Intro

Discover the 5 ways W2 form impacts taxes, payroll, and employee benefits, including wage reporting, tax withholding, and compliance with IRS regulations, to ensure accurate filing and avoid penalties.

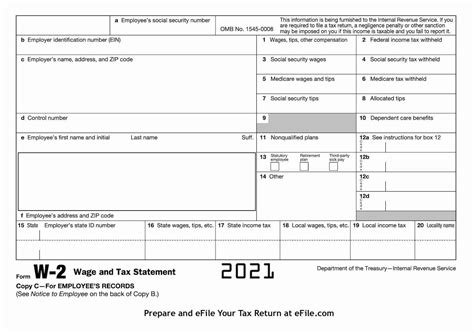

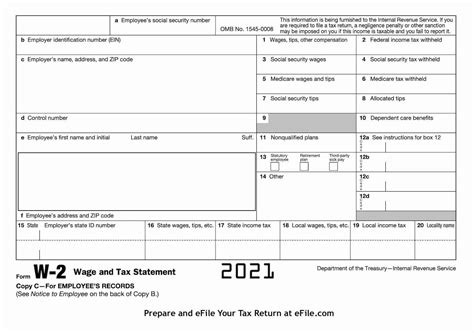

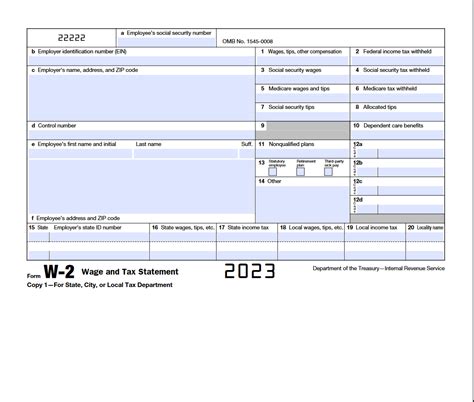

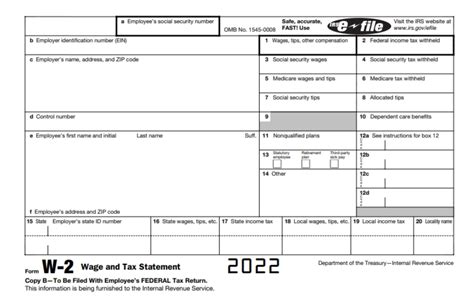

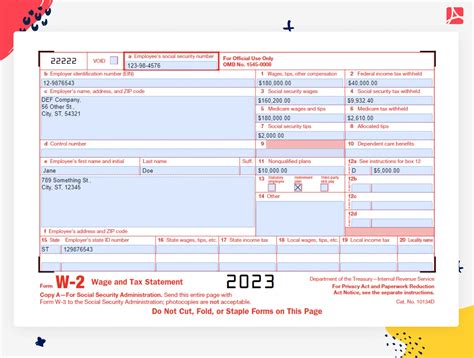

The W2 form is a crucial document for both employers and employees in the United States. It serves as a record of the wages earned by an employee and the taxes withheld from their income. The importance of understanding the W2 form cannot be overstated, as it plays a pivotal role in the tax filing process. In this article, we will delve into the significance of the W2 form, its components, and provide guidance on how to obtain, correct, and utilize it for tax purposes.

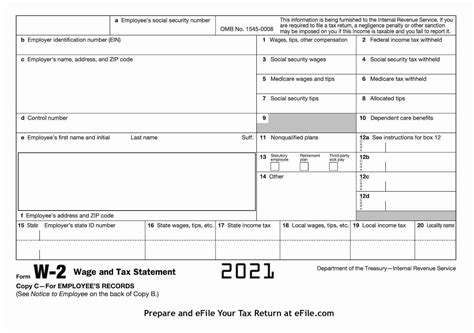

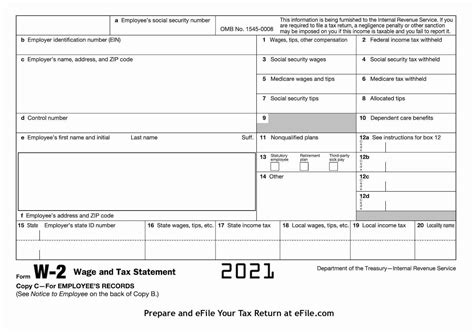

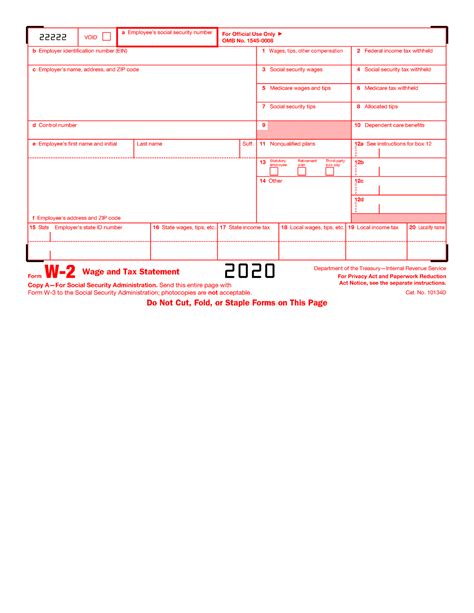

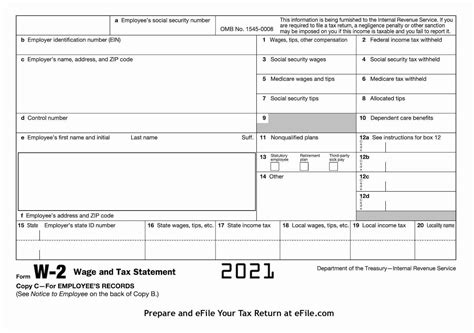

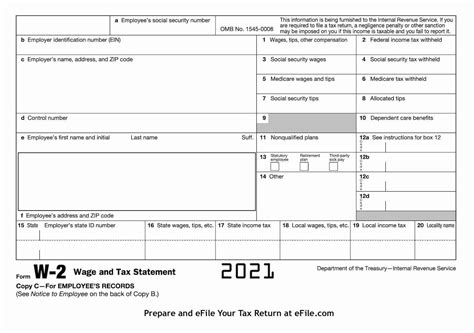

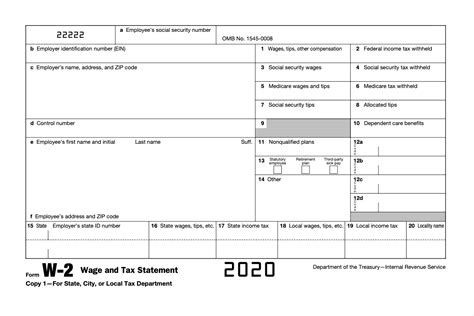

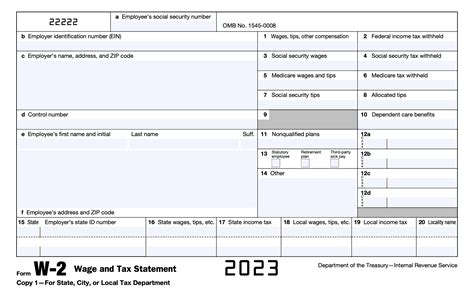

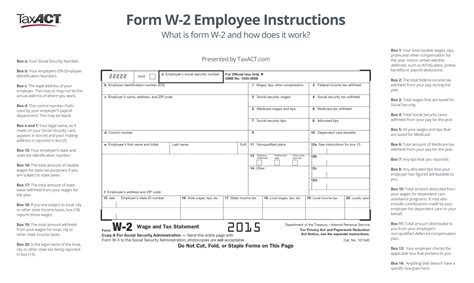

The W2 form is issued by employers to their employees by January 31st of each year, detailing the employee's income and tax withholding for the previous tax year. This form is essential for employees to file their tax returns accurately. Employers must also submit a copy of the W2 form to the Social Security Administration (SSA) by the same deadline. The information contained in the W2 form includes the employee's name, address, Social Security number, wages earned, and the amount of federal, state, and local taxes withheld.

Understanding the W2 form is vital for both employees and employers to ensure compliance with tax laws and to avoid any potential penalties. The form's accuracy is crucial, as it directly affects an individual's tax liability and potential refund. Any discrepancies or errors on the W2 form can lead to delays in processing tax returns, potentially causing financial hardship for employees who rely on their tax refunds.

Introduction to W2 Forms

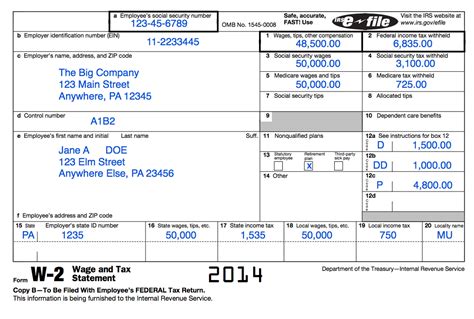

Components of a W2 Form

A standard W2 form includes several key pieces of information: - Employee's name, address, and Social Security number - Employer's name, address, and Employer Identification Number (EIN) - Wages, tips, and other compensation - Federal income tax withheld - Social Security wages and tax withheld - Medicare wages and tax withheld - Other relevant tax information, such as dependent care benefitsObtaining a W2 Form

Correcting Errors on a W2 Form

If an employee discovers an error on their W2 form, such as an incorrect Social Security number or inaccurate income reporting, they should notify their employer immediately. The employer will need to issue a corrected W2 form, known as a W2c, to the employee and the SSA. It is essential to resolve any discrepancies promptly to avoid delays in filing tax returns and to ensure accurate tax reporting.Utilizing the W2 Form for Tax Purposes

Importance of Accurate W2 Forms

Accurate W2 forms are essential for both employees and employers. For employees, an accurate W2 form ensures that their tax return is processed correctly, and they receive the refund they are entitled to. For employers, accurate W2 forms help maintain compliance with tax laws and regulations, reducing the risk of penalties and fines.Common Issues with W2 Forms

Resolving W2 Form Discrepancies

To resolve discrepancies with a W2 form, employees should first contact their employer to request a corrected W2c form. If the issue persists, they may need to contact the IRS for further assistance. The IRS can help resolve issues related to incorrect or missing W2 forms, ensuring that tax returns are processed accurately and efficiently.Best Practices for Handling W2 Forms

Electronic W2 Forms

Many employers now offer electronic W2 forms, which can be accessed through an online portal or emailed directly to employees. Electronic W2 forms provide a convenient and secure way for employees to access their tax information, reducing the risk of lost or misplaced documents.Security and Privacy of W2 Forms

Consequences of W2 Form Errors

Errors on W2 forms can have significant consequences, including delays in processing tax returns, additional taxes owed, and reduced refunds. In severe cases, incorrect or fraudulent W2 forms can lead to audits, fines, and even criminal charges. It is essential for both employers and employees to prioritize the accuracy and integrity of W2 forms to avoid these potential consequences.W2 Forms and Tax Audits

Retaining W2 Forms

It is recommended that employees retain their W2 forms for at least three years, as the IRS may request them during an audit or to verify tax information. Employers are also required to keep W2 forms on file for a specified period, as mandated by tax laws and regulations.W2 Forms Image Gallery

What is a W2 form, and why is it important?

+A W2 form, or Wage and Tax Statement, is a document provided by employers to their employees and the IRS, detailing the employee's income and tax withholding for the tax year. It is crucial for filing tax returns accurately and ensuring compliance with tax laws.

How do I obtain a copy of my W2 form if I did not receive it from my employer?

+If you did not receive your W2 form from your employer, you should contact them directly to request a copy. If you are unable to obtain it from your employer, you can contact the IRS for assistance.

What should I do if I find an error on my W2 form?

+If you discover an error on your W2 form, notify your employer immediately. They will need to issue a corrected W2c form to you and the SSA. It is essential to resolve any discrepancies promptly to avoid delays in filing your tax return.

Can I file my tax return without a W2 form?

+While it is possible to file a tax return without a W2 form, it is not recommended. The W2 form provides critical information necessary for accurate tax reporting. If you are missing a W2 form, you should contact your employer or the IRS to obtain a copy or seek alternative documentation.

How long should I keep my W2 forms?

+It is recommended that you retain your W2 forms for at least three years, as the IRS may request them during an audit or to verify tax information. Employers are also required to keep W2 forms on file for a specified period, as mandated by tax laws and regulations.

In conclusion, the W2 form is a vital document for both employers and employees, serving as a record of wages earned and taxes withheld. Understanding the components, importance, and best practices for handling W2 forms can help minimize potential issues and ensure compliance with tax laws. By prioritizing the accuracy and security of W2 forms, individuals can navigate the tax filing process more efficiently and avoid unnecessary complications. We invite you to share your thoughts on the significance of W2 forms and any experiences you may have had with them. Your insights can help others better understand the role of W2 forms in the tax reporting process.