Intro

Master your military finances with these 7 personal finance tips tailored for MacDill AFB personnel. Learn how to manage your military pay, create a budget, pay off debt, and build wealth. Discover strategies for saving on base, navigating VA loans, and optimizing your TSP. Secure your financial future today.

As a MacDill AFB military personnel, managing your finances effectively is crucial to ensure a secure financial future for yourself and your loved ones. Given the unique challenges and benefits that come with military life, it's essential to develop smart financial habits that cater to your distinct situation. Here are seven personal finance tips tailored specifically for MacDill AFB military personnel:

Living on a military base can come with its perks, but it's essential to create a budget that works for you, not against you. Start by tracking your income and expenses to understand where your money is going. Make sure to include all the benefits you receive, such as your Basic Allowance for Housing (BAH) and Subsistence Allowance (BAS), in your budget. You can use a budgeting app like Mint or Personal Capital to make it easier.

Consider working with a financial advisor who has experience with military personnel to get personalized advice.

Take Advantage of Tax Benefits

As a military personnel, you're entitled to specific tax benefits that can help reduce your tax liability. For instance, you may be eligible for the Military Spouse Residency Relief Act, which allows your spouse to claim the same state of residency as you, even if they're not physically present in that state. Additionally, you may be able to deduct certain expenses related to your military service, such as uniform expenses or relocation costs. Consult with a tax professional to ensure you're taking advantage of all the tax benefits available to you.

Build an Emergency Fund

Having an emergency fund in place is crucial for military personnel, given the uncertainty of deployment and other unexpected events. Aim to save 3-6 months' worth of living expenses in a easily accessible savings account. This fund will help you cover unexpected expenses, such as car repairs or medical bills, without going into debt.

Consider setting up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

Pay Off High-Interest Debt

High-interest debt, such as credit card balances, can be a significant burden for military personnel. Make it a priority to pay off these debts as quickly as possible, while also making timely payments on other debts, such as your car loan or mortgage. Consider consolidating your debt into a lower-interest loan or balance transfer credit card to make it more manageable.

Avoid using debt to finance consumer purchases, and instead focus on saving for big-ticket items, such as a down payment on a house.

Invest in Your Future

As a military personnel, you have access to the Thrift Savings Plan (TSP), a retirement savings plan that offers low fees and a range of investment options. Take advantage of this benefit by contributing to your TSP account regularly. You can also consider contributing to a Roth IRA or traditional IRA to supplement your retirement savings.

Make sure to understand the fees and investment options associated with your retirement accounts to make informed decisions.

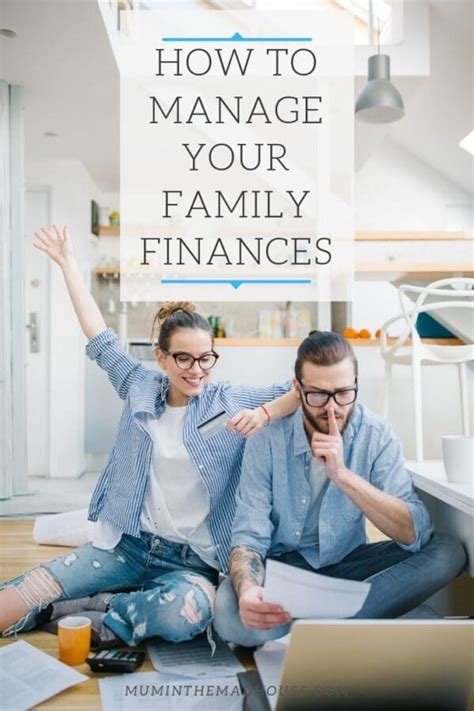

Take Care of Your Family's Finances

As a military personnel, your family's financial well-being is just as important as your own. Make sure to communicate openly with your spouse or partner about your financial goals and challenges. Consider creating a joint budget and financial plan to ensure you're both on the same page.

Don't forget to take care of your dependents' financial needs, such as saving for college or setting up a trust fund.

Stay Informed and Educated

Finally, stay informed and educated about personal finance and the unique benefits and challenges that come with being a military personnel. Take advantage of financial education resources, such as the Military Financial Readiness Survey or the National Foundation for Credit Counseling, to improve your financial literacy.

Stay up-to-date on changes to military benefits and policies that may impact your finances.

By following these seven personal finance tips, you'll be better equipped to manage your finances effectively and achieve your long-term financial goals.

Gallery of Personal Finance for Military Personnel

Personal Finance for Military Personnel Image Gallery

FAQs

What are the tax benefits available to military personnel?

+Military personnel are eligible for various tax benefits, including the Military Spouse Residency Relief Act and deductions for uniform expenses and relocation costs.

How can I take care of my family's finances as a military personnel?

+Communicate openly with your spouse or partner about your financial goals and challenges, create a joint budget and financial plan, and consider saving for your dependents' needs, such as college or a trust fund.

What are some common financial challenges faced by military personnel?

+Military personnel often face unique financial challenges, such as managing debt, saving for retirement, and navigating the complexities of military pay and benefits.