Intro

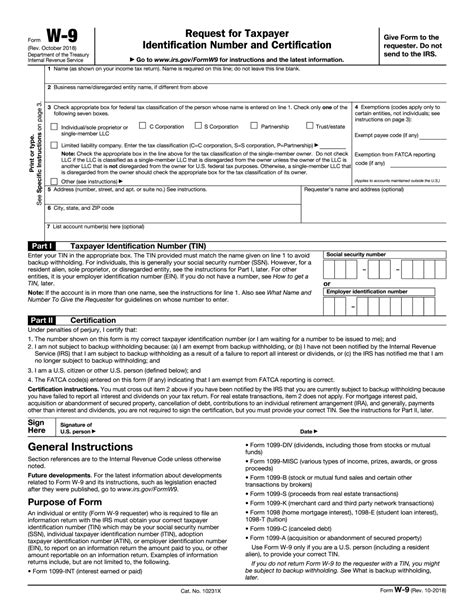

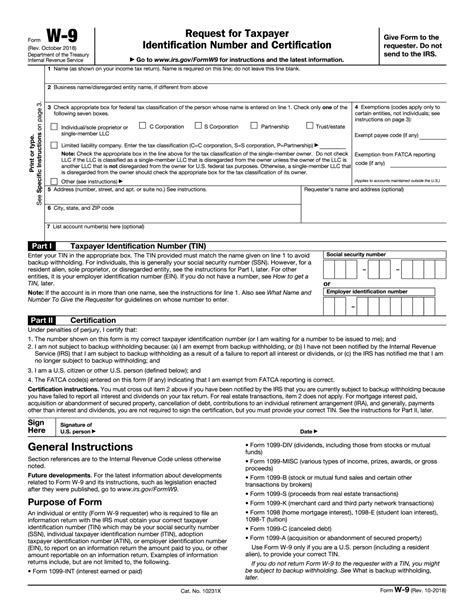

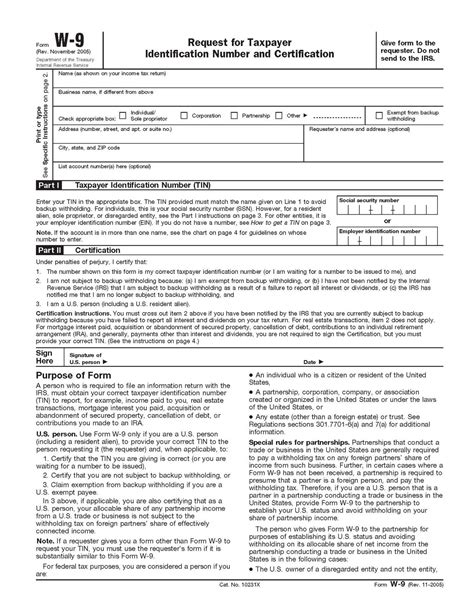

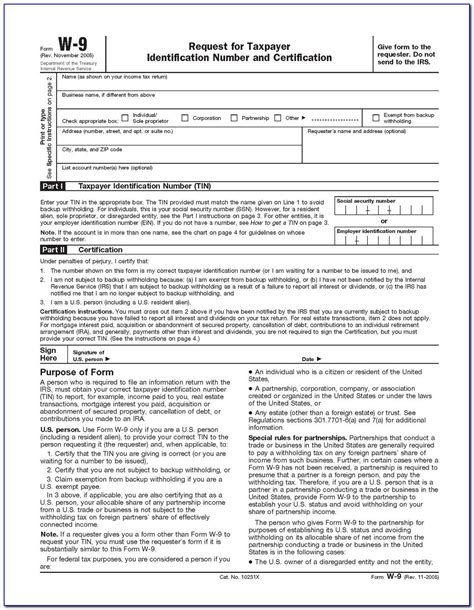

Download a printable W-9 form for tax purposes, including independent contractor work, freelancer jobs, and self-employment income, with instructions and IRS guidelines.

The importance of having a printable W-9 form cannot be overstated, especially for freelancers, independent contractors, and small business owners. The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document that provides the necessary information to the Internal Revenue Service (IRS) for tax purposes. In this article, we will delve into the world of printable W-9 forms, exploring their benefits, working mechanisms, and steps to complete them.

Having a printable W-9 form at your disposal can save you time and effort, especially when dealing with multiple clients or projects. It eliminates the need to manually fill out the form every time, reducing the risk of errors and inconsistencies. Moreover, a printable W-9 form can be easily shared with clients, making it a convenient and efficient way to provide the required information. Whether you're a freelancer, independent contractor, or small business owner, having a printable W-9 form is essential for streamlining your tax-related processes.

The W-9 form is a standard document used by the IRS to collect taxpayer identification numbers and certifications from individuals and businesses. It is typically required when working with clients, vendors, or other parties that need to report income paid to you. The form provides the necessary information to the IRS, ensuring that you are properly accounted for and that your tax obligations are met. With a printable W-9 form, you can easily complete and submit the required information, making it an essential tool for anyone who needs to provide taxpayer identification numbers and certifications.

What is a W-9 Form?

Benefits of a Printable W-9 Form

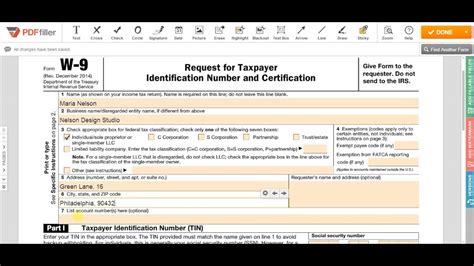

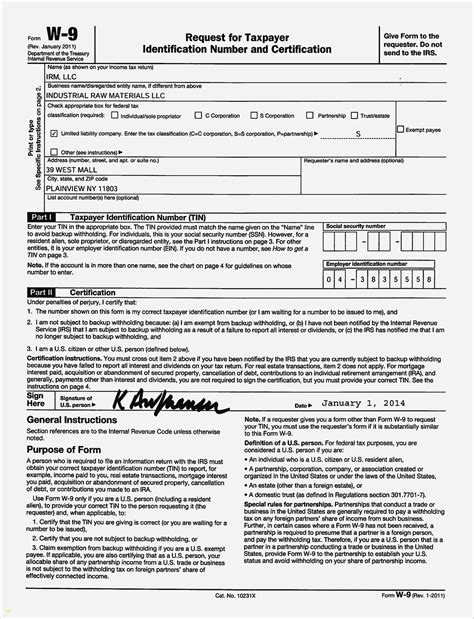

How to Complete a W-9 Form

Working Mechanisms of a W-9 Form

Steps to Obtain a Printable W-9 Form

Practical Examples of Using a Printable W-9 Form

Statistical Data on the Importance of W-9 Forms

Benefits of Using a Printable W-9 Form for Businesses

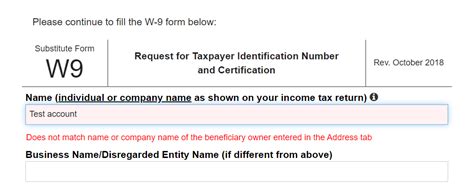

Common Mistakes to Avoid When Completing a W-9 Form

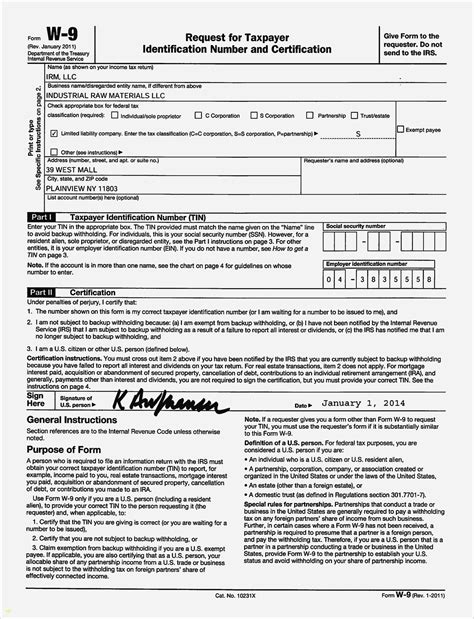

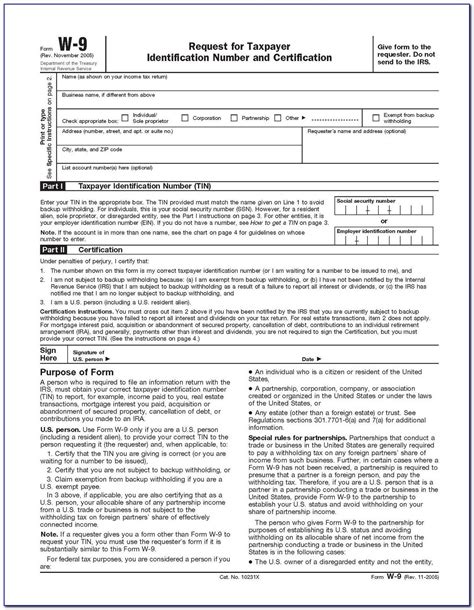

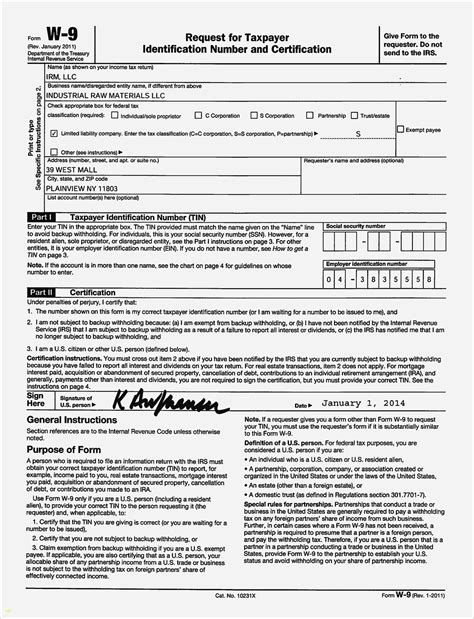

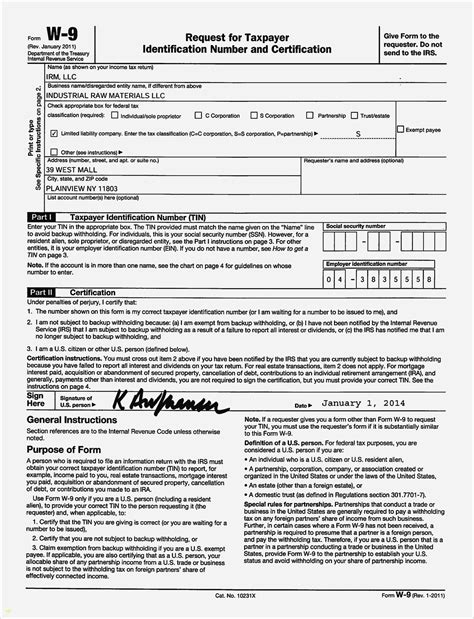

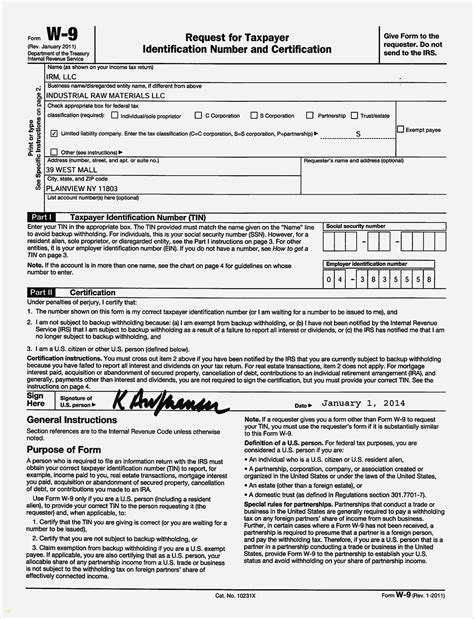

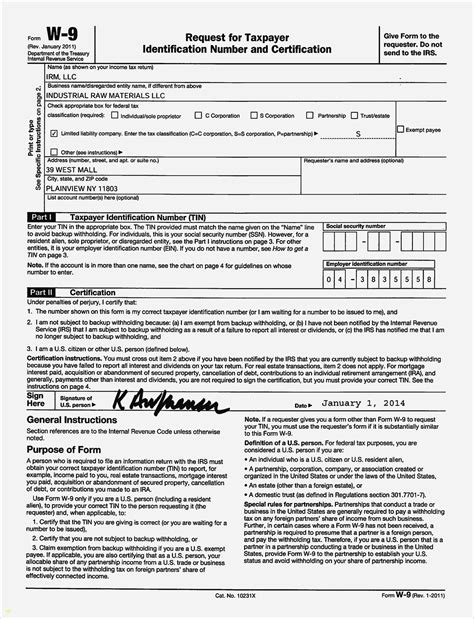

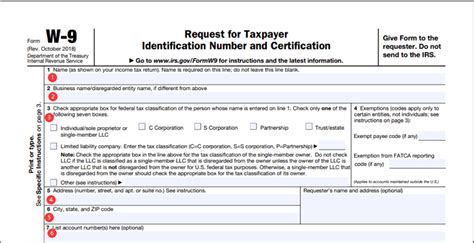

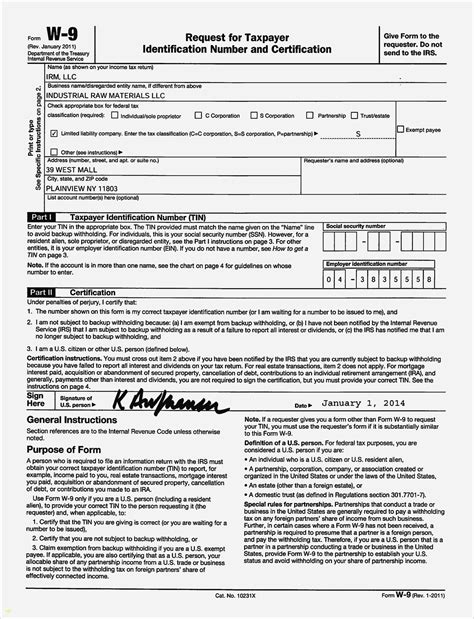

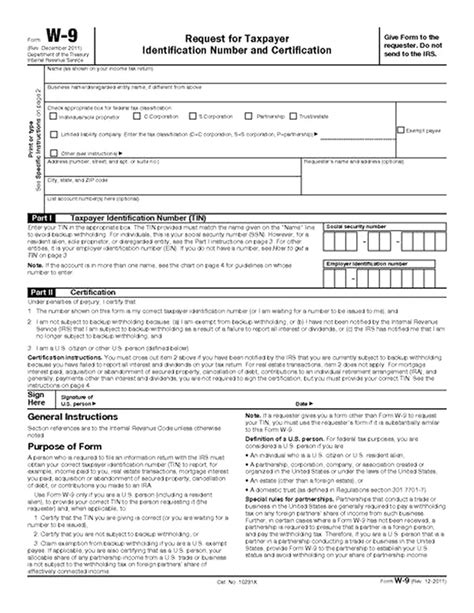

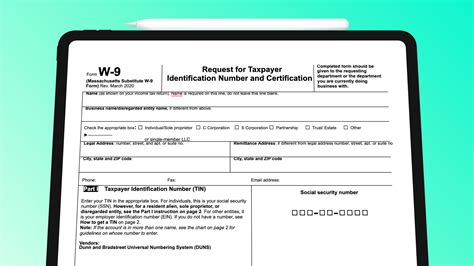

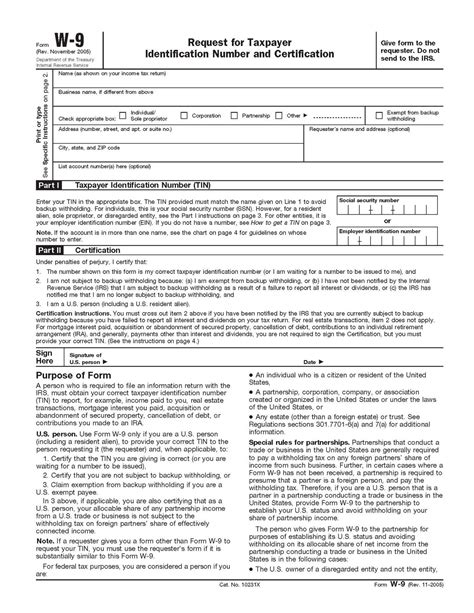

Gallery of Printable W-9 Forms

Printable W-9 Form Image Gallery

What is a W-9 form used for?

+A W-9 form is used to provide taxpayer identification numbers and certifications to clients, vendors, or other parties.

How do I obtain a printable W-9 form?

+You can obtain a printable W-9 form by visiting the IRS website and downloading the form, or by using a printable template or software.

What are the benefits of using a printable W-9 form?

+The benefits of using a printable W-9 form include streamlining tax-related processes, reducing errors and inconsistencies, saving time and effort, and enhancing organization and compliance.

What are some common mistakes to avoid when completing a W-9 form?

+Common mistakes to avoid when completing a W-9 form include inaccurate or incomplete information, failure to sign and date the form, using an outdated or incorrect form, not providing the necessary certifications, and failing to submit the completed form to the client or party requesting it.

How do I use a printable W-9 form for my business?

+You can use a printable W-9 form for your business by filling out the form with your information and certifications, signing and dating the form, and submitting it to clients, vendors, or other parties as needed.

In final thoughts, having a printable W-9 form is essential for freelancers, independent contractors, and small business owners. It provides a convenient and efficient way to provide taxpayer identification numbers and certifications to clients, vendors, or other parties. By understanding the benefits, working mechanisms, and steps to complete a W-9 form, you can streamline your tax-related processes, reduce errors and inconsistencies, and enhance organization and compliance. Whether you're just starting out or have been in business for years, a printable W-9 form is a valuable tool that can help you navigate the complex world of taxes with ease. We invite you to share your thoughts and experiences with using printable W-9 forms, and to take advantage of the resources and information provided in this article to improve your tax-related processes.