Intro

Download the latest Printable W9 Form for tax purposes, including independent contractor income and self-employment earnings, with easy filling and submission guidelines.

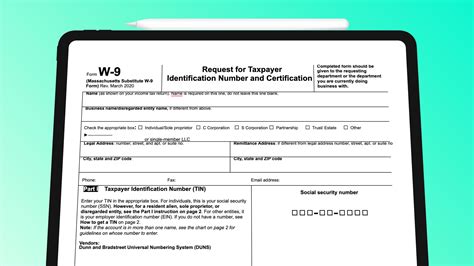

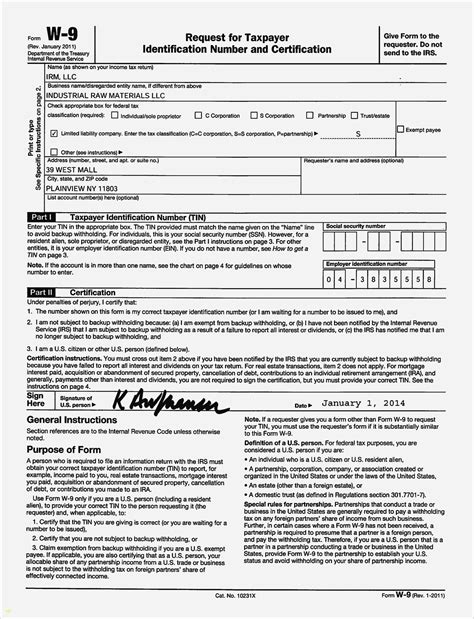

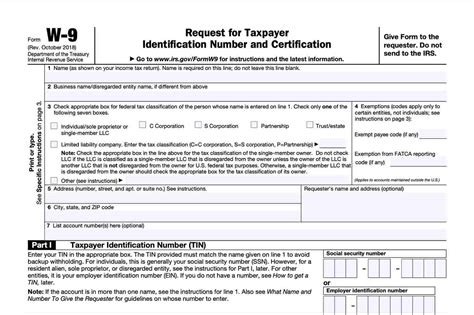

The importance of properly completing and submitting tax forms cannot be overstated, especially for businesses and independent contractors. One crucial form that plays a significant role in this process is the W-9 form. The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is used to provide a taxpayer identification number to the person or business that is requesting it, typically for tax purposes. This form is essential for freelancers, independent contractors, and businesses to ensure they are compliant with tax laws and regulations. In this article, we will delve into the details of the W-9 form, its importance, how to fill it out, and where to download a printable version.

The W-9 form is a critical document for anyone who receives income that is subject to reporting on an information return, such as a 1099-MISC. It serves as a way for payers to collect the necessary information from payees to file their information returns with the IRS. The form requires the payee to provide their name, business name, address, taxpayer identification number (which can be a Social Security number or an Employer Identification Number), and to certify their tax status. This certification is crucial because it helps the payer determine whether they are required to withhold taxes from the payments made to the payee.

Understanding the W-9 form and its requirements is vital for both payers and payees. For payers, having a completed W-9 form on file ensures they can accurately report payments to the IRS and avoid potential penalties. For payees, providing accurate and complete information on the W-9 form helps ensure they receive their payments without unnecessary withholding and that their tax obligations are properly reported. The IRS takes the accuracy of this information seriously, and any discrepancies can lead to delays in processing tax returns or even audits.

What is a W-9 Form?

A W-9 form is a legal document that provides a taxpayer identification number to the person or business requesting it. This form is typically used by businesses to collect necessary information from vendors, freelancers, or independent contractors they work with. The information provided on the W-9 form is used to prepare information returns, such as the 1099-MISC, which reports miscellaneous income paid to non-employees. The form requires the taxpayer to certify their identification number and tax status, which helps the payer determine backup withholding requirements.

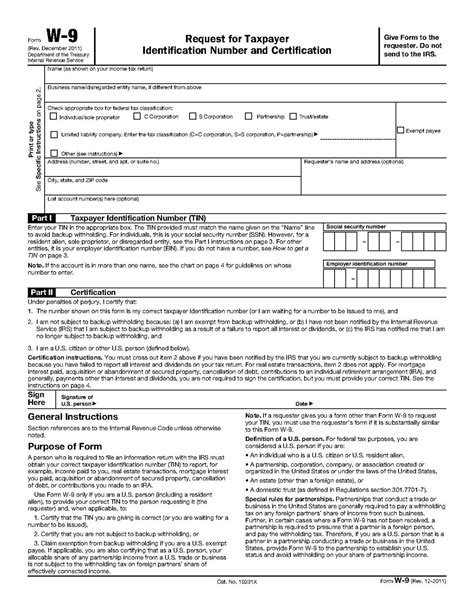

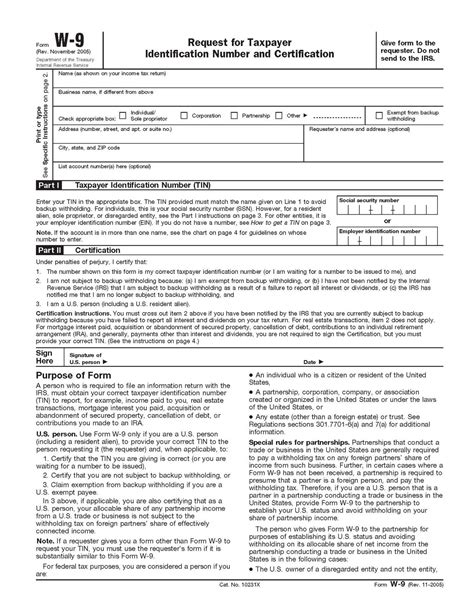

Key Components of the W-9 Form

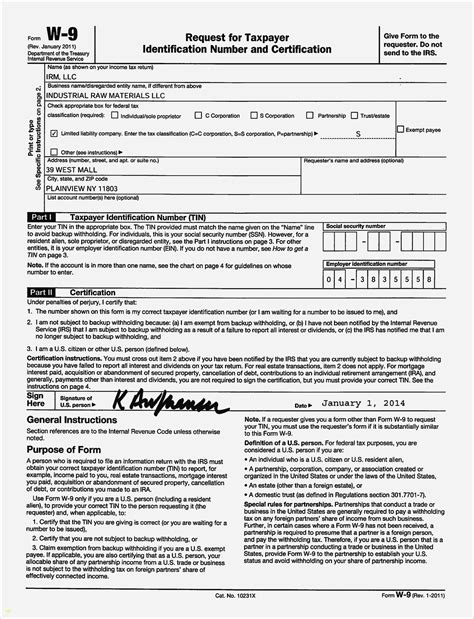

The W-9 form includes several key components that must be accurately completed: - **Name and Business Name**: The taxpayer's name and business name, if applicable. - **Address**: The taxpayer's address. - **Taxpayer Identification Number**: This can be either a Social Security number or an Employer Identification Number. - **Tax Classification**: The taxpayer must indicate their tax classification, such as individual, sole proprietorship, partnership, corporation, etc. - **Certification**: The taxpayer must certify their tax status and that they are not subject to backup withholding.How to Fill Out a W-9 Form

Filling out a W-9 form is relatively straightforward, but it's crucial to ensure all information is accurate and complete. Here are the steps to follow:

- Download the Form: You can download a printable W-9 form from the IRS website or other reputable sources.

- Provide Your Name and Business Name: Enter your name as shown on your tax return, and if applicable, your business name.

- Enter Your Address: Provide your address where you want to receive tax information.

- Taxpayer Identification Number: Enter your Social Security number or Employer Identification Number.

- Select Your Tax Classification: Choose the appropriate tax classification that applies to you.

- Certify Your Tax Status: Read the certification statements carefully and sign the form if you agree with the statements.

Tips for Accurate Completion

- Ensure your name and taxpayer identification number match the information on file with the Social Security Administration or the IRS. - If you are a foreign person, you may need to provide additional documentation or use a different form. - Keep a copy of the completed W-9 form for your records.Where to Download a Printable W-9 Form

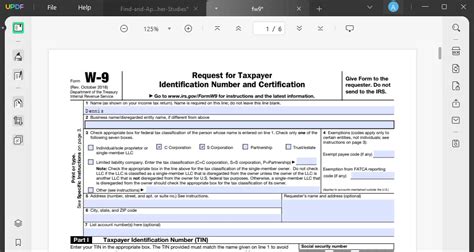

You can download a printable W-9 form from several sources:

- IRS Website: The official IRS website (irs.gov) provides the most current version of the W-9 form that you can download and print.

- Tax Preparation Software: Many tax preparation software programs, such as TurboTax or H&R Block, offer downloadable W-9 forms.

- Business Supply Websites: Websites that specialize in business forms and supplies may also offer printable W-9 forms.

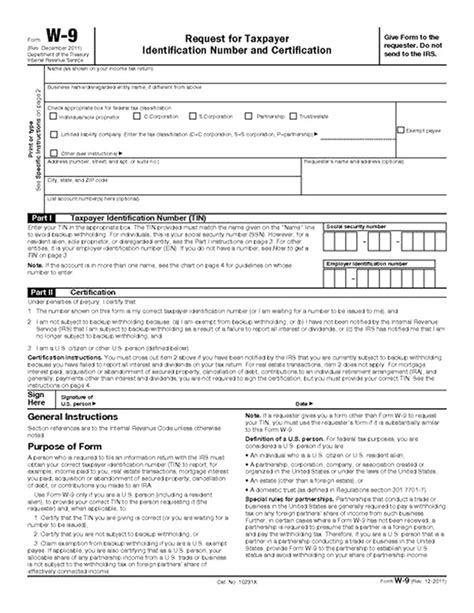

Ensuring Compliance

It's essential to use the most current version of the W-9 form to ensure compliance with IRS regulations. The IRS periodically updates forms, so always check for the latest version before downloading and using a W-9 form.Importance of the W-9 Form for Businesses

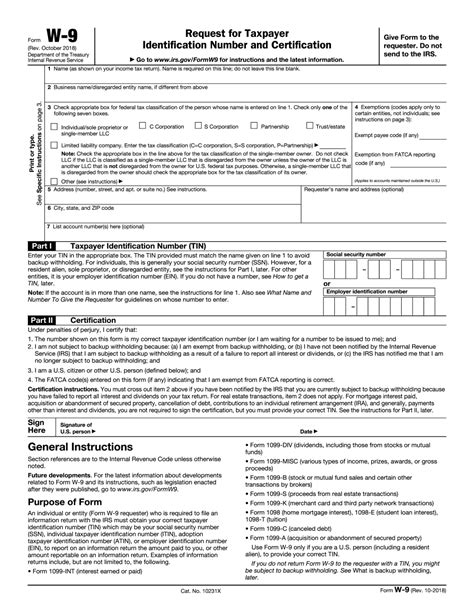

For businesses, the W-9 form is a critical tool for managing their tax obligations and ensuring compliance with IRS regulations. By having a completed W-9 form on file for each vendor, freelancer, or independent contractor they work with, businesses can accurately report payments on information returns and avoid potential penalties for non-compliance. The W-9 form also helps businesses determine whether they need to withhold taxes from payments made to these individuals or entities.

Benefits for Businesses

- **Simplified Tax Reporting**: The W-9 form simplifies the process of reporting payments to the IRS. - **Compliance with IRS Regulations**: Using the W-9 form ensures businesses are meeting their tax obligations and reducing the risk of audits or penalties. - **Accurate Withholding**: The form helps businesses determine the correct withholding requirements, avoiding unnecessary withholding or under-withholding.Common Mistakes to Avoid

When filling out a W-9 form, there are several common mistakes to avoid:

- Inaccurate or Missing Information: Ensure all information is accurate and complete.

- Using an Outdated Form: Always use the most current version of the W-9 form.

- Not Keeping a Copy: Keep a copy of the completed form for your records.

Consequences of Mistakes

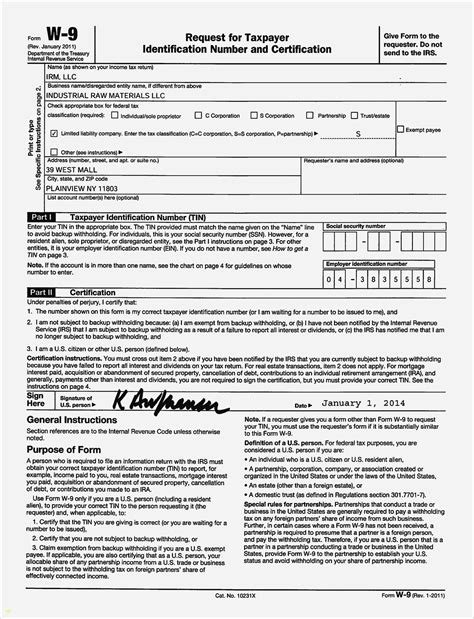

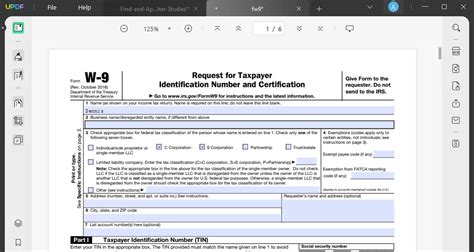

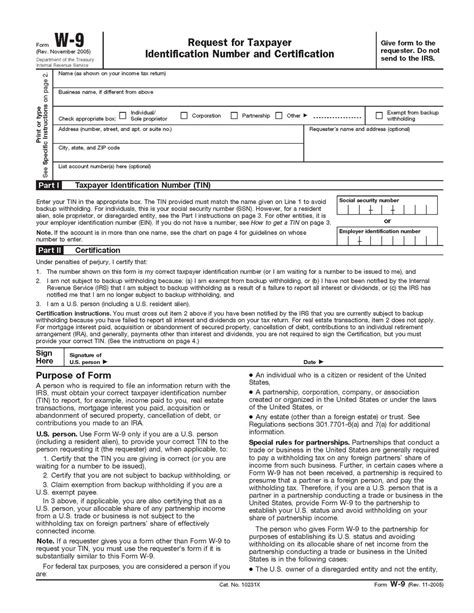

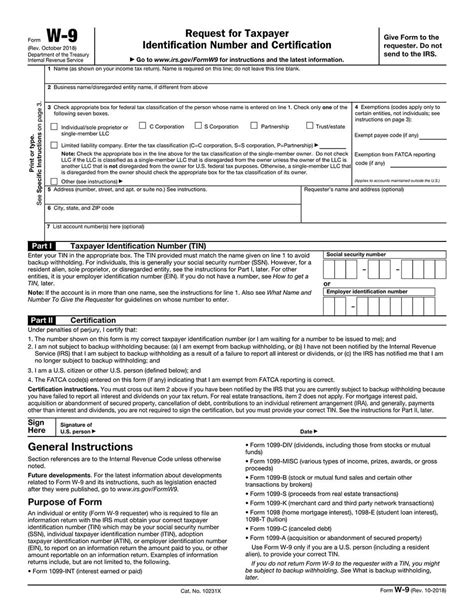

- **Delays in Processing**: Inaccurate or incomplete information can delay the processing of tax returns. - **Penalties**: Failure to comply with IRS regulations can result in penalties. - **Audits**: Mistakes on the W-9 form can increase the risk of an audit.W-9 Form Image Gallery

What is the purpose of the W-9 form?

+The W-9 form is used to provide a taxpayer identification number to the person or business requesting it, typically for tax purposes.

Who needs to fill out a W-9 form?

+Freelancers, independent contractors, and businesses that receive income subject to reporting on an information return need to fill out a W-9 form.

Where can I download a printable W-9 form?

+You can download a printable W-9 form from the IRS website, tax preparation software, or business supply websites.

What are the consequences of not filling out a W-9 form correctly?

+Inaccurate or incomplete information on the W-9 form can lead to delays in processing tax returns, penalties, and increased risk of audits.

How often do I need to update my W-9 form?

+You should update your W-9 form whenever your business or personal information changes, such as a change in address or tax classification.

In conclusion, the W-9 form is a vital document for both individuals and businesses, serving as a critical link in the tax reporting process. By understanding the importance of the W-9 form, how to fill it out accurately, and where to download a printable version, individuals and businesses can ensure compliance with IRS regulations and avoid potential penalties. Whether you are a freelancer, independent contractor, or business owner, taking the time to properly complete and submit a W-9 form is an essential part of managing your tax obligations. We invite you to share your experiences or questions about the W-9 form in the comments below, and don't forget to share this article with anyone who might find it helpful.