Intro

Get instant access to free printable money templates, including budgeting worksheets, expense trackers, and cash flow planners, to manage finances efficiently and achieve financial stability with customizable and printable templates.

Managing finances effectively is a crucial aspect of personal and professional life. One of the simplest yet most effective tools for achieving financial stability is the use of printable money templates. These templates offer a straightforward and organized way to track expenses, create budgets, and set financial goals. They are especially useful for individuals who prefer a tangible approach to financial management or need a complement to digital tools.

Printable money templates cater to a wide range of financial needs, from basic budgeting to complex financial planning. They can help individuals identify areas where they can cut back on unnecessary expenses, allocate funds more efficiently, and make informed decisions about their financial resources. Moreover, these templates are highly customizable, allowing users to tailor them to their specific financial situations and goals.

The importance of using printable money templates cannot be overstated. In an era dominated by digital finance tools, these templates provide a refreshing alternative that combines the benefits of traditional paper-based systems with the flexibility of modern financial planning. They are accessible, easy to use, and require minimal setup, making them an ideal choice for anyone looking to take control of their finances without getting overwhelmed by complex software or apps.

Benefits of Using Printable Money Templates

The benefits of incorporating printable money templates into one's financial routine are numerous. Firstly, they promote financial awareness by providing a clear and comprehensive overview of one's income and expenses. This transparency is key to making smart financial decisions and avoiding debt. Secondly, these templates help in setting realistic financial goals, whether it's saving for a big purchase, paying off loans, or building an emergency fund. By having a physical record of progress, individuals can stay motivated and focused on their objectives.

Moreover, printable money templates are versatile and can be used in various aspects of financial management. They can serve as budget planners, expense trackers, savings monitors, and even investment trackers. This versatility makes them an indispensable tool for anyone seeking to streamline their financial affairs and achieve long-term financial stability.

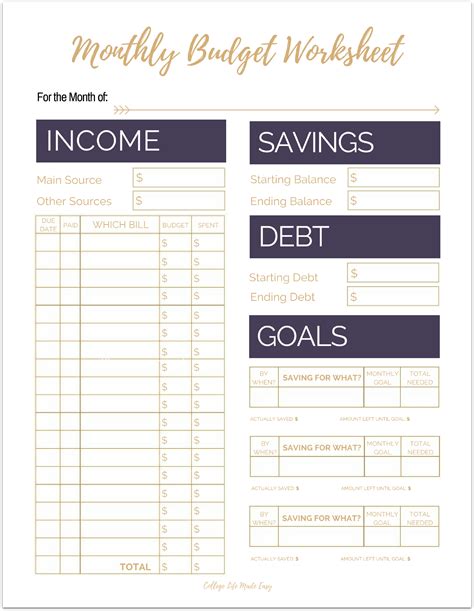

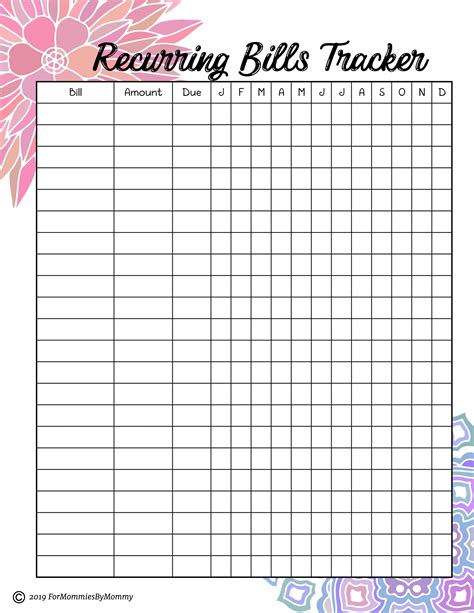

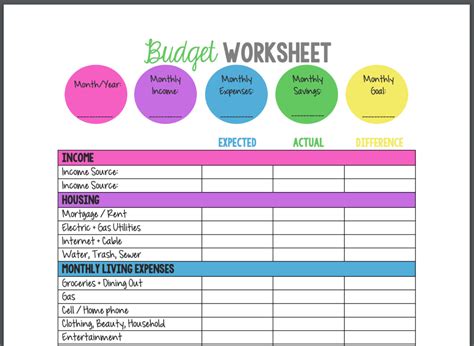

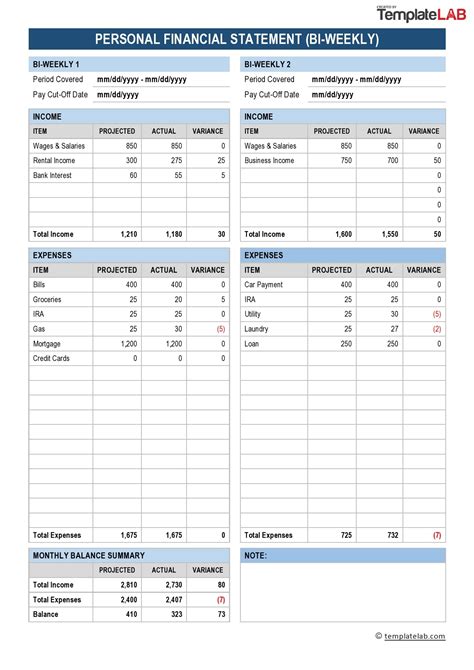

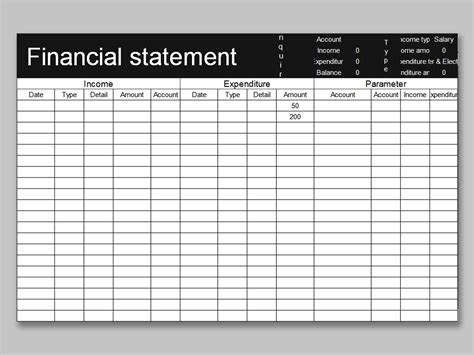

Types of Printable Money Templates

There are several types of printable money templates available, each designed to address specific financial needs. Budget templates are among the most popular, helping users allocate their income into different categories of expenses. Expense trackers are another common type, useful for monitoring daily, weekly, or monthly expenditures. For those focused on saving, savings trackers provide a visual representation of progress towards financial goals.How to Use Printable Money Templates Effectively

To maximize the benefits of printable money templates, it's essential to use them consistently and correctly. The first step is to choose a template that aligns with your financial goals and needs. Once you have selected an appropriate template, fill it out accurately and regularly. For budget templates, this means allocating your income into the designated expense categories. For expense trackers, it involves recording every purchase, no matter how small.

Regular review and adjustment are also crucial. As financial situations change, the template should be updated to reflect these changes. This might involve adjusting budget allocations, setting new savings goals, or identifying areas where expenses can be reduced. By regularly reviewing and updating the template, individuals can ensure that their financial strategy remains effective and aligned with their current needs and goals.

Customizing Your Printable Money Templates

One of the significant advantages of printable money templates is their customizability. Users can modify existing templates or create their own from scratch to better suit their financial circumstances. This might involve adding or removing categories, changing the layout for better readability, or incorporating personal financial goals and deadlines.Customization can also extend to the frequency of use. Some individuals might find it beneficial to use daily or weekly templates for close monitoring of expenses, while others might prefer monthly templates for a broader overview of their financial situation. The key is to find a rhythm that works for you and to stick to it consistently.

Advantages Over Digital Financial Tools

While digital financial tools have become increasingly popular, printable money templates offer several advantages. Firstly, they provide a tangible and tactile experience that many find more engaging and easier to understand than digital interfaces. This can be particularly beneficial for individuals who are not tech-savvy or prefer a more traditional approach to financial management.

Moreover, printable templates are not dependent on internet connectivity or specific devices, making them accessible anywhere and at any time. This independence from technology can be a significant advantage for those who travel frequently, live in areas with poor internet connectivity, or simply prefer the simplicity of paper-based systems.

Combining Printable Templates with Digital Tools

It's also worth noting that printable money templates and digital financial tools are not mutually exclusive. In fact, combining both can offer a powerful approach to financial management. For example, individuals can use printable templates for daily or weekly tracking and then input the data into a digital tool for long-term analysis and planning. This hybrid approach can leverage the strengths of both methods, providing a comprehensive and flexible financial management system.Conclusion and Next Steps

In conclusion, printable money templates are a valuable resource for anyone seeking to improve their financial literacy and stability. By offering a practical, customizable, and accessible means of financial planning and tracking, these templates can play a pivotal role in achieving long-term financial goals. Whether used alone or in conjunction with digital tools, printable money templates are an indispensable asset in the journey towards financial freedom.

Final Thoughts

As individuals embark on their financial journeys, it's essential to remember that financial management is a process. It involves setting goals, tracking progress, and making adjustments as needed. Printable money templates can be a constant companion in this journey, providing a reliable and effective means of staying on track. By embracing these templates and making them a part of daily financial routines, individuals can take the first step towards a more secure, stable, and prosperous financial future.Printable Money Templates Image Gallery

What are the benefits of using printable money templates?

+The benefits include promoting financial awareness, helping set realistic financial goals, and providing a versatile means of financial management.

How can I customize my printable money templates?

+You can customize your templates by adding or removing categories, changing the layout, or incorporating personal financial goals and deadlines.

Can I use printable money templates alongside digital financial tools?

+Yes, combining both can offer a powerful approach to financial management, leveraging the strengths of both methods for a comprehensive financial system.

We invite you to share your experiences with printable money templates and how they have impacted your financial journey. Whether you're just starting out or have years of experience, your insights can help others navigate their own paths to financial stability. Feel free to comment below, and don't forget to share this article with anyone who might benefit from the simplicity and effectiveness of printable money templates. Together, let's take the first step towards a more financially secure future.