Intro

Get W9 Form Now: Download and fill out the IRS W9 tax form easily, with guides on independent contractor tax, 1099 filing, and self-employment income reporting.

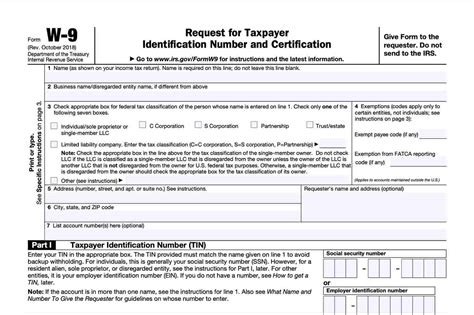

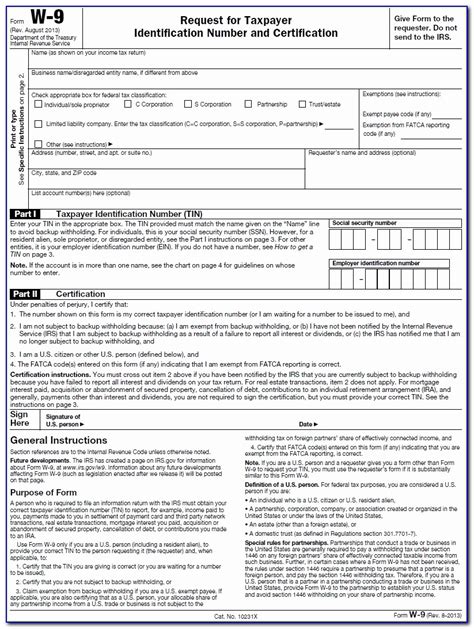

The W9 form is a crucial document for businesses and individuals in the United States, serving as a request for taxpayer identification number and certification. It is used to provide a taxpayer identification number to the Internal Revenue Service (IRS) and to certify that the number is correct. In this article, we will delve into the importance of the W9 form, its components, and the steps to obtain one.

The W9 form is essential for various purposes, including reporting income, claiming tax deductions, and verifying the identity of independent contractors, freelancers, and vendors. It is typically required by businesses and organizations that hire independent contractors or make payments to non-employees. The form helps to ensure compliance with tax laws and regulations, reducing the risk of penalties and fines.

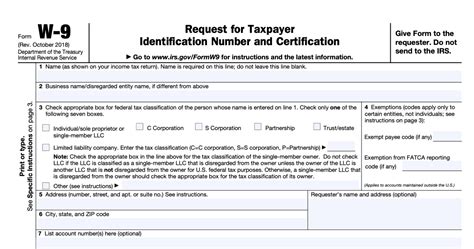

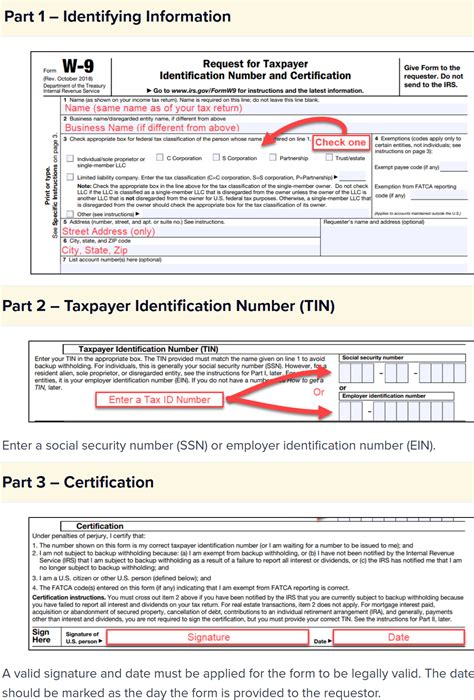

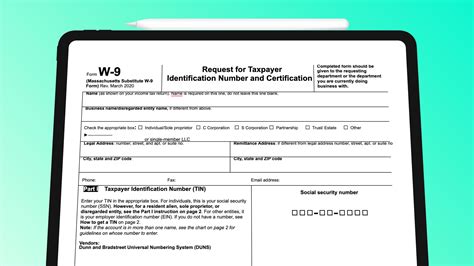

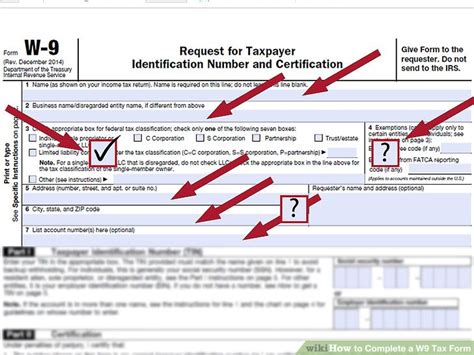

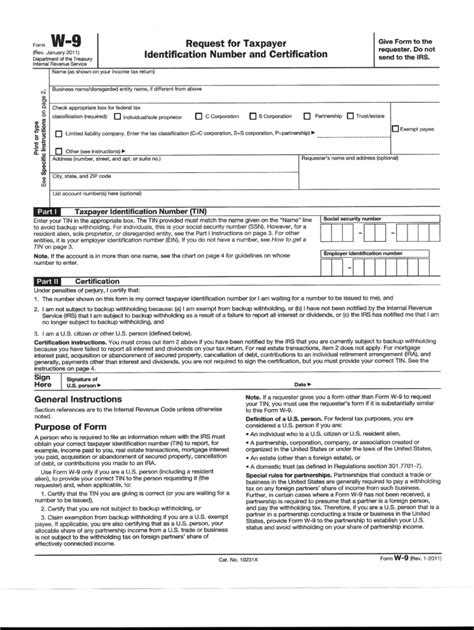

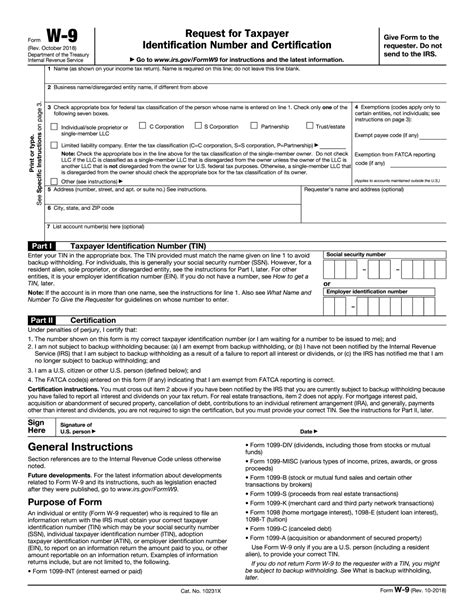

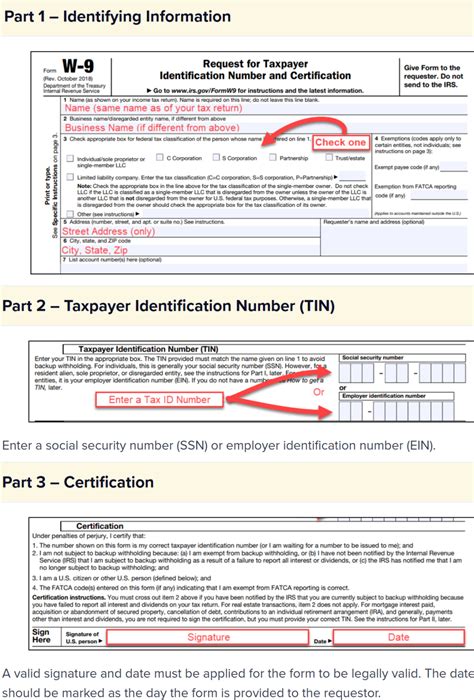

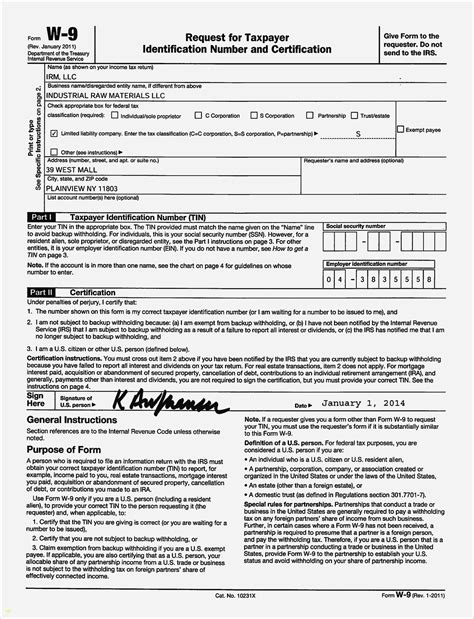

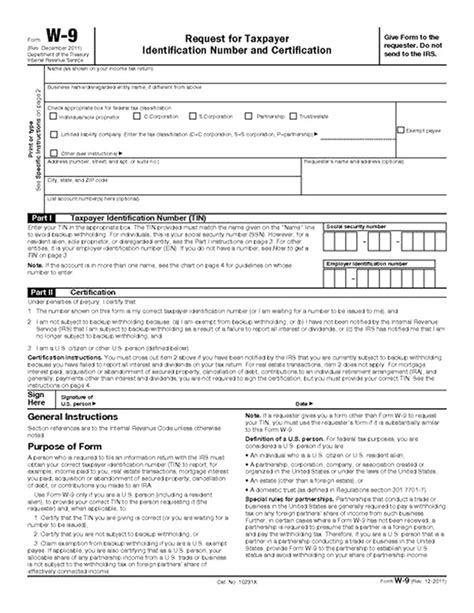

To understand the significance of the W9 form, it is essential to know its components. The form consists of several sections, including the taxpayer's name, business name, address, taxpayer identification number, and certification. The taxpayer identification number can be either a Social Security number (SSN) or an Employer Identification Number (EIN). The certification section requires the taxpayer to confirm that the information provided is accurate and that they are not subject to backup withholding.

Understanding the W9 Form

The W9 form is a simple, one-page document that can be easily obtained from the IRS website or through various online platforms. To get a W9 form, individuals and businesses can visit the IRS website and download the form, or they can contact the IRS directly to request a copy. The form can also be obtained through online tax preparation software or by contacting a tax professional.

Components of the W9 Form

The components of the W9 form are crucial, and it is essential to understand what each section requires. The form consists of the following sections:

- Taxpayer's name and business name

- Address

- Taxpayer identification number (SSN or EIN)

- Certification

Each section requires specific information, and it is essential to ensure that the information provided is accurate and complete.

Steps to Obtain a W9 Form

To obtain a W9 form, follow these steps:

- Visit the IRS website: The IRS website provides a downloadable version of the W9 form.

- Contact the IRS: Individuals and businesses can contact the IRS directly to request a copy of the form.

- Use online tax preparation software: Many online tax preparation software programs offer the W9 form as part of their services.

- Contact a tax professional: Tax professionals, such as accountants or tax attorneys, can provide the W9 form and assist with completion.

Benefits of the W9 Form

The W9 form provides several benefits, including:

- Compliance with tax laws and regulations

- Verification of taxpayer identification number

- Reduction of penalties and fines

- Simplification of tax reporting

By understanding the importance of the W9 form and its components, individuals and businesses can ensure compliance with tax laws and regulations, reducing the risk of penalties and fines.

Common Uses of the W9 Form

The W9 form is commonly used for:

- Reporting income

- Claiming tax deductions

- Verifying the identity of independent contractors, freelancers, and vendors

- Compliance with tax laws and regulations

The form is essential for various purposes, and its use is widespread among businesses and organizations.

Tips for Completing the W9 Form

To complete the W9 form accurately, follow these tips:

- Ensure accuracy: Double-check the information provided to ensure accuracy.

- Use the correct taxpayer identification number: Use either an SSN or EIN, depending on the individual's or business's tax status.

- Sign the form: The form must be signed by the taxpayer or an authorized representative.

By following these tips, individuals and businesses can ensure that the W9 form is completed accurately and efficiently.

W9 Form and Tax Compliance

The W9 form plays a crucial role in tax compliance, as it helps to verify the taxpayer identification number and ensure that the correct tax deductions are claimed. By completing the W9 form accurately, individuals and businesses can reduce the risk of penalties and fines associated with tax non-compliance.

W9 Form and Independent Contractors

The W9 form is essential for independent contractors, as it helps to verify their identity and ensure that they are compliant with tax laws and regulations. By completing the W9 form, independent contractors can provide their taxpayer identification number and certify that they are not subject to backup withholding.

W9 Form Image Gallery

What is the purpose of the W9 form?

+The W9 form is used to provide a taxpayer identification number and certify that the number is correct. It is typically required by businesses and organizations that hire independent contractors or make payments to non-employees.

How do I obtain a W9 form?

+To obtain a W9 form, visit the IRS website, contact the IRS directly, use online tax preparation software, or contact a tax professional.

What information is required on the W9 form?

+The W9 form requires the taxpayer's name, business name, address, taxpayer identification number, and certification.

Why is the W9 form important?

+The W9 form is essential for tax compliance, as it helps to verify the taxpayer identification number and ensure that the correct tax deductions are claimed.

Can I complete the W9 form online?

+Yes, the W9 form can be completed online through various platforms, including the IRS website and online tax preparation software.

In conclusion, the W9 form is a vital document for businesses and individuals in the United States, serving as a request for taxpayer identification number and certification. By understanding the importance of the W9 form and its components, individuals and businesses can ensure compliance with tax laws and regulations, reducing the risk of penalties and fines. If you have any questions or concerns about the W9 form, feel free to comment below or share this article with others who may find it useful. Remember to always verify the accuracy of the information provided on the W9 form to ensure compliance with tax laws and regulations.