Intro

Discover 5 ways to utilize W9 printable forms for tax compliance, including independent contractor management, income reporting, and IRS filing, with tips on W9 form download, printable W9 templates, and tax season preparation.

The W9 form is a crucial document for freelancers, independent contractors, and businesses in the United States. It provides essential information to clients, allowing them to prepare tax documents and comply with IRS regulations. In this article, we will explore the importance of the W9 form, its components, and provide guidance on how to obtain a W9 printable template.

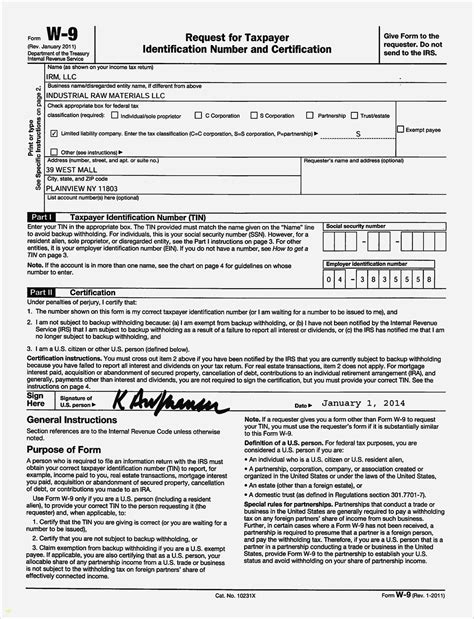

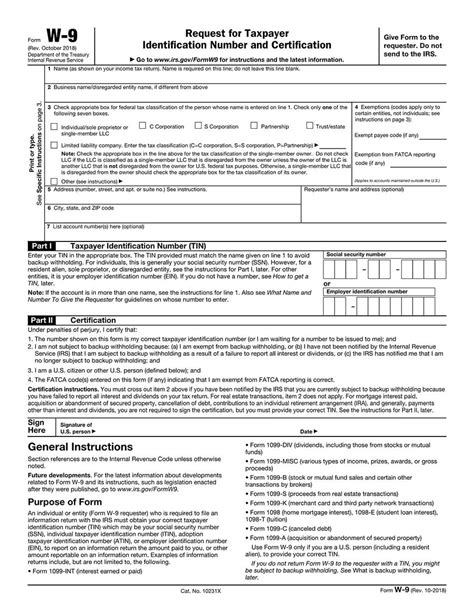

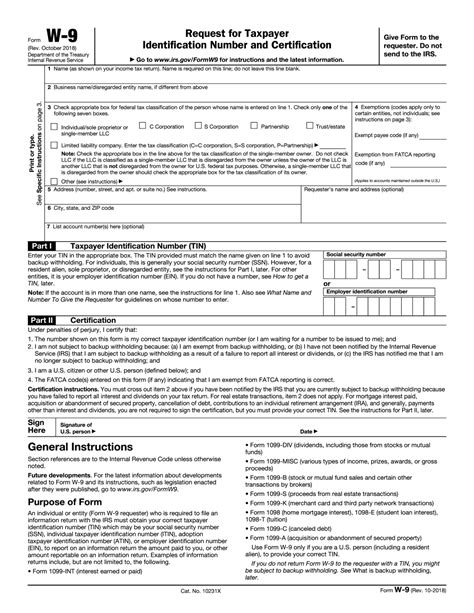

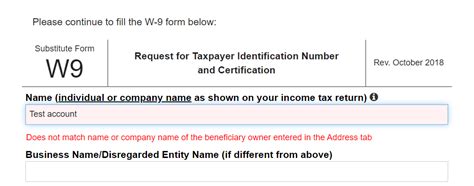

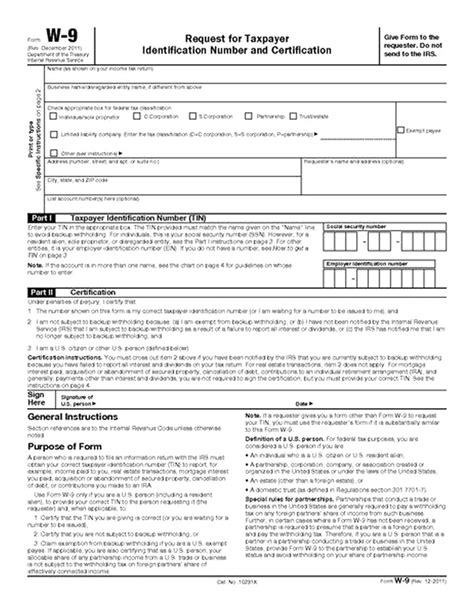

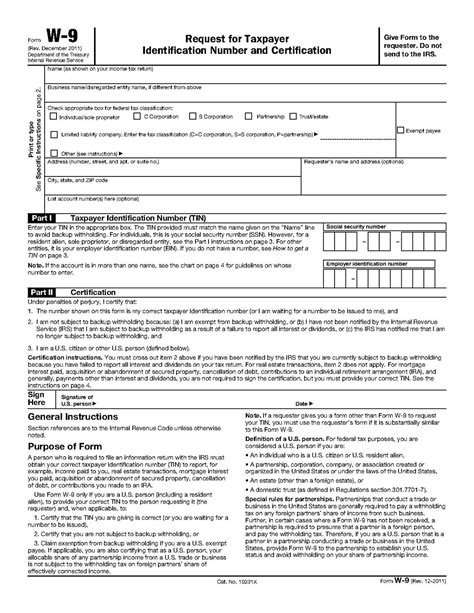

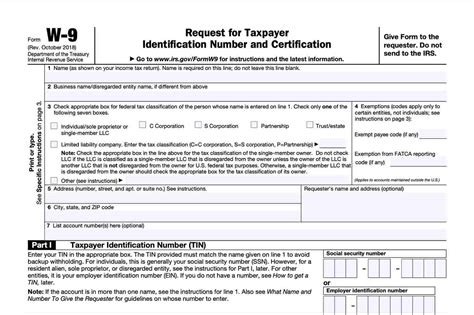

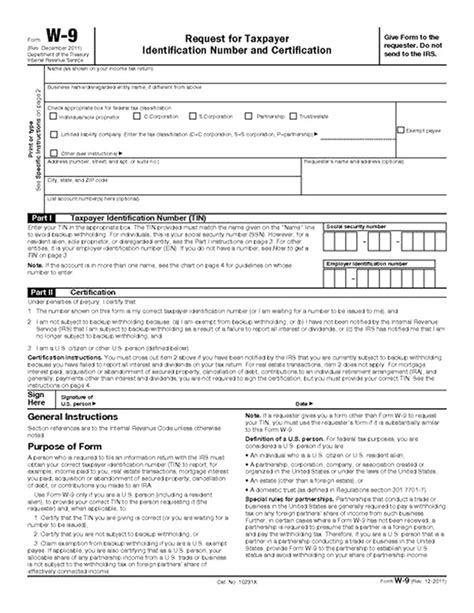

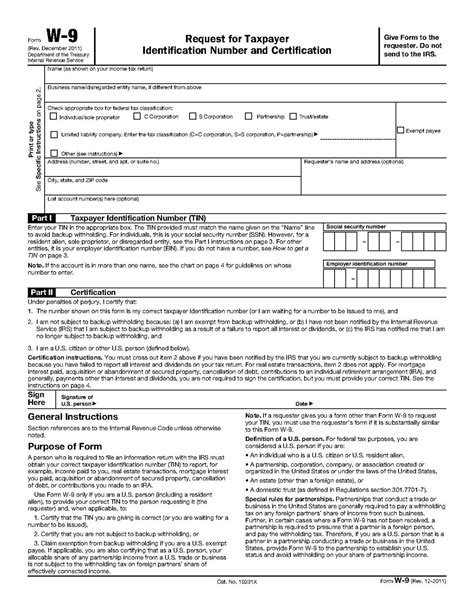

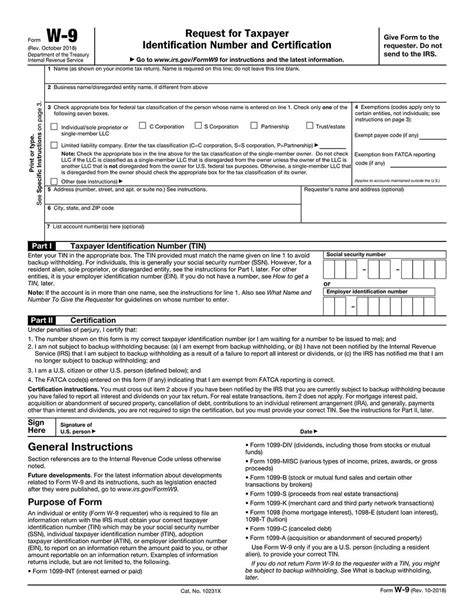

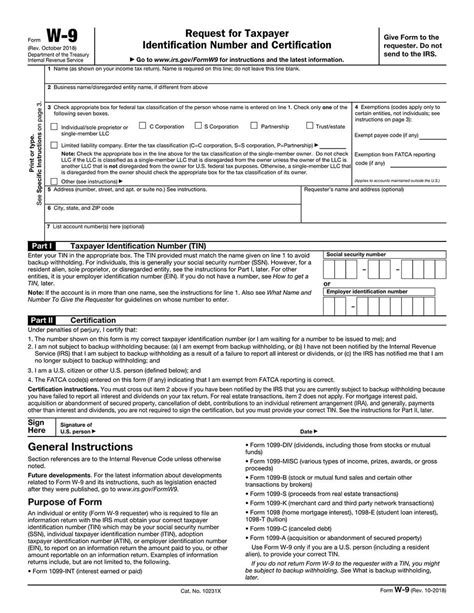

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is used to collect identifying information from independent contractors, freelancers, and sole proprietors. This information includes the taxpayer's name, business name, address, and taxpayer identification number (TIN). The W9 form is typically required by clients who pay more than $600 to an independent contractor in a calendar year.

The W9 form serves several purposes, including verifying the taxpayer's identity, ensuring compliance with tax laws, and facilitating the preparation of tax documents such as the 1099-MISC form. The 1099-MISC form is used to report miscellaneous income, including payments made to independent contractors. By obtaining a completed W9 form from contractors, clients can ensure they have the necessary information to prepare accurate tax documents.

Understanding the W9 Form

Benefits of Using a W9 Printable Template

Where to Find a W9 Printable Template

How to Complete a W9 Printable Template

Common Mistakes to Avoid When Completing a W9 Form

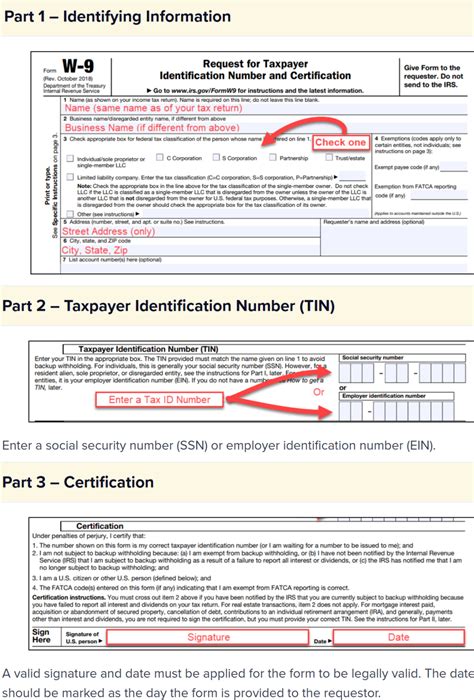

Here are some key points to consider when completing a W9 form:

- Provide accurate and complete information

- Use the correct TIN (SSN or EIN)

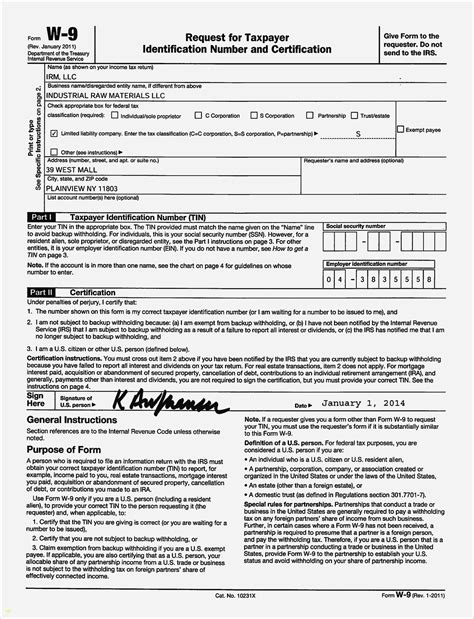

- Sign and date the form

- Certify the accuracy of the information

- Review the form carefully before submitting it

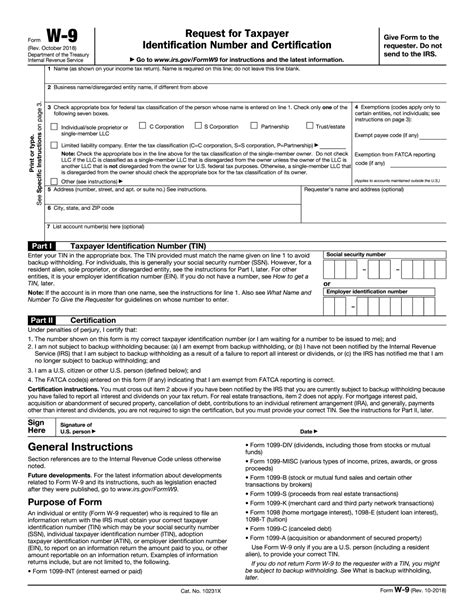

W9 Form Components

The W9 form consists of several components, including: * Part I: Taxpayer Identification Number (TIN) * Part II: Certification * Part III: Special Meets and ConditionsPart I requires the contractor to provide their TIN, which can be either an SSN or an EIN. Part II requires the contractor to certify that they are not subject to backup withholding and that they are a U.S. person or resident alien. Part III provides special meets and conditions, including the certification that the contractor is not subject to the Foreign Account Tax Compliance Act (FATCA).

W9 Form Uses

The W9 form has several uses, including: * Verifying the taxpayer's identity * Ensuring compliance with tax laws * Facilitating the preparation of tax documents * Reporting miscellaneous incomeThe W9 form is an essential document for independent contractors, freelancers, and businesses. It provides critical information to clients, allowing them to prepare tax documents and comply with IRS regulations.

W9 Form Image Gallery

What is the purpose of the W9 form?

+The W9 form is used to collect identifying information from independent contractors, freelancers, and sole proprietors, including their name, business name, address, and taxpayer identification number (TIN).

Who needs to complete a W9 form?

+Independent contractors, freelancers, and sole proprietors who receive more than $600 in payments from a client in a calendar year must complete a W9 form.

How do I obtain a W9 printable template?

+A W9 printable template can be obtained from the official IRS website, online tax preparation software, or business supply websites.

What are the consequences of not completing a W9 form?

+Failure to complete a W9 form can result in delays or errors in tax document preparation, potentially leading to penalties or fines.

Can I use a W9 form for multiple clients?

+Yes, you can use a W9 form for multiple clients, but you must provide a separate W9 form for each client.

In summary, the W9 form is a critical document for independent contractors, freelancers, and businesses. It provides essential information to clients, allowing them to prepare tax documents and comply with IRS regulations. By understanding the importance of the W9 form, its components, and how to obtain a W9 printable template, contractors can ensure they are complying with tax laws and regulations. If you have any questions or concerns about the W9 form, we encourage you to comment below or share this article with others who may find it helpful. Additionally, you can take action by downloading a W9 printable template and completing it accurately to ensure compliance with tax laws and regulations.