Intro

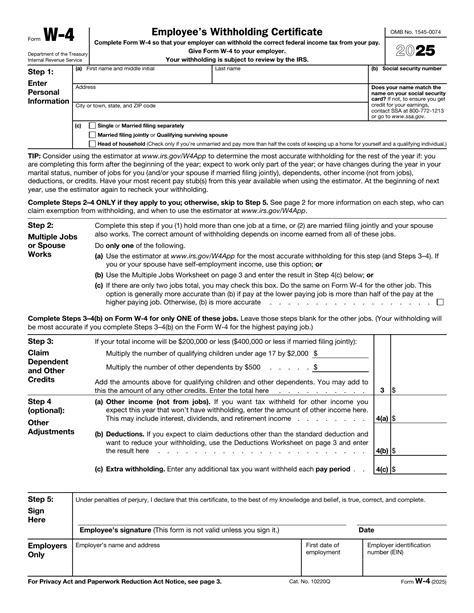

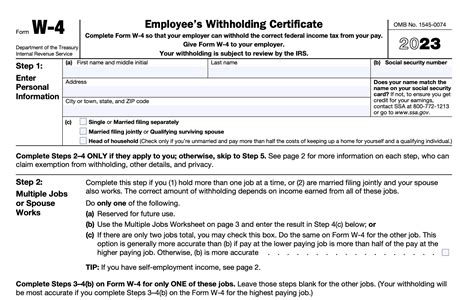

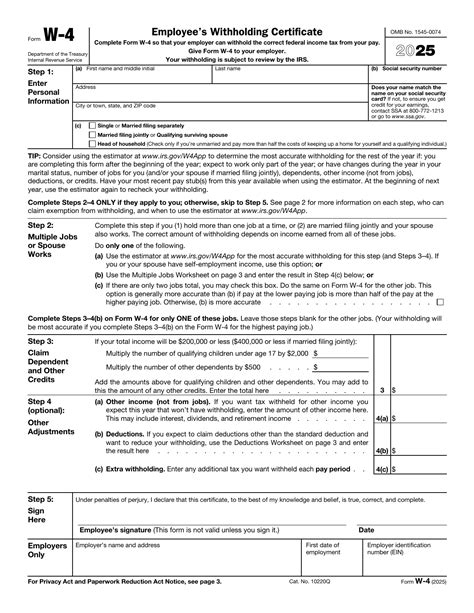

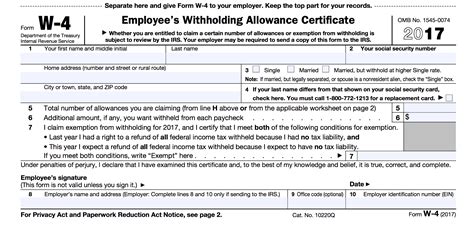

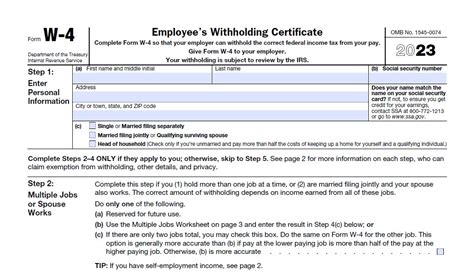

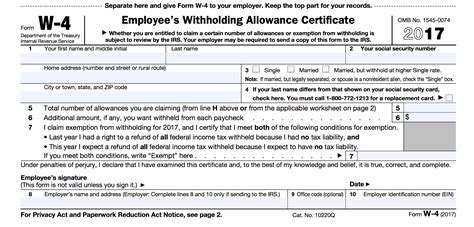

Download W4 printable form template for employee tax withholding, featuring IRS-approved layout and fields for exemptions, deductions, and filing status, making it easy to manage payroll and tax compliance with accuracy and efficiency.

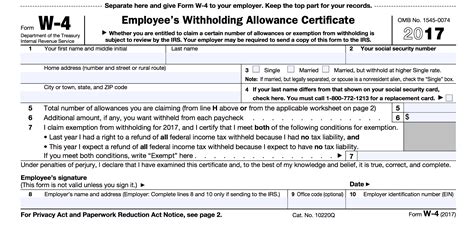

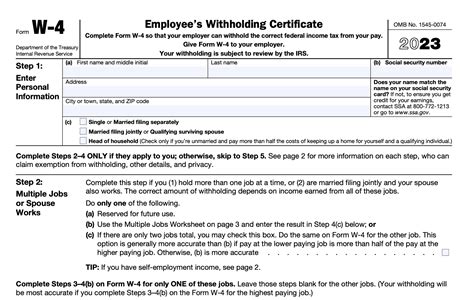

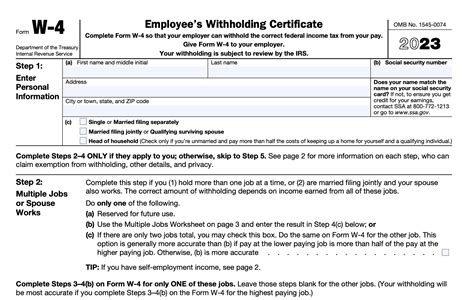

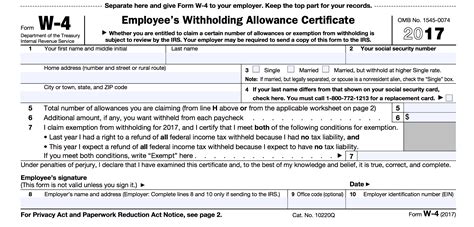

The W4 printable form template is a crucial document for employees and employers alike, as it plays a significant role in determining the amount of federal income tax to be withheld from an employee's wages. The W4 form, also known as the Employee's Withholding Certificate, is used by employers to calculate the correct amount of taxes to be deducted from an employee's paycheck. In this article, we will delve into the world of W4 printable form templates, exploring their importance, benefits, and how to use them effectively.

The W4 form is typically completed by employees when they start a new job or experience a change in their tax situation, such as getting married, having children, or changing their address. The form requires employees to provide personal and financial information, including their name, address, Social Security number, and the number of allowances they claim. The number of allowances claimed affects the amount of taxes withheld from an employee's wages, with more allowances resulting in less tax being withheld.

Understanding the W4 Form

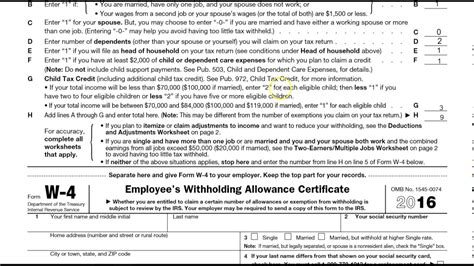

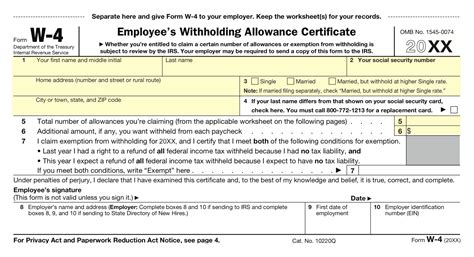

The W4 form consists of several sections, including personal information, withholding allowances, and additional income or deductions. Employees must carefully complete each section to ensure accurate tax withholding. The form also includes a worksheet to help employees determine the correct number of allowances to claim based on their individual circumstances.

Benefits of Using a W4 Printable Form Template

Using a W4 printable form template offers several benefits, including convenience, accuracy, and compliance with tax regulations. The template provides a standardized format for employees to complete their tax information, reducing errors and ensuring that all necessary information is included. Additionally, the template can be easily printed and completed by hand or filled out electronically, making it a flexible solution for employees and employers.

How to Complete a W4 Form

Completing a W4 form requires careful attention to detail and an understanding of the tax implications of the information provided. Employees should start by completing the personal information section, including their name, address, and Social Security number. Next, they should determine the number of withholding allowances to claim, using the worksheet provided on the form. The worksheet takes into account factors such as the employee's filing status, number of dependents, and other income or deductions.

Steps to Complete a W4 Form

The following steps can help employees complete a W4 form accurately:

- Step 1: Complete the personal information section

- Step 2: Determine the number of withholding allowances to claim

- Step 3: Complete the worksheet to calculate the correct number of allowances

- Step 4: Sign and date the form

- Step 5: Submit the completed form to the employer

Common Mistakes to Avoid When Completing a W4 Form

When completing a W4 form, employees should avoid common mistakes, such as:

- Claiming too many or too few withholding allowances

- Failing to report additional income or deductions

- Not signing and dating the form

- Not submitting the completed form to the employer

Gallery of W4 Form Templates

W4 Form Template Gallery

Frequently Asked Questions

What is the purpose of the W4 form?

+The W4 form is used to determine the amount of federal income tax to be withheld from an employee's wages.

How often should I complete a W4 form?

+You should complete a W4 form when you start a new job or experience a change in your tax situation, such as getting married or having children.

What happens if I claim too many or too few withholding allowances?

+If you claim too many allowances, you may owe taxes when you file your tax return. If you claim too few allowances, you may have too much tax withheld from your wages.

Can I complete a W4 form electronically?

+Yes, many employers offer electronic W4 forms that can be completed and submitted online.

What should I do if I have questions about completing a W4 form?

+You should contact your employer's human resources department or a tax professional for assistance.

In conclusion, the W4 printable form template is an essential tool for employees and employers to ensure accurate tax withholding. By understanding the importance of the W4 form, using a printable form template, and avoiding common mistakes, employees can ensure that their taxes are withheld correctly. We invite you to share your thoughts and experiences with W4 forms in the comments below. If you found this article helpful, please share it with others who may benefit from this information.