Intro

Discover the far-reaching impact of the China Mirage on the global economy. Learn how Chinas economic rise and diplomatic clout influence trade, investment, and geopolitics worldwide. Explore five key ways the China Mirage affects global market trends, international relations, and economic stability, and what it means for businesses and investors.

The China Mirage, a term coined by economist and author James Bradley, refers to the illusion of China's unstoppable economic growth and its perceived status as a global economic powerhouse. However, beneath the surface, China's economic reality is far more complex and nuanced. In this article, we will delve into five ways the China Mirage affects the global economy, exploring the implications of this phenomenon on international trade, investment, and economic stability.

What is the China Mirage?

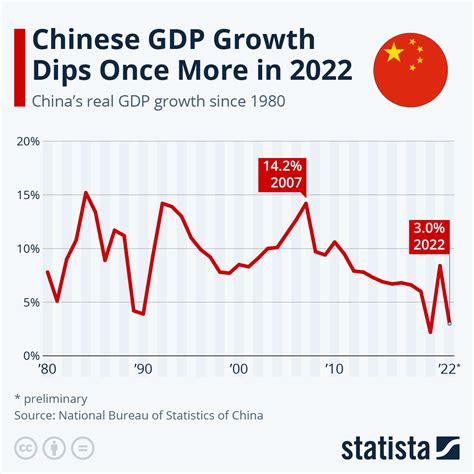

The China Mirage refers to the widespread perception that China's economic growth is unstoppable and that the country will continue to drive global economic growth for decades to come. This perception is fueled by China's impressive economic growth rates over the past few decades, as well as its large and growing middle class. However, this perception is also influenced by China's opaque economic data and the government's ability to manipulate economic statistics.

How the China Mirage Affects Global Economy

1. Distorted Global Trade Patterns

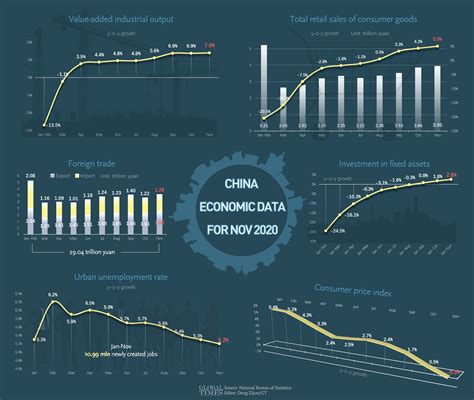

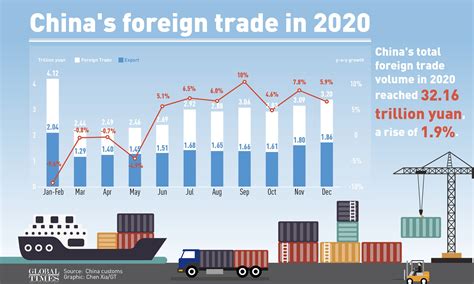

The China Mirage has led to distorted global trade patterns, as countries and companies have invested heavily in China-based supply chains. However, China's economic reality is far more complex, with a highly dependent export-driven economy and a struggling domestic market. This has led to an over-reliance on Chinese exports, which can be vulnerable to economic shocks and disruptions.

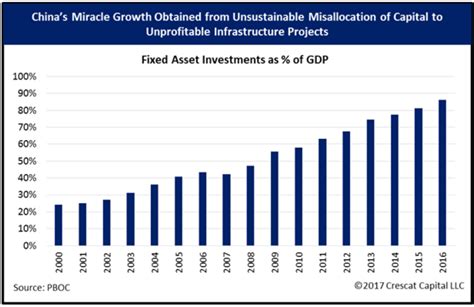

2. Misallocated Investment

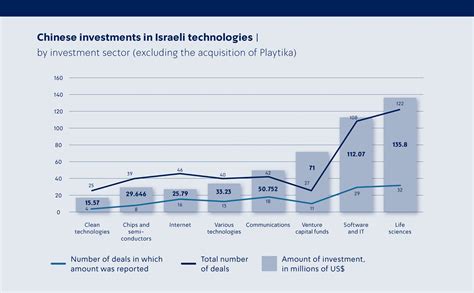

The China Mirage has also led to misallocated investment, as investors and companies have poured billions of dollars into China-based projects and ventures. However, many of these investments have been based on unrealistic expectations of China's economic growth potential, leading to significant losses and write-downs.

3. Inflated Asset Prices

The China Mirage has contributed to inflated asset prices, particularly in the real estate and stock markets. As investors have bet on China's continued economic growth, asset prices have soared, creating a bubble that is vulnerable to popping.

4. Unstable Global Economic Environment

The China Mirage has created an unstable global economic environment, as countries and companies have become increasingly dependent on China's economic growth. However, China's economic reality is far more complex, with significant risks and challenges, including a rapidly aging population, a shrinking workforce, and a heavily indebted economy.

5. Loss of Competitiveness

The China Mirage has also led to a loss of competitiveness, as countries and companies have become too focused on the Chinese market and have neglected other emerging markets and opportunities. This has led to a lack of diversification and a failure to develop new markets and industries.

Conclusion: Looking Beyond the China Mirage

In conclusion, the China Mirage has significant implications for the global economy, from distorted trade patterns to misallocated investment and inflated asset prices. However, by looking beyond the China Mirage and understanding the complexities of China's economic reality, countries and companies can develop more sustainable and diversified economic strategies.

Gallery of China Mirage Economy

China Mirage Economy Image Gallery

What is the China Mirage?

+The China Mirage refers to the widespread perception that China's economic growth is unstoppable and that the country will continue to drive global economic growth for decades to come.

How does the China Mirage affect global trade patterns?

+The China Mirage has led to distorted global trade patterns, as countries and companies have invested heavily in China-based supply chains.

What are the implications of the China Mirage for global economic stability?

+The China Mirage has created an unstable global economic environment, as countries and companies have become increasingly dependent on China's economic growth.