Intro

Discover 5 W2 printable forms for easy tax reporting, including employee, employer, and IRS forms, with fillable templates and printable worksheets for efficient W2 processing and compliance.

The importance of accurate and timely tax reporting cannot be overstated, particularly for employers and employees alike. One crucial aspect of this process involves the utilization of W2 printable forms. These forms are essential for reporting wages paid to employees and the taxes withheld from their pay. The W2 form, officially known as the Wage and Tax Statement, is a critical document that both employees and employers must understand and manage effectively. This article delves into the world of W2 printable forms, exploring their significance, how they work, and the steps involved in completing them accurately.

For employers, the process of generating and distributing W2 forms to their employees is a legal requirement. This process typically occurs at the beginning of each year, in preparation for tax filing season. The information contained within these forms is vital for employees to complete their tax returns accurately, ensuring they claim the correct amount of taxes withheld and potentially receive the refunds they are due. Moreover, the data from W2 forms is also used by the Social Security Administration to track earnings and determine Social Security benefits.

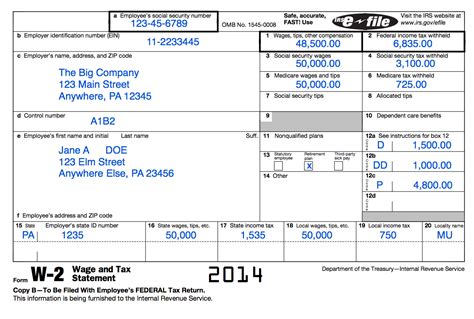

The preparation and distribution of W2 forms involve several key steps. Employers must first gather all necessary information, including employee names, addresses, Social Security numbers, wages paid, and taxes withheld. This information is then used to fill out the W2 form, either manually or through payroll software designed to streamline the process. Once completed, employers must provide each employee with a copy of their W2 form by a specified deadline, usually by January 31st of each year. Employers also submit a copy of all W2 forms to the Social Security Administration, along with a W3 form, which is a transmittal form summarizing the information from all the W2 forms.

Understanding W2 Forms

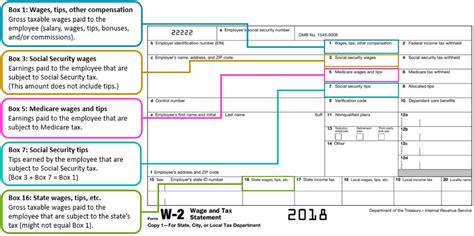

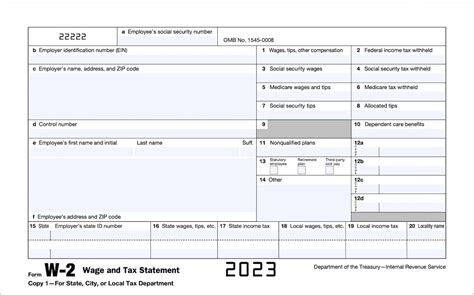

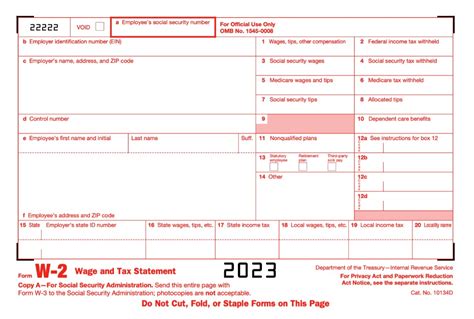

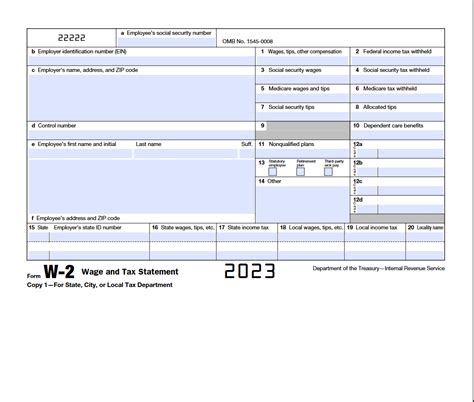

Understanding the components of a W2 form is essential for both employers and employees. The form is divided into several boxes, each containing specific information. Box 1, for instance, reports the employee's wages, tips, and other compensation, while Box 2 indicates the federal income tax withheld from those wages. Other boxes provide details on Social Security wages, Social Security tax withheld, Medicare wages and tips, and Medicare tax withheld, among other things. Accurate completion of these boxes ensures that employees can file their taxes correctly and that employers meet their legal obligations.

Benefits of Using W2 Printable Forms

The use of W2 printable forms offers several benefits, particularly in terms of convenience and accuracy. For employers, these forms can be easily generated and printed, reducing the administrative burden associated with tax reporting. Additionally, using printable forms can help minimize errors, as the format is standardized and less prone to mistakes compared to manual completion. Employees also benefit, as they receive a clear and concise document that outlines their tax withholding information, making the tax filing process smoother.

Steps to Complete W2 Forms Accurately

Completing W2 forms accurately involves several steps:

- Gather Employee Information: Collect each employee's name, address, and Social Security number.

- Calculate Wages and Taxes: Determine the total wages paid and taxes withheld for each employee.

- Fill Out the Form: Use the gathered information to fill out each box on the W2 form.

- Review for Accuracy: Double-check the form for any errors or omissions.

- Distribute to Employees: Provide each employee with their W2 form by the specified deadline.

- Submit to SSA: Send a copy of all W2 forms and the W3 transmittal form to the Social Security Administration.

Common Mistakes to Avoid

When completing W2 forms, it's crucial to avoid common mistakes that can lead to delays or penalties. These include:

- Incorrect or missing Social Security numbers.

- Inaccurate wages or tax withholding amounts.

- Failure to distribute forms to employees on time.

- Not submitting forms to the Social Security Administration.

Using Payroll Software for W2 Forms

Many employers utilize payroll software to generate and manage W2 forms. This software can automatically calculate wages and taxes, fill out the forms, and even submit them electronically to the Social Security Administration. Using payroll software can significantly reduce the risk of errors and streamline the entire process, making it a valuable tool for employers of all sizes.

Security and Privacy Concerns

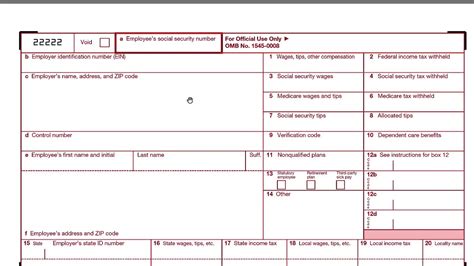

Given the sensitive nature of the information contained on W2 forms, security and privacy are of utmost concern. Employers must ensure that they handle and store these forms securely, protecting them from unauthorized access. This includes using secure methods for distributing the forms to employees, such as mailing them directly to the employee's address or using a secure online portal.

Electronic Filing of W2 Forms

The Social Security Administration encourages employers to file W2 forms electronically, as it reduces errors and speeds up processing times. Employers with 250 or more W2 forms are required to file electronically. This process involves using IRS-approved software to generate an electronic file that is then submitted to the SSA through their Business Services Online portal.

Conclusion and Next Steps

In conclusion, W2 printable forms play a vital role in the tax reporting process for both employers and employees. Understanding how to complete these forms accurately and the benefits of using printable forms can simplify tax season. By following the steps outlined and avoiding common mistakes, employers can ensure compliance with tax laws and provide their employees with the necessary information for their tax returns. As technology continues to evolve, the use of payroll software and electronic filing will become even more prevalent, further streamlining the process.

W2 Forms Image Gallery

What is the deadline for distributing W2 forms to employees?

+The deadline for distributing W2 forms to employees is January 31st of each year.

How do I correct a mistake on a W2 form that has already been submitted?

+To correct a mistake, you will need to complete a W2c form, which is a corrected W2 form, and submit it to the Social Security Administration.

Can I file W2 forms electronically if I have fewer than 250 forms?

+Yes, while it is not required for employers with fewer than 250 W2 forms, electronic filing is still an option and can simplify the process.

We hope this comprehensive guide to W2 printable forms has been informative and helpful. Whether you're an employer looking to streamline your tax reporting process or an employee seeking to understand your tax withholding information better, the importance of accurate and timely W2 form completion cannot be overstated. Feel free to share this article with others who might find it useful, and don't hesitate to reach out with any further questions or comments. Your engagement and feedback are valued, and we look forward to providing more insightful content in the future.