Intro

Discover 5 ways around earnings season volatility, navigating stock market fluctuations with insider tips on earnings reports, financial analysis, and investment strategies.

The concept of earnings is a fundamental aspect of personal finance and investing. Earnings refer to the profit made by a company or individual from their business or investment activities. However, there are situations where individuals may need to navigate around earnings, either due to financial constraints or investment strategies. In this article, we will explore five ways around earnings, providing insights and practical examples to help readers make informed decisions.

Earnings are a crucial factor in determining the financial health and stability of a company or individual. They can impact investment decisions, creditworthiness, and overall financial well-being. However, there are instances where earnings may not be the primary focus or may need to be circumvented. For instance, during economic downturns, companies may need to prioritize cost-cutting measures over earnings growth. Similarly, investors may need to consider alternative investment strategies that do not rely solely on earnings.

The importance of understanding earnings and navigating around them cannot be overstated. It requires a deep understanding of financial markets, investment strategies, and personal finance principles. By exploring alternative approaches to earnings, individuals can make more informed decisions about their financial resources and investment portfolios. In the following sections, we will delve into five ways around earnings, providing a comprehensive analysis of each approach.

Understanding Earnings and Their Limitations

Earnings are a key performance indicator for companies, reflecting their ability to generate profits from their operations. However, earnings can be limited by various factors, such as market conditions, competition, and regulatory environments. Companies may need to adapt their business strategies to navigate these challenges and maintain their earnings growth. For instance, a company may diversify its product offerings or expand into new markets to reduce its dependence on a single revenue stream.

Factors Affecting Earnings

Several factors can impact earnings, including: * Market trends and conditions * Competition and market share * Regulatory environments and compliance * Operational efficiency and cost management * Investment in research and developmentThese factors can either positively or negatively impact earnings, depending on how they are managed. Companies that can effectively navigate these challenges can maintain their earnings growth and achieve long-term financial stability.

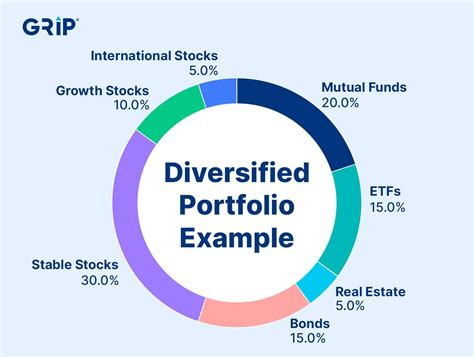

Way 1: Diversification of Investment Portfolio

One way to navigate around earnings is to diversify your investment portfolio. This involves spreading your investments across different asset classes, such as stocks, bonds, and real estate, to reduce your reliance on a single income stream. Diversification can help mitigate the risks associated with earnings fluctuations and provide a more stable source of income.

For example, an investor may allocate their portfolio as follows:

- 40% stocks

- 30% bonds

- 30% real estate

By diversifying their portfolio, the investor can reduce their exposure to market volatility and earnings fluctuations, ensuring a more stable source of income.

Benefits of Diversification

The benefits of diversification include: * Reduced risk and volatility * Increased potential for long-term growth * Improved income stability * Enhanced flexibility and adaptabilityDiversification is a key strategy for navigating around earnings, as it allows investors to manage their risk and maintain a stable source of income.

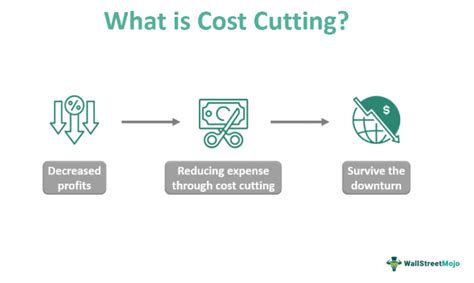

Way 2: Cost-Cutting Measures

Another way to navigate around earnings is to implement cost-cutting measures. This involves reducing expenses and improving operational efficiency to maintain profitability. Cost-cutting measures can help companies and individuals conserve their financial resources and navigate earnings challenges.

For instance, a company may implement cost-cutting measures such as:

- Reducing energy consumption and utility costs

- Streamlining operations and eliminating unnecessary expenses

- Renegotiating contracts and agreements with suppliers

By implementing cost-cutting measures, companies and individuals can maintain their earnings and achieve long-term financial stability.

Types of Cost-Cutting Measures

Some common types of cost-cutting measures include: * Reducing labor costs and overhead expenses * Improving operational efficiency and productivity * Renegotiating contracts and agreements with suppliers * Eliminating unnecessary expenses and wasteCost-cutting measures can help companies and individuals navigate earnings challenges and maintain their financial stability.

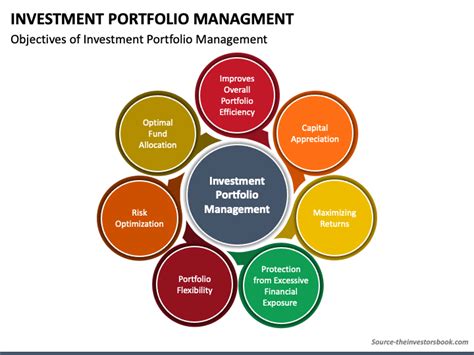

Way 3: Alternative Investment Strategies

Alternative investment strategies can provide a way to navigate around earnings. These strategies involve investing in non-traditional assets, such as private equity, hedge funds, or real assets, to generate returns that are not correlated with earnings. Alternative investment strategies can help investors manage their risk and maintain a stable source of income.

For example, an investor may consider alternative investment strategies such as:

- Investing in private equity or venture capital

- Investing in hedge funds or alternative mutual funds

- Investing in real assets, such as real estate or commodities

By investing in alternative assets, investors can reduce their reliance on earnings and maintain a stable source of income.

Benefits of Alternative Investment Strategies

The benefits of alternative investment strategies include: * Reduced correlation with earnings and market volatility * Increased potential for long-term growth and returns * Improved diversification and risk management * Enhanced flexibility and adaptabilityAlternative investment strategies can provide a way to navigate around earnings and maintain a stable source of income.

Way 4: Income-Generating Assets

Income-generating assets can provide a way to navigate around earnings. These assets, such as dividend-paying stocks, bonds, or real estate investment trusts (REITs), generate regular income that is not dependent on earnings. Income-generating assets can help investors maintain a stable source of income and reduce their reliance on earnings.

For instance, an investor may consider income-generating assets such as:

- Dividend-paying stocks

- Bonds or fixed-income securities

- Real estate investment trusts (REITs)

- Peer-to-peer lending or crowdfunding platforms

By investing in income-generating assets, investors can maintain a stable source of income and navigate earnings challenges.

Types of Income-Generating Assets

Some common types of income-generating assets include: * Dividend-paying stocks * Bonds or fixed-income securities * Real estate investment trusts (REITs) * Peer-to-peer lending or crowdfunding platformsIncome-generating assets can provide a way to navigate around earnings and maintain a stable source of income.

Way 5: Tax-Efficient Investing

Tax-efficient investing can provide a way to navigate around earnings. This involves optimizing investment strategies to minimize tax liabilities and maximize after-tax returns. Tax-efficient investing can help investors maintain their earnings and achieve long-term financial stability.

For example, an investor may consider tax-efficient investing strategies such as:

- Investing in tax-deferred retirement accounts

- Using tax-loss harvesting to offset capital gains

- Investing in municipal bonds or tax-exempt securities

- Using charitable donations to reduce tax liabilities

By implementing tax-efficient investing strategies, investors can maintain their earnings and achieve long-term financial stability.

Benefits of Tax-Efficient Investing

The benefits of tax-efficient investing include: * Reduced tax liabilities and increased after-tax returns * Improved investment efficiency and effectiveness * Enhanced flexibility and adaptability * Increased potential for long-term growth and wealth accumulationTax-efficient investing can provide a way to navigate around earnings and maintain a stable source of income.

Investing Strategies Image Gallery

What are the benefits of diversifying my investment portfolio?

+The benefits of diversifying your investment portfolio include reduced risk and volatility, increased potential for long-term growth, and improved income stability.

How can I implement cost-cutting measures in my business?

+You can implement cost-cutting measures in your business by reducing labor costs and overhead expenses, improving operational efficiency and productivity, renegotiating contracts and agreements with suppliers, and eliminating unnecessary expenses and waste.

What are the advantages of alternative investment strategies?

+The advantages of alternative investment strategies include reduced correlation with earnings and market volatility, increased potential for long-term growth and returns, improved diversification and risk management, and enhanced flexibility and adaptability.

How can I generate income from my investments?

+You can generate income from your investments by investing in income-generating assets, such as dividend-paying stocks, bonds, or real estate investment trusts (REITs), and by using tax-efficient investing strategies to minimize tax liabilities and maximize after-tax returns.

What is tax-efficient investing, and how can it benefit my investments?

+Tax-efficient investing involves optimizing investment strategies to minimize tax liabilities and maximize after-tax returns. It can benefit your investments by reducing tax liabilities, improving investment efficiency and effectiveness, and increasing potential for long-term growth and wealth accumulation.

In conclusion, navigating around earnings requires a deep understanding of financial markets, investment strategies, and personal finance principles. By exploring alternative approaches to earnings, individuals can make more informed decisions about their financial resources and investment portfolios. Whether it's diversifying your investment portfolio, implementing cost-cutting measures, or using alternative investment strategies, there are various ways to navigate around earnings and achieve long-term financial stability. We encourage readers to share their thoughts and experiences on navigating around earnings and to explore the various strategies and approaches discussed in this article. By working together and sharing our knowledge, we can create a more informed and financially stable community.