Intro

Boost investment strategies with the Zacks Earnings Calendar Guide, featuring earnings reports, stock analysis, and market insights to optimize portfolio performance and maximize returns.

The world of finance is complex and ever-changing, with numerous factors influencing the performance of companies and the overall market. One crucial aspect of this world is earnings season, a period when publicly traded companies release their quarterly earnings reports. These reports provide valuable insights into a company's financial health, growth prospects, and future potential. For investors, analysts, and financial enthusiasts, staying on top of earnings season is vital for making informed decisions. This is where the Zacks Earnings Calendar comes into play, serving as a comprehensive guide to navigating the earnings season landscape.

Understanding the importance of earnings reports and the role of the Zacks Earnings Calendar is essential for anyone looking to delve into the world of finance. Earnings reports are not just numbers; they are a window into a company's strategy, management's vision, and the industry's trends. The Zacks Earnings Calendar is a tool designed to help individuals track these reports, analyze them, and make strategic investment decisions. By leveraging this calendar, users can stay ahead of the curve, anticipating market movements and identifying potential investment opportunities.

The significance of the Zacks Earnings Calendar extends beyond its functionality as a tracking tool. It represents a gateway to a deeper understanding of the financial markets, offering insights into the factors that drive stock prices, the impact of economic conditions on industries, and the art of portfolio management. For newcomers to the world of investing, the calendar can be an invaluable resource, providing a structured approach to learning about earnings seasons, financial analysis, and investment strategies. Seasoned investors also benefit from the calendar's detailed data and analytics, which can refine their investment tactics and enhance their market acumen.

Introduction to Zacks Earnings Calendar

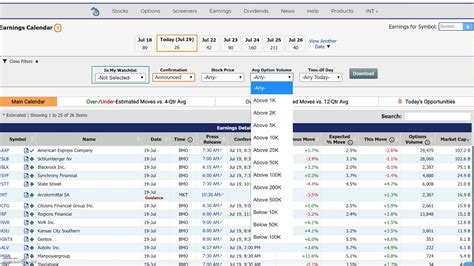

The Zacks Earnings Calendar is a sophisticated tool that compiles earnings report release dates for thousands of publicly traded companies. This calendar is updated in real-time, ensuring that users have access to the most current information available. One of the key features of the Zacks Earnings Calendar is its ability to filter earnings reports by date, allowing users to focus on specific time frames or to plan ahead for upcoming reports. This feature is particularly useful for investors who are looking to capitalize on the volatility that often surrounds earnings announcements.

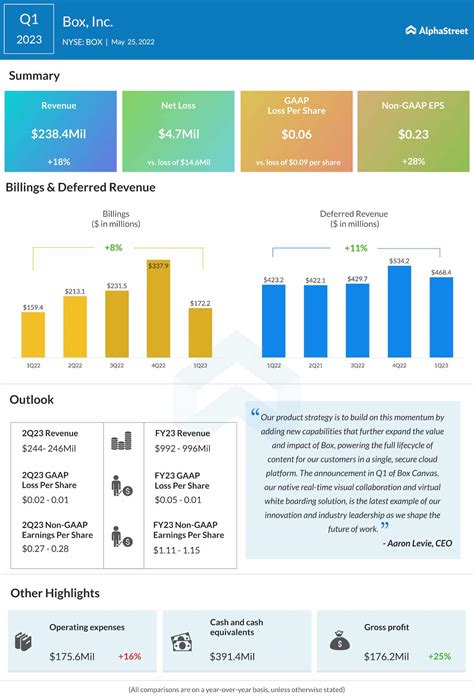

In addition to its filtering capabilities, the Zacks Earnings Calendar provides detailed earnings trends and estimates. These trends and estimates are derived from a consensus of analyst predictions, offering a snapshot of what the market expects from a company's upcoming earnings report. By comparing these expectations with the actual earnings results, investors can gauge the market's reaction and make informed decisions about their investments. The calendar also includes historical earnings data, enabling users to analyze a company's past performance and identify patterns or trends that could influence future earnings.

Benefits of Using Zacks Earnings Calendar

The benefits of utilizing the Zacks Earnings Calendar are multifaceted. Firstly, it enhances investors' ability to predict stock price movements. By knowing when earnings reports are scheduled to be released and what the market expects from these reports, investors can position themselves to capitalize on potential price swings. Secondly, the calendar facilitates the identification of investment opportunities. Through its detailed analysis and earnings trends, users can uncover companies that are poised for growth or those that may be undervalued, presenting attractive investment prospects.

Moreover, the Zacks Earnings Calendar aids in risk management. By staying informed about upcoming earnings reports and their potential impact on stock prices, investors can mitigate risk by adjusting their portfolios accordingly. This proactive approach to investment management can help protect against significant losses and ensure that investments remain aligned with an individual's financial goals and risk tolerance.

How to Use Zacks Earnings Calendar Effectively

To maximize the benefits of the Zacks Earnings Calendar, users should adopt a strategic approach to its use. This begins with setting up a watchlist of companies that are of interest, either because they are currently part of an investor's portfolio or because they are being considered for future investment. The calendar's filtering feature can then be used to focus on specific dates or time frames, ensuring that no important earnings reports are missed.

Another key strategy is to analyze the earnings trends and estimates provided by the calendar. This involves comparing consensus earnings estimates with actual results to understand how the market reacts to earnings surprises—whether positive or negative. Historical earnings data should also be examined to identify any recurring patterns or anomalies that could influence future earnings reports.

Strategies for Earnings Season

During earnings season, having a well-defined strategy is crucial. One approach is to focus on companies with a history of beating earnings estimates, as these companies often experience a surge in stock price following the release of their reports. Conversely, companies that consistently miss estimates may see their stock prices decline, presenting an opportunity to short sell or avoid investment altogether.

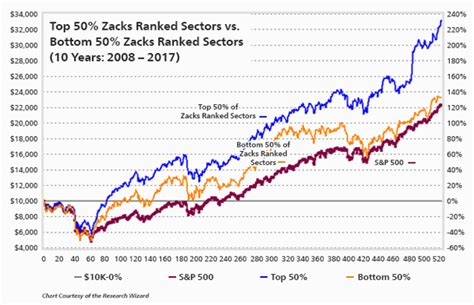

Another strategy involves analyzing the earnings reports of companies within specific industries. This can provide insights into industry trends and the relative performance of different companies within the same sector. By identifying leaders and laggards, investors can make more informed decisions about where to allocate their investments.

Common Mistakes to Avoid

Despite the potential for significant gains during earnings season, there are common mistakes that investors should avoid. One of the most critical errors is failing to consider the broader market context. Earnings reports do not occur in a vacuum; they are influenced by economic conditions, industry trends, and overall market sentiment. Ignoring these factors can lead to misinterpretation of earnings results and poor investment decisions.

Another mistake is overreacting to earnings surprises. While a positive earnings surprise can lead to a rapid increase in stock price, this movement may not be sustainable in the long term. Similarly, a negative surprise does not necessarily signal the end of a company's growth prospects. Investors should take a step back, analyze the underlying factors contributing to the surprise, and consider the company's long-term potential before making any decisions.

Best Practices for Investment Success

Achieving success in investing, particularly during earnings season, requires adherence to best practices. Diversification is key, as it spreads risk across different asset classes and industries, protecting against significant losses if any one investment performs poorly. Regular portfolio rebalancing is also essential, ensuring that investments remain aligned with an individual's risk tolerance and financial goals.

Furthermore, investors should maintain a long-term perspective, avoiding the temptation to make impulsive decisions based on short-term market fluctuations. Earnings season can be volatile, but companies with strong fundamentals and growth potential will often weather temporary storms and emerge stronger over time.

Conclusion and Future Outlook

As the financial landscape continues to evolve, the importance of the Zacks Earnings Calendar will only grow. With its comprehensive data, real-time updates, and analytical tools, this calendar stands as a beacon of insight for investors navigating the complexities of earnings season. Whether you are a seasoned investor or just beginning your financial journey, leveraging the Zacks Earnings Calendar can significantly enhance your investment strategies and contribute to your long-term financial success.

The future of investing will undoubtedly be shaped by technological advancements, changes in market dynamics, and the emergence of new investment opportunities. Through it all, the principles of diligent research, strategic planning, and adaptability will remain paramount. By embracing these principles and utilizing tools like the Zacks Earnings Calendar, investors can position themselves for success, no matter what the future holds.

Earnings Season Image Gallery

What is the Zacks Earnings Calendar?

+The Zacks Earnings Calendar is a tool that compiles earnings report release dates for thousands of publicly traded companies, providing real-time updates and detailed earnings trends and estimates.

How can I use the Zacks Earnings Calendar effectively?

+To use the Zacks Earnings Calendar effectively, set up a watchlist of companies, analyze earnings trends and estimates, and consider the broader market context when making investment decisions.

What are some common mistakes to avoid during earnings season?

+Common mistakes to avoid include failing to consider the broader market context, overreacting to earnings surprises, and not maintaining a diversified portfolio.

How can I achieve success in investing during earnings season?

+Achieving success in investing during earnings season involves adhering to best practices such as diversification, regular portfolio rebalancing, and maintaining a long-term perspective.

What role does the Zacks Earnings Calendar play in investment strategies?

+The Zacks Earnings Calendar plays a crucial role in investment strategies by providing detailed data and analytics that can refine investment tactics and enhance market acumen.

In conclusion, the Zacks Earnings Calendar is an indispensable tool for investors seeking to navigate the complexities of earnings season. By understanding its benefits, learning how to use it effectively, and avoiding common mistakes, investors can position themselves for success in the financial markets. As the investment landscape continues to evolve, the importance of staying informed and adapting to changes will only grow, making the Zacks Earnings Calendar an essential resource for years to come. We invite you to share your experiences with the Zacks Earnings Calendar, ask questions, and explore how this powerful tool can enhance your investment journey.