Intro

Unlock the full potential of your business with Staccato C2 DPO. Discover 5 ways this game-changing platform impacts your operations, from streamlined billing and revenue management to enhanced customer engagement and data-driven decision making. Transform your business with Staccato C2 DPOs advanced capabilities and stay ahead of the competition.

As a business owner, you're constantly looking for ways to improve your operations, increase efficiency, and boost profits. One often overlooked aspect of business management is the impact of Staccato C2 DPO (Days Payable Outstanding) on your bottom line. In this article, we'll delve into the world of Staccato C2 DPO and explore five ways it can significantly impact your business.

What is Staccato C2 DPO?

Staccato C2 DPO refers to the number of days, on average, that a company takes to pay its suppliers. It's a crucial metric in accounts payable management, as it affects cash flow, supplier relationships, and overall business performance. By understanding Staccato C2 DPO, you can identify areas for improvement and make data-driven decisions to optimize your accounts payable process.

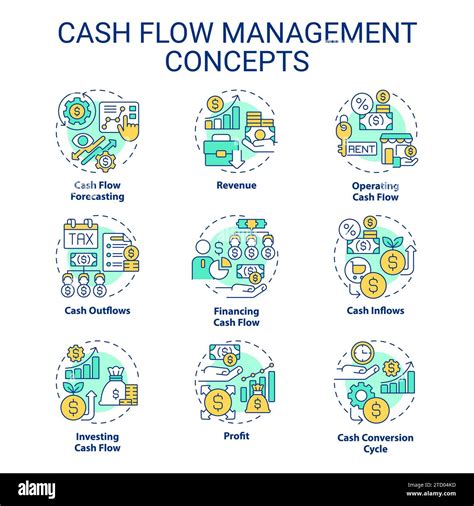

Impact on Cash Flow

One of the most significant impacts of Staccato C2 DPO is on your business's cash flow. When you delay payments to suppliers, you're essentially holding onto cash that could be used for other purposes, such as investing in growth initiatives or covering unexpected expenses. By optimizing your Staccato C2 DPO, you can improve cash flow management and reduce the need for short-term borrowing.

Benefits of Improved Cash Flow

- Increased liquidity for investments and growth initiatives

- Reduced reliance on short-term borrowing

- Improved ability to respond to changing market conditions

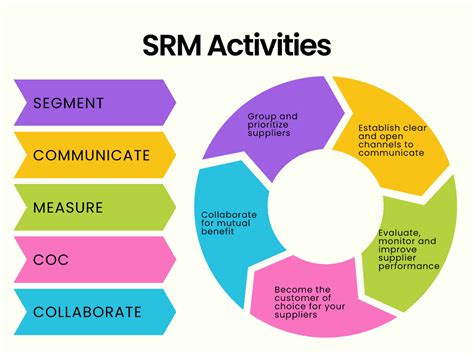

Supplier Relationships and Negotiation Power

Your Staccato C2 DPO can also impact your relationships with suppliers. When you consistently pay suppliers on time, you build trust and strengthen your negotiating power. Suppliers may be more willing to offer discounts or flexible payment terms, which can lead to cost savings and improved profitability.

Benefits of Strong Supplier Relationships

- Improved negotiation power and potential for discounts

- Increased trust and reliability with suppliers

- Enhanced ability to respond to supply chain disruptions

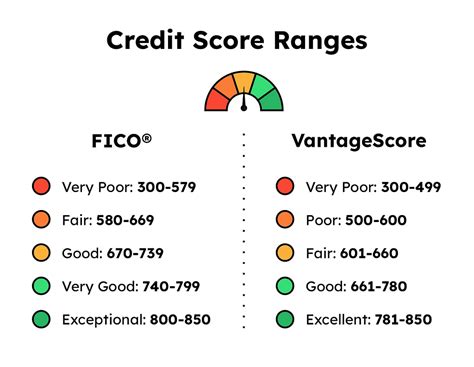

Impact on Credit Rating and Reputation

Your Staccato C2 DPO can also affect your credit rating and reputation. A high Staccato C2 DPO may indicate to lenders and suppliers that your business is struggling to manage its finances, which can lead to a lower credit rating and reduced access to credit. Conversely, a low Staccato C2 DPO can demonstrate your business's financial stability and responsibility.

Benefits of a Strong Credit Rating

- Improved access to credit and financing options

- Increased credibility with suppliers and lenders

- Enhanced ability to negotiate favorable terms

Opportunities for Cost Savings

By optimizing your Staccato C2 DPO, you can also identify opportunities for cost savings. For example, you may be able to negotiate discounts with suppliers or reduce the need for expensive short-term borrowing.

Benefits of Cost Savings

- Improved profitability and bottom-line results

- Increased competitiveness in the market

- Enhanced ability to invest in growth initiatives

Improved Financial Reporting and Compliance

Finally, optimizing your Staccato C2 DPO can also improve financial reporting and compliance. By accurately tracking and managing your accounts payable, you can ensure that your financial statements are accurate and compliant with regulatory requirements.

Benefits of Improved Financial Reporting

- Enhanced accuracy and reliability of financial statements

- Improved compliance with regulatory requirements

- Increased transparency and accountability

Gallery of Staccato C2 DPO Images

Staccato C2 DPO Image Gallery

What is the ideal Staccato C2 DPO for my business?

+The ideal Staccato C2 DPO varies depending on your industry, supplier relationships, and financial goals. However, a general rule of thumb is to aim for a Staccato C2 DPO that is lower than your industry average.

How can I improve my Staccato C2 DPO?

+There are several ways to improve your Staccato C2 DPO, including implementing an accounts payable automation system, negotiating with suppliers, and improving cash flow management.

What are the benefits of a low Staccato C2 DPO?

+A low Staccato C2 DPO can lead to improved cash flow management, stronger supplier relationships, and increased credibility with lenders.

In conclusion, your Staccato C2 DPO has a significant impact on your business's financial performance, supplier relationships, and reputation. By understanding the importance of Staccato C2 DPO and implementing strategies to optimize it, you can improve cash flow management, negotiation power, and overall profitability. Take the first step today and start optimizing your Staccato C2 DPO for a stronger, more resilient business.

We hope you found this article informative and helpful. If you have any questions or would like to share your experiences with Staccato C2 DPO, please leave a comment below.