Intro

Manage finances with 5 free budget sheets, featuring expense tracking, income management, and savings planning, to achieve financial stability and control.

Creating a budget is an essential step in managing personal finances effectively. It helps individuals track their income and expenses, making it easier to make informed decisions about how to allocate their resources. One of the most effective tools for creating and managing a budget is a budget sheet. A budget sheet is a document that outlines projected income and expenses, providing a clear picture of one's financial situation. In this article, we will explore five free budget sheets that can help individuals manage their finances more efficiently.

Budgeting is crucial for achieving financial stability and security. It allows individuals to prioritize their spending, save money, and make progress towards their long-term financial goals. Without a budget, it's easy to overspend and accumulate debt, which can lead to financial stress and anxiety. By using a budget sheet, individuals can take control of their finances and make conscious decisions about how to use their money.

Effective budgeting involves tracking income and expenses, categorizing spending, and making adjustments as needed. It's essential to regularly review and update the budget to ensure it remains realistic and aligned with financial goals. A budget sheet can be a valuable tool in this process, providing a clear and concise overview of one's financial situation. With the right budget sheet, individuals can simplify their financial management and make progress towards their goals.

Introduction to Budget Sheets

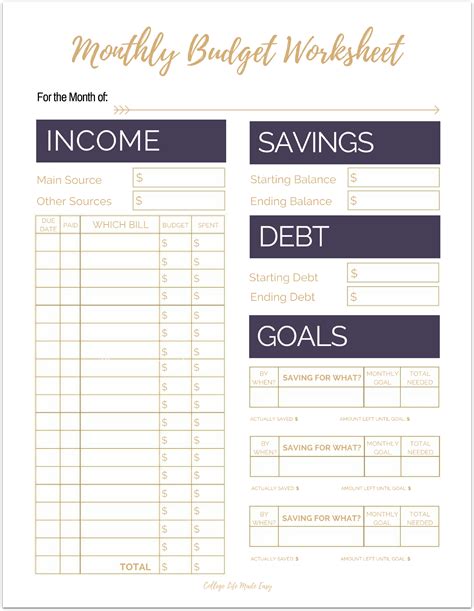

A budget sheet is a document that outlines projected income and expenses. It's a simple yet powerful tool that can help individuals manage their finances more efficiently. Budget sheets can be customized to suit individual needs and preferences, making them a versatile tool for financial management. By using a budget sheet, individuals can identify areas where they can cut back on spending, make adjustments to their budget, and make progress towards their financial goals.

Benefits of Using Budget Sheets

Using a budget sheet can have numerous benefits, including: * Improved financial awareness and understanding * Increased control over spending and expenses * Enhanced ability to prioritize spending and make conscious financial decisions * Simplified financial management and tracking * Increased savings and reduced debt5 Free Budget Sheets

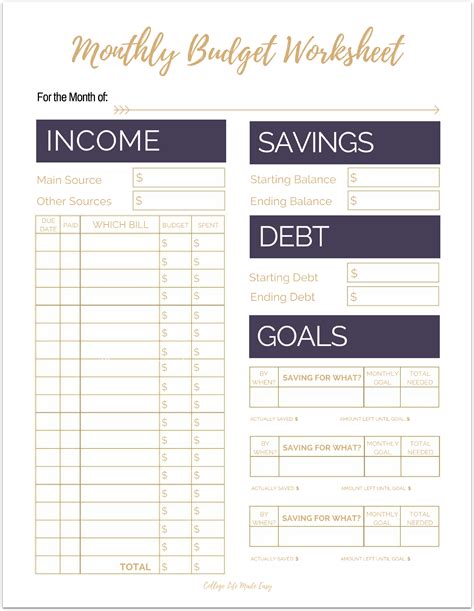

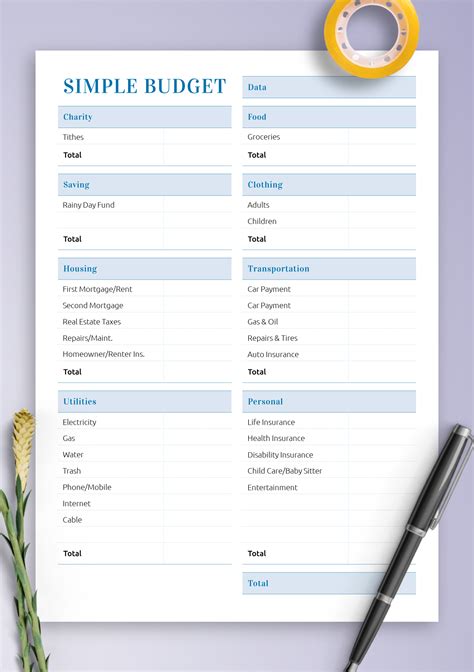

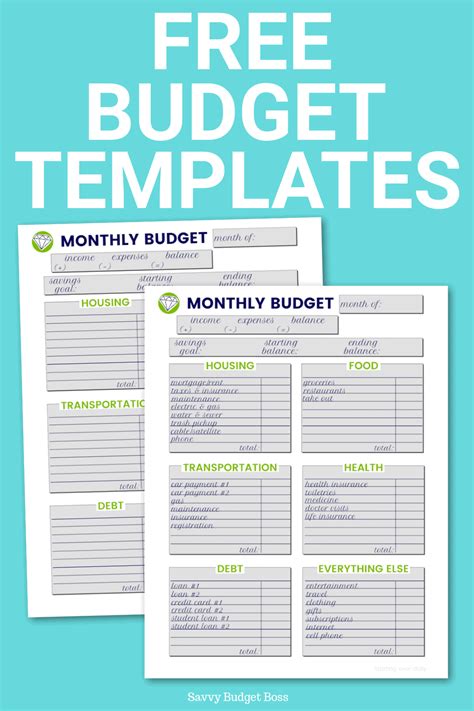

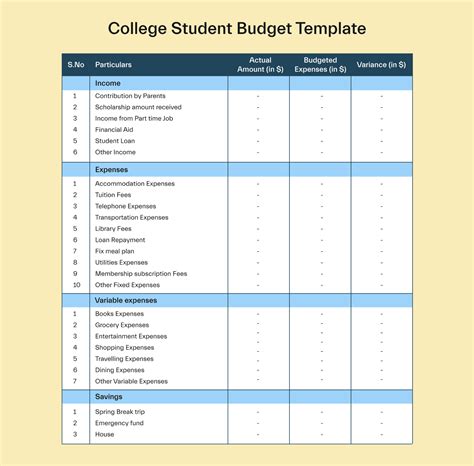

Here are five free budget sheets that can help individuals manage their finances more efficiently:

- Microsoft Excel Budget Template: This template is a popular choice for creating a budget sheet. It's easy to use, customizable, and provides a clear overview of income and expenses.

- Google Sheets Budget Template: This template is similar to the Microsoft Excel template but is available online and can be accessed from anywhere.

- Mint Budget Sheet: This budget sheet is provided by Mint, a popular personal finance app. It's easy to use, provides a clear overview of income and expenses, and can be customized to suit individual needs.

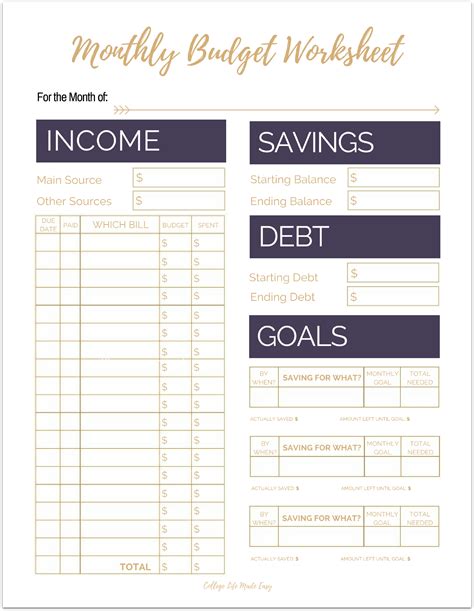

- Personal Budget Worksheet: This budget sheet is a simple yet effective tool for managing finances. It provides a clear overview of income and expenses and can be customized to suit individual needs.

- Budget Planner Worksheet: This budget sheet is a comprehensive tool for managing finances. It provides a clear overview of income and expenses, allows for categorization of spending, and can be customized to suit individual needs.

How to Use a Budget Sheet

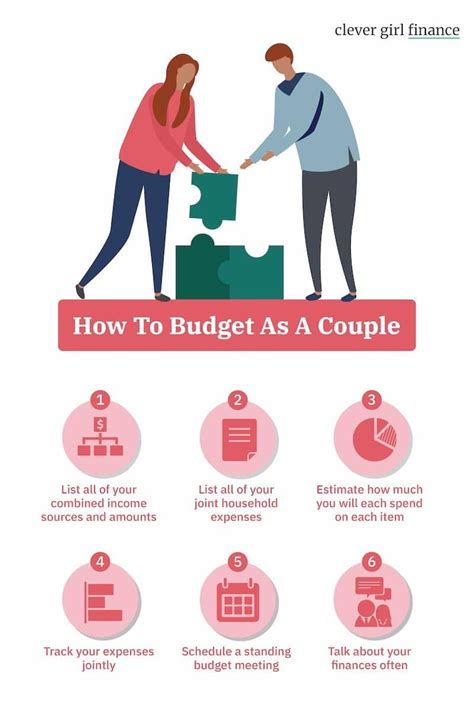

Using a budget sheet is a simple process that involves the following steps: * Identify income and expenses * Categorize spending * Set financial goals * Track progress and make adjustments as neededCustomizing Your Budget Sheet

A budget sheet can be customized to suit individual needs and preferences. This can involve adding or removing categories, setting financial goals, and tracking progress. By customizing the budget sheet, individuals can make it more effective and relevant to their financial situation.

Tips for Effective Budgeting

Here are some tips for effective budgeting: * Track income and expenses regularly * Categorize spending to identify areas for improvement * Set realistic financial goals and track progress * Make adjustments to the budget as needed * Review and update the budget regularlyCommon Budgeting Mistakes

There are several common budgeting mistakes that individuals can make, including:

- Failing to track income and expenses

- Not categorizing spending

- Setting unrealistic financial goals

- Not making adjustments to the budget as needed

- Not reviewing and updating the budget regularly

Overcoming Budgeting Challenges

Overcoming budgeting challenges involves identifying the root cause of the problem and making adjustments to the budget as needed. This can involve seeking advice from a financial advisor, using budgeting tools and resources, and staying committed to financial goals.Budgeting for Long-Term Goals

Budgeting for long-term goals involves setting realistic financial goals and making a plan to achieve them. This can involve saving money, investing in a retirement account, and making smart financial decisions.

Conclusion and Next Steps

In conclusion, creating a budget is an essential step in managing personal finances effectively. By using a budget sheet, individuals can take control of their finances, make conscious decisions about how to use their money, and make progress towards their long-term financial goals. The five free budget sheets outlined in this article can help individuals get started with budgeting and achieve financial stability and security.Free Budget Sheets Image Gallery

What is a budget sheet?

+A budget sheet is a document that outlines projected income and expenses, providing a clear picture of one's financial situation.

How do I create a budget sheet?

+To create a budget sheet, identify your income and expenses, categorize your spending, and set financial goals. You can use a budget template or create your own using a spreadsheet or budgeting app.

What are the benefits of using a budget sheet?

+The benefits of using a budget sheet include improved financial awareness and understanding, increased control over spending and expenses, and enhanced ability to prioritize spending and make conscious financial decisions.

How often should I review and update my budget sheet?

+It's recommended to review and update your budget sheet regularly, ideally every month or quarter, to ensure it remains realistic and aligned with your financial goals.

Can I customize my budget sheet to suit my individual needs?

+Yes, you can customize your budget sheet to suit your individual needs and preferences. This can involve adding or removing categories, setting financial goals, and tracking progress.

We hope this article has provided you with valuable information and resources to help you manage your finances more efficiently. By using a budget sheet and following the tips and advice outlined in this article, you can take control of your finances, make conscious decisions about how to use your money, and make progress towards your long-term financial goals. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them achieve financial stability and security.