Intro

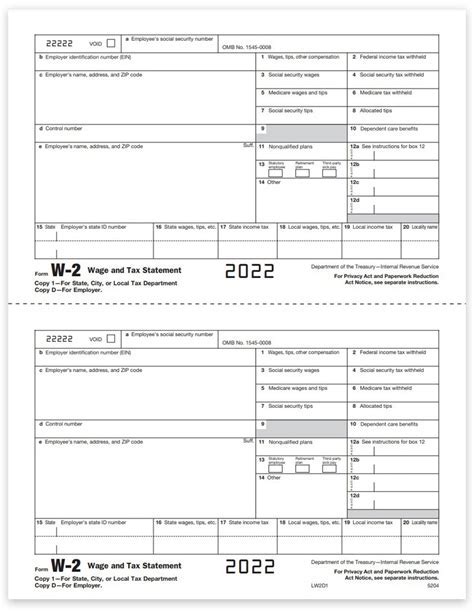

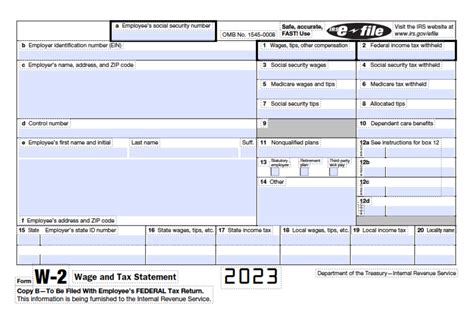

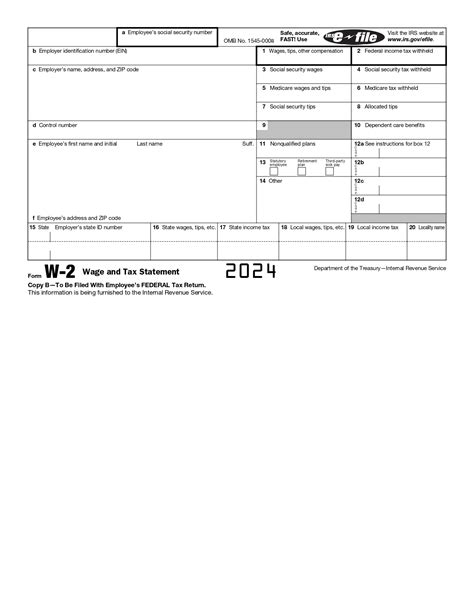

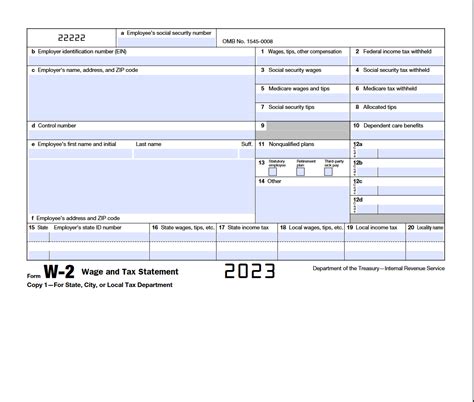

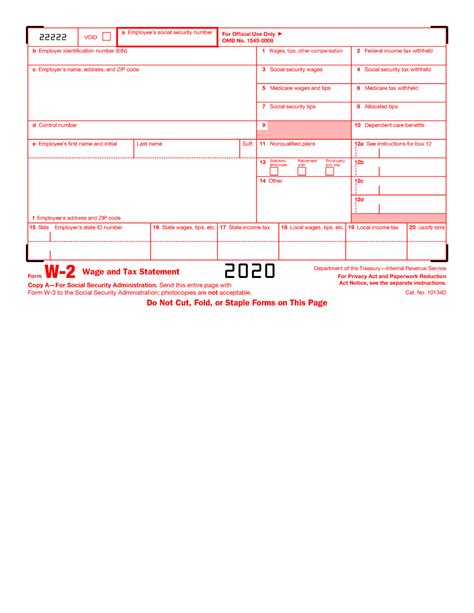

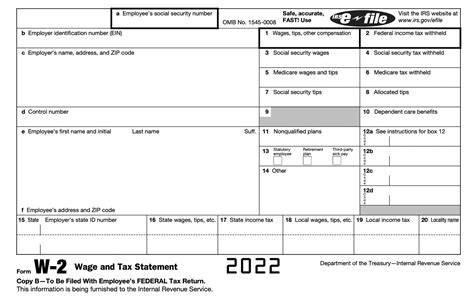

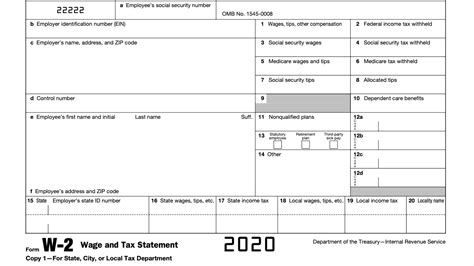

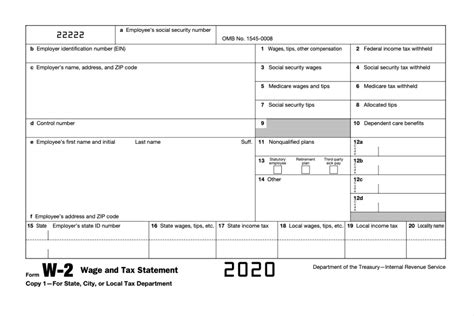

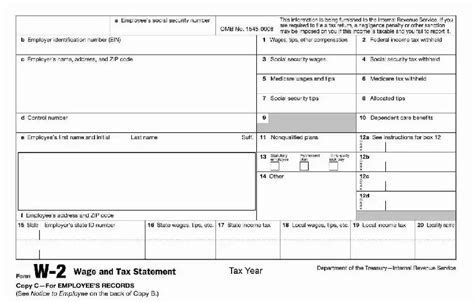

Download a free W2 Form Printable Template to simplify tax reporting. Easily fill out employee wages, taxes, and deductions with this IRS-approved template, ideal for payroll processing and compliance with tax laws and regulations.

The W2 form is a crucial document for both employers and employees in the United States. It serves as a record of an employee's income and taxes withheld, and it is used by the Internal Revenue Service (IRS) to track tax payments and ensure compliance with tax laws. In this article, we will delve into the world of W2 forms, exploring their importance, components, and the process of obtaining a W2 form printable template.

The W2 form is typically issued by employers to their employees by January 31st of each year, and it outlines the employee's income, taxes withheld, and other relevant tax information for the previous tax year. This form is essential for employees to file their tax returns accurately, and it is also used by the IRS to verify the accuracy of tax returns. With the rise of digital technology, it has become easier for employers to generate and distribute W2 forms to their employees. One popular option is to use a W2 form printable template, which can be easily downloaded and completed online.

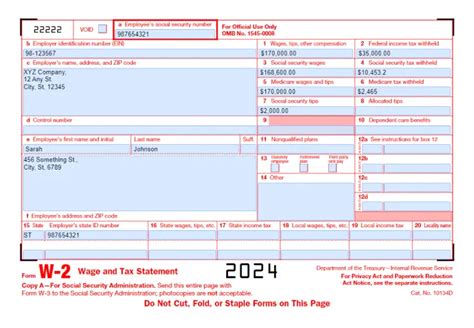

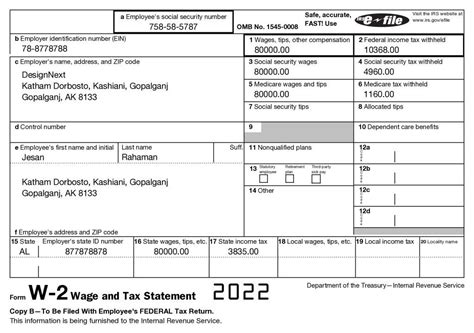

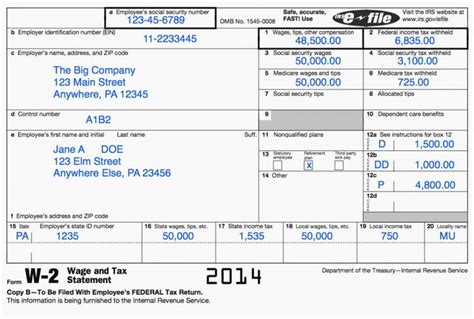

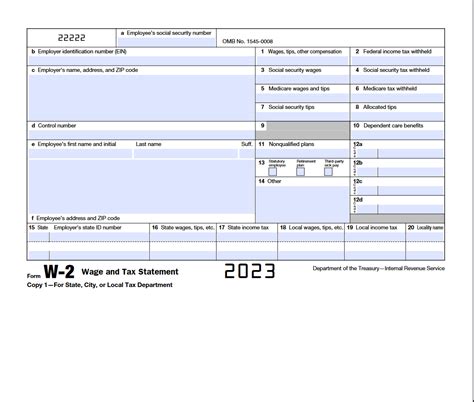

The W2 form contains several key pieces of information, including the employee's name, address, and Social Security number, as well as the employer's name, address, and Employer Identification Number (EIN). It also includes the employee's wages, tips, and other compensation, as well as the amount of federal income tax withheld, Social Security tax withheld, and Medicare tax withheld. Additionally, the W2 form may include other information, such as the amount of retirement plan contributions, dependent care benefits, and health savings account contributions.

Understanding the W2 Form Components

To complete a W2 form, employers must gather accurate and up-to-date information about their employees' income and taxes withheld. This includes calculating the correct amount of federal income tax withheld, Social Security tax withheld, and Medicare tax withheld. Employers must also ensure that they are using the correct W2 form printable template, which can be obtained from the IRS website or through a reputable online provider.

Benefits of Using a W2 Form Printable Template

Using a W2 form printable template offers several benefits for employers. For one, it saves time and reduces the risk of errors, as the template is pre-formatted and includes all the necessary fields and calculations. Additionally, a W2 form printable template can be easily customized to fit an employer's specific needs, and it can be used to generate multiple W2 forms for different employees. This can be especially helpful for small businesses or startups that may not have the resources to invest in specialized payroll software.

Steps to Obtain a W2 Form Printable Template

To obtain a W2 form printable template, employers can follow these steps: * Visit the IRS website and search for the W2 form printable template * Download the template and save it to their computer * Complete the template with the necessary information, including employee names, addresses, and tax information * Review and verify the accuracy of the information * Print and distribute the completed W2 forms to employeesW2 Form Printable Template Examples

There are several types of W2 form printable templates available, each with its own unique features and benefits. For example, some templates may include additional fields for reporting tips or other types of income, while others may be designed specifically for use with payroll software. Employers should choose a template that meets their specific needs and is compatible with their payroll system.

Common Mistakes to Avoid When Using a W2 Form Printable Template

When using a W2 form printable template, employers should be aware of common mistakes to avoid. These include: * Inaccurate or incomplete information * Incorrect calculations or formatting * Failure to include required fields or information * Using an outdated or incorrect template * Not verifying the accuracy of the information before distributing the W2 forms to employeesBest Practices for Using a W2 Form Printable Template

To ensure accuracy and compliance with tax laws, employers should follow best practices when using a W2 form printable template. These include:

- Verifying the accuracy of employee information and tax data

- Using the correct template and following IRS guidelines

- Completing the template carefully and accurately

- Reviewing and verifying the completed W2 forms before distributing them to employees

- Keeping accurate records of W2 forms and related tax information

W2 Form Printable Template FAQs

Some common questions and answers about W2 form printable templates include: * What is a W2 form printable template? * How do I obtain a W2 form printable template? * What information is required on a W2 form? * How do I complete a W2 form printable template? * What are the benefits of using a W2 form printable template?Gallery of W2 Form Printable Templates

W2 Form Image Gallery

What is a W2 form?

+A W2 form is a document that reports an employee's income and taxes withheld to the Internal Revenue Service (IRS).

How do I obtain a W2 form printable template?

+You can obtain a W2 form printable template from the IRS website or through a reputable online provider.

What information is required on a W2 form?

+A W2 form requires information such as the employee's name, address, and Social Security number, as well as the employer's name, address, and Employer Identification Number (EIN).

How do I complete a W2 form printable template?

+To complete a W2 form printable template, you will need to gather accurate and up-to-date information about your employees' income and taxes withheld, and then fill in the required fields on the template.

What are the benefits of using a W2 form printable template?

+Using a W2 form printable template can save time and reduce the risk of errors, as the template is pre-formatted and includes all the necessary fields and calculations.

In conclusion, a W2 form printable template is a valuable tool for employers who need to generate and distribute W2 forms to their employees. By understanding the components of a W2 form, following best practices, and avoiding common mistakes, employers can ensure accuracy and compliance with tax laws. Whether you are a small business owner or a large corporation, using a W2 form printable template can help streamline your payroll process and reduce the risk of errors. We invite you to share your experiences and tips for using W2 form printable templates, and to ask any questions you may have about this topic.