Intro

Discover community-driven banking solutions with Puget Sound Cooperative. Learn how this member-owned cooperative offers personalized financial services, empowering individuals and businesses in the Puget Sound region. Explore benefits of cooperative banking, including local decision-making, competitive rates, and community investments, for a more sustainable and equitable financial future.

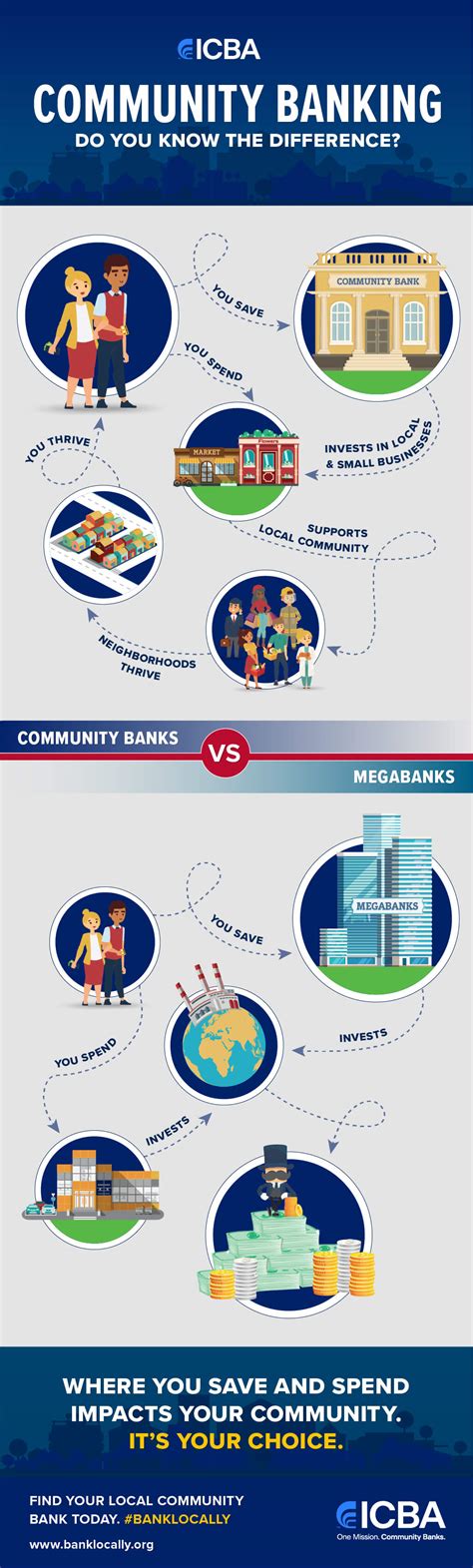

The Puget Sound Cooperative is a shining example of community-driven banking solutions, where the focus is on people over profits. In an era where big banks often prioritize shareholder interests over those of their customers, cooperatives like Puget Sound are a breath of fresh air. By empowering individuals and communities to take control of their financial lives, cooperatives are revolutionizing the way we think about banking.

In this article, we'll delve into the world of cooperatives, exploring the benefits, mechanics, and real-world examples of community-driven banking solutions. We'll also examine the Puget Sound Cooperative in detail, highlighting its unique features and the impact it has on the community.

What are Cooperatives?

A cooperative is a business owned and controlled by its members, who share common interests and goals. In the context of banking, cooperatives are member-owned financial institutions that provide financial services to their members. The key characteristic of a cooperative is that it is not-for-profit, meaning that any surplus funds are reinvested in the business or distributed to members in the form of dividends.

Benefits of Cooperatives

Cooperatives offer a range of benefits to their members, including:

- Democratized decision-making: Members have a say in the direction of the cooperative, ensuring that decisions are made in the best interests of the community.

- Community focus: Cooperatives are rooted in the local community, with a deep understanding of the unique needs and challenges of the area.

- Competitive rates and fees: Cooperatives often offer more favorable rates and fees compared to traditional banks, as they are not driven by profit margins.

- Personalized service: Cooperatives are known for their personalized approach, with members receiving tailored advice and support.

The Puget Sound Cooperative: A Community-Driven Banking Solution

The Puget Sound Cooperative is a member-owned cooperative serving the Puget Sound region in Washington State. With a strong focus on community development, the cooperative offers a range of financial services, including loans, deposits, and financial education programs.

Unique Features of the Puget Sound Cooperative

The Puget Sound Cooperative has several unique features that set it apart from traditional banks:

- Community-based lending: The cooperative offers lending programs tailored to the specific needs of the local community, including small business loans and affordable housing initiatives.

- Financial education: The cooperative provides financial education programs, empowering members to take control of their financial lives and make informed decisions.

- Community engagement: The cooperative is actively engaged in the local community, supporting initiatives that promote economic development and social justice.

How Cooperatives Work

Cooperatives operate on a simple yet effective principle: members pool their resources to achieve a common goal. In the context of banking, this means that members deposit their funds into the cooperative, which then uses these funds to provide loans and other financial services.

Steps to Join a Cooperative

Joining a cooperative is a straightforward process:

- Meet the eligibility criteria: Check if you meet the cooperative's membership criteria, which may include living or working in a specific area.

- Attend an orientation: Many cooperatives offer orientation sessions to introduce new members to the organization and its services.

- Deposit funds: Deposit a minimum amount into your account to become a member.

- Participate in decision-making: Attend meetings and participate in decision-making processes to shape the direction of the cooperative.

Real-World Examples of Community-Driven Banking Solutions

Cooperatives are not limited to the Puget Sound region. Community-driven banking solutions can be found in various forms around the world:

- Credit unions: Not-for-profit financial cooperatives that provide financial services to their members.

- Mutual banks: Depository institutions owned by their depositors, who share in the profits and decision-making processes.

- Community land trusts: Non-profit organizations that provide affordable housing options and community development initiatives.

Challenges and Opportunities

While cooperatives offer a range of benefits, they also face unique challenges:

- Scalability: Cooperatives often struggle to scale their operations, limiting their reach and impact.

- Regulatory frameworks: Cooperatives must navigate complex regulatory frameworks, which can be time-consuming and costly.

- Education and awareness: Many people are unaware of the benefits and opportunities offered by cooperatives, highlighting the need for education and awareness initiatives.

Conclusion

The Puget Sound Cooperative is a shining example of community-driven banking solutions, where the focus is on people over profits. By empowering individuals and communities to take control of their financial lives, cooperatives are revolutionizing the way we think about banking. As we move forward, it's essential to recognize the benefits and challenges of cooperatives, working together to create a more equitable and just financial system.

Puget Sound Cooperative Image Gallery

What is a cooperative?

+A cooperative is a business owned and controlled by its members, who share common interests and goals.

What are the benefits of cooperatives?

+Cooperatives offer a range of benefits, including democratized decision-making, community focus, competitive rates and fees, and personalized service.

How do I join a cooperative?

+To join a cooperative, meet the eligibility criteria, attend an orientation, deposit funds, and participate in decision-making processes.