Intro

Discover the 5 ways to complete I9 forms accurately, ensuring compliance with employment eligibility verification, immigration laws, and workforce management regulations, to avoid errors and penalties.

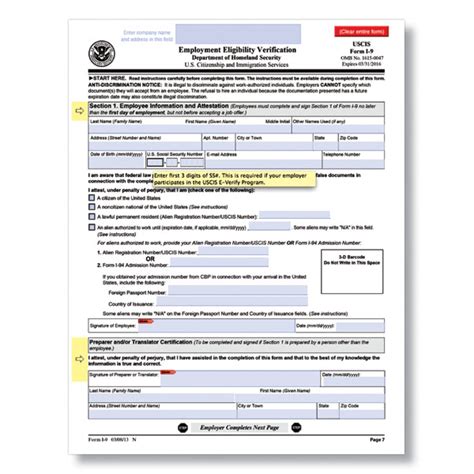

The I-9 form is a crucial document for employers in the United States, as it verifies the identity and employment authorization of new hires. The form is used to confirm that employees are eligible to work in the country, and it must be completed for all new employees, including citizens and non-citizens. In this article, we will explore five ways the I-9 form can impact employers and employees, and provide guidance on how to complete the form correctly.

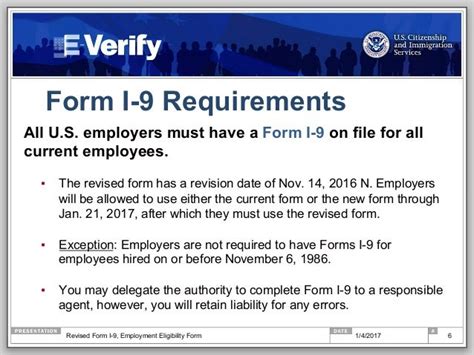

The I-9 form is a critical component of the hiring process, and it is essential for employers to understand its importance. The form helps to prevent unauthorized employment and ensures that employers are complying with federal immigration laws. Employers who fail to properly complete the I-9 form can face significant fines and penalties, making it essential to get it right.

The consequences of not completing the I-9 form correctly can be severe. Employers who are found to have knowingly hired unauthorized workers can face fines of up to $4,000 per employee, while those who are found to have failed to properly complete the I-9 form can face fines of up to $1,100 per employee. Additionally, employers who are found to have engaged in a pattern or practice of hiring unauthorized workers can face even more significant fines and penalties.

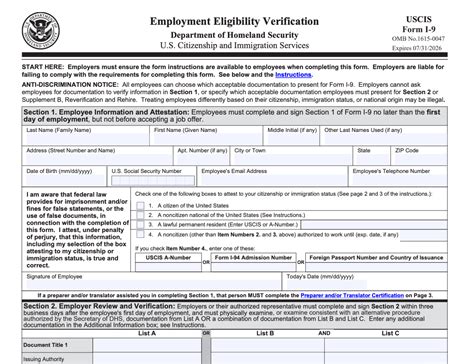

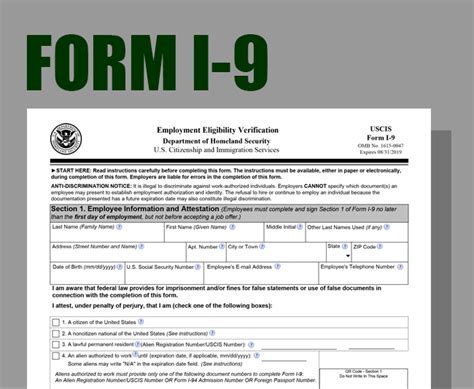

Understanding the I-9 Form

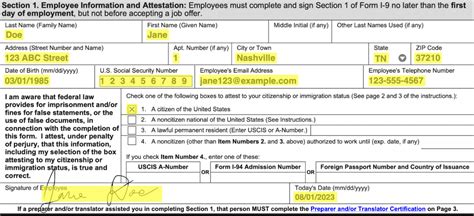

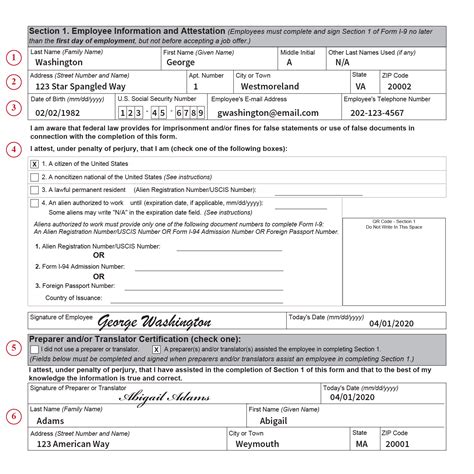

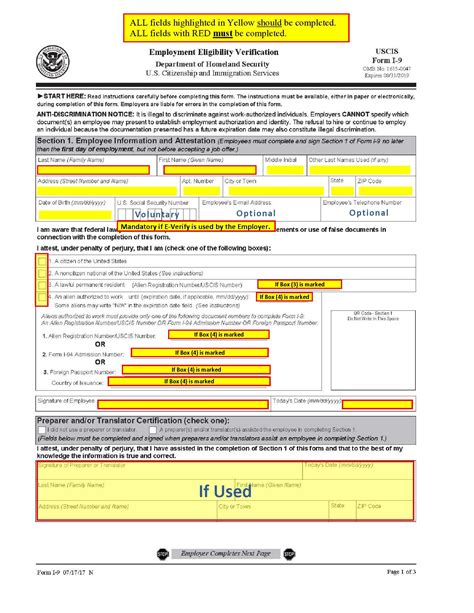

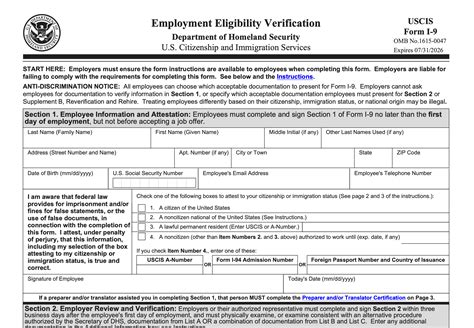

Section 1: Employee Information

Section 1 of the I-9 form requires employees to provide basic biographical information, including their name, address, and date of birth. Employees must also provide their Social Security number or other documentation that establishes their identity and employment authorization. This section must be completed on the first day of work, and employees must provide the required documentation to support their claim of employment authorization.Completing the I-9 Form

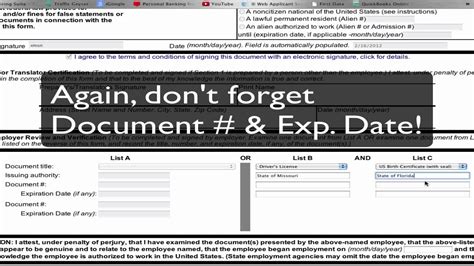

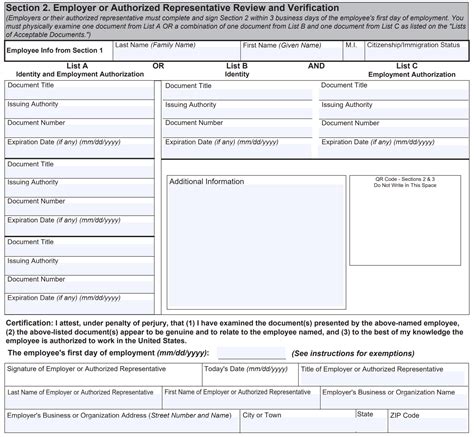

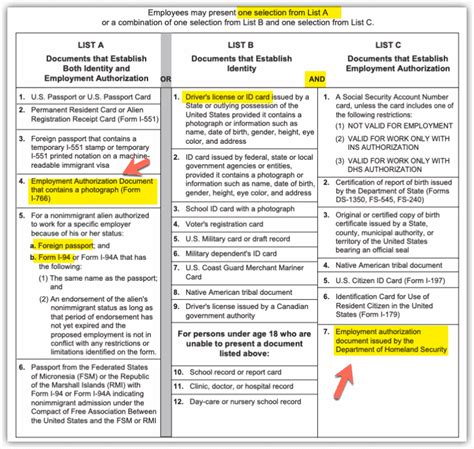

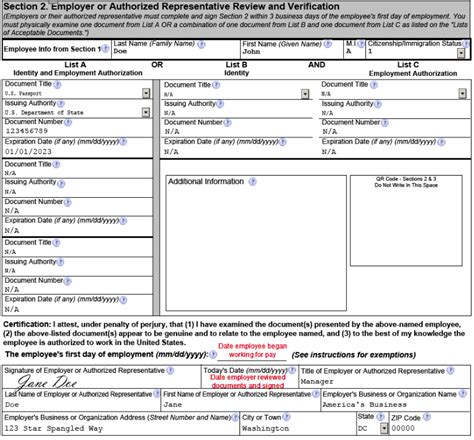

Section 2: Employer Review

Section 2 of the I-9 form requires employers to review the employee's documentation and verify their identity and employment authorization. Employers must accept only documentation that is listed on the I-9 form, and they must ensure that the documentation is genuine and relates to the employee. This section must be completed within three business days of the employee's first day of work, and employers must retain the I-9 form for all current employees.Common Mistakes to Avoid

Avoiding Discrimination

Employers must also be careful to avoid discriminating against employees based on their national origin or citizenship status. The I-9 form is designed to verify employment authorization, not to discriminate against employees. Employers must ensure that they are treating all employees equally, regardless of their national origin or citizenship status.Best Practices for Completing the I-9 Form

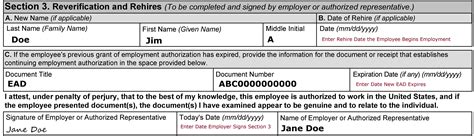

Retaining the I-9 Form

Employers must retain the I-9 form for all current employees, as well as for former employees for a specified period of time. The I-9 form must be retained for at least three years after the date of hire, or one year after the date of termination, whichever is later. Employers must also ensure that they are storing the I-9 form in a secure location, such as a locked file cabinet or a secure electronic storage system.Electronic I-9 Forms

Benefits of Electronic I-9 Forms

Electronic I-9 forms can provide several benefits, including improved efficiency and reduced errors. Electronic I-9 forms can also provide improved security, as they can be stored in a secure electronic storage system. Additionally, electronic I-9 forms can provide improved compliance, as they can be designed to ensure that all required fields are completed.I-9 Form Image Gallery

What is the purpose of the I-9 form?

+The I-9 form is used to verify the identity and employment authorization of new hires.

Who must complete the I-9 form?

+All new employees must complete the I-9 form on their first day of work.

What documentation is required to complete the I-9 form?

+Employees must provide documentation that establishes their identity and employment authorization, such as a passport or driver's license and Social Security card.

How long must the I-9 form be retained?

+The I-9 form must be retained for at least three years after the date of hire, or one year after the date of termination, whichever is later.

Can the I-9 form be completed electronically?

+Yes, the I-9 form can be completed electronically, but employers must ensure that they are using an electronic I-9 form that is compliant with federal regulations.

In conclusion, the I-9 form is a critical component of the hiring process, and it is essential for employers to understand its importance. By following the best practices outlined in this article, employers can ensure that they are completing the I-9 form correctly and avoiding common mistakes. Additionally, employers can benefit from using electronic I-9 forms, which can provide improved efficiency and reduced errors. We invite you to comment below and share your experiences with completing the I-9 form. Have you encountered any challenges or successes with the I-9 form? Share your thoughts and help others learn from your experiences.