Intro

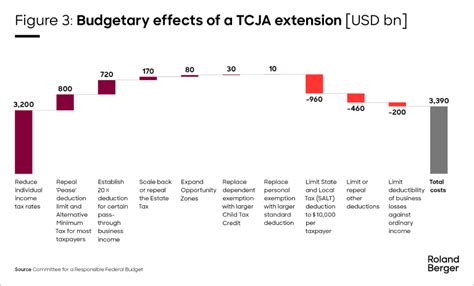

Understand the implications of the Trump TCJA extension on taxpayers. Learn whats at stake for individuals and businesses as the Tax Cuts and Jobs Act provisions are set to expire. Discover the key tax changes, including individual and corporate tax rates, deductions, and credits, and how to prepare for the potential tax law changes.

As the nation continues to navigate the complexities of the Trump Tax Cuts and Jobs Act (TCJA), one pressing concern for taxpayers is the looming expiration of certain provisions. The TCJA, signed into law in 2017, introduced sweeping changes to the U.S. tax code, with many of its provisions set to sunset in the coming years. In this article, we will explore what's at stake for taxpayers as the TCJA extension approaches.

Understanding the TCJA

Before delving into the specifics of the TCJA extension, it's essential to understand the law's core components. The TCJA aimed to stimulate economic growth by reducing corporate and individual tax rates, increasing the standard deduction, and limiting certain deductions. Key provisions include:

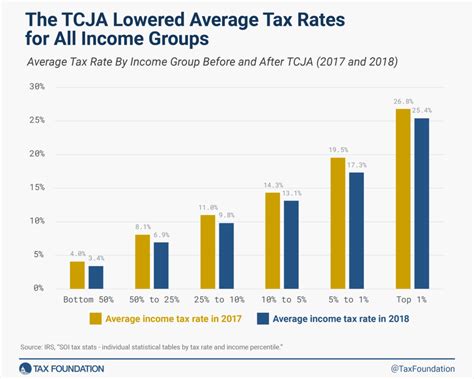

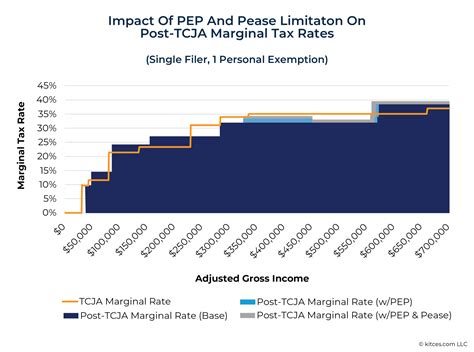

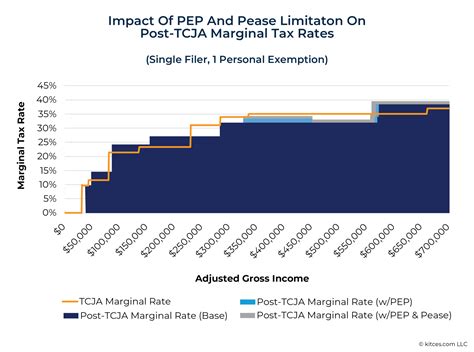

- Lower individual tax rates across seven brackets

- Reduced corporate tax rate from 35% to 21%

- Increased standard deduction from $6,350 to $12,000 for single filers and $12,700 to $24,000 for joint filers

- State and Local Tax (SALT) deduction cap of $10,000

- Mortgage interest deduction limit of $750,000

Provisions Set to Expire

Several TCJA provisions are set to expire or sunset in the coming years, affecting various taxpayer groups. These include:

- Individual tax rate reductions: The lower individual tax rates introduced by the TCJA are set to expire on December 31, 2025. If not extended, tax rates will revert to pre-TCJA levels.

- State and Local Tax (SALT) deduction cap: The $10,000 SALT deduction cap, which affects high-income taxpayers, is set to expire on December 31, 2025.

- Mortgage interest deduction limit: The $750,000 mortgage interest deduction limit, which applies to new mortgages, is set to expire on December 31, 2025.

What's at Stake for Taxpayers?

The looming expiration of TCJA provisions raises significant concerns for taxpayers. Here are some key implications:

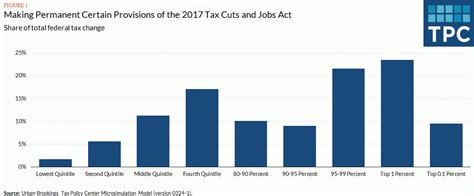

- Higher tax bills: If the individual tax rate reductions expire, taxpayers can expect higher tax bills. This could disproportionately affect middle-class families, who may face increased tax liabilities.

- Reduced housing market activity: The expiration of the mortgage interest deduction limit could lead to reduced housing market activity, as higher mortgage interest rates may deter potential buyers.

- Increased SALT deduction: If the SALT deduction cap expires, high-income taxpayers may see increased tax deductions, which could lead to reduced tax liabilities.

Possible Extension or Repeal Scenarios

Several scenarios could play out as the TCJA extension approaches:

- Extension of TCJA provisions: Lawmakers may extend the TCJA provisions, maintaining the current tax landscape. This could provide stability for taxpayers and the economy.

- Repeal of TCJA provisions: Conversely, lawmakers may repeal certain TCJA provisions, potentially leading to increased tax revenues but also affecting taxpayers.

- Modification of TCJA provisions: Lawmakers may modify certain TCJA provisions, such as adjusting the SALT deduction cap or mortgage interest deduction limit.

Impact on Tax Planning and Compliance

The uncertainty surrounding the TCJA extension can create challenges for taxpayers and tax professionals. Key considerations include:

- Tax planning: Taxpayers should review their tax plans to account for potential changes to the tax code.

- Compliance: Taxpayers must ensure compliance with current tax laws and regulations, while also preparing for potential changes.

Conclusion

As the TCJA extension approaches, taxpayers must navigate the complex and evolving tax landscape. Understanding the provisions set to expire and the potential implications is crucial for effective tax planning and compliance. While the future of the TCJA is uncertain, one thing is clear: taxpayers must stay informed and adapt to changing tax laws to minimize their tax liabilities.

Gallery of TCJA Extension-Related Images

TCJA Extension Image Gallery

Frequently Asked Questions

What is the TCJA extension?

+The TCJA extension refers to the potential extension or modification of the Tax Cuts and Jobs Act (TCJA) provisions, which are set to expire in the coming years.

What TCJA provisions are set to expire?

+Several TCJA provisions are set to expire, including individual tax rate reductions, the State and Local Tax (SALT) deduction cap, and the mortgage interest deduction limit.

How will the TCJA extension affect taxpayers?

+The TCJA extension will affect taxpayers in various ways, including potential changes to tax rates, deductions, and credits. Taxpayers should review their tax plans to ensure compliance with current tax laws and regulations.