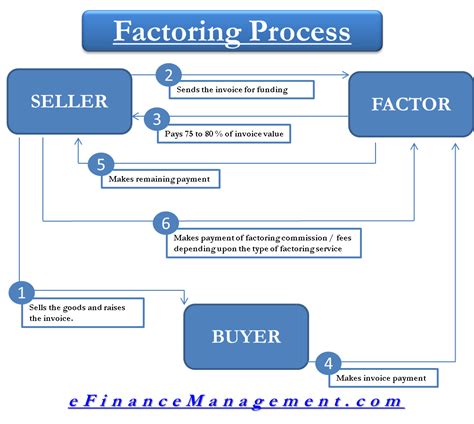

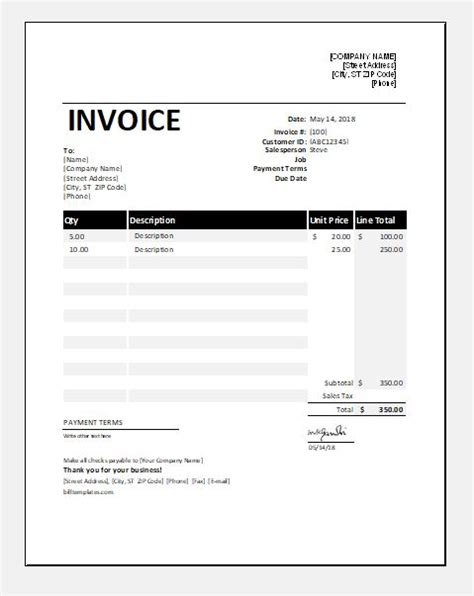

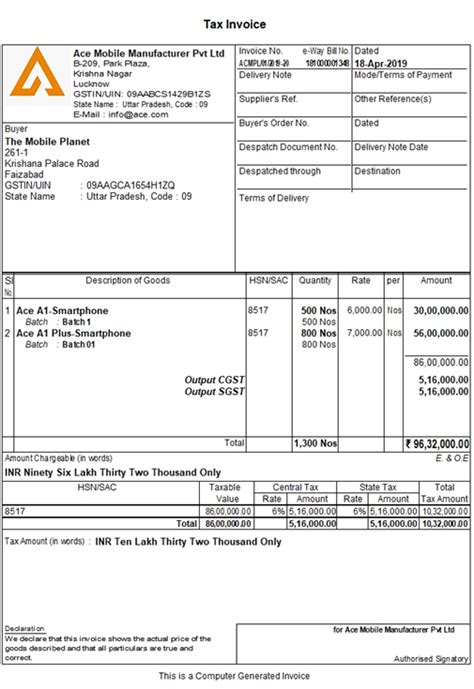

The process of bill sales typically involves a few key steps. First, a business identifies the invoices it wishes to sell and submits them to a factoring company. The factoring company then verifies the invoices and assesses the creditworthiness of the customers. Once the invoices are approved, the factoring company advances a significant portion of the invoice value to the business, usually within 24 hours. The business can then use these funds as needed, while the factoring company collects the full payment from the customer.

Benefits of Bill Sales

The benefits of bill sales are numerous and can have a significant impact on a company's financial health. Some of the most notable advantages include improved cash flow, reduced bad debt, and increased financial flexibility. By selling invoices, businesses can receive immediate payment, which can be used to cover essential expenses, such as payroll, rent, and supplies. This approach also helps companies avoid the risks associated with late payments, as the factoring company takes on the responsibility of collecting the debt.

Improved Cash Flow

Improved cash flow is one of the most significant benefits of bill sales. By receiving immediate payment for outstanding invoices, businesses can ensure they have the necessary funds to cover operational expenses and invest in growth opportunities. This can be particularly useful for companies with long payment terms, as it allows them to manage their finances more effectively and avoid cash flow gaps.Reduced Bad Debt

Bill sales can also help businesses reduce their bad debt. When a company sells its invoices to a factoring company, it transfers the risk of non-payment to the factoring company. This means that if a customer fails to pay an invoice, the business will not be affected, as the factoring company will absorb the loss. This approach can help companies avoid damaged credit scores and increased debt, which can have long-term consequences for their financial stability.How Bill Sales Work

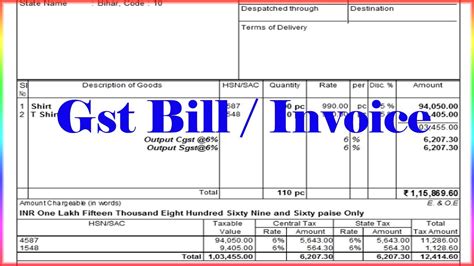

The process of bill sales is relatively straightforward. Here are the key steps involved:

- Invoice Submission: The business submits its outstanding invoices to a factoring company.

- Verification: The factoring company verifies the invoices and assesses the creditworthiness of the customers.

- Approval: The factoring company approves the invoices and advances a significant portion of the invoice value to the business.

- Collection: The factoring company collects the full payment from the customer.

- Repayment: The business repays the factoring company, usually with a small fee.

Types of Bill Sales

There are several types of bill sales, each with its own advantages and disadvantages. Some of the most common types include:- Factoring: This involves selling invoices to a factoring company, which then collects the payment from the customer.

- Invoice Discounting: This involves borrowing money from a lender using outstanding invoices as collateral.

- Invoice Financing: This involves selling invoices to a financier, which then collects the payment from the customer.

Benefits for SMEs

Bill sales can be particularly beneficial for SMEs, which often face cash flow challenges due to delayed payments from clients. By selling their invoices, SMEs can receive the necessary funds to cover operational expenses, invest in growth opportunities, and improve their overall financial stability. Some of the most notable benefits for SMEs include:

- Improved Cash Flow: Bill sales can provide SMEs with immediate access to funds, reducing the need to wait for customers to settle their accounts.

- Reduced Bad Debt: Bill sales can help SMEs reduce their bad debt, as the factoring company takes on the responsibility of collecting the debt.

- Increased Financial Flexibility: Bill sales can provide SMEs with the financial flexibility to invest in growth opportunities, such as new equipment, staff, and marketing campaigns.

Case Studies

Several companies have successfully used bill sales to improve their cash flow and manage their finances more effectively. For example:- Company A: A small business that sells products to large retailers. The company used bill sales to receive immediate payment for its outstanding invoices, which helped it cover operational expenses and invest in growth opportunities.

- Company B: A medium-sized enterprise that provides services to corporate clients. The company used bill sales to reduce its bad debt and improve its cash flow, which helped it avoid financial difficulties and invest in new staff and equipment.

Challenges and Limitations

While bill sales can be a useful financial tool for businesses, there are several challenges and limitations to consider. Some of the most notable challenges include:

- Fees: Bill sales can involve fees, such as factoring fees and interest charges, which can eat into a company's profits.

- Creditworthiness: Bill sales require businesses to have creditworthy customers, which can be a challenge for companies that deal with high-risk clients.

- Complexity: Bill sales can be complex, involving multiple parties and legal agreements, which can be time-consuming and costly to establish.

Best Practices

To get the most out of bill sales, businesses should follow best practices, such as:- Choose a Reputable Factoring Company: Businesses should choose a reputable factoring company that has experience in their industry and a track record of success.

- Understand the Fees: Businesses should understand the fees involved in bill sales, including factoring fees and interest charges, and factor them into their financial planning.

- Monitor Cash Flow: Businesses should monitor their cash flow closely, using bill sales to manage their finances effectively and avoid cash flow gaps.

Future of Bill Sales

The future of bill sales looks promising, with more businesses turning to this financial tool to manage their finances effectively. Some of the trends that are expected to shape the future of bill sales include:

- Digitalization: The bill sales industry is expected to become more digitalized, with online platforms and mobile apps making it easier for businesses to access factoring services.

- Increased Adoption: Bill sales are expected to become more widely adopted, as more businesses recognize the benefits of this financial tool.

- Greater Transparency: The bill sales industry is expected to become more transparent, with factoring companies providing clearer information about their fees and services.

Conclusion and Recommendations

In conclusion, bill sales can be a useful financial tool for businesses, providing immediate access to funds and helping to manage cash flow effectively. However, businesses should be aware of the challenges and limitations involved, including fees, creditworthiness, and complexity. To get the most out of bill sales, businesses should follow best practices, such as choosing a reputable factoring company, understanding the fees, and monitoring cash flow closely.Bill Sales Image Gallery

What is bill sales?

+Bill sales, also known as invoice financing or factoring, is a financial tool that allows businesses to sell their outstanding invoices to a third-party financier, who then collects the payment from the customer.

How do bill sales work?

+The process of bill sales typically involves a few key steps, including invoice submission, verification, approval, collection, and repayment.

What are the benefits of bill sales?

+The benefits of bill sales include improved cash flow, reduced bad debt, and increased financial flexibility, which can help businesses manage their finances more effectively and invest in growth opportunities.

Are bill sales suitable for all businesses?

+Bill sales can be suitable for many businesses, but they may not be the best option for every company. Businesses should carefully consider their financial situation and goals before deciding whether bill sales are right for them.

How can I get started with bill sales?

+To get started with bill sales, businesses should research and compare different factoring companies, understand the fees and terms involved, and carefully review their financial situation and goals.

We hope this article has provided you with a comprehensive understanding of bill sales and their benefits for businesses. If you have any further questions or would like to share your experiences with bill sales, please don't hesitate to comment below. You can also share this article with others who may be interested in learning more about this financial tool. Additionally, you can take specific actions, such as researching factoring companies or consulting with a financial advisor, to determine whether bill sales are right for your business.