Intro

Master the art of go-ahead entries with our expert guide. Discover 5 actionable strategies to nail entry points, minimize risk, and maximize profits. Learn how to read charts, identify trends, and make informed decisions using technical analysis, trading psychology, and risk management techniques.

Investing in the stock market can be a thrilling yet intimidating experience, especially for new investors. One of the most effective ways to enter the market is through a strategy called "go-ahead entry." This approach involves identifying a stock that has broken out of its resistance level, signaling a potential upward trend. However, it requires a combination of technical analysis, market understanding, and emotional control. In this article, we will explore five ways to nail a go-ahead entry and increase your chances of success in the stock market.

Understanding the Basics of Go-Ahead Entry

A go-ahead entry is a trading strategy that involves buying a stock after it has broken out of its resistance level. This breakout is often accompanied by increased volume, indicating a surge in investor interest. The strategy relies on the idea that once a stock has broken out of its resistance level, it will continue to trend upward, providing a profitable opportunity for investors.

Key Elements of a Go-Ahead Entry

Before we dive into the five ways to nail a go-ahead entry, it's essential to understand the key elements of this strategy:

- Resistance level: A price level at which a stock has historically struggled to break through.

- Breakout: When a stock's price exceeds its resistance level, indicating a potential change in trend.

- Volume: The number of shares traded during a given period. Increased volume during a breakout can confirm the validity of the trend.

Way #1: Identify the Right Stock

To nail a go-ahead entry, you need to identify a stock that has the potential to break out of its resistance level. Look for stocks that have been consolidating or trending upward, with a clear resistance level in place. You can use technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands to help identify potential breakout stocks.

Stock Screening Criteria

When searching for stocks to apply the go-ahead entry strategy, consider the following criteria:

- Trend: Look for stocks that have been trending upward or consolidating.

- Resistance level: Identify a clear resistance level that the stock has struggled to break through.

- Volume: Look for stocks with increasing volume, indicating growing investor interest.

- Fundamentals: Consider the company's financial health, industry trends, and competitive landscape.

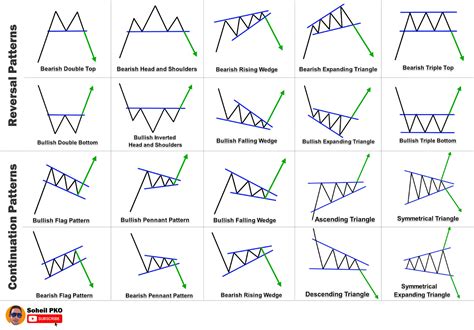

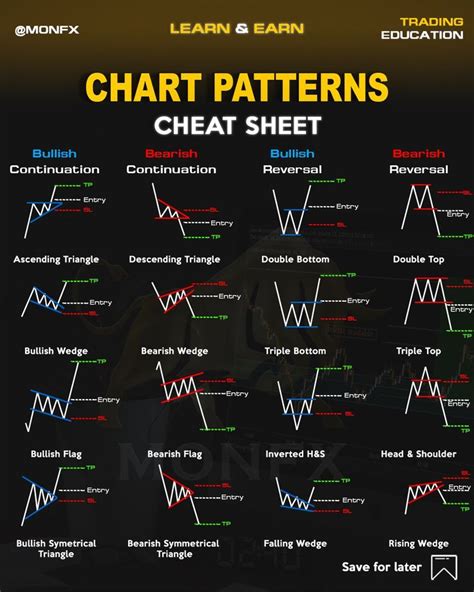

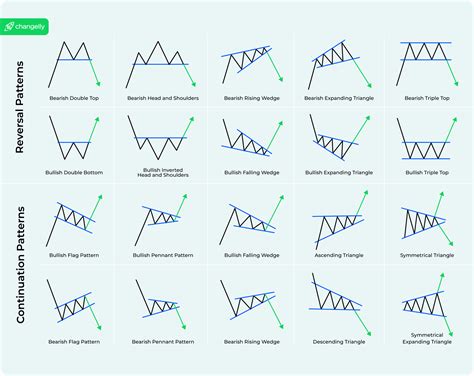

Way #2: Analyze Chart Patterns

Chart patterns can provide valuable insights into a stock's potential breakout. Look for patterns such as:

- Head and shoulders: A reversal pattern that can indicate a potential breakout.

- Inverse head and shoulders: A bullish pattern that can signal a breakout.

- Triangles: A consolidation pattern that can precede a breakout.

Pattern Recognition Tips

When analyzing chart patterns, keep the following tips in mind:

- Look for confirmation: Use multiple indicators to confirm the validity of the pattern.

- Consider the context: Take into account the overall market trend and the stock's sector performance.

- Be patient: Wait for the pattern to complete before entering a trade.

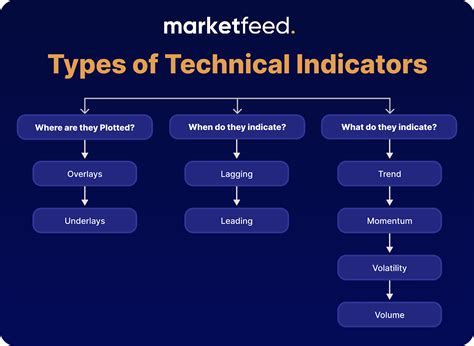

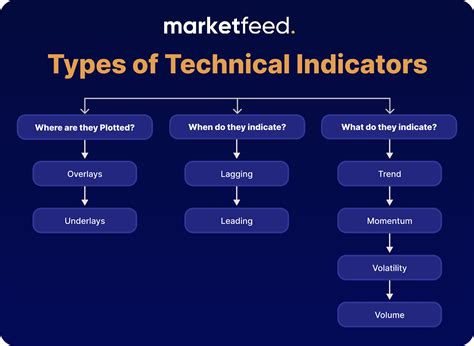

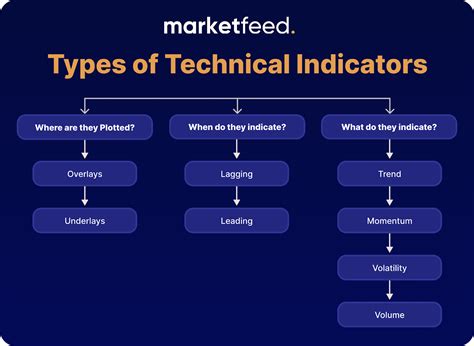

Way #3: Use Technical Indicators

Technical indicators can help you identify potential breakout stocks and confirm the validity of the trend. Some popular indicators for go-ahead entry include:

- Moving averages: A crossover of short-term and long-term moving averages can indicate a breakout.

- Relative strength index (RSI): A reading above 70 can indicate overbought conditions, while a reading below 30 can indicate oversold conditions.

- Bollinger Bands: A breakout above the upper band can indicate a strong uptrend.

Indicator Selection Tips

When selecting technical indicators for go-ahead entry, consider the following:

- Choose indicators that complement each other: Use a combination of indicators to confirm the validity of the trend.

- Adjust indicator settings: Experiment with different indicator settings to find the optimal configuration for your trading strategy.

- Use indicators in conjunction with chart patterns: Combine indicators with chart patterns to increase the accuracy of your trade signals.

Way #4: Monitor Market Sentiment

Market sentiment can provide valuable insights into the potential success of a go-ahead entry. Monitor sentiment indicators such as:

- Put-call ratio: A low put-call ratio can indicate bullish sentiment.

- Option activity: Increased option activity can indicate growing investor interest.

- Social media sentiment: Monitor social media platforms to gauge investor sentiment.

Sentiment Analysis Tips

When analyzing market sentiment, keep the following tips in mind:

- Consider multiple sources: Use a combination of sentiment indicators to get a comprehensive view of market sentiment.

- Be cautious of extremes: Avoid trading during periods of extreme bullish or bearish sentiment.

- Monitor sentiment changes: Look for changes in sentiment to confirm the validity of your trade signals.

Way #5: Develop a Trading Plan

A well-structured trading plan is essential for successful go-ahead entry. Develop a plan that includes:

- Trade setup: Define the conditions for entering a trade, including the stock's trend, chart pattern, and technical indicators.

- Risk management: Establish a risk management strategy, including stop-loss levels and position sizing.

- Trade management: Define the conditions for managing a trade, including profit targets and trailing stops.

Trading Plan Tips

When developing a trading plan, consider the following:

- Be specific: Clearly define your trade setup and risk management strategy.

- Be disciplined: Stick to your plan and avoid impulsive decisions.

- Continuously review and adjust: Regularly review your plan and make adjustments as needed.

Go-Ahead Entry Image Gallery

What is a go-ahead entry?

+A go-ahead entry is a trading strategy that involves buying a stock after it has broken out of its resistance level.

How do I identify a potential breakout stock?

+Look for stocks with a clear resistance level, increasing volume, and a strong trend. Use technical indicators and chart patterns to confirm the validity of the breakout.

What are some common mistakes to avoid when using the go-ahead entry strategy?

+Avoid impulsive decisions, and stick to your trading plan. Be cautious of extreme market sentiment and avoid over-trading.

We hope this article has provided you with valuable insights into the go-ahead entry strategy. By following these five ways to nail a go-ahead entry, you can increase your chances of success in the stock market. Remember to stay disciplined, continuously review and adjust your trading plan, and avoid impulsive decisions. Happy trading!