Intro

Master budgeting with 5 budget worksheet tips, including expense tracking, financial planning, and savings strategies to achieve fiscal stability and money management success.

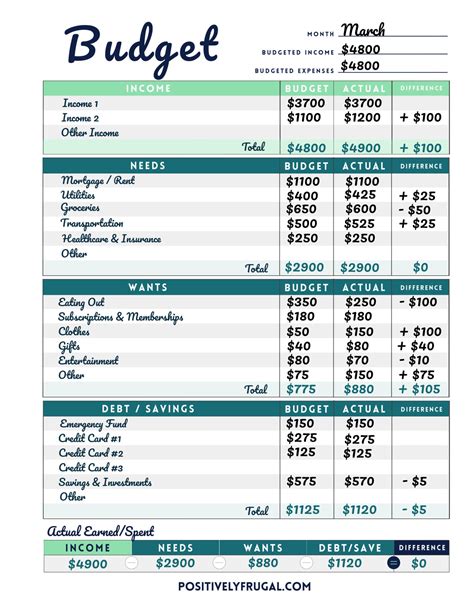

Creating a budget is an essential step in managing your finances effectively. A well-structured budget helps you track your income and expenses, making it easier to achieve your financial goals. One of the most effective tools for creating and managing a budget is a budget worksheet. In this article, we will explore five budget worksheet tips to help you make the most out of your budgeting efforts.

A budget worksheet is a document that outlines your income and expenses, providing a clear picture of your financial situation. It helps you identify areas where you can cut back on unnecessary expenses and allocate your resources more efficiently. With a budget worksheet, you can set financial goals and track your progress over time. Whether you are looking to save money, pay off debt, or build wealth, a budget worksheet is an indispensable tool.

Using a budget worksheet can have a significant impact on your financial well-being. By providing a clear and concise overview of your income and expenses, it helps you make informed decisions about how to allocate your resources. A budget worksheet also helps you identify areas where you can reduce expenses, allowing you to free up more money for savings and investments. Additionally, it enables you to track your progress over time, making it easier to stay motivated and focused on your financial goals.

Understanding Budget Worksheets

Before we dive into the tips, it's essential to understand what a budget worksheet is and how it works. A budget worksheet is a document that outlines your income and expenses, providing a clear picture of your financial situation. It typically includes categories for income, fixed expenses, variable expenses, and savings. By filling out a budget worksheet, you can identify areas where you can cut back on unnecessary expenses and allocate your resources more efficiently.

Tip 1: Identify Your Financial Goals

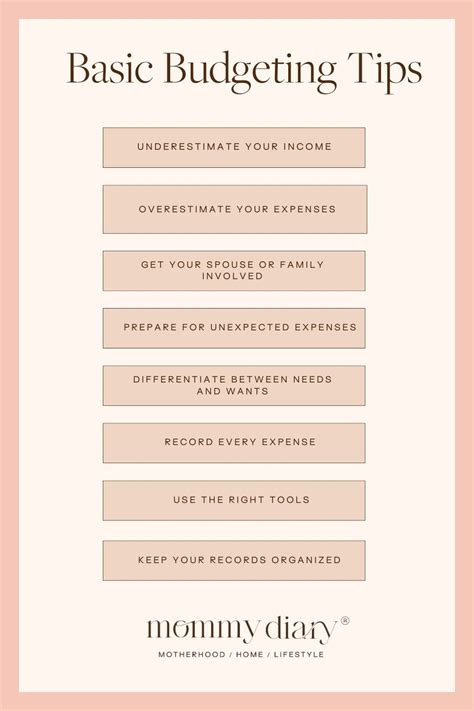

The first step in creating an effective budget worksheet is to identify your financial goals. What do you want to achieve with your budget? Are you looking to save money, pay off debt, or build wealth? By setting clear financial goals, you can create a budget that is tailored to your needs and priorities. Consider both short-term and long-term goals, such as saving for a down payment on a house or retirement.

Setting SMART Financial Goals

When setting financial goals, it's essential to make sure they are specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of saying "I want to save money," say "I want to save $1,000 in the next three months for a vacation." By making your goals SMART, you can create a budget that is focused and effective.

Tip 2: Track Your Income and Expenses

The next step in creating an effective budget worksheet is to track your income and expenses. Start by listing all your sources of income, including your salary, investments, and any side hustles. Then, list all your expenses, including fixed expenses like rent and utilities, and variable expenses like entertainment and hobbies. Make sure to include everything, no matter how small it may seem.

Categorizing Expenses

When tracking your expenses, it's helpful to categorize them into different groups, such as:

- Housing: rent, utilities, maintenance

- Transportation: car payment, insurance, gas

- Food: groceries, dining out

- Entertainment: movies, concerts, hobbies

- Debt repayment: credit cards, loans

By categorizing your expenses, you can see where your money is going and make adjustments as needed.

Tip 3: Create a Budget Plan

Once you have identified your financial goals and tracked your income and expenses, it's time to create a budget plan. Start by allocating your income into different categories, based on your priorities and goals. Make sure to include a category for savings and emergency funds.

50/30/20 Rule

A helpful rule of thumb when creating a budget plan is the 50/30/20 rule. This means allocating 50% of your income towards necessary expenses like housing and utilities, 30% towards discretionary spending like entertainment and hobbies, and 20% towards saving and debt repayment.

Tip 4: Monitor and Adjust

Creating a budget worksheet is not a one-time task. It's essential to monitor and adjust your budget regularly to ensure you are on track to meet your financial goals. Set aside time each month to review your budget and make adjustments as needed.

Identifying Areas for Improvement

When monitoring your budget, look for areas where you can improve. Are there any expenses that are higher than expected? Are there any areas where you can cut back? By identifying areas for improvement, you can make adjustments to your budget and stay on track to meet your financial goals.

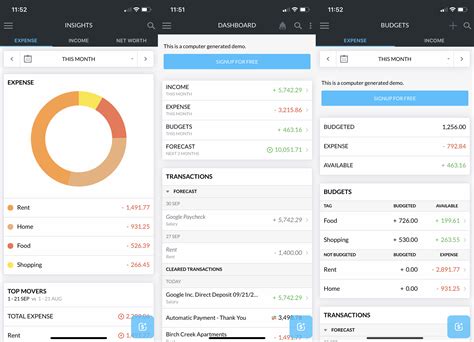

Tip 5: Automate Your Budget

Finally, consider automating your budget to make it easier to stick to. Set up automatic transfers from your checking account to your savings or investment accounts. You can also use budgeting apps or software to track your income and expenses and receive alerts when you go over budget.

Benefits of Automating Your Budget

Automating your budget can have several benefits, including:

- Reduced stress and anxiety

- Increased savings and investment

- Improved financial discipline

- Enhanced financial security

By following these five budget worksheet tips, you can create a budget that is tailored to your needs and priorities, and helps you achieve your financial goals.

Budget Worksheet Image Gallery

What is a budget worksheet?

+A budget worksheet is a document that outlines your income and expenses, providing a clear picture of your financial situation.

Why is it important to track my income and expenses?

+Tracking your income and expenses helps you identify areas where you can cut back on unnecessary expenses and allocate your resources more efficiently.

How often should I review my budget?

+You should review your budget regularly, ideally once a month, to ensure you are on track to meet your financial goals and make adjustments as needed.

What is the 50/30/20 rule?

+The 50/30/20 rule is a guideline for allocating your income towards necessary expenses, discretionary spending, and saving and debt repayment.

How can I automate my budget?

+You can automate your budget by setting up automatic transfers from your checking account to your savings or investment accounts, and using budgeting apps or software to track your income and expenses.

We hope this article has provided you with valuable insights and tips on how to create an effective budget worksheet. By following these tips and regularly reviewing your budget, you can achieve financial stability and security. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them take control of their finances. Remember, creating a budget is just the first step – it's up to you to stick to it and make adjustments as needed to achieve your financial goals.