Intro

Download 5 free W9 printable forms, including fillable and editable templates, for easy IRS tax reporting, independent contractor management, and compliance with tax laws and regulations.

The 5 W9 printable forms are essential documents for businesses and individuals to report their income and taxes to the Internal Revenue Service (IRS). Understanding the importance of these forms is crucial for maintaining compliance with tax laws and avoiding potential penalties. In this article, we will delve into the world of W9 forms, exploring their significance, benefits, and step-by-step guides on how to complete them.

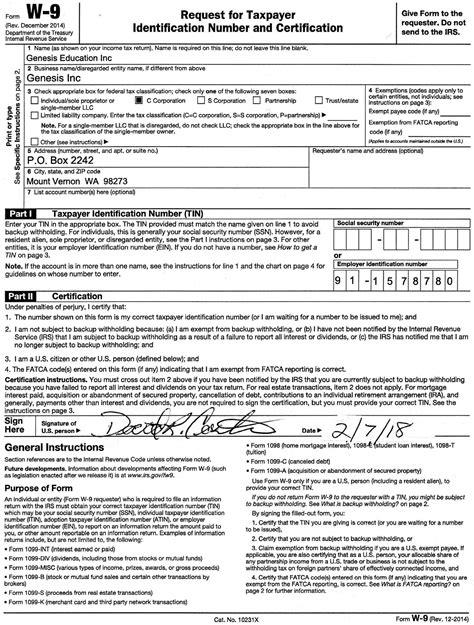

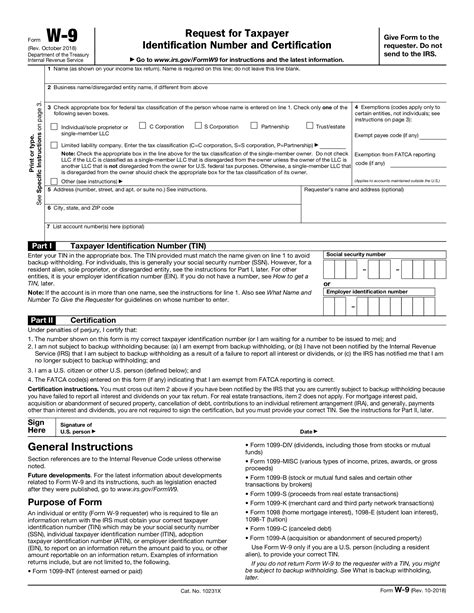

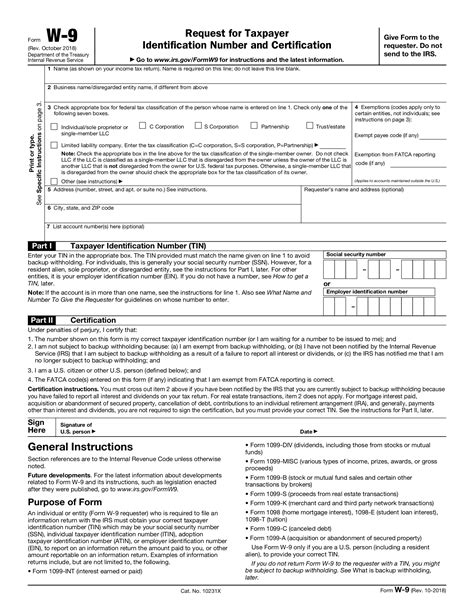

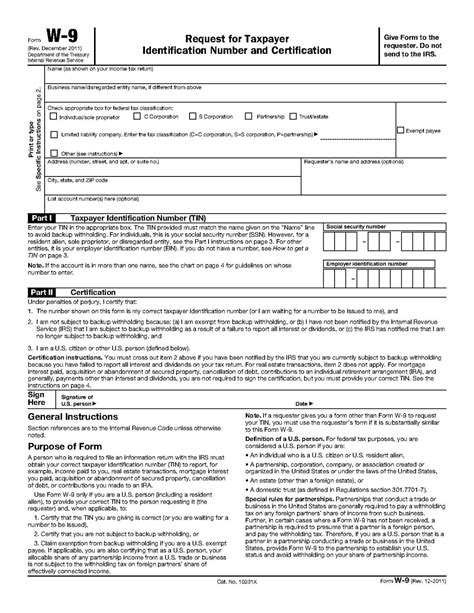

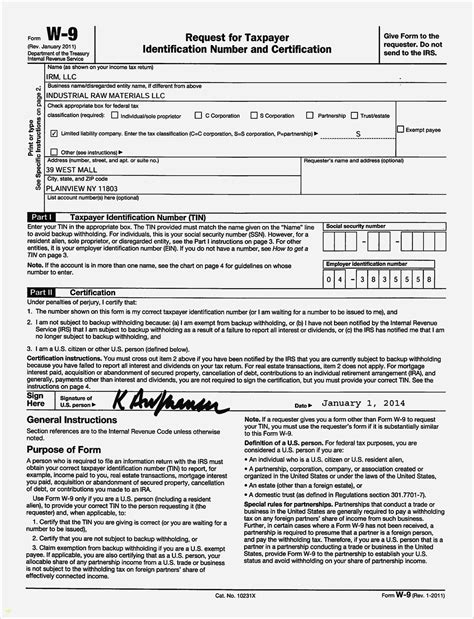

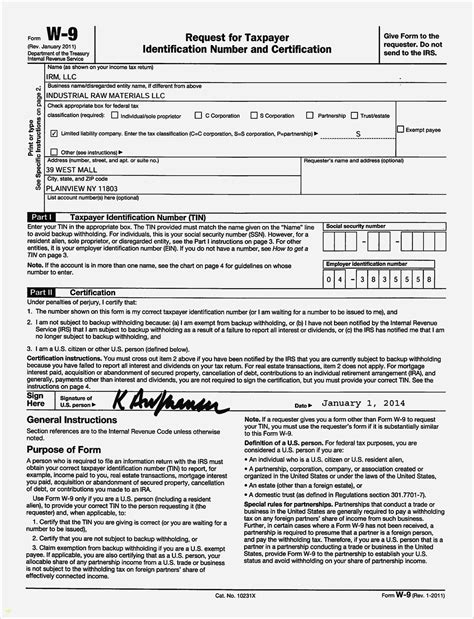

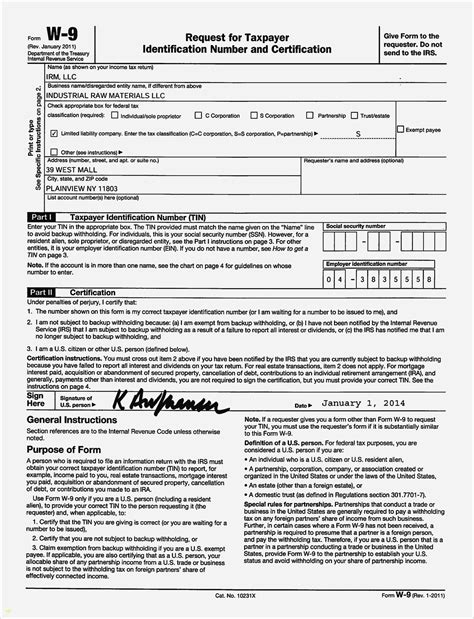

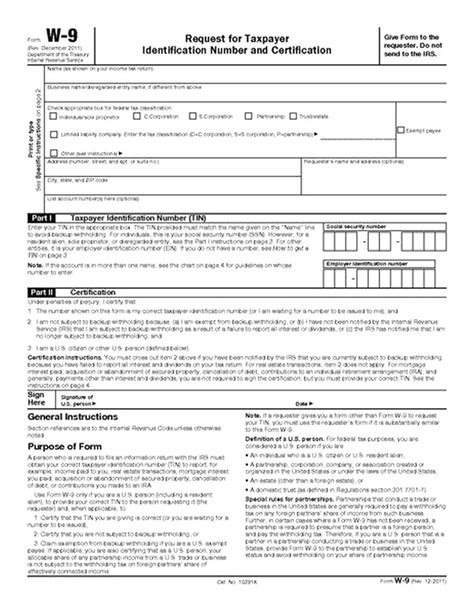

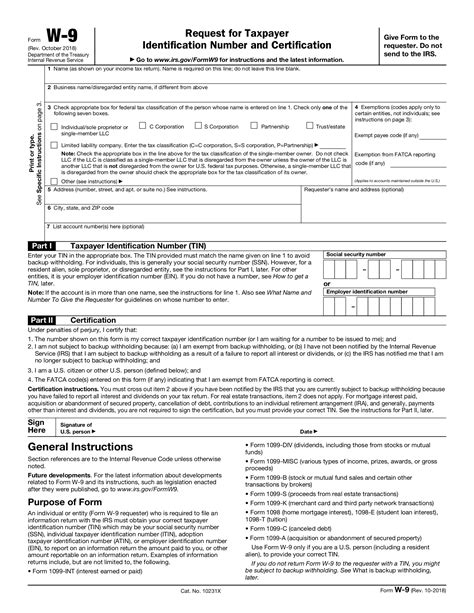

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document used by businesses to collect necessary information from their vendors, freelancers, and independent contractors. This information includes the taxpayer identification number, name, and address, which are essential for reporting income and taxes to the IRS. The 5 W9 printable forms refer to the different types of W9 forms that cater to various business needs and industries.

Completing a W9 form is a straightforward process that requires attention to detail and accuracy. The form typically includes sections for the taxpayer's name, business name, address, taxpayer identification number, and certification. It is essential to ensure that all information provided is correct and up-to-date to avoid any potential issues with the IRS. Businesses can obtain W9 forms from the IRS website or use printable templates available online.

Benefits of Using W9 Forms

Using W9 forms offers numerous benefits for businesses and individuals. Some of the advantages include:

- Simplified tax reporting: W9 forms provide a standardized way of collecting taxpayer information, making it easier for businesses to report income and taxes to the IRS.

- Reduced errors: By using W9 forms, businesses can minimize errors and inconsistencies in taxpayer information, reducing the risk of penalties and fines.

- Improved compliance: W9 forms help businesses maintain compliance with tax laws and regulations, ensuring that they are meeting their tax obligations.

Types of W9 Forms

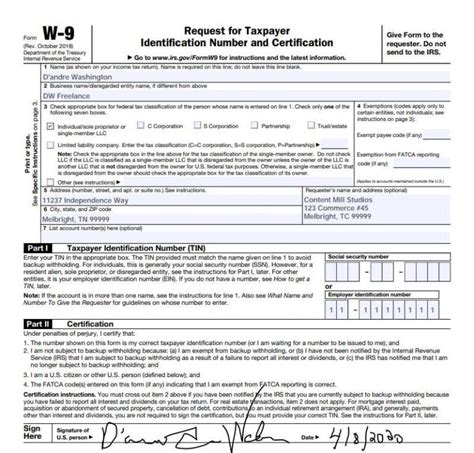

There are several types of W9 forms available, each catering to specific business needs and industries. Some of the most common types of W9 forms include:

- Standard W9 Form: This is the most commonly used W9 form, suitable for most businesses and individuals.

- W9 Form for Freelancers: This form is designed specifically for freelancers and independent contractors, providing additional information required for tax reporting.

- W9 Form for Vendors: This form is used by businesses to collect information from their vendors and suppliers.

- W9 Form for Real Estate: This form is used in the real estate industry to report income and taxes related to property transactions.

- W9 Form for Non-Profit Organizations: This form is designed for non-profit organizations, providing additional information required for tax-exempt status.

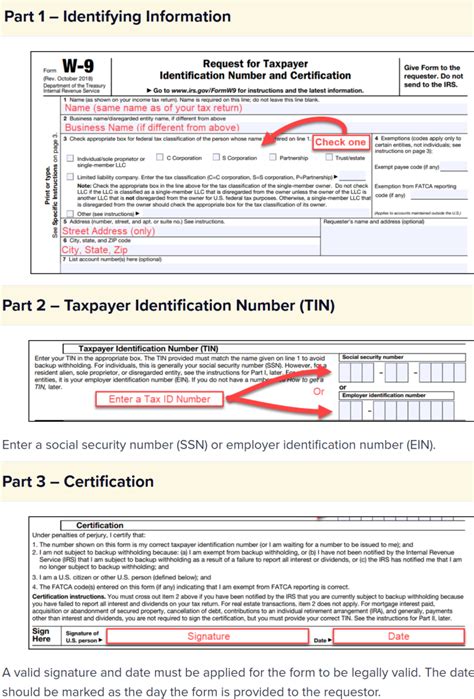

Step-by-Step Guide to Completing a W9 Form

Completing a W9 form is a straightforward process that requires attention to detail and accuracy. Here is a step-by-step guide to help you complete a W9 form:

- Download the W9 Form: Obtain a W9 form from the IRS website or use a printable template available online.

- Enter Your Name and Business Name: Provide your name and business name, ensuring that the information is accurate and up-to-date.

- Enter Your Address: Provide your address, including your street address, city, state, and ZIP code.

- Enter Your Taxpayer Identification Number: Provide your taxpayer identification number, which can be your Social Security number or Employer Identification Number (EIN).

- Certify Your Information: Certify that the information provided is accurate and true, signing and dating the form.

Common Mistakes to Avoid When Completing a W9 Form

When completing a W9 form, it is essential to avoid common mistakes that can lead to errors and penalties. Some of the most common mistakes to avoid include:

- Inaccurate Information: Ensure that all information provided is accurate and up-to-date, including your name, business name, address, and taxpayer identification number.

- Missing Information: Ensure that all required fields are completed, including your name, business name, address, taxpayer identification number, and certification.

- Incorrect Taxpayer Identification Number: Ensure that your taxpayer identification number is correct, whether it is your Social Security number or EIN.

Best Practices for Managing W9 Forms

Managing W9 forms effectively is crucial for maintaining compliance with tax laws and regulations. Some best practices for managing W9 forms include:

- Keep Accurate Records: Maintain accurate and up-to-date records of all W9 forms, including the date received and the taxpayer identification number.

- Verify Information: Verify the information provided on the W9 form, ensuring that it is accurate and consistent with other records.

- Update Records: Update your records regularly to reflect any changes in taxpayer information, including name, address, or taxpayer identification number.

Conclusion and Next Steps

In conclusion, the 5 W9 printable forms are essential documents for businesses and individuals to report their income and taxes to the IRS. By understanding the importance of W9 forms, completing them accurately, and managing them effectively, businesses can maintain compliance with tax laws and regulations, avoiding potential penalties and fines. To learn more about W9 forms and tax compliance, visit the IRS website or consult with a tax professional.

W9 Forms Image Gallery

What is a W9 form?

+A W9 form is a document used by businesses to collect necessary information from their vendors, freelancers, and independent contractors, including their taxpayer identification number, name, and address.

How do I complete a W9 form?

+To complete a W9 form, download the form from the IRS website or use a printable template, enter your name and business name, address, taxpayer identification number, and certify your information.

What are the benefits of using W9 forms?

+The benefits of using W9 forms include simplified tax reporting, reduced errors, and improved compliance with tax laws and regulations.

What are the common mistakes to avoid when completing a W9 form?

+Common mistakes to avoid when completing a W9 form include inaccurate information, missing information, and incorrect taxpayer identification number.

How do I manage W9 forms effectively?

+To manage W9 forms effectively, keep accurate records, verify information, and update records regularly to reflect any changes in taxpayer information.

We hope this article has provided you with a comprehensive understanding of the 5 W9 printable forms and their importance in tax compliance. If you have any further questions or concerns, please do not hesitate to comment below or share this article with others who may find it helpful. Additionally, you can visit the IRS website or consult with a tax professional to learn more about W9 forms and tax compliance.