Intro

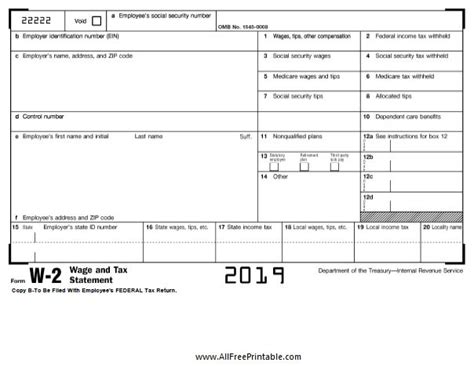

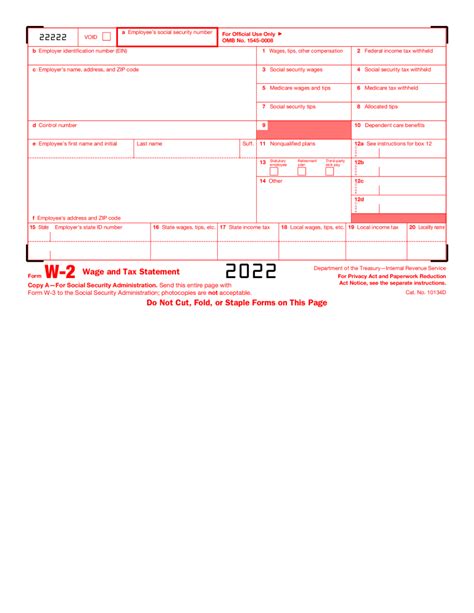

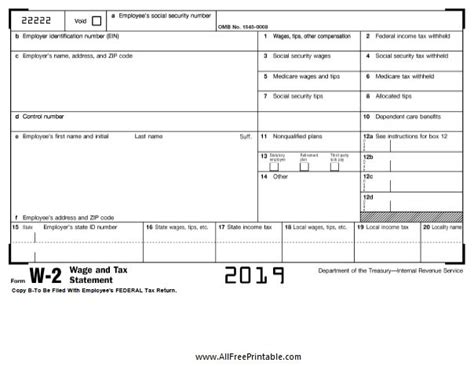

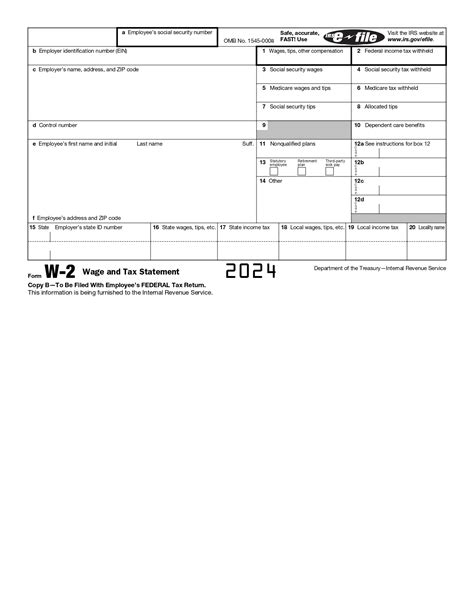

Get instant access to a free W2 Form Printable Template, featuring fillable fields for employee wages, taxes, and deductions, making tax season easier with printable W-2 forms and IRS compliant templates.

The W2 form is a crucial document for both employers and employees in the United States. It serves as a record of an employee's annual wages and taxes withheld, which is essential for filing income tax returns. Employers are required to provide a W2 form to each employee by January 31st of every year, and the form must be submitted to the Social Security Administration (SSA) by the same deadline. In this article, we will delve into the world of W2 forms, exploring their importance, components, and providing a comprehensive guide on how to obtain a W2 form printable template.

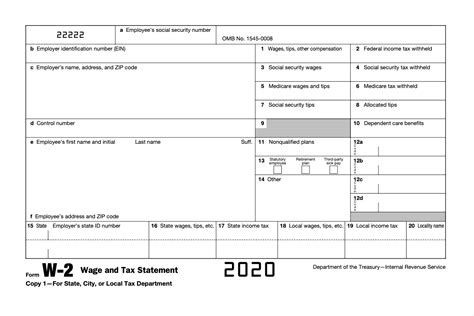

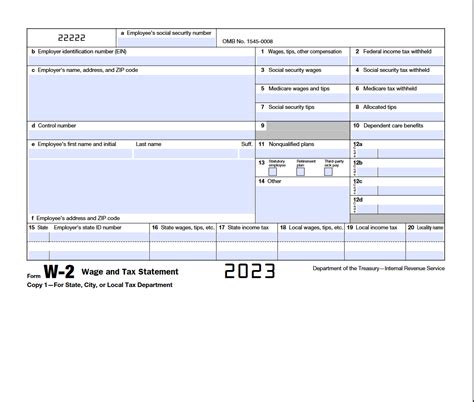

The W2 form is a vital tool for employees to accurately report their income and claim deductions and credits on their tax returns. It contains crucial information, such as the employee's name, address, Social Security number, and the amount of wages, tips, and taxes withheld. Employers must ensure that the W2 form is accurate and complete, as errors can lead to delays in processing tax returns and potential penalties. The importance of the W2 form cannot be overstated, as it plays a critical role in the tax filing process.

For employers, the W2 form is a necessary document that must be provided to each employee. It serves as a record of the employee's wages and taxes withheld, which is essential for filing the employer's tax returns. The W2 form also contains information about the employer, such as their name, address, and Employer Identification Number (EIN). This information is crucial for the SSA to verify the employer's identity and ensure that the correct amount of taxes is being withheld.

Understanding the W2 Form

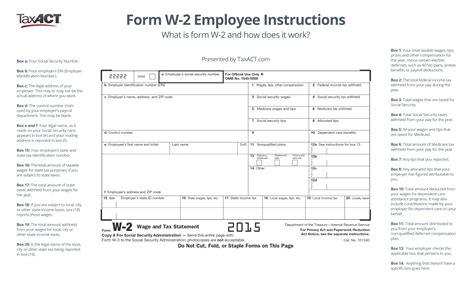

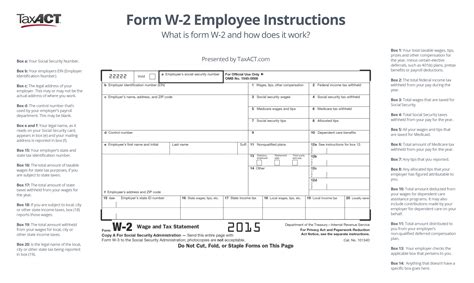

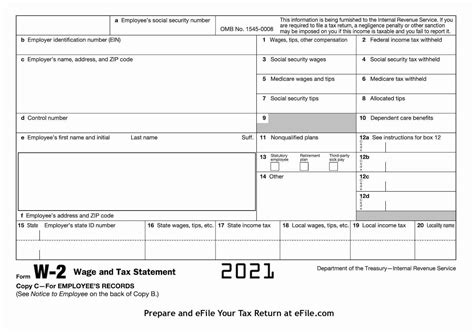

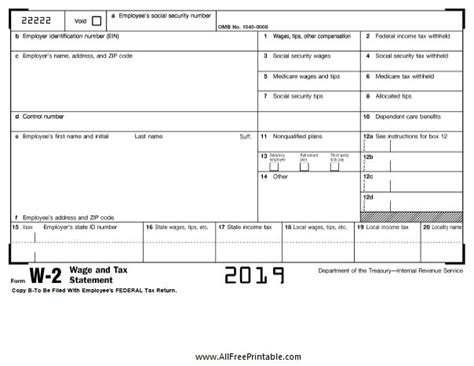

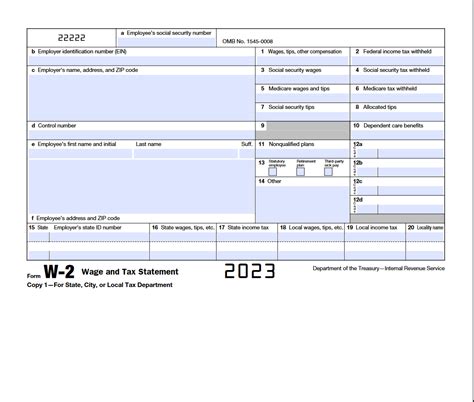

The W2 form is a complex document that contains several sections and boxes. Each box represents a specific type of income or tax withholding, and it is essential to understand what each box represents. The most common boxes on the W2 form include: * Box 1: Wages, tips, and other compensation * Box 2: Federal income tax withheld * Box 3: Social Security wages * Box 4: Social Security tax withheld * Box 5: Medicare wages and tips * Box 6: Medicare tax withheld * Box 7: Social Security tips * Box 8: Allocated tips * Box 10: Dependent care benefits

Obtaining a W2 Form Printable Template

There are several ways to obtain a W2 form printable template. Employers can purchase W2 forms from office supply stores or online retailers, or they can download a printable template from the SSA website. The SSA provides a free W2 form printable template that can be downloaded and printed on plain paper. However, it is essential to note that the SSA requires employers to use a specific type of paper and ink when printing W2 forms.

Benefits of Using a W2 Form Printable Template

Using a W2 form printable template can save employers time and money. It eliminates the need to purchase pre-printed W2 forms, which can be expensive, especially for small businesses. Additionally, a printable template can be easily customized to include the employer's logo and other relevant information. This can help to create a professional and polished appearance, which is essential for maintaining a positive reputation.

Steps to Complete a W2 Form

Completing a W2 form can be a complex process, especially for employers who are new to the process. Here are the steps to follow: 1. Gather all necessary information, including the employee's name, address, Social Security number, and wages and taxes withheld. 2. Fill out the employer's information, including their name, address, and EIN. 3. Complete the employee's information, including their name, address, and Social Security number. 4. Calculate the employee's wages and taxes withheld, and fill out the corresponding boxes on the W2 form. 5. Review the W2 form for accuracy and completeness, and make any necessary corrections.

Common Mistakes to Avoid

When completing a W2 form, there are several common mistakes to avoid. These include: * Inaccurate or incomplete information * Incorrect calculations * Failure to include all necessary information * Using the wrong type of paper or ink

W2 Form Filing Requirements

Employers are required to file W2 forms with the SSA by January 31st of every year. This can be done electronically or by mail. Employers who file electronically must use the SSA's Business Services Online (BSO) system, which provides a secure and efficient way to submit W2 forms. Employers who file by mail must use a specific type of envelope and include a completed Form W3, which is a transmittal form that accompanies the W2 forms.

Penalties for Late Filing

Employers who fail to file W2 forms on time may be subject to penalties. The SSA imposes a penalty of $30 per form for late filing, with a maximum penalty of $250,000 per year. Additionally, employers who intentionally disregard the filing requirements may be subject to a penalty of $100 per form, with a maximum penalty of $500,000 per year.

W2 Form Image Gallery

What is a W2 form?

+A W2 form is a document that employers provide to their employees, showing the employee's annual wages and taxes withheld.

How do I obtain a W2 form printable template?

+You can obtain a W2 form printable template from the SSA website or by purchasing W2 forms from an office supply store.

What are the penalties for late filing of W2 forms?

+The SSA imposes a penalty of $30 per form for late filing, with a maximum penalty of $250,000 per year.

In conclusion, the W2 form is a critical document that plays a vital role in the tax filing process. Employers must provide a W2 form to each employee by January 31st of every year, and the form must be submitted to the SSA by the same deadline. By understanding the importance of the W2 form and using a printable template, employers can save time and money, while also ensuring that they are in compliance with the SSA's filing requirements. We hope that this article has provided you with valuable information and insights into the world of W2 forms. If you have any questions or comments, please do not hesitate to reach out to us. Share this article with your friends and colleagues, and help us spread the word about the importance of W2 forms.