Intro

Discover 5 ways to optimize I-9 form compliance, including electronic verification, audit preparation, and employee onboarding, to minimize errors and ensure seamless immigration paperwork, employment eligibility, and workforce management.

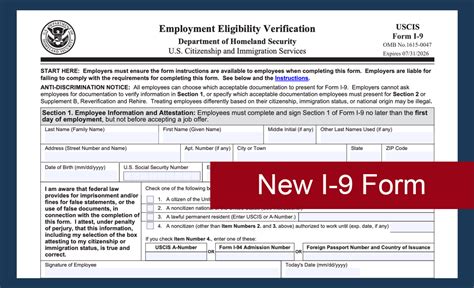

The I-9 form is a crucial document for employers in the United States, as it helps to verify the identity and employment authorization of new hires. The form is used to confirm that an employee is eligible to work in the country, and it must be completed for all new employees, including citizens and non-citizens. In this article, we will explore five ways the I-9 form can impact employers and employees, and provide guidance on how to complete the form correctly.

The I-9 form is a critical component of the hiring process, and it is essential that employers understand the importance of completing the form accurately and on time. Failure to do so can result in significant fines and penalties, as well as damage to an employer's reputation. In addition to the financial consequences, an employer's failure to properly complete the I-9 form can also lead to delays in the hiring process, which can impact an employee's ability to start work on time.

The I-9 form is typically completed in conjunction with other hiring paperwork, such as tax forms and benefits enrollment. However, the I-9 form is unique in that it requires specific documentation from the employee, such as a passport or driver's license, to verify their identity and employment authorization. Employers must also ensure that the form is completed correctly, as errors or omissions can lead to problems down the line.

Understanding the I-9 Form Requirements

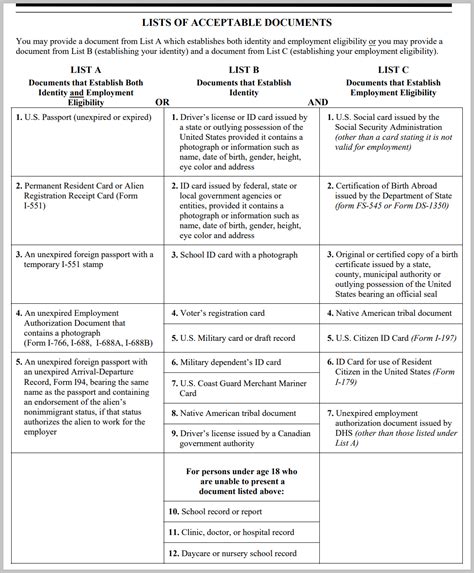

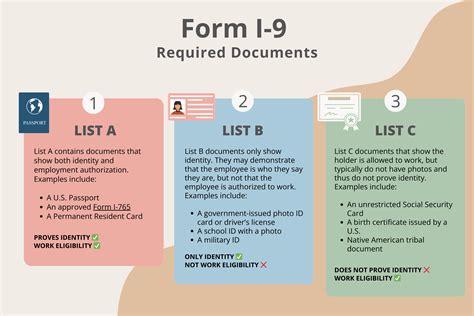

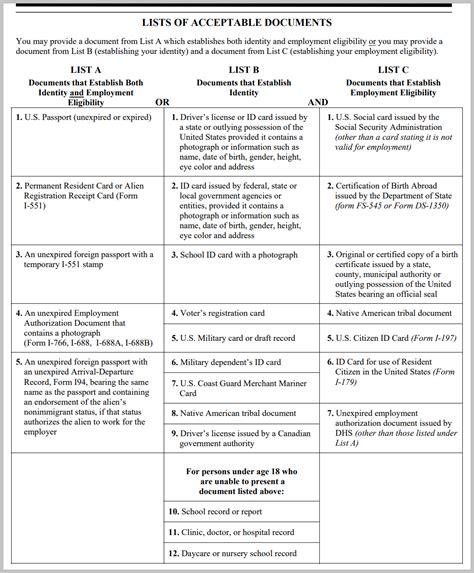

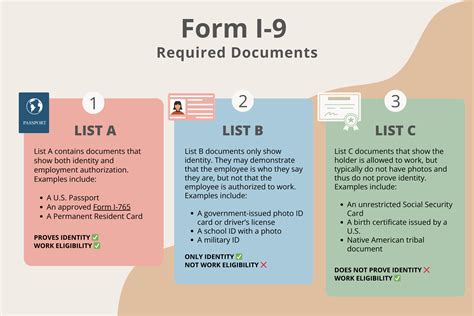

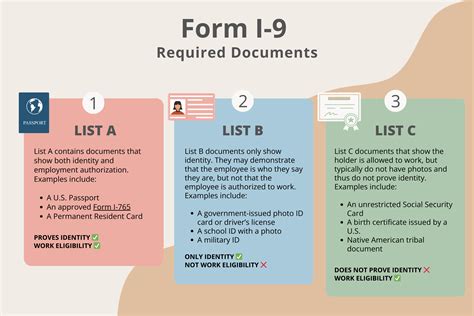

To complete the I-9 form, employers must provide specific information about the employee, including their name, address, and date of birth. The employee must also provide documentation to verify their identity and employment authorization, such as a passport, driver's license, or social security card. The employer must review the documentation and verify its authenticity, and then complete the I-9 form accordingly.

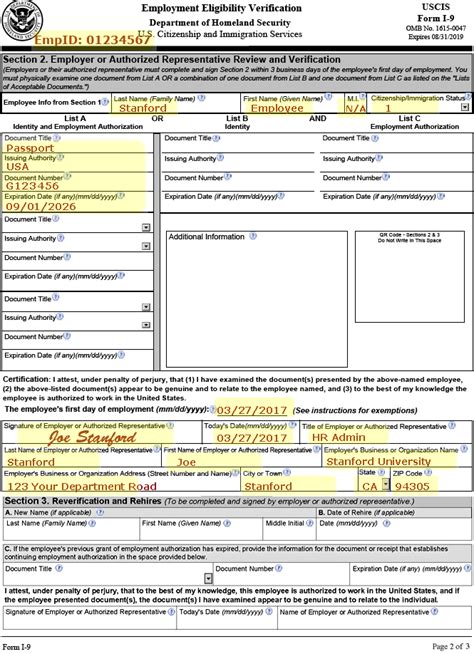

The I-9 form is typically completed in three sections: Section 1, which is completed by the employee; Section 2, which is completed by the employer; and Section 3, which is used to reverify an employee's employment authorization if necessary. Employers must ensure that each section is completed correctly and on time, as failure to do so can result in fines and penalties.

Section 1: Employee Information

Section 1 of the I-9 form is completed by the employee and requires them to provide specific information, including their name, address, and date of birth. The employee must also attest to their citizenship status and provide documentation to verify their identity and employment authorization.Section 2: Employer Review and Verification

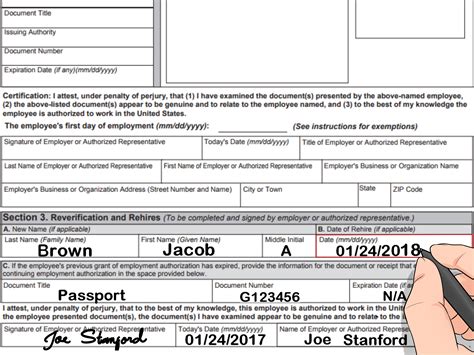

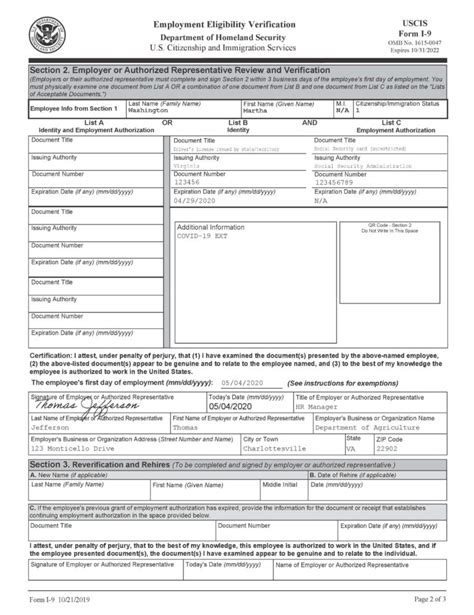

Section 2 of the I-9 form is completed by the employer and requires them to review the employee's documentation and verify its authenticity. The employer must also complete the form accordingly, based on the information provided by the employee.Section 3: Reverification

Section 3 of the I-9 form is used to reverify an employee's employment authorization if necessary. This may be required if an employee's work authorization is about to expire, or if an employer needs to update an employee's I-9 form for any other reason.The Importance of Accurate I-9 Form Completion

Accurate completion of the I-9 form is critical for employers, as it helps to prevent errors and omissions that can lead to fines and penalties. Employers must ensure that the form is completed correctly and on time, and that all required documentation is provided.

To ensure accurate completion of the I-9 form, employers should:

- Review the form carefully before completing it

- Ensure that all required documentation is provided

- Verify the authenticity of the documentation

- Complete the form accordingly, based on the information provided

- Keep the completed form on file for the required period

Consequences of Inaccurate I-9 Form Completion

Inaccurate completion of the I-9 form can result in significant fines and penalties for employers. The U.S. Immigration and Customs Enforcement (ICE) is responsible for enforcing the I-9 form requirements, and employers who fail to comply can face serious consequences.Some of the consequences of inaccurate I-9 form completion include:

- Fines and penalties

- Damage to an employer's reputation

- Delays in the hiring process

- Loss of business licenses

- Criminal prosecution

Best Practices for I-9 Form Completion

To ensure accurate and efficient completion of the I-9 form, employers should follow best practices, including:

- Providing clear instructions to employees

- Ensuring that all required documentation is provided

- Verifying the authenticity of the documentation

- Completing the form accordingly, based on the information provided

- Keeping the completed form on file for the required period

Employers should also consider implementing an I-9 form compliance program, which can help to ensure that the form is completed accurately and on time. This can include:

- Providing training to HR staff and managers

- Implementing an I-9 form completion process

- Conducting regular audits to ensure compliance

- Keeping accurate records of I-9 form completion

I-9 Form Compliance Programs

An I-9 form compliance program can help employers to ensure that the form is completed accurately and on time. This can include providing training to HR staff and managers, implementing an I-9 form completion process, and conducting regular audits to ensure compliance.Employers should also consider implementing an electronic I-9 form system, which can help to streamline the completion process and reduce errors. This can include:

- Using an electronic I-9 form platform

- Implementing an automated I-9 form completion process

- Conducting regular audits to ensure compliance

I-9 Form Audits and Compliance

I-9 form audits are an essential part of ensuring compliance with the I-9 form requirements. Employers should conduct regular audits to ensure that the form is completed accurately and on time, and that all required documentation is provided.

To conduct an I-9 form audit, employers should:

- Review the completed I-9 form for errors and omissions

- Verify the authenticity of the documentation

- Ensure that all required documentation is provided

- Keep accurate records of I-9 form completion

Employers should also consider implementing an I-9 form compliance program, which can help to ensure that the form is completed accurately and on time. This can include providing training to HR staff and managers, implementing an I-9 form completion process, and conducting regular audits to ensure compliance.

I-9 Form Compliance Resources

There are several resources available to help employers ensure I-9 form compliance, including:- The U.S. Citizenship and Immigration Services (USCIS) website

- The U.S. Immigration and Customs Enforcement (ICE) website

- I-9 form compliance software

- I-9 form completion guides

Employers should also consider consulting with an immigration attorney or HR expert to ensure that they are complying with the I-9 form requirements.

I-9 Form Completion Tips

To ensure accurate and efficient completion of the I-9 form, employers should follow these tips:

- Provide clear instructions to employees

- Ensure that all required documentation is provided

- Verify the authenticity of the documentation

- Complete the form accordingly, based on the information provided

- Keep the completed form on file for the required period

Employers should also consider implementing an I-9 form compliance program, which can help to ensure that the form is completed accurately and on time. This can include providing training to HR staff and managers, implementing an I-9 form completion process, and conducting regular audits to ensure compliance.

I-9 Form Completion Checklists

To ensure accurate and efficient completion of the I-9 form, employers should use a checklist to verify that all required information is provided. This can include:- Employee name and address

- Date of birth

- Citizenship status

- Documentation to verify identity and employment authorization

- Employer information

Employers should also consider implementing an electronic I-9 form system, which can help to streamline the completion process and reduce errors.

I-9 Form Image Gallery

What is the purpose of the I-9 form?

+The I-9 form is used to verify the identity and employment authorization of new hires.

Who must complete the I-9 form?

+All new employees, including citizens and non-citizens, must complete the I-9 form.

What documentation is required to complete the I-9 form?

+Employees must provide documentation to verify their identity and employment authorization, such as a passport, driver's license, or social security card.

What are the consequences of inaccurate I-9 form completion?

+Inaccurate completion of the I-9 form can result in significant fines and penalties, as well as damage to an employer's reputation.

How can employers ensure I-9 form compliance?

+Employers can ensure I-9 form compliance by providing clear instructions to employees, verifying the authenticity of documentation, and conducting regular audits.

In

Final Thoughts