Intro

Discover 5 budget sheets to track expenses, manage finances, and create a personalized budget plan with templates, spreadsheets, and budgeting tools for effective money management and financial planning.

Creating a budget can be a daunting task, especially for those who are new to managing their finances. However, having a budget in place is essential for achieving financial stability and security. A budget sheet is a tool that can help individuals and businesses track their income and expenses, making it easier to make informed financial decisions. In this article, we will explore the importance of budget sheets and provide examples of different types of budget sheets that can be used.

Budgeting is an essential aspect of personal finance, and it is crucial to have a clear understanding of where your money is going. A budget sheet can help you identify areas where you can cut back on unnecessary expenses and allocate your resources more efficiently. By using a budget sheet, you can create a personalized plan that suits your financial goals and needs. Whether you are looking to save money, pay off debt, or build wealth, a budget sheet can be a valuable tool in helping you achieve your objectives.

Having a budget in place can also help reduce financial stress and anxiety. When you have a clear understanding of your financial situation, you can make informed decisions about how to manage your money. This can help you avoid overspending, reduce debt, and build a safety net for unexpected expenses. Additionally, a budget sheet can help you identify areas where you can improve your financial literacy, such as investing, saving, and retirement planning. By taking control of your finances, you can achieve financial freedom and security, which can have a positive impact on your overall well-being.

Types of Budget Sheets

There are several types of budget sheets that can be used, depending on your individual needs and goals. Here are five examples of budget sheets that can be used:

1. Zero-Based Budget Sheet

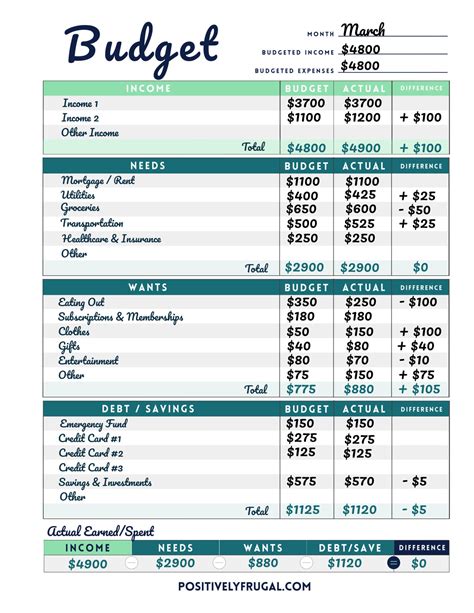

A zero-based budget sheet is a type of budget that starts from a "zero balance" and allocates every dollar of income towards a specific expense or savings goal. This type of budget is useful for individuals who want to have complete control over their finances and ensure that every dollar is being used efficiently.2. 50/30/20 Budget Sheet

The 50/30/20 budget sheet is a type of budget that allocates 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. This type of budget is useful for individuals who want to strike a balance between enjoying their life today and building a secure financial future.3. Envelope Budget Sheet

An envelope budget sheet is a type of budget that uses a cash-based system to manage expenses. This type of budget involves dividing expenses into categories and allocating a specific amount of cash for each category. The cash is then placed in an envelope, and expenses are paid using the cash in the envelope. This type of budget is useful for individuals who want to stick to a budget and avoid overspending.4. Priority-Based Budget Sheet

A priority-based budget sheet is a type of budget that prioritizes expenses based on importance and urgency. This type of budget is useful for individuals who want to ensure that essential expenses, such as rent and utilities, are paid first, and then allocate remaining funds towards discretionary spending.5. Incremental Budget Sheet

An incremental budget sheet is a type of budget that involves making small, incremental changes to expenses over time. This type of budget is useful for individuals who want to make gradual changes to their spending habits and build new financial habits over time.Benefits of Using a Budget Sheet

Using a budget sheet can have several benefits, including:

- Improved financial awareness and understanding

- Increased control over finances

- Reduced financial stress and anxiety

- Improved ability to achieve financial goals

- Increased savings and wealth-building

By using a budget sheet, individuals can gain a better understanding of their financial situation and make informed decisions about how to manage their money. This can lead to improved financial outcomes, such as increased savings, reduced debt, and improved credit scores.

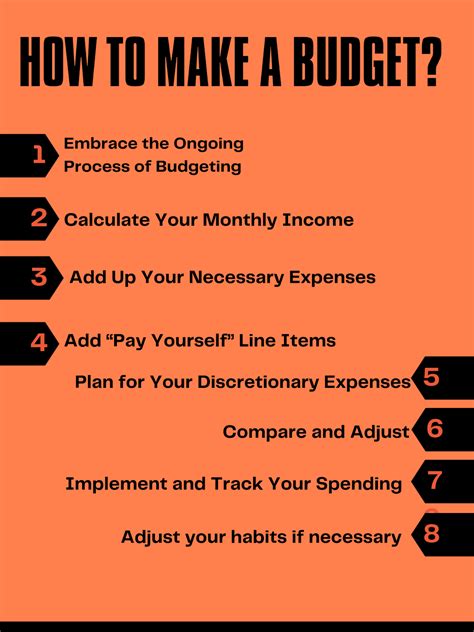

How to Create a Budget Sheet

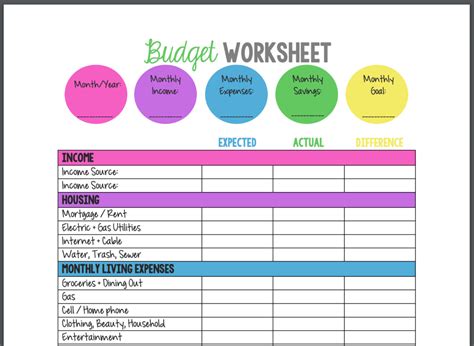

Creating a budget sheet is a straightforward process that involves several steps. Here are the steps to follow:

- Identify income: Start by identifying all sources of income, including salary, investments, and any side hustles.

- Track expenses: Next, track all expenses, including necessary expenses, such as rent and utilities, and discretionary spending, such as entertainment and hobbies.

- Categorize expenses: Categorize expenses into different groups, such as housing, transportation, and food.

- Set financial goals: Set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals, such as saving for a down payment on a house or paying off debt.

- Allocate funds: Allocate funds towards each expense category and savings goal based on priority and importance.

- Review and adjust: Regularly review and adjust the budget sheet to ensure that it is working effectively and make any necessary changes.

Common Budgeting Mistakes to Avoid

When creating a budget sheet, there are several common mistakes to avoid. Here are some of the most common mistakes:

- Not tracking expenses: Failing to track expenses can make it difficult to understand where money is going and make informed decisions about how to manage finances.

- Not prioritizing expenses: Failing to prioritize expenses can lead to overspending and financial stress.

- Not saving for emergencies: Failing to save for emergencies can lead to financial shock and stress when unexpected expenses arise.

- Not reviewing and adjusting the budget: Failing to review and adjust the budget regularly can lead to stagnation and failure to achieve financial goals.

By avoiding these common mistakes, individuals can create a budget sheet that is effective and helps them achieve their financial goals.

Tools and Resources for Creating a Budget Sheet

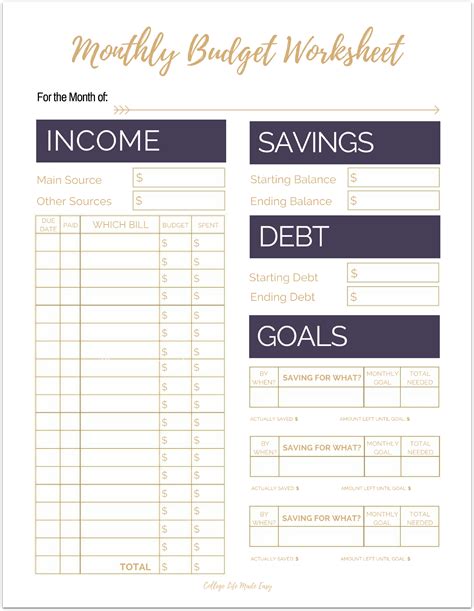

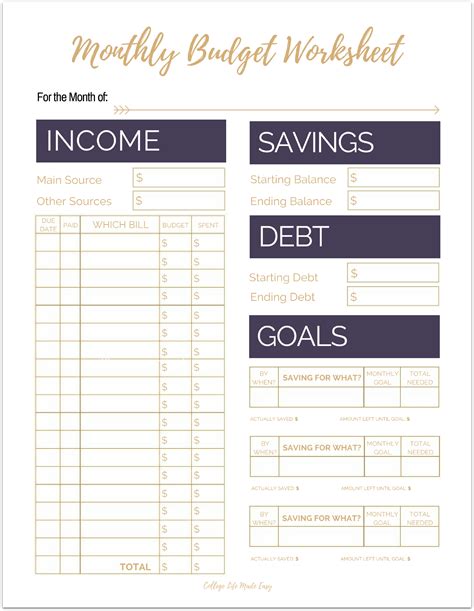

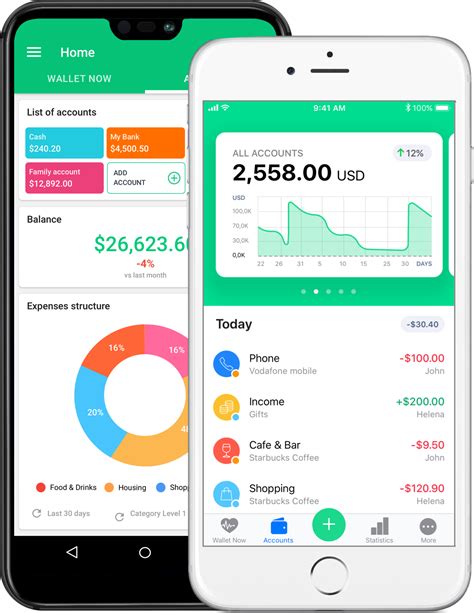

There are several tools and resources available to help individuals create a budget sheet. Here are some of the most popular tools and resources:

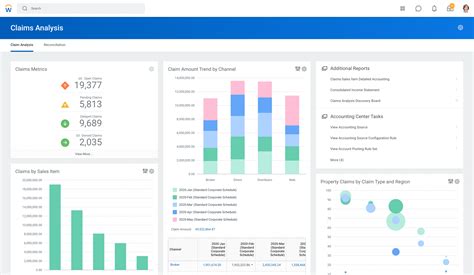

- Budgeting apps: Budgeting apps, such as Mint and You Need a Budget (YNAB), can help individuals track expenses and create a budget.

- Spreadsheets: Spreadsheets, such as Google Sheets and Microsoft Excel, can be used to create a budget sheet and track expenses.

- Budgeting templates: Budgeting templates, such as those found in Microsoft Excel, can provide a starting point for creating a budget sheet.

- Financial advisors: Financial advisors can provide personalized advice and guidance on creating a budget sheet and achieving financial goals.

By using these tools and resources, individuals can create a budget sheet that is tailored to their needs and helps them achieve their financial goals.

Budget Sheets Image Gallery

What is a budget sheet?

+A budget sheet is a tool used to track income and expenses, making it easier to make informed financial decisions.

Why is it important to use a budget sheet?

+Using a budget sheet can help individuals gain control over their finances, reduce financial stress and anxiety, and achieve financial goals.

How do I create a budget sheet?

+To create a budget sheet, start by identifying income and expenses, categorizing expenses, setting financial goals, allocating funds, and reviewing and adjusting the budget regularly.

What are some common budgeting mistakes to avoid?

+Common budgeting mistakes to avoid include not tracking expenses, not prioritizing expenses, not saving for emergencies, and not reviewing and adjusting the budget regularly.

What tools and resources are available to help create a budget sheet?

+Tools and resources available to help create a budget sheet include budgeting apps, spreadsheets, budgeting templates, and financial advisors.

In conclusion, creating a budget sheet is an essential step in achieving financial stability and security. By understanding the importance of budgeting, using the right tools and resources, and avoiding common mistakes, individuals can create a budget sheet that helps them achieve their financial goals. Whether you are looking to save money, pay off debt, or build wealth, a budget sheet can be a valuable tool in helping you achieve financial freedom and security. We invite you to share your thoughts and experiences with budgeting in the comments below, and to share this article with others who may benefit from it.