Intro

Discover the advantages of banking with Thunderbolt Area Credit Union. Enjoy personalized service, competitive rates, and convenient online banking. Experience the benefits of membership, including financial education, community involvement, and exclusive discounts. Learn how Thunderbolt Area Credit Union can help you achieve financial freedom and security with its member-focused approach.

Credit unions have been a staple of community banking for decades, offering a unique alternative to traditional banks. The Thunderbolt Area Credit Union is one such institution, providing its members with a range of financial services and benefits. In this article, we will explore the 5 benefits of joining the Thunderbolt Area Credit Union.

The importance of having a reliable financial institution cannot be overstated. In today's fast-paced world, individuals and families need access to secure, convenient, and affordable banking services. Credit unions like Thunderbolt Area Credit Union offer a refreshing alternative to big banks, with a focus on community, cooperation, and member benefits.

By joining a credit union, individuals can tap into a network of like-minded individuals who are working together to achieve financial stability and success. Credit unions are not-for-profit organizations, meaning that any profits are reinvested into the institution, benefiting members in the form of lower fees, better loan rates, and improved services.

Benefits of Thunderbolt Area Credit Union

1. Better Loan Rates and Terms

One of the primary benefits of joining the Thunderbolt Area Credit Union is access to better loan rates and terms. As a not-for-profit organization, credit unions are able to offer more competitive loan rates compared to traditional banks. This can result in significant savings for members, especially those looking to purchase a home, car, or finance other large expenses.

In addition to better loan rates, credit unions often offer more flexible loan terms, including longer repayment periods and lower fees. This can make it easier for members to manage their debt and achieve their financial goals.

2. Lower Fees and Charges

Another benefit of joining the Thunderbolt Area Credit Union is lower fees and charges. Unlike traditional banks, credit unions are not driven by the need to generate profits for shareholders. As a result, they are able to keep fees and charges to a minimum, passing the savings on to members.

This can include lower fees for services such as ATM withdrawals, overdrafts, and loan applications. Members may also enjoy free or low-cost services such as online banking, bill pay, and mobile banking.

Types of Fees and Charges

- ATM withdrawal fees

- Overdraft fees

- Loan application fees

- Monthly maintenance fees

- Online banking fees

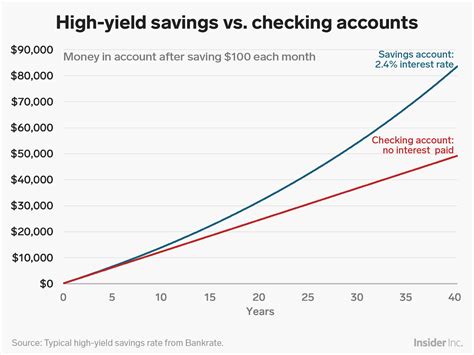

3. Higher Savings Rates

Credit unions like Thunderbolt Area Credit Union often offer higher savings rates compared to traditional banks. This can help members grow their savings over time, achieving their long-term financial goals.

In addition to higher savings rates, credit unions may offer a range of savings products, including certificates of deposit (CDs), money market accounts, and individual retirement accounts (IRAs). These products can provide members with a safe and secure way to save for the future.

Types of Savings Products

- Certificates of deposit (CDs)

- Money market accounts

- Individual retirement accounts (IRAs)

- Traditional savings accounts

4. Improved Customer Service

Credit unions are known for their commitment to customer service, with a focus on building strong relationships with members. At Thunderbolt Area Credit Union, members can expect to receive personalized service from knowledgeable and friendly staff.

This can include access to financial counseling, budgeting advice, and investment guidance. Members may also enjoy online resources and educational materials, helping them to better manage their finances and achieve their goals.

Types of Customer Service

- Financial counseling

- Budgeting advice

- Investment guidance

- Online resources and educational materials

5. Community Involvement

Finally, credit unions like Thunderbolt Area Credit Union are committed to giving back to the community. This can include sponsorship of local events, support for charitable organizations, and investment in community development projects.

By joining the Thunderbolt Area Credit Union, members can feel confident that they are supporting an institution that shares their values and is committed to making a positive impact in the community.

Types of Community Involvement

- Sponsorship of local events

- Support for charitable organizations

- Investment in community development projects

Gallery of Credit Union Benefits

Credit Union Benefits

What is a credit union?

+A credit union is a not-for-profit financial cooperative that provides financial services to its members.

What are the benefits of joining a credit union?

+The benefits of joining a credit union include better loan rates, lower fees, higher savings rates, improved customer service, and community involvement.

How do I join the Thunderbolt Area Credit Union?

+To join the Thunderbolt Area Credit Union, you can visit their website or stop by one of their branches to apply for membership.

In conclusion, joining the Thunderbolt Area Credit Union can provide individuals with a range of benefits, from better loan rates and lower fees to improved customer service and community involvement. By becoming a member of this credit union, individuals can take advantage of these benefits and achieve their financial goals.