Intro

Master 5 W9 Forms tips for hassle-free tax compliance, including accurate identification, vendor management, and IRS requirements, to streamline your businesss paperwork and avoid penalties.

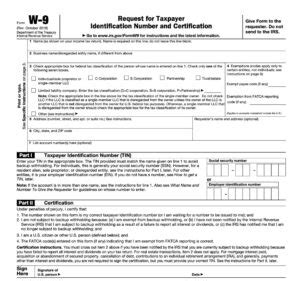

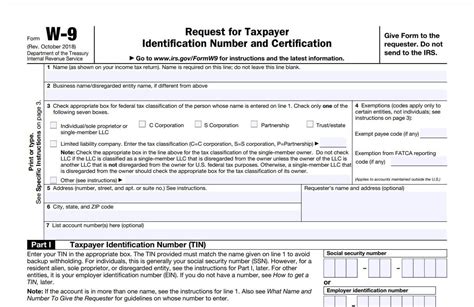

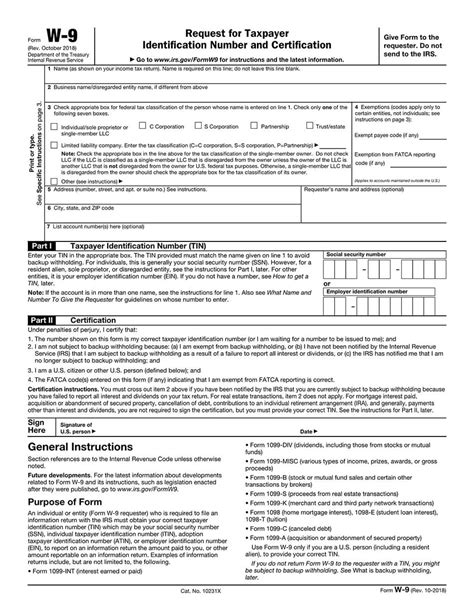

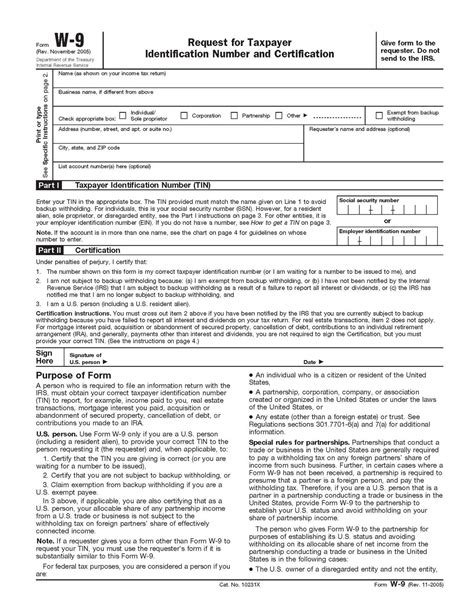

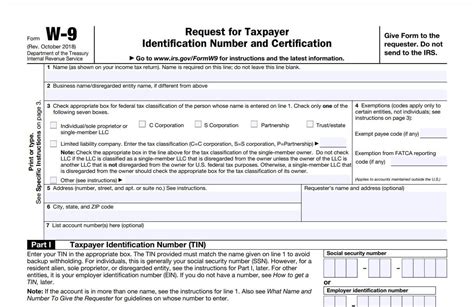

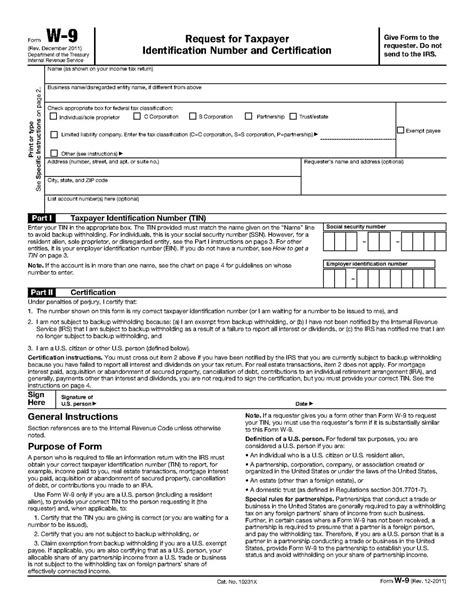

The 5 W9 Forms Tips are essential for businesses and individuals to understand, as they play a crucial role in ensuring compliance with tax regulations. The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by businesses to verify the identity and tax status of their vendors, contractors, and other payees. In this article, we will delve into the importance of W9 forms, their benefits, and provide valuable tips on how to complete them accurately.

The W9 form is a critical document that helps businesses comply with tax laws and regulations. It is used to collect information about a payee's tax identification number, name, and address, as well as their tax classification, such as individual, corporation, or partnership. The information provided on the W9 form is used to generate a 1099-MISC form, which reports the income paid to the payee during the tax year. The 1099-MISC form is then used by the payee to report their income on their tax return.

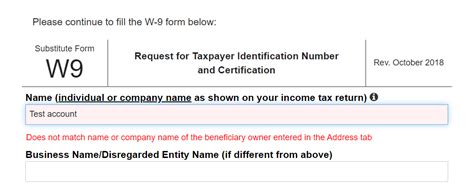

Completing a W9 form accurately is essential to avoid any potential issues with the IRS. An incorrect or incomplete W9 form can lead to delays in payment, penalties, and even audits. Therefore, it is crucial to understand the importance of W9 forms and how to complete them correctly. In the following sections, we will provide 5 valuable tips on how to complete a W9 form accurately and efficiently.

Understanding the W9 Form

Benefits of W9 Forms

5 W9 Forms Tips

Common Mistakes to Avoid

Best Practices for W9 Forms

Conclusion and Next Steps

W9 Forms Image Gallery

What is a W9 form?

+A W9 form is a document used by businesses to verify the identity and tax status of their vendors, contractors, and other payees.

Why is it important to complete a W9 form accurately?

+Completing a W9 form accurately is essential to avoid any potential issues with the IRS, such as delays in payment, penalties, and audits.

What are the common mistakes to avoid when completing a W9 form?

+Common mistakes to avoid include providing an incorrect or incomplete tax identification number, choosing the incorrect tax classification, and not keeping a copy of the completed W9 form.

How often should I review and update the W9 form?

+It is recommended to review and update the W9 form regularly, such as annually, to ensure accuracy and compliance.

What are the benefits of using W9 forms?

+The benefits of using W9 forms include ensuring compliance with tax regulations, generating accurate 1099-MISC forms, and preventing errors and potential audits.

We hope this article has provided you with valuable information and tips on how to complete a W9 form accurately and efficiently. If you have any further questions or concerns, please do not hesitate to comment below. Share this article with your friends and colleagues to help them understand the importance of W9 forms and how to complete them correctly. Take the first step today and ensure compliance with tax regulations by following the 5 W9 forms tips outlined in this article.