Intro

Get a free monthly budget template to track expenses, manage finances, and create a personalized spending plan with ease, using budgeting tools and financial worksheets.

Creating and managing a budget is an essential aspect of personal finance and can significantly impact one's financial stability and success. A well-crafted budget helps individuals understand their income and expenses, make informed financial decisions, and achieve their long-term financial goals. In this article, we will delve into the importance of budgeting, the benefits of using a free monthly budget template, and provide guidance on how to effectively use such a template to manage your finances.

Budgeting is not just about tracking expenses; it's a comprehensive approach to managing your financial resources. It involves understanding your income, categorizing your expenses, setting financial goals, and making adjustments as necessary to ensure you're on track to meet those goals. A budget acts as a roadmap, helping you navigate through financial challenges and opportunities. Whether you're looking to save for a big purchase, pay off debt, or simply ensure you have enough money for daily living expenses, a budget is your first step towards financial clarity and control.

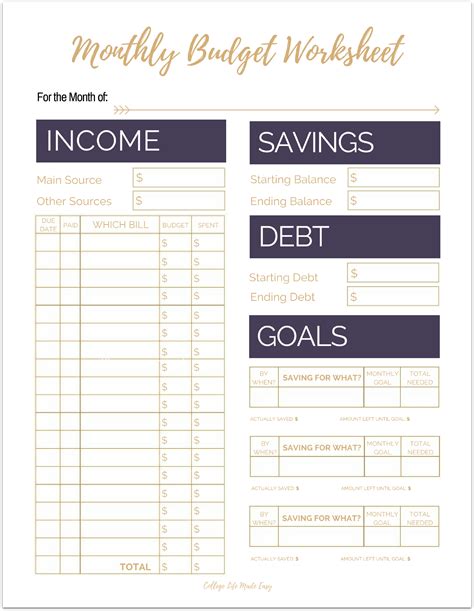

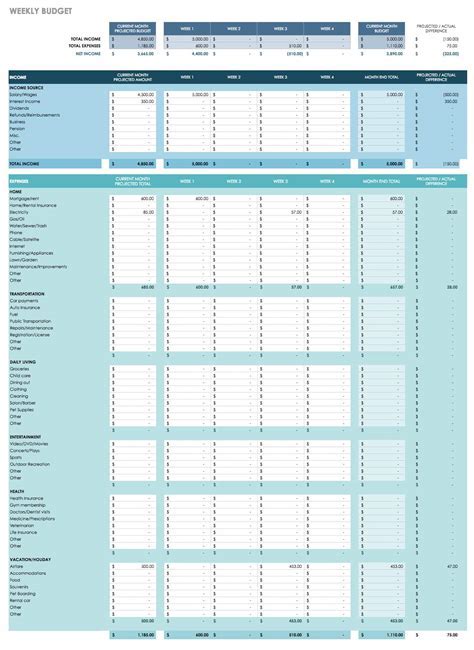

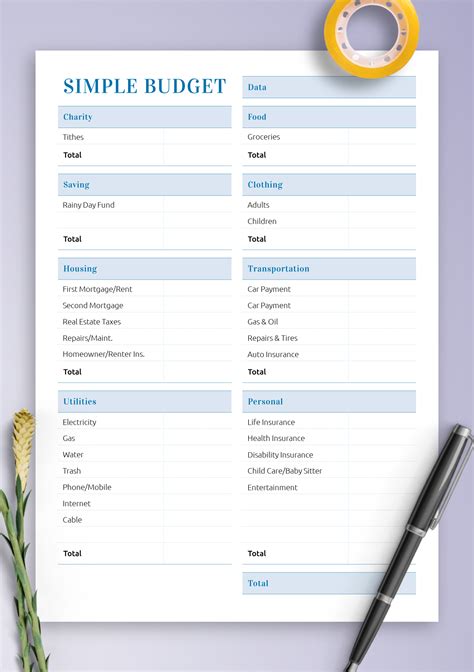

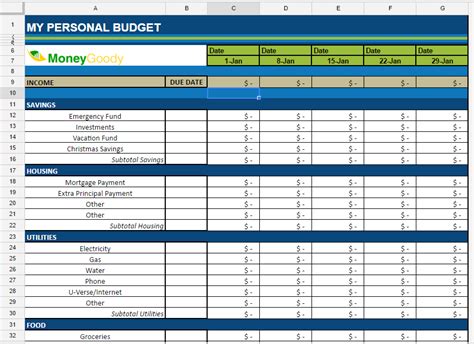

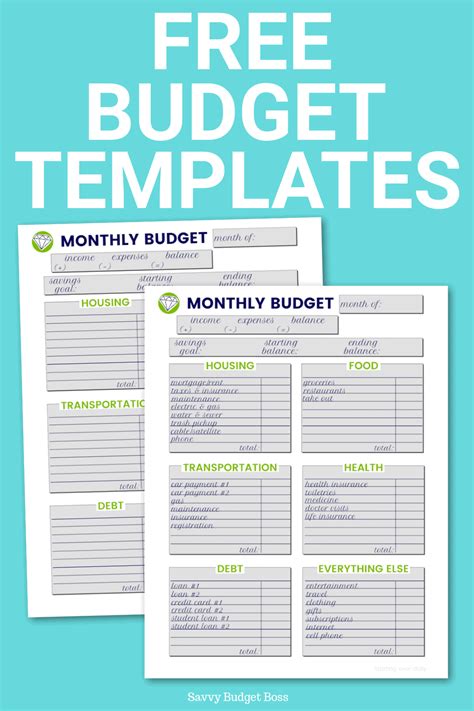

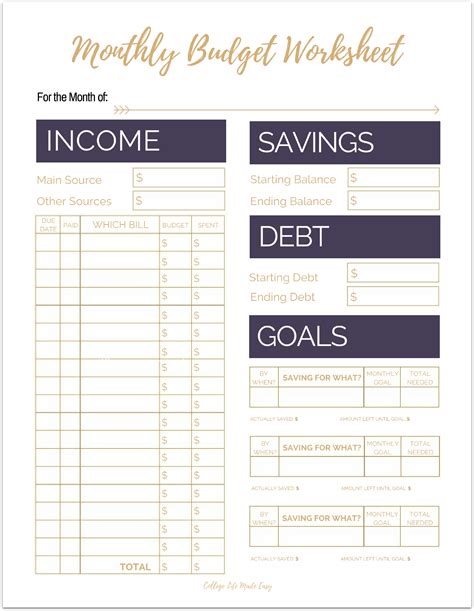

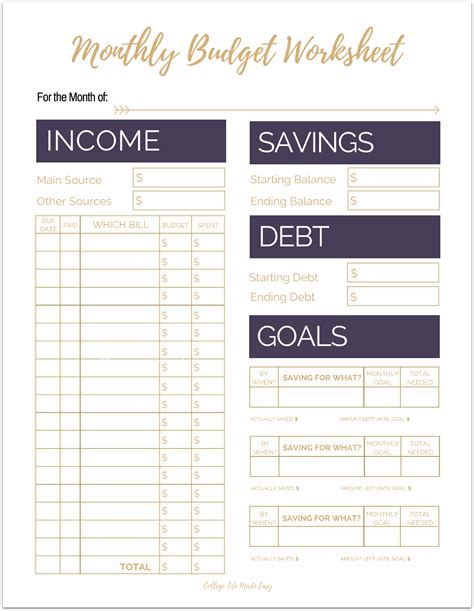

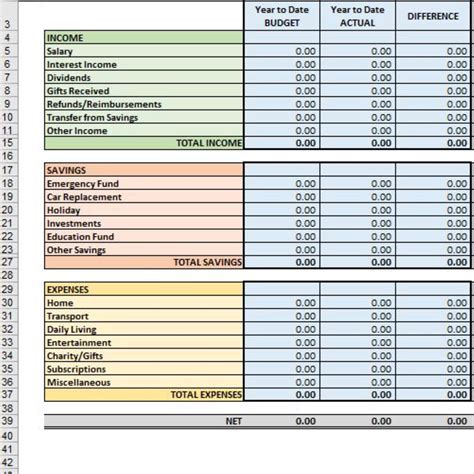

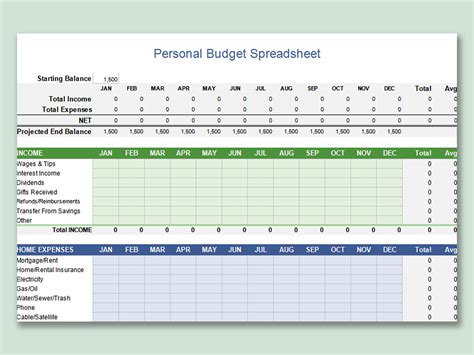

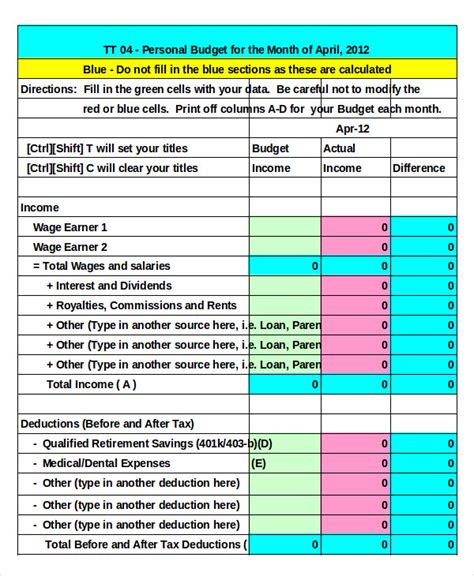

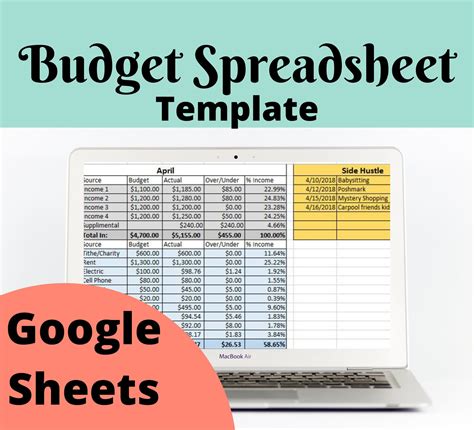

In today's digital age, there are numerous tools and templates available to help with budgeting, ranging from simple spreadsheets to complex financial management software. Among these, free monthly budget templates stand out for their accessibility and ease of use. These templates are designed to be user-friendly, allowing individuals to input their financial information and track their expenses and income over time. They often come with pre-set categories for common expenses, such as housing, transportation, and entertainment, making it easier for users to organize their finances.

Benefits of Using a Free Monthly Budget Template

The benefits of using a free monthly budget template are numerous. Firstly, it helps in organizing your financial data in one place, making it easier to understand your spending habits and identify areas where you can cut back. Secondly, these templates are often customizable, allowing you to tailor them to your specific financial situation and goals. This flexibility is particularly useful as your financial priorities change over time. Lastly, using a budget template can help reduce financial stress by providing a clear picture of your financial situation and helping you make informed decisions about how to allocate your resources.

Key Features of an Effective Budget Template

When selecting a free monthly budget template, there are several key features to look for. The template should be easy to use and understand, even for those who are not financially savvy. It should include categories for all common expenses, as well as spaces for noting income and any financial goals you're working towards. Additionally, a good template will allow for adjustments and updates, reflecting the dynamic nature of personal finance.How to Use a Free Monthly Budget Template Effectively

Using a free monthly budget template effectively involves several steps. First, you need to gather all your financial information, including your income, fixed expenses, and any debt you're paying off. Next, you'll input this information into your template, making sure to categorize your expenses appropriately. It's also important to regularly review and update your budget, as your financial situation and goals can change over time.

Here are some practical tips for getting the most out of your budget template:

- Track Every Expense: For one month, write down every single transaction you make, no matter how small. This will give you a clear picture of where your money is going.

- Categorize Expenses: Divide your expenses into categories like housing, food, entertainment, etc. This helps in understanding which areas you can cut back on.

- Set Realistic Goals: Whether it's saving for a down payment on a house, paying off credit card debt, or building an emergency fund, make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART).

- Review and Adjust: Regularly review your budget to see if you're on track to meet your goals. Make adjustments as necessary to stay on course.

Common Budgeting Mistakes to Avoid

While budgeting can seem straightforward, there are several common mistakes that people make. One of the most significant is failing to account for irregular expenses, such as car maintenance or property taxes, which can come up unexpectedly and blow a hole in your budget. Another mistake is not prioritizing needs over wants, leading to overspending in categories like entertainment or hobbies. Lastly, not regularly reviewing and updating your budget can lead to stagnation and a failure to adapt to changing financial circumstances.Free Monthly Budget Templates for Different Financial Situations

Different individuals and families have unique financial situations and goals. For example, a college student may be focused on managing student loan debt and living expenses on a tight budget, while a retiree may be concerned with making their savings last and managing healthcare expenses. Fortunately, there are free monthly budget templates available for a wide range of financial situations.

For those just starting out, a simple budget template that focuses on basic expense categories and savings goals may be sufficient. On the other hand, individuals with more complex financial situations, such as those with significant investments or self-employment income, may require more advanced templates that can accommodate multiple income streams and expense categories.

Customizing Your Budget Template

One of the advantages of using a free monthly budget template is the ability to customize it to fit your specific needs. This might involve adding or removing expense categories, setting up automatic calculations for income and expenses, or integrating your template with other financial tools, such as budgeting apps or spreadsheets.To customize your budget template effectively, start by identifying your unique financial goals and challenges. Consider what categories are most relevant to your situation and how you can use your template to track progress towards your goals. Don't be afraid to experiment and try out different approaches until you find a system that works for you.

Conclusion and Next Steps

In conclusion, using a free monthly budget template is a powerful step towards taking control of your finances. By providing a clear and comprehensive view of your income and expenses, these templates help you make informed decisions about how to allocate your resources, achieve your financial goals, and build a more stable financial future.

As you embark on your budgeting journey, remember that it's a process that requires patience, discipline, and flexibility. Don't be too hard on yourself if you encounter setbacks or find that your budget needs adjustments over time. The key is to keep moving forward, continually learning and improving your approach to personal finance.

Free Monthly Budget Templates Image Gallery

What is the purpose of a free monthly budget template?

+The purpose of a free monthly budget template is to help individuals organize their financial data, track income and expenses, and make informed decisions about their financial resources.

How do I choose the right budget template for my needs?

+Choose a budget template that aligns with your financial situation and goals. Consider the complexity of your finances, the categories you need to track, and whether you prefer a simple or detailed approach to budgeting.

Can I customize a free monthly budget template?

+Yes, most free monthly budget templates are customizable. You can add or remove categories, set financial goals, and make adjustments as needed to fit your unique financial situation.

How often should I review and update my budget?

+It's recommended to review and update your budget regularly, ideally once a month. This helps you stay on track with your financial goals, adjust to changes in income or expenses, and make informed decisions about your financial future.

Are free monthly budget templates secure to use?

+Most free monthly budget templates are secure to use, especially those from reputable sources. However, always ensure you're downloading from a trusted website and be cautious of any templates that ask for sensitive financial information.

We hope this comprehensive guide to free monthly budget templates has provided you with the insights and tools you need to take control of your finances. Remember, budgeting is a journey, and it's okay to start small and learn as you go. By committing to regular budgeting and continually seeking ways to improve your financial management skills, you'll be well on your way to achieving financial stability and success. Don't hesitate to share your experiences, tips, or questions about budgeting in the comments below, and consider sharing this article with others who might benefit from learning more about the power of budgeting.